[ad_1]

undefined undefined/iStock by way of Getty Photographs

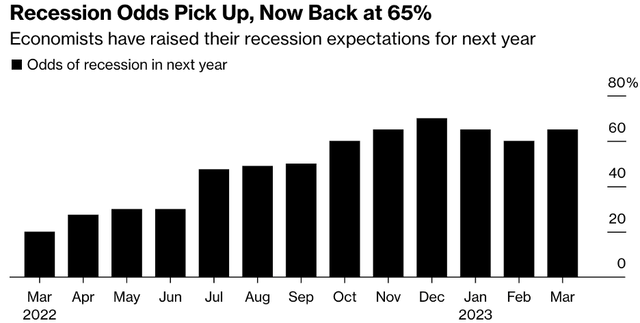

For nearly a yr, traders have been nervous a few looming recession that by no means actually arrived. Versus broad-based layoffs and disappointing numbers, we now have seen “mini recessions” in sure sectors of the financial system, together with the tech sector. These mini-recessions sound a lot much less alarming than the worldwide monetary disaster of 2008 or another recessionary interval the U.S. has gone by means of. With the worldwide financial system nonetheless going through huge challenges within the type of excessive inflation, supply-chain disruption, and geopolitical uncertainty, it might be naïve to rule out the chance of a recession simply but. Based on economists surveyed by Bloomberg, there’s a 65% chance of a U.S. recession throughout the subsequent 12 months.

Exhibit 1: U.S. recession odds

Bloomberg

I’m not a fan of predicting recessions – I’d relatively give attention to figuring out corporations which are well-positioned to develop in the long run. That being mentioned, I don’t wish to flip a blind eye to the dangers the American financial system is going through right this moment as these dangers can have an effect on the efficiency of my funding portfolio. Whether or not we see a recession in 2023 or not, one factor is for positive – financial challenges will persist.

This brings us to the retail sector. For greater than a decade, e-commerce corporations have grabbed market share from conventional retailers, however the power of the e-commerce business is but to be examined by a recessionary atmosphere. Again in 2020 when the U.S. financial system plunged into recession, enterprise circumstances have been skewed in favor of the e-commerce sector because of once-in-a-lifetime developments equivalent to worldwide mobility restrictions. As we navigate the present financial challenges, e-commerce corporations is not going to profit from pandemic tailwinds and should compete with low cost retailers who normally thrive amid difficult macroeconomic circumstances.

Odds Will Tilt In Favor Of Low cost Retailers In A Recession

Historical past may not repeat itself, however as traders, there’s so much to study by trying within the rearview mirror. Throughout recessions, the extent of unemployment usually rises, and family financial savings begin depleting. Though we would have entered this troublesome section with higher family financial savings in comparison with the previous due to the fiscal and financial coverage increase throughout the pandemic, customers will flip cautious when the chance of unemployment will increase – which naturally occurs throughout a recession. We have to perceive just a few essential information factors to judge the prospects for e-commerce corporations and low cost retailers throughout a recession.

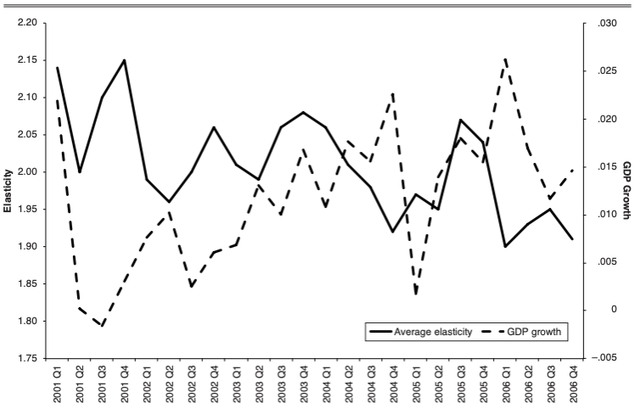

Throughout recessions, the worth elasticity of demand will increase throughout virtually all product classes. The rise within the value elasticity of demand can fluctuate relying on the product class, however basically, shopper buying choices are typically impacted by the pricing to the next diploma throughout recessions. The under chart illustrates how the typical value elasticity to demand was impacted by GDP development between 2001 and 2006.

Exhibit 2: Common elasticity by quarter

Columbia College

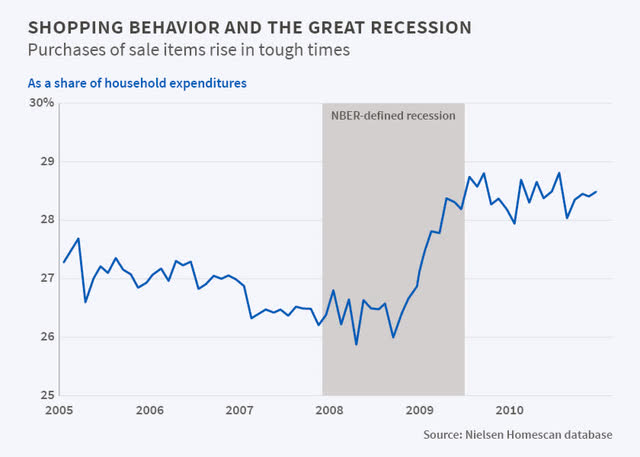

Going by the above information, if the U.S. enters a recession later this yr, we will anticipate the worth elasticity of demand to extend notably. This means that customers will begin in search of bargains and discounted objects to avoid wasting even seemingly smaller quantities. What this additionally means is that customers will prioritize financial savings over comfort throughout a recession. The procuring habits of Individuals throughout the monetary disaster of 2008 confirms our findings. As illustrated under, purchases of sale objects elevated sharply throughout the 2008 recession and remained elevated for just a few years.

Exhibit 3: Purchases of sale objects as a proportion of family expenditure

Nationwide Bureau of Financial Analysis

Now that we now have established the truth that Individuals will most certainly be looking out for bargains and discounted objects if the U.S. enters a recession within the foreseeable future, the subsequent step is to evaluate whether or not e-commerce corporations can compete with low cost retail shops.

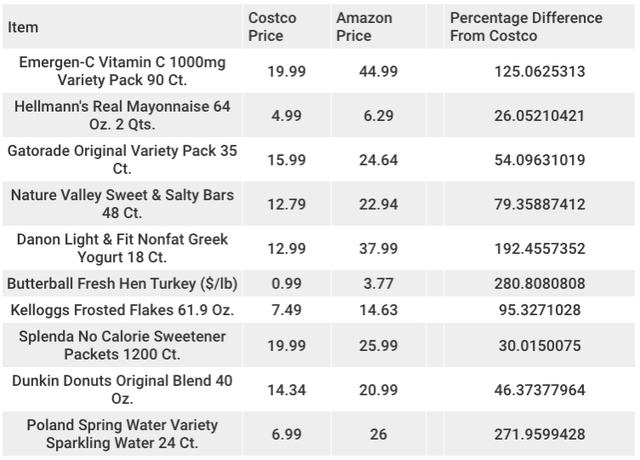

For ease of comparability, I’ll use Costco Wholesale Company (COST) as a proxy for a median low cost retailer within the U.S. whereas Amazon.com, Inc. (AMZN) shall be used as a proxy for the e-commerce sector. LendEDU lately (April 2023) carried out a value comparability between Amazon and Costco to find out which is cheaper. Based on their findings utilizing 38 completely different merchandise, Costco was 12.1% cheaper than Amazon from a complete value perspective. Throughout a recession, the demand for important objects equivalent to groceries could be anticipated to stay regular compared to electronics and non-essential objects. Based on LendEDU, meals objects on Amazon have been considerably dearer than Costco in April.

Exhibit 4: Meals & beverage costs on Amazon and Costco

LendEDU

Constructing on our earlier dialogue of value elasticity traits throughout recessions, we will conclude that low cost retailers stand to learn throughout a recession – or at the least climate financial downturns higher than e-commerce marketplaces.

A granular view of e-commerce gross sales presents extra information to be bullish on low cost retailers throughout recessions. Based on information compiled by eMarketer, as of Might 1, 2022, shopper electronics gross sales dominated Amazon’s retail gross sales adopted by attire and equipment.

Exhibit 5: Amazon U.S. e-commerce gross sales by product class

eMarketer

With important objects equivalent to meals and drinks accounting for lower than 4% of whole gross sales, Amazon gross sales are dominated by non-essential objects that may take a large hit throughout a recession. That is true for a lot of different e-commerce platforms as nicely.

Low cost Retailers Rating A Valuation Win

With financial challenges persisting, traders must pay shut consideration to the valuation ranges of corporations. With rates of interest persevering with to stay elevated, future money flows shall be discounted at increased charges in comparison with the final 5 years. It will primarily decrease the current worth of those anticipated money flows, thereby making high-growth corporations expensively valued out there as the majority of their lifetime money flows are anticipated to be generated sooner or later. Amazon, the main e-commerce platform on the earth, has already turned itself right into a cash-flow machine, which makes it probably the most comparable e-commerce platform to low cost retailers. A direct comparability between Amazon and low cost retailers doesn’t make a variety of sense on condition that Amazon has branched into many different enterprise classes, however there is not any hurt in doing a comparability to get an understanding of the relative valuation stage.

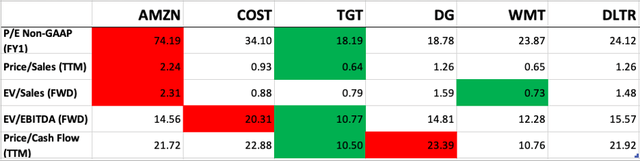

Exhibit 6: Valuation comparability of Amazon and retailers

In search of Alpha

I’ve added an emphasis by highlighting the most costly corporations from a valuation metric in crimson and the most affordable corporations in inexperienced for ease of reference. On common, low cost retailers (I included Walmart on this class as the corporate runs promotions throughout recessions) are extra attractively valued than Amazon right this moment, and these retailers are considerably extra worthwhile than many e-commerce platforms.

Takeaway

Recession fears are persevering with to make an impression on inventory costs and funding choices. The e-commerce sector appears well-positioned to develop in the long run aided by a number of macroeconomic tailwinds together with the rising Web penetration in growing areas of the world and the rising significance positioned on comfort. Nonetheless, throughout a recession, low cost retailers are more likely to outperform high-flying e-commerce corporations. Traders who’re attempting to find recession-proof shares may wish to think about prime American low cost retailers right this moment.

[ad_2]

Source link