[ad_1]

Althom/iStock Editorial by way of Getty Photos

Huntington Bancshares Integrated (NASDAQ:HBAN) is without doubt one of the largest regional banks in America – particularly working throughout twelve states from its headquarters primarily based in Columbus Ohio. This financial institution holding firm operates via its subsidiary referred to as The Huntington Nationwide Financial institution that provides people alongside companies with an array of banking providers. As of March thirty first of this yr the corporate had amassed belongings totaling $189 billion with deposits amounting to $145 billion while having offered loans price $119 billion – rendering it as an impactful participant inside the trade.

I’ll consider Huntington’s inventory primarily based on its valuation, development, profitability, and danger. I may even evaluate it to a few of its friends within the regional banking sector. My important thesis is that Huntington is a purchase suggestion, as it’s buying and selling at a reduction to its intrinsic worth, strong profitability, and a manageable danger profile. I may even talk about the best-in-class dividend and as at all times check out the challenges that would have an effect on Huntington’s efficiency and outlook within the close to and long run.

Funding Technique

For starters, Huntington is correct the place I prefer it buying and selling at nearly 15% above its 52-week low. I added this to my funding technique quite a few years in the past with nice success. I will let famed investor Michael Burry clarify its worth:

“As for when to purchase, I combine some barebones technical evaluation into my technique — a software held over from my days as a commodities dealer. Nothing fancy. However I want to purchase inside 10% to fifteen% of a 52-week low that has proven itself to supply some worth help. That is the contrarian a part of me. And if a inventory… breaks to a brand new low, most often I lower the loss. That is the sensible half. I stability the truth that I’m essentially turning my again on probably better worth with the truth that since implementing this rule, I have not had a single misfortune blow up my total portfolio.”

What does this imply?

Now’s the time to purchase, because the inventory trades at $10.53 at current.

Second, this can be a risky holding closely topic to financial circumstances, the upcoming debt ceiling matter, and extra.

So what?

An funding in Huntington needs to be a comparatively small holding for those who do not plan to carry for a decade– and I do not.

Lastly, I plan to carry onto this till it hits $15 per share.

No extra rhetorical questions. I’ll promote my shares when the corporate reaches my worth goal of $15. Acquired it?

To assume they advised me I could not be a comic.

Dividend Monster

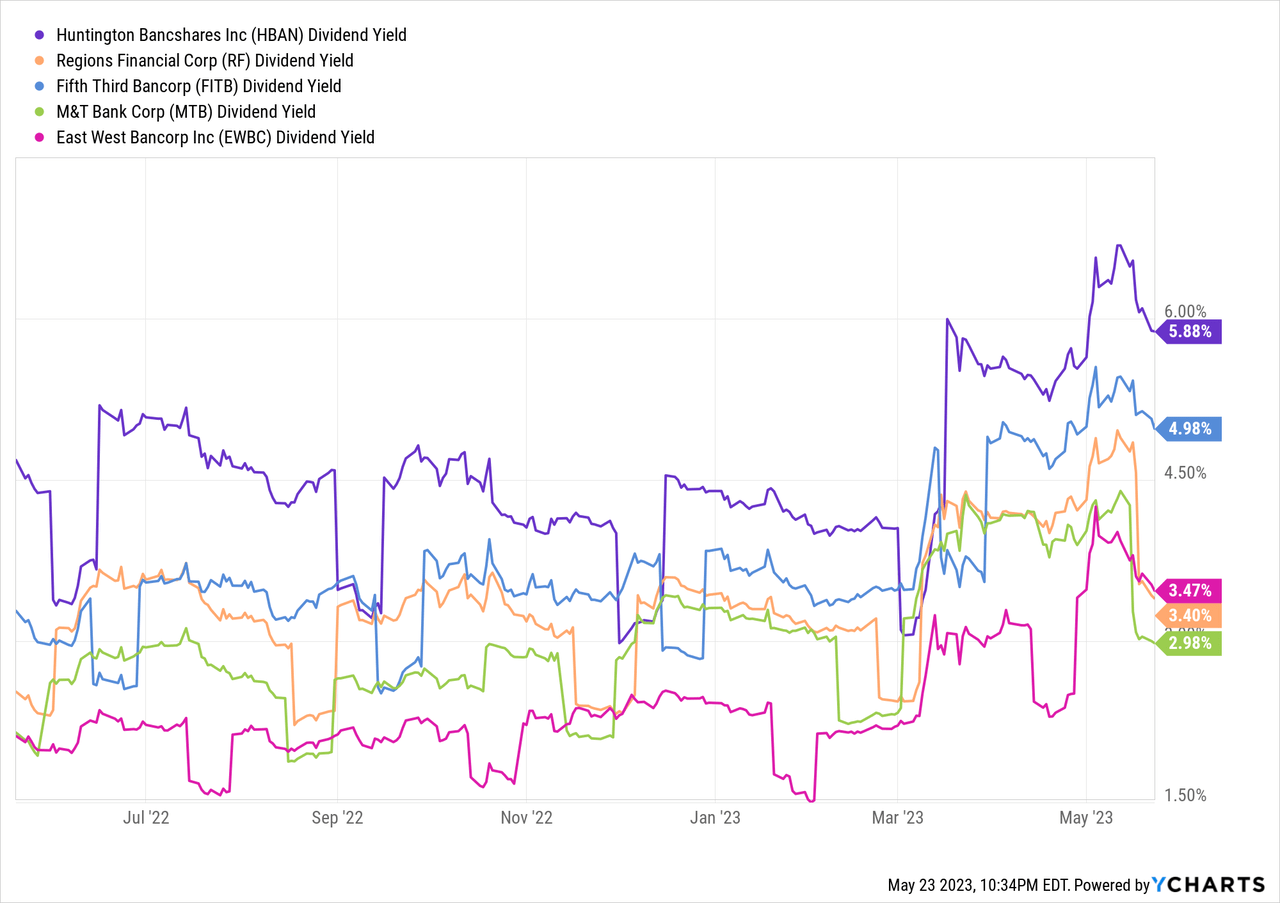

One of the crucial interesting points of Huntington’s inventory is its beneficiant dividend coverage. The financial institution has been paying dividends persistently since 1990. The present annual dividend is $0.64 per share, which interprets to a yield of 5.88% primarily based on the present inventory worth of $10.53. That is nicely above the common yield of two.9% for the regional banking sector and 1.66% for the S&P 500 index.

Not solely is Huntington’s dividend excessive, however it is usually sustainable and rising. The financial institution’s payout ratio, which reveals how a lot of its earnings are distributed to shareholders, is 40%, which is above the trade common of 34% and inside its personal goal vary of 40% to 60%. Which means the financial institution retains sufficient earnings to reinvest in its enterprise and help its future development. The financial institution’s free money circulate yield, which reveals how a lot money it generates relative to its market worth, is 3.39% and signifies that the financial institution has greater than sufficient money to cowl its dividend and different obligations.

Huntington’s dividend has additionally been rising at a exceptional tempo over time. The financial institution has elevated its dividend at a compound annual charge of 10% over the previous 5 years and 15% over the previous 10 years. Whereas I don’t count on Huntington to take care of such a excessive dividend development charge sooner or later, given the challenges posed by the low rate of interest surroundings and the combination of TCF Monetary Company, which it acquired in December 2022, I nonetheless consider that Huntington will proceed to reward its shareholders with above-average dividend development and returns.

Profitability

Profitability Metrics HBAN Business Return on belongings (ROA) 1.26% 0.98% Return on common fairness (ROE) 13.92% 10% Web curiosity margin (NIM) 3.65% 2.97% Mortgage/Deposit Ratio 82% 62% Click on to enlarge

To briefly clarify the importance right here:

Return on belongings (ROA) measures how effectively a financial institution makes use of its belongings to generate earnings. The next ROA signifies {that a} financial institution is extra worthwhile and productive. Huntington’s ROA of 1.26% is nicely above the trade common of 0.98%, which signifies that Huntington is ready to earn extra earnings from its belongings than its opponents. This displays Huntington’s capacity to optimize its asset combine, preserve excessive asset high quality, and management its working bills.

Return on common fairness (ROE) measures how successfully a financial institution makes use of its shareholders’ fairness to generate earnings. The next ROE signifies {that a} financial institution is extra worthwhile and rewarding to its shareholders. Huntington’s ROE of 13.92% is considerably greater than the trade common of 10%, which signifies that Huntington is ready to earn extra earnings from its fairness than its opponents. This displays Huntington’s capacity to leverage its capital, develop its earnings, and pay engaging dividends.

Web curiosity margin (NIM) measures the distinction between the curiosity earnings a financial institution earns from its loans and investments and the curiosity expense it pays on its deposits and borrowings. The next NIM signifies {that a} financial institution is extra worthwhile and environment friendly in managing its curiosity earnings and expense. Huntington’s NIM of three.65% is far greater than the trade common of two.97%, which signifies that Huntington is ready to earn extra curiosity earnings from its loans and investments than its opponents. This displays Huntington’s capacity to supply aggressive mortgage charges, diversify its mortgage portfolio, and handle its rate of interest danger.

Mortgage/Deposit Ratio measures the proportion of a financial institution’s loans which can be funded by its deposits. The next mortgage/deposit ratio signifies {that a} financial institution is extra worthwhile and aggressive in lending out its deposits. Huntington’s mortgage/deposit ratio of 82% is greater than the trade common of 62%, which signifies that Huntington is ready to lend out extra of its deposits than its opponents. This displays Huntington’s capacity to draw and retain deposit prospects, generate mortgage demand, and preserve liquidity.

Valuation

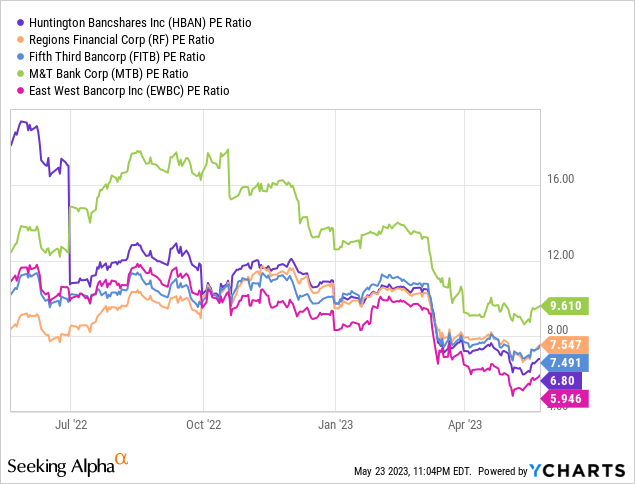

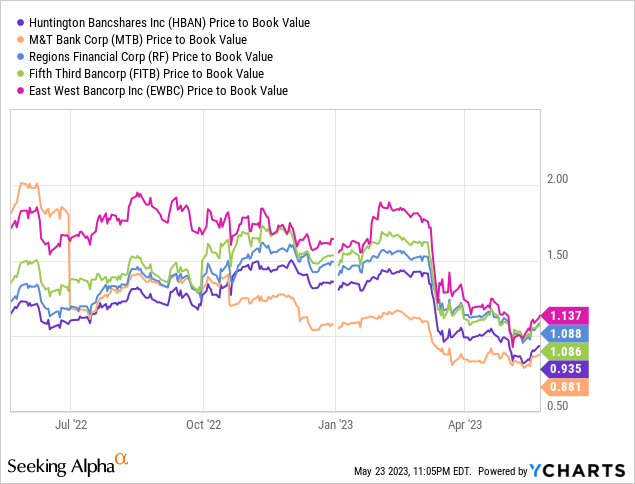

It isn’t onerous to see that Huntington is affordable. All we’ve to do is do some peer evaluation. I normally carry out an extra returns mannequin for financial institution valuation, however for Huntington, I consider a peer evaluation is way more related and illuminating. I in contrast with Areas Monetary Corp. (RF), Fifth Third Bancorp (FITB), M&T Financial institution Corp. (MTB), and East West Bancorp (EWBC).

Writer, YCharts

Huntington is buying and selling on the second lowest P/E amongst its friends, second solely to East West Bancorp. Coincidentally, I’m very bullish on East West Bancorp, and you could find my article about why Li Lu, The “Warren Buffett of China” invested in it right here.

Writer, YCharts

Guide worth is one other crucial metric for us to try. I am completely satisfied to report that Huntington is once more second solely to at least one as the most cost effective buying and selling on BV. I calculate the Guide Worth Per Share to be about $11.27, which means you should buy this nice financial institution at or under e-book worth. The actual story right here is that the financial institution trades on the least expensive or close to the most cost effective amongst its friends in almost each related valuation metric.

My valuation is sort of easy, actually.

Huntington Trades at a P/E of 6.80, its historic median is 12.84. Assuming conservatively that Huntington someway doesn’t return to this median and falls brief at 10-11, we are able to count on an appreciation to no less than $15 per share, offering someplace within the vary of a 50% return. Evaluating my valuation to my colleague Leo Nelissen who reached a goal of $16, and the Wall St consensus of round $13 my valuation is the colloquial completely satisfied medium. This financial institution has no purpose to be buying and selling at such low multiples, however I’ve created a conservative estimate for these making an attempt occasions.

Dangers

Huntington Financial institution just isn’t with out its dangers and challenges, because it operates in a extremely aggressive and controlled trade that’s uncovered to varied financial and market components. I’ll present what I contemplate to be the 2 important dangers that Huntington faces or might face sooner or later:

Credit score danger: That is the chance of loss as a consequence of debtors or counterparties failing to repay their loans or obligations. Credit score danger is inherent in any lending enterprise and will be affected by modifications in financial circumstances, buyer conduct, trade developments, or credit score high quality. Huntington has a diversified mortgage portfolio throughout numerous segments, reminiscent of client, business, and actual property. Nevertheless, a few of these segments could also be extra weak to credit score deterioration than others, particularly throughout recessions or downturns. For instance, Huntington has a major publicity to the auto lending section, which accounted for 17% of its whole loans. Auto loans are inclined to have greater default charges and decrease restoration charges than different forms of loans, and may additionally be topic to regulatory scrutiny or litigation. Huntington additionally has a large publicity to the power sector, which accounted for 4% of its whole loans. Vitality loans are topic to volatility in oil and gasoline costs and demand, in addition to environmental and social dangers.

Huntington has been proactive in managing its credit score danger by sustaining excessive underwriting requirements, enhancing its credit score monitoring and danger ranking techniques, rising its mortgage loss reserves and provisions, and lowering its publicity to sure segments or geographies. Nevertheless, credit score danger stays a major danger issue that would have an effect on Huntington’s earnings, asset high quality, capital adequacy, and fame.

Rate of interest danger: That is the chance of loss as a consequence of modifications in rates of interest that have an effect on the financial institution’s internet curiosity earnings and margin. Rate of interest danger is inherent in any banking enterprise and will be affected by modifications in financial coverage, market circumstances, buyer conduct, or competitors. Huntington has a big deposit base that gives a low-cost supply of funding for its lending actions. Nevertheless, a few of these deposits are delicate to rate of interest modifications and will reprice sooner than the financial institution’s belongings. This might end in a compression of the financial institution’s internet curiosity margin and earnings if rates of interest rise quickly or unexpectedly.

Huntington has been energetic in managing its rate of interest danger by adjusting its asset-liability combine, hedging its rate of interest publicity, diversifying its charge earnings sources, and optimizing its deposit pricing technique. Nevertheless, rate of interest danger stays a major danger issue that would have an effect on Huntington’s earnings, profitability, development potential, and valuation.

The Michael Burry Bonus

Famed Investor Michael Burry initiated a place in Huntington, accounting for about 2% of his portfolio– in step with my suggestion. Burry is an admittedly onerous investor to observe into trades, however of notice is that Huntington is at or under the place he bought it primarily based on the time of his 13F submitting. Burry has an impressive return (a 3-year efficiency of 356%), and as you doubtless guessed, it is not as a result of he picks a bunch of losers.

Burry tends to purchase out-of-favor companies and promote them after they’ve been “polished up a bit.” That is exactly the chance we’ve right here, leaving me with little to no uncertainty about his funding thesis. Michael Burry’s vote of confidence just isn’t purpose sufficient to put money into Huntington. Nevertheless, alongside its rising dividend, well-managed profitability, and its low cost valuation, it is onerous to not seize a number of shares.

Love him or hate him. He outperforms your favourite analysts yr after yr. So both seize some popcorn and watch or name up your dealer and make a transfer.

Takeaway

Huntington trades at a reduction to its intrinsic worth and has strong profitability and a manageable danger profile. The financial institution additionally pays a beneficiant and rising dividend that gives a gentle earnings stream and a margin of security. I consider the financial institution has a possible upside of 42% from current ranges on a conservative valuation. What’s extra is that whilst you look ahead to that share worth appreciation, you’ll be able to gather your fats 5.88% dividend. I assign a purchase ranking to Huntington inventory at its present worth of $10.53 and preserve a purchase till $12, at which level I’ll situation a maintain ranking as worth helps diminish.

[ad_2]

Source link