[ad_1]

Drew Angerer

Nintendo is ripe for a share worth enhance.

When the Change launched on the March third 2017, Nintendo (OTCPK:NTDOY) share worth was $5.45 by mid-week March eighth 2017. After the vastly disappointing sell-through for the Wii U, the Change was the quickest promoting residence console for Nintendo and the second quickest promoting residence console of all time. By yr finish 2017 Nintendo’s inventory had greater than doubled.

Nintendo Nasdaq Share Value (Nasdaq)

The submit pandemic correction, which has seen gross sales in catalogue software program decline dramatically, and the age of the Change, correlated with a share worth decline for the reason that excessive of 2021.

I count on Nintendo’s share worth to extend considerably following a doable announcement of a brand new console from Nintendo. The share worth may surpass the excessive of $16 in December 2020. It is because all the indications present Nintendo just isn’t slowing down, if something, Nintendo is consolidating on its document gross sales for brand new video games, doubling down on constructing belief with its person base by avoiding controversial monetization, and probably shoring up the Change set up base with a console that follows the identical construct rules that made the Change an enormous success, particularly removing supporting two {hardware} gadgets on the similar time.

The Legend of Zelda: Tears of the Kingdom is most definitely a becoming swansong sport earlier than the subsequent Nintendo console.

With unit gross sales of 10 million items worldwide in simply 3 days in market, information that The Legend of Zelda: Tears of the Kingdom is the quickest promoting sport within the Zelda franchise ought to come to no shock. In line with Gamesindustry.biz the sport is the UK’s greatest boxed online game launch of the yr within the UK and is Nintendo’s (OTCPK:NTDOY) second quickest promoting title after the 2008’s Wii Match.

The Legend of Zelda: Tears of the Kingdom might be the swansong sport for the Change platform earlier than a doable announcement of the console alternative this August at Gamescom. Nintendo can be planning to launch Pikmin 4 on July twenty first . The truth that Nintendo might be ending the Change lifecycle with such a powerful franchise is credit score to the corporate that understands its market so properly. When the primary Zelda sport for the Change, The Legend of Zelda: Breath of the Wild, launched again in March 2017, it really offered extra items than there have been {hardware} gross sales for the Change console within the US. It could be a becoming tribute to the Change, which is the third best-selling console of all time, that the Zelda franchise bookended this console’s lifecycle.

Nintendo has taken little danger with its core enterprise, garnering it each good and dangerous enterprise.

Within the final a number of weeks there have been numerous blended messages from Nintendo. The discharge of The Legend of Zelda: Tears of the Kingdom got here a number of weeks after the disappointing fiscal outcomes for monetary yr 2023. The silver lining within the cloud is that these Zelda numbers ought to increase revenues for Nintendo in its Q1 fiscal 2024.

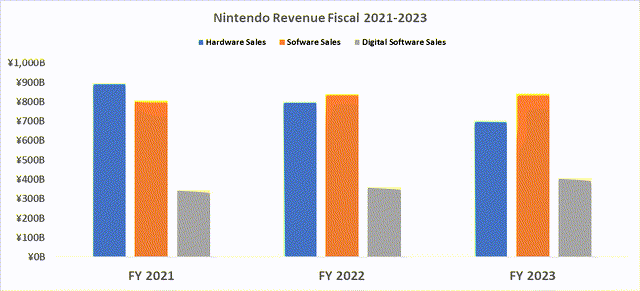

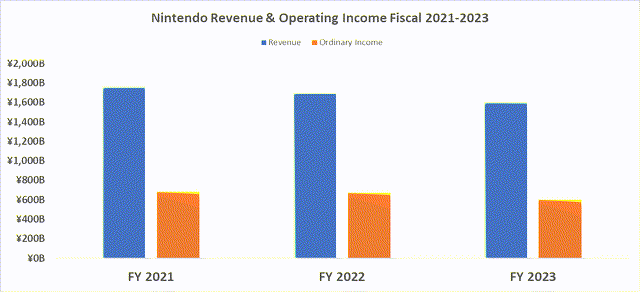

The 2023 fiscal outcomes confirmed a year-on-year decline of 5% for income and a ten.4% decline in abnormal revenue. That is primarily as a result of reality the Change is approaching its end-of-lifecycle and the wind has been taken out of Nintendo’s sails.

Within the final three fiscal years, Nintendo might be accused of being a bit boring. The corporate doesn’t play quick and free with its IP, which suggests it’s fairly risk-averse. This comes from a place of dominance and an intensive understanding of its core markets, that are predominately household and kids. Nintendo could also be sluggish in monetizing its video games with add-on packs and downloadable content material (for instance, the corporate launched Mario Kart 8 Deluxe – Booster Course Go 5 years after the bottom sport for the Change dropped), however the firm is aware of that participating in controversial microtransactions and loot packing containers will drive its viewers away. This grounding in interesting to its core viewers has proved fortuitous, however it will possibly additionally make it somewhat too specialised and unappealing to the mature gamer or these gamers occupied with third-party AAA video games.

To its credit score, the corporate’s financials proved to be a gradual ship throughout and after the pandemic (2020-2022), marking it as one that’s much less troubled by submit pandemic correction, particularly within the downturn in catalog sport spending. The upside of specializing in household video games and having a excessive set up base for the Change is that Nintendo doesn’t must depend on others, like Sony’s (SONY) PlayStation or Microsoft’s (MSFT) Xbox, to construct its fortune. Only recently, Gamesindustry.biz revealed articles that confirmed Pokémon Scarlet and Violet (launched in November 2022) was the quickest promoting Pokémon sport, Splatoon 3 (launched in September 2022) is the quickest promoting sport in Japan, and Tremendous Mario Bros Film (launched in April 2023) is the quickest promoting field workplace movie within the animation style. As well as, Nintendo’s evergreen titles reminiscent of Mario Kart 8 Deluxe, Pokémon, Zelda, and Change Sports activities dominate software program gross sales by means of charts (Video games Gross sales Knowledge (GSD), Chart Observe, Circana). When the calendar for brand new releases runs low, it isn’t unusual to seek out that as much as half of the highest 10 video games are Nintendo first-party catalog video games.

Provided that the corporate just isn’t in direct competitors with Sony or Microsoft, Nintendo is enjoying in a distinct subject. The constraints of the ageing Change have meant fewer ports from AAA video games from third get together publishers (for instance, there isn’t a Name of Obligation or Madden NFL on the Change, and the most recent FIFA video games run on an older sport engine and have the label “Legacy Editions”), this implies Nintendo depends on itself to generate its fortune.

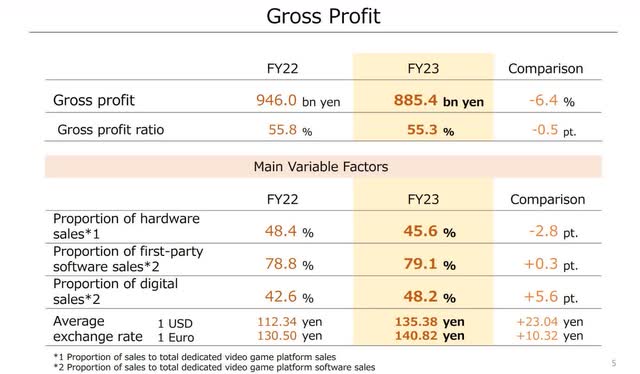

On common, Nintendo first-party titles account for nearly 80% of the software program sell-through.

Nintendo’s Gross Revenue & Channel % Income (Nintendo Fiscal 12 months Ended March 2023 Earnings Launch)

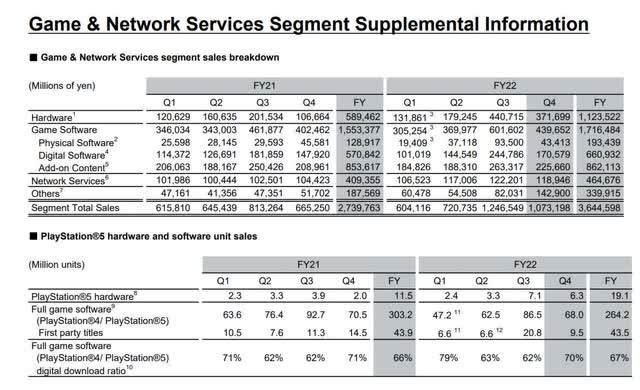

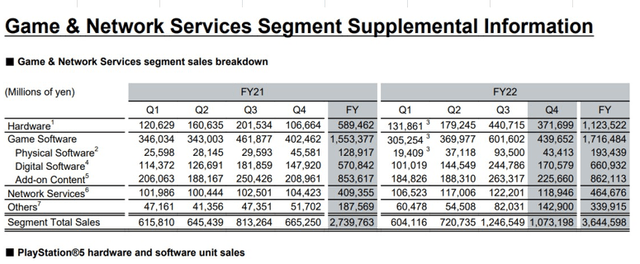

Against this, Sony’s PlayStation first-party video games account for simply 16% of PlayStation software program income.

Sony PlayStation Financials (Sony’s Incomes Launch FY2022)

This reliance on first-party video games might be its Achilles heel as a result of there’s a excessive expectation that Nintendo should ship hit after hit if it desires to see progress in high line income, given it can’t rely from the success of ported video games. The latest decline in income for the previous two fiscal years is an instance that the technique of self-reliance can backfire. Pokémon and Splatoon broke information for Nintendo in its fiscal 2023, however that was not sufficient to maintain progress.

What about that new console?

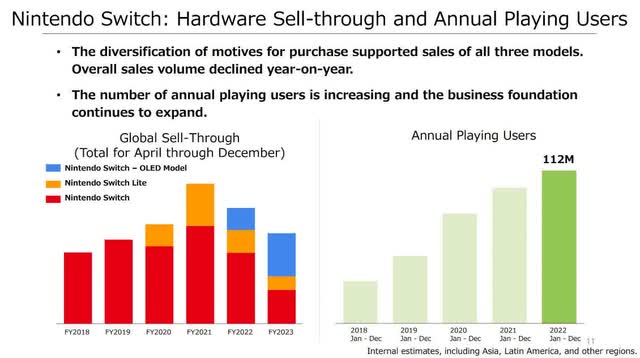

The Change 2, or Change Professional, or no matter their new console shall be known as, have to be Nintendo’s worst saved secret. For my part, a brand new console ought to be launched both subsequent yr, or in 2025, as a result of after posting two consecutive monetary years of declining income, it’s the solely card they’ve left to play to generate progress. Software program alone can’t offset the losses in income from declining Change {hardware} gross sales.

The fact is that the Change is de facto starting to indicate its age. The console can’t help a lot of the third-party AAA video games popping out for the PS5 and Xbox Collection. If that isn’t bothering Nintendo, it’s most definitely annoying the third-party publishers, who’re seeing cash left on the desk.

The explanation I’m so adamant that Nintendo will launch a brand new console quickly is due to the historic time gaps between its console and handheld generations. There was a six-year hole between the 3DS (launched in February 2011) and the Change (launched in March 2017). There was a five-year hole in launch dates between the Wii U (launched in November 2012) and the Change. There was a six-year hole between the Wii U and the Wii (launched in November 2006) and a five-year hole between the Wii and the GameCube (launched September 2001). The Change is now in its seventh yr in market, so it’s time for a brand new launch. Nintendo may probably lengthen the Change lifecycle past 2025 however that might be unadvisable given the path in {hardware} gross sales. If Nintendo had been to increase the Change past 2025 with out releasing a brand new console, it will critically jeopardise future income progress given virtually all of the losses in its income are from {hardware} spending declines.

Nintendo Income Fiscal by {Hardware} & Software program gross sales 2021-2023 (This author, firm information)

Nintendo {Hardware} Gross sales (Nintendo Fiscal 12 months Ended March 2023 Earnings Launch)

An issue Nintendo may face is that the Change might be, in some ways, the top of its {hardware} improvements. It efficiently migrated handheld gaming with that of the console, it may due to this fact be unsurprising to seek out that Nintendo will re-iterate on this hybrid design. I imagine the possibilities of Nintendo releasing a devoted handheld console and separate TV consoles are over. The Change 2 will most definitely be like the brand new PC gaming handheld, the Asus ROG Ally, that shall be launched available on the market quickly. The truth that the Change Deck and the Asus ROG Ally ape the design of the Change, and its TV console performance is testomony to the prowess of the Change’s {hardware} engineering. Extra of the identical design just isn’t a foul factor. Nintendo may take a chunk from Apple’s (NASDAQ: AAPL) iPhone technique of iterative enhancements. A brand new idea or blue-sky pondering just isn’t wanted if the present design ticks all the fitting packing containers.

A look at their newest financials.

Within the fiscal yr 2023 financials, Nintendo posted ¥1.605B, a decline of 5.5% on final yr’s fiscal outcomes and an 8.9% decline in comparison with its 2021 fiscal outcomes. {Hardware} income declines account for the corporate’s losses. {Hardware} spending within the final two fiscal years declined by 21.4%, however this was offset by a 17.7% enhance in software program spending.

The online revenue ratio stands at 28.2%, 0.9 share factors increased than final fiscal.

Nintendo Income & Working Revenue (This Author, firm information)

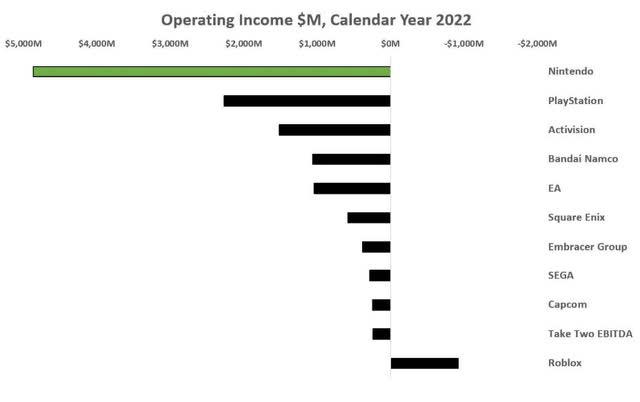

Nintendo has achieved very properly in preserving a lid on spending and reaching a really sturdy abnormal revenue of ¥641B. When in comparison with its rivals, Nintendo’s working revenue is flying excessive. Throughout calendar 2022 Nintendo’s working revenue was 2x that to the PlayStation Division from Sony, 3x Activision Blizzard (ATVI) and virtually 4x Bandai Namco (BANDAI NAMCO Holdings Inc) or Digital Arts (EA).

Working Revenue, Online game firms. Calendar 2022 (This author, firm information)

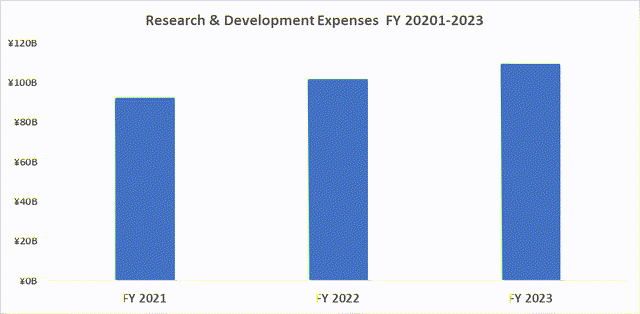

Nintendo is ramping up its analysis and improvement prices. Funding elevated by 7.7% between fiscal 2023 and monetary 2022. When in comparison with fiscal 2021, analysis and improvement prices elevated by 18.0%. We already know this fiscal yr will see income from The Legend of Zelda Tears of the Kingdom and Pikmin 4, so Nintendo just isn’t planning to decelerate sport releases any time quickly. Nintendo would wish to leverage greater than The Legend of Zelda: Tears of the Kingdom to shift {hardware} items.

Nintendo Analysis & Improvement expenditure Fiscal 2021-2023 (This author, firm information)

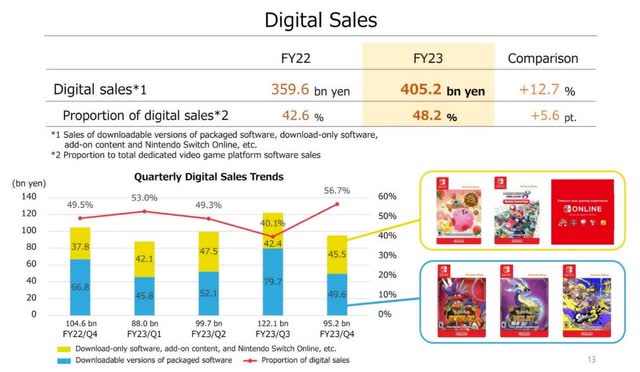

Software program gross sales account for half of income, permitting for continued growth on this class. At the moment, digital revenues account for a mean of 43% of whole software program gross sales. Though that is markedly decrease in comparison with different online game publishers, for instance, 89% of PlayStation software program income in its fiscal 2022 was from digital spending, Nintendo will have the ability to capitalize on higher digital gross sales sooner or later as its subsequent console ought to be supporting a bigger exhausting drive and reminiscence house than the 64-gigabyte reminiscence that got here with its present premier console, the OLED Change.

Nintendo Digital Gross sales (Nintendo Fiscal 12 months Ended March 2023 Earnings Launch)

Nintendo’s 42.6% digital income footprint is half that of the PlayStation.

PlayStation Earnings by division Fiscal 2022 (Sony’s Incomes Launch FY2022)

Nintendo is lastly mining its worthwhile IP on the large display. I imagine the large success of the Tremendous Mario Bros Film may lead Nintendo to construct an prolonged cinematic universe, like Marvel and DC’s prolonged cinematic universes. A sequel to the Tremendous Mario Bros Film might be simply as profitable, or extra so, than the primary movie. Nintendo could also be sluggish on the uptake in lending its IP to movie and tv, however this might all change throughout the subsequent a number of years. Many sport firms are investing in movie and tv productions of their IP as a result of they know the synergies it creates with sport gross sales and model consciousness.

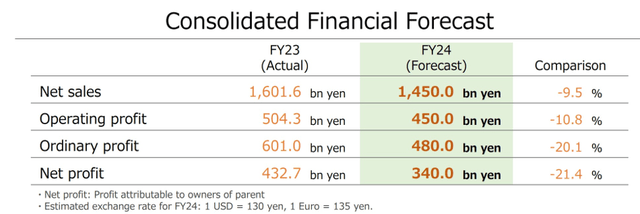

Nintendo is forecasting a 2024 fiscal yr with a 9.5% decline in web gross sales and a 20.1% decline in abnormal revenue, however this forecast is projected with no official announcement of a brand new console, which may probably be forthcoming by subsequent yr.

Nintendo consolidated Monetary Forecast FY2024 (Nintendo Fiscal 12 months Ended March 2023 Earnings Launch)

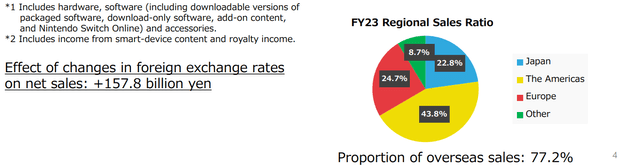

The decline within the worth of the Yen helps Nintendo.

With The Japanese Yen falling almost 5% towards the greenback and over 6% towards the euro in 2023 to this point, this has made Nintendo’s exports extra attractively priced to avid gamers within the US and Europe. This development, which has been occurring for no less than a yr, offers a tailwind to Nintendo’s earnings when overseas earnings return to Japan. With 77.2% of income coming from exterior Japan, Nintendo acknowledged that it has gained an extra ¥157.8B since fiscal final yr. As a proportion of high line income, this acquire quantities to only beneath 10%.

Nintendo’s income by territory (Nintendo Fiscal 12 months Ended March 2023 Earnings Launch)

Conclusion

I believe Nintendo is a superb firm to carry for a long-term funding. On the time of writing, Nintendo’s inventory market valuation is buying and selling on the mid $10.94 USD mark with a excessive P/E ratio of 15.19. When the brand new console is unveiled, the inventory worth ought to head upwards as the corporate seems to be to have discovered from its errors with the Wii U and can most definitely double down with a extra highly effective Change-like console.

Nintendo confirmed it’ll attend Gamescom in Germany this August, and we should always count on some huge bulletins. As I believe, a brand new console ought to be launched throughout the subsequent two years, which is able to reverse Nintendo’s declining income and fortify its place because the dominant participant within the online game market.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.

[ad_2]

Source link