[ad_1]

zennie/E+ through Getty Pictures

Introduction

The Schwab U.S. Dividend Fairness ETF (NYSEARCA:SCHD), and the SPDR S&P Dividend ETF (NYSEARCA:SDY) are sometimes bandied round because the go-to ETF choices for dividend buyers. The previous offers larger emphasis to the basics and the sustainability of dividend performs, while the latter focuses on shares which have grown their dividends for a minimum of 20 years.

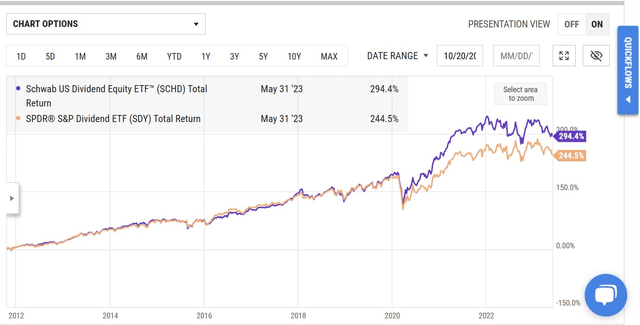

If one have been to have a look at mixture returns since SCHD’s inception again in Oct 2011 (SDY started its buying and selling historical past 6 years previous to SCHD, in Nov 2005), it has come out on high, however do contemplate that this outperformance hasn’t been uniform, and far of it came about throughout the post-pandemic section.

YCharts

SCHD and SDY: Key Screening Concerns

For the uninitiated, SCHD tracks the Dow Jones U.S. Dividend 100 Index, a subset of the Dow Jones U.S. Broad Inventory Market Index. In the meantime, SDY follows the S&P Excessive Yield Dividend Aristocrats Index, a subset of the S&P Composite 1500.

Throughout the preliminary section of inventory choice, it’s evident that SDY levies extra exacting requirements than SCHD. For context, SDY expects its potential shares to have grown their dividend yearly for 20 straight years, whereas SCHD’s expectation is proscribed to simply 10 years of dividend funds (no matter annual dividend progress throughout these 10 years). Admittedly, simply because an organization doesn’t develop its dividend yearly doesn’t essentially make it a bog-standard inventory, because it may very well be reinvesting extra funds to reinforce its IP/asset base, pay down debt, and even pursue bolt-on M&As each different yr, which in flip might assist bid up valuations. Additionally word that in SCHD’s secondary screening section, the place it seeks to find out a composite rating (extra on this later), it does contemplate the 5-year dividend progress charge of potential shares.

SDY additionally has extra stringent requirements in relation to the liquidity of those shares; SDY focuses on shares which have a 3-month common every day worth traded determine of over $5m, whereas SCHD’s liquidity threshold is far decrease at $2m per day on common (on a 3-month foundation, right here as properly).

Finally, SDY’s shares are weighted on the indicated annual dividend yield foundation. SCHD, alternatively, goes via a couple of extra layers of screening, the place its shares are first ranked by indicated dividend yield, after which the highest 50% transfer on to the following stage. Within the following stage, these shares are put via a rigorous basic check with the aim of arriving at a composite rating of the elemental screeners together with FCF to Debt, Return on Fairness, and many others. Finally, the highest 100 primarily based on the composite rating make it to the index the place they’re cap weighted).

The massive takeaway from this part is that while SDY implements increased quantitative thresholds in hunting down shares within the preliminary stage, SCHD’s screening course of is extra elongated and fine-tuned.

How Ought to Buyers Examine These ETFs?

To be able to decide which ETF is the higher choose, we’ve measured these two merchandise throughout six totally different parameters and picked a winner inside every class. Listed here are our ideas:

Construction

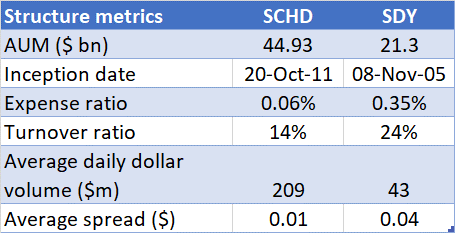

SCHD is the extra secure portfolio and faces much less strain from transaction prices. Final yr its annual turnover ratio got here in at solely 14%, round 1000bps decrease than SDY, the place sometimes 1 in 4 shares are churned yearly.

Then, one of many first issues that long-term buyers will search for is the expense ratio, and right here too SCHD has a transparent edge; its expense ratio of simply 0.06% is roughly 6x decrease than SDY’s corresponding determine.

SCHD’s low-cost characteristic makes it a very talked-about choose within the dividend investing house. For context, word that despite the fact that SCHD got here to the bourses 6 years after SDY, it has managed to build up an AUM determine that’s over 2x increased.

With extra market members flocking to the SCHD counter, liquidity isn’t an issue (common every day greenback volumes are ~5x that of SDY) with the bid-ask spreads at lowly ranges. These numbers make SCHD the extra appropriate automobile for many who are fastidious about good fills and have a buying and selling mindset.

ETF.com, Looking for Alpha

Dividend credentials

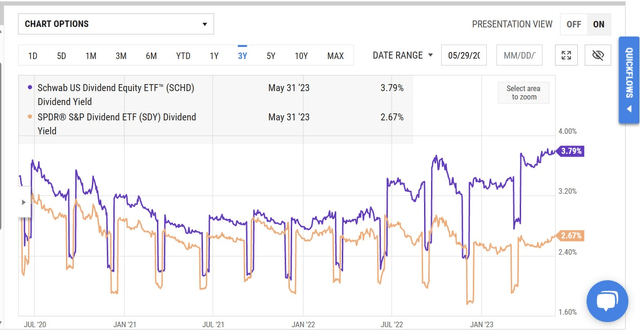

YCharts

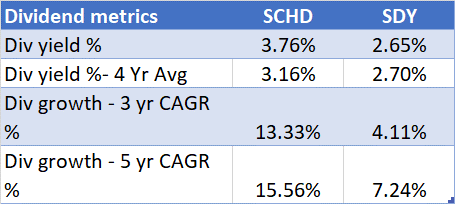

SCHD has at all times provided a superior yield to SDY, however round a yr in the past, the distinction was barely 30bps. Lately, it’s properly over 100bps. That isn’t all; for those who pursue SCHD at this juncture, you’ll be locking in a determine that’s 60bps increased than its personal historic yield common (4-year). Conversely, with SDY, its present yield is sub-par, coming in round 5bps decrease than its historic common.

Since SDY focuses on shares that develop their dividends, one would hope that it may very well be beneficiant with its dividend progress observe document. Sadly, its dividend progress credentials are fairly underwhelming because it has solely grown at single-digit CAGR ranges each on a 3-year, and 5-year foundation. In distinction, the ETF which doesn’t place a variety of emphasis on dividend progress has really been much more beneficiant in rising its dividends. Each within the brief and medium time period, it has grown its dividends in double-digit phrases.

Looking for Alpha

Portfolio publicity and technical issues

Should you’re eager on diversification, SDY needs to be your most well-liked wager. Not solely does it cowl a bigger variety of shares (272 shares versus 104 shares for SCHD), it’s also not top-heavy fairly not like SCHD. Though SCHD covers over 100 shares, a lot will rely on the top-10’s efficiency, as they account for 42% of the full portfolio in mixture. With SDY, the holdings are extra properly unfold out, with the highest 10 accounting for less than 16% of the portfolio.

Looking for Alpha

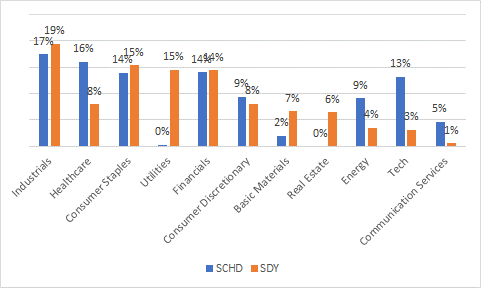

Though each ETFs have industrials as the highest sector, we really feel that SCHD is a tad extra aggressive in its positioning, whereas SDY is extra of a defensive play.

With SDY, the 4 most important defensive sectors (staples, healthcare, utilities, and actual property) account for 44% of the full portfolio, whereas these sectors solely account for 30% of SCHD’s portfolio. Should you assume that threat sentiment might flip in H2-22, SDY can be higher positioned to deal with drawdowns. By the way, SCHD doesn’t have any publicity to utilities or actual property, two sectors which are additionally prone to rising charge environments. With the rising charge atmosphere near really fizzling out, you may argue that cash begins flowing again to those sectors.

One additionally will get the sense that SCHD is a bit more uncovered to pockets that look overbought; tech and communication providers have been the shining lights of the markets in latest months, however with valuations at sky-high ranges, one does marvel if additional outsized positive aspects can be doable at these ranges.

Morningstar

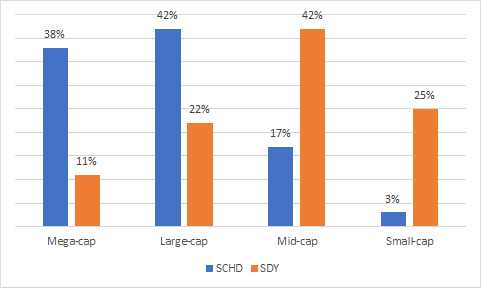

If one views each these ETFs from a special lens (market-cap differentials), one will get an identical takeaway. SCHD is presently closely uncovered to large-and-mega cap shares (80% of the full holdings) whereas solely one-third of SDY’s portfolio comes from that cohort. Conversely, the remainder of SDY’s portfolio (67%) comes from small and mid-caps.

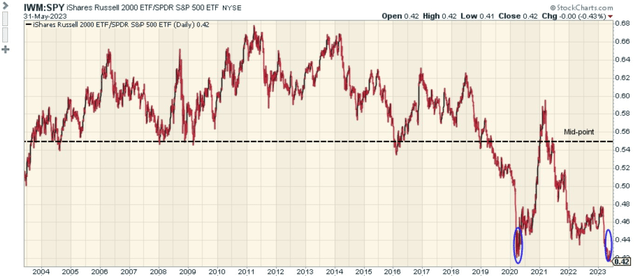

Clearly, mega-caps and enormous caps are in a great way however for those who imagine within the notion of mean-reversion within the markets, you must cling your hat on the small and mid-caps bucket at this juncture. The chart under highlights how oversold constituents of the Russell 2000 look, in relation to the mega and large-cap-based S&P 500. Additionally contemplate that this ratio has now dropped to the pandemic-era lows, a terrain from the place it beforehand staged a sensible comeback.

StockCharts

Even if you wish to dismiss the small and large-cap ratio and concentrate on simply SDY and SCHD per se, word that the mean-reversion theme presently favors SDY because the SDY: SCHD ratio is presently within the decrease half of the life-long vary and is round 8% off the mid-point.

StockCharts

Ahead Valuations

In accordance with YCharts, each SDY and SCHD will doubtless supply related weighted common earnings progress potential of seven% or so, over the following 5 years. Nonetheless, apparently sufficient, with SCHD you’ll should pay a decrease ahead P/E to get that stage of earnings progress. As per YCharts, SCHD presently trades at a ahead P/E of 13.6x, a 20% low cost to SDY’s corresponding a number of of 17x.

Backside Line

We discover it tough to select one clear winner, as there are good causes to get behind each SCHD and SDY. Granted, SCHD has much more issues going for it, together with its superior construction, the earnings angle, and low-cost ahead valuations. Nonetheless, given how oversold a few of SDY’s key pockets look, you may’t write off the potential of a comeback at these ranges. SDY additionally seems higher positioned to guard your portfolio if threat sentiment turns south.

[ad_2]

Source link