[ad_1]

Pleasureofart

Introduction

It is time to speak about an industrial inventory I’ve by no means lined earlier than. The Illinois-based IDEX Company (NYSE:IEX) is a implausible wealth compounder with a satisfying dividend observe report.

This well-diversified industrial firm has found out methods to persistently develop its enterprise by way of numerous cycles. Whereas the corporate is at the moment combating financial headwinds and healthcare de-stocking, I consider we might get enticing shopping for alternatives within the months forward, which could profit traders looking for high-quality compounders within the industrial house.

So, let’s dive into the small print!

Shopping for Compounders To Generate Wealth

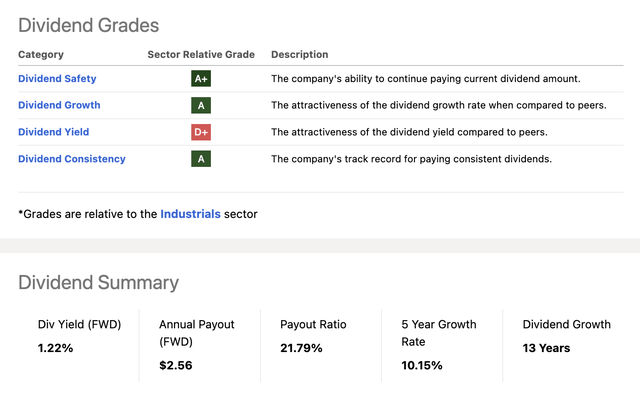

Let’s begin by taking a better take a look at the corporate’s dividend scorecard. What we see are 4 classes: security, development, yield, and consistency.

The corporate scores extraordinarily excessive on security, development, and consistency.

Looking for Alpha

Sadly, its dividend yield scores very low, as IDEX Company shares yield just one.2%.

Whereas this, sadly, makes IEX shares unsuitable for income-seeking traders, the corporate behind the IEX ticker is a complete return star.

The opposite day, I learn a paper titled The Anatomy of a Compounder, which regarded into the elements that make a inventory a long-term compounded.

This is its conclusion (emphasis added):

It’s stated that Albert Einstein described compounding curiosity as essentially the most highly effective power within the universe. We firmly consider that the long-term pattern in firm earnings with excessive money conversion determines the era of returns, and that discovering compounders is the holy grail of investing. The mindset of being on a continuing seek for compounders is a greater use of time than exhausting one’s mental capital and time on buying and selling out and in of shares and segments of the market in a need to look good within the quick time period.

Basically, the paper states that one of the best shares mixed with one of the best technique end in essentially the most wealth. On this case, they give attention to corporations with constant earnings development and excessive money conversion. These corporations are sometimes the dividend development stars of the market, even when they generally include a low yield.

Moreover, the paper makes the case that traders’ solely job must be to search out the precise picks and purchase them on the proper value. That is it.

Do not commerce good shares. Personal them.

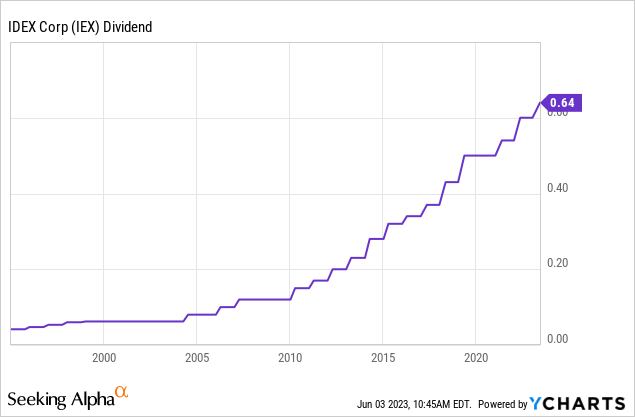

With that stated, going again to IDEX’s dividend, the corporate has grown its dividend by 10.2% per yr over the previous 5 years – on common, that’s.

The ten-year common is 11.6%, which reveals that the corporate’s dividend development has been very constant previously.

The newest hike was introduced on Might 25, when the corporate hiked by 6.7%. That is regardless of financial challenges, however extra on that later.

Whereas the corporate has had extended intervals with out hikes – primarily throughout recessions – it has by no means reduce its dividend.

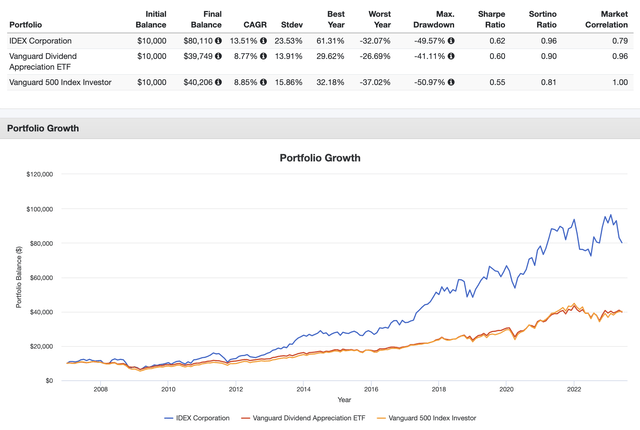

Moreover, the inventory has returned 13.5% for the reason that begin of 2007. It has outperformed each the S&P 500 and the Vanguard Dividend Appreciation ETF (VIG) by a large margin and with subdued volatility. Since 2007, the usual deviation has been simply 23.5%. This provides the inventory a good risk-adjusted return (Sharpe Ratio) of 0.62%.

Portfolio Visualizer

Now, with that stated, let’s have a look beneath the hood and uncover why IEX is a long-term compounder.

What Makes IDEX So Particular

The Firm Behind The IEX Ticker

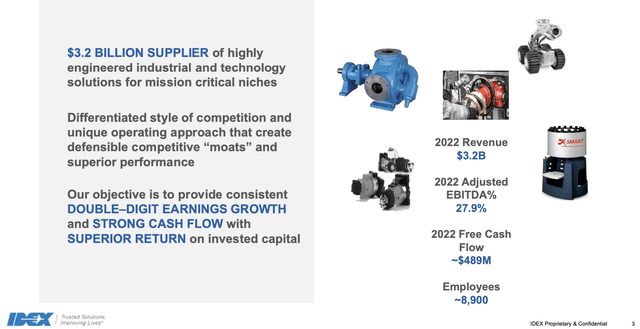

With a market cap of $15.8 billion, IDEX is among the greatest gamers within the Specialty Industrial Equipment business, which is part of the economic sector.

IDEX Company

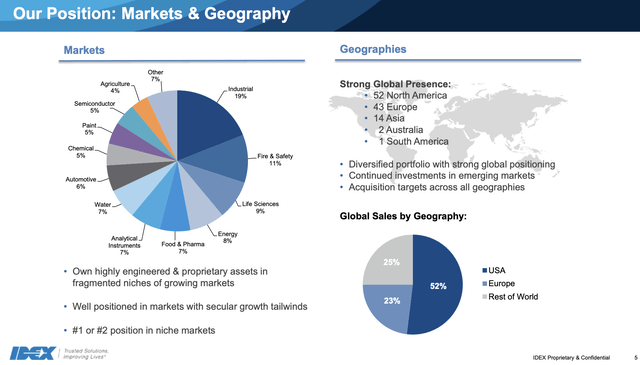

The corporate is an utilized options supplier that serves area of interest markets worldwide. The corporate operates by way of over 50 wholly-owned subsidiaries, united by the philosophy of embracing its 80/20 precept and prioritizing customer support.

IDEX Company

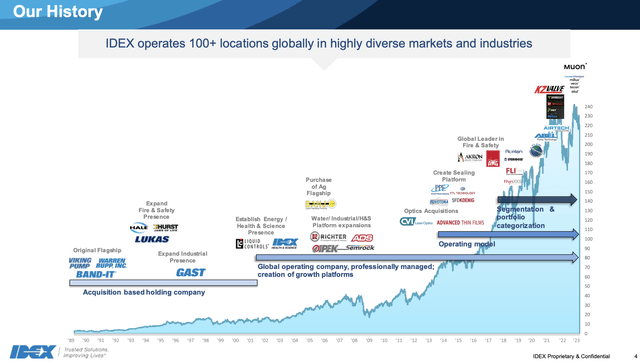

Wanting on the chart under, we see that IEX has a historical past of aggressive M&A, which is widespread amongst compounders in that sector. Basically, profitable corporations use free money stream to amass new companies. As soon as these corporations are built-in, free money stream improves, debt is decreased, and new M&A initiatives are initiated. It is a bit like taking part in Monopoly. In some unspecified time in the future, there isn’t any stopping one of the best gamers.

IDEX Company

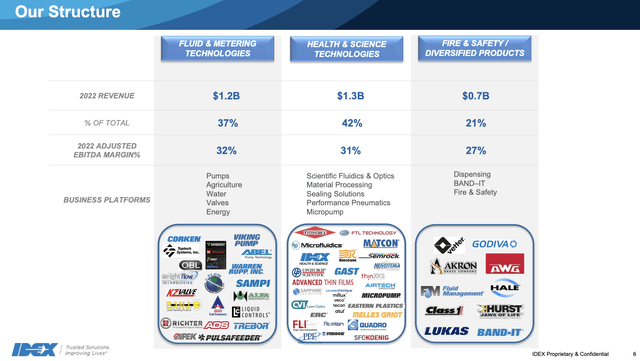

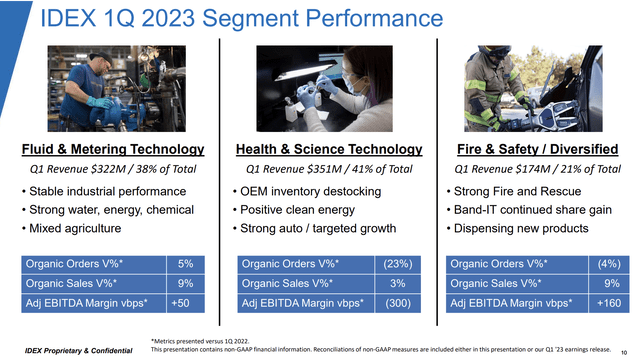

As we will see under, IDEX has three reportable segments: Fluid & Metering Applied sciences (“FMT”), Well being & Science Applied sciences (“HST”), and Hearth & Security/Diversified Merchandise (“FSDP”).

These segments are structured to greatest serve buyer wants and supply administration effectivity, aligning with natural development, strategic acquisitions, and capital allocation priorities.

The FMT phase designs and distributes fluid-handling pump modules and techniques, serving industries equivalent to meals, chemical, industrial, water and wastewater, agriculture, and power. The HST phase affords precision fluidics, pumps, sealing options, medical units, optical elements, and extra, serving markets like meals and beverage, life sciences, prescribed drugs, and aerospace/protection. The FSDP phase contains companies associated to fireside security, meting out, and numerous merchandise.

IDEX Company

Now, let’s take a better take a look at the corporate’s capital spending plans.

How IEX Spends Its Capital

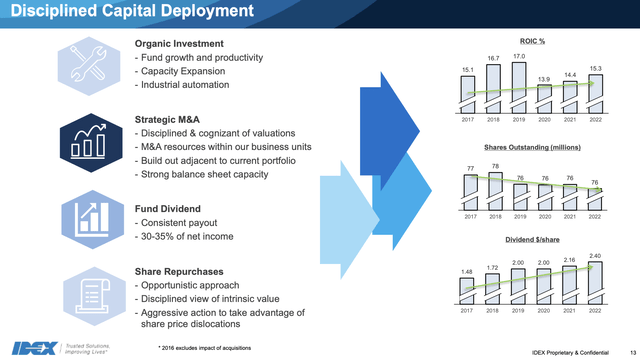

IEX’s capital deployment priorities are completely aligned with its long-term targets. The corporate’s fundamental precedence is natural development, which incorporates increasing present capacities and enhancing services by way of, i.e., automation. Over the previous six years, the corporate has achieved returns on invested capital of 14% to 17%.

IDEX Company

The second precedence is M&A. The corporate goals to purchase corporations every time it sees alternatives to create synergies. As we simply briefly mentioned, the corporate has an enormous portfolio of corporations that every one carry one thing distinctive to the desk.

Precedence quantity three is its dividend. The corporate goals to take care of a gentle payout ratio of 30% to 35% of its internet earnings.

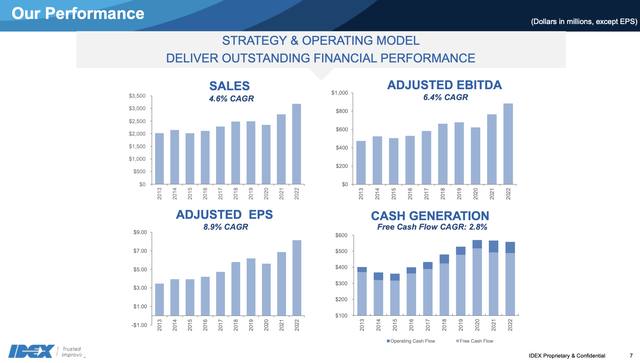

Over the previous ten years, the corporate has grown its EPS by 8.9% per yr. The corporate struggled a bit in 2014 and 2015 when manufacturing entered a recession. It additionally suffered in 2020 as a result of pandemic.

IDEX Company

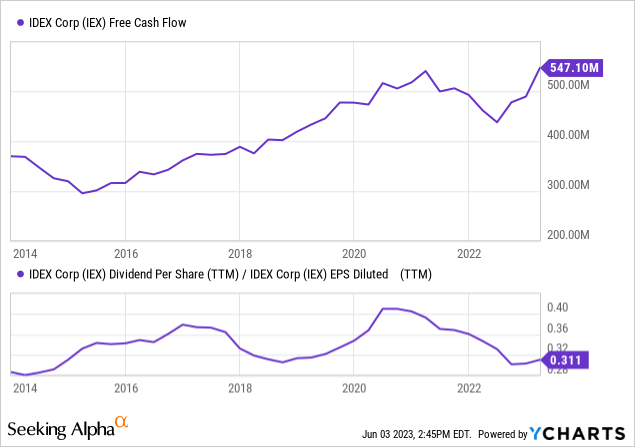

Moreover, free money stream development was a bit sluggish, with a CAGR of two.8%. Nonetheless, free money stream is now rebounding once more. Additionally observe that I added the payout ratio within the chart under, which reveals that the corporate’s payout ratio is, as soon as once more, on the decrease certain of its goal vary. That is good for future (anticipated) dividend development.

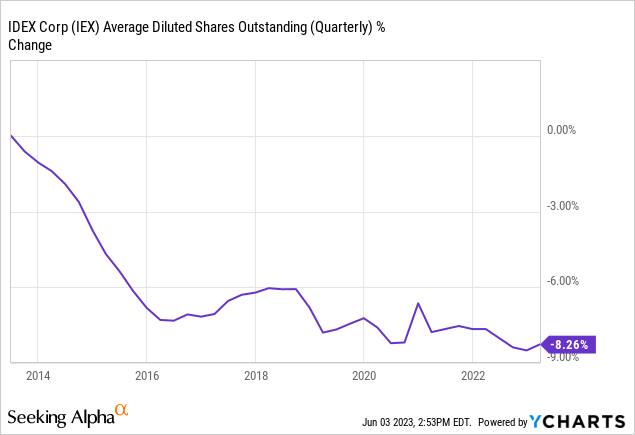

The fourth precedence is repurchasing shares. The corporate makes use of an opportunistic buyback method, which implies it deploys money for buybacks when it believes its enterprise is undervalued.

Over the previous ten years, IEX has purchased again 8.3% of its shares, which is not quite a bit, however it does add up over time.

Additionally, the corporate maintains a really wholesome stability sheet.

IDEX Corp is anticipated to finish this yr with $640 million in internet debt. This interprets to roughly 0.7x EBITDA. Therefore, the corporate enjoys a BBB+ credit standing. I consider this ranking can be boosted to A- over the following few years.

Latest Occasions & Valuation

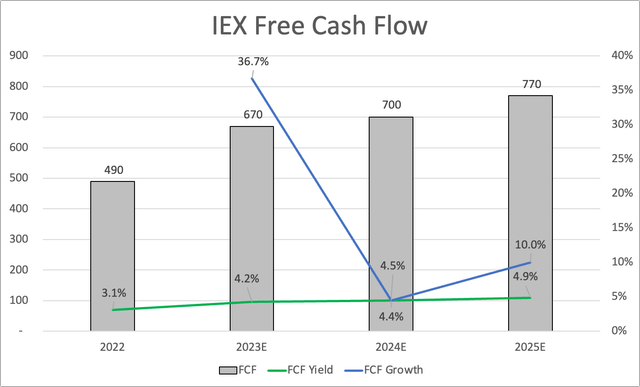

Let’s begin with one of the best information. IEX is anticipated to proceed the aforementioned surge in free money stream. This yr, IEX is anticipated to spice up free money stream to $670 million, adopted by a gradual surge to $770 million in 2025. These numbers point out a free money stream yield rise to 4.9% in 2025.

Leo Nelissen

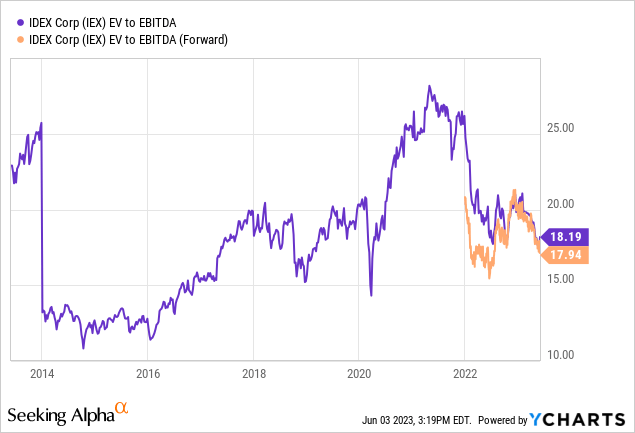

When wanting on the IEX share value, we see that euphoria remains to be subdued. IEX shares are 15% under their 52-week excessive and down 8.4% year-to-date.

This is smart, as traders have dumped cyclical shares resulting from a gentle decline in financial development expectations.

Nonetheless, IEX continues to do extraordinarily properly.

Within the first quarter, IDEX achieved report gross sales with optimistic natural development throughout all three segments. The corporate reported $2.09 adjusted earnings per share and robust free money stream. Whereas the FMT and FSD segments carried out exceptionally properly, offsetting some strain within the HST phase, IDEX skilled a broader and extra extended recalibration throughout the HST phase, significantly within the analytical instrumentation, life science, pharma, and semiconductor markets.

IDEX Company

Furthermore, regardless of the end-market demand remaining optimistic, IDEX believes its clients have a ample stock of crucial elements within the close to time period.

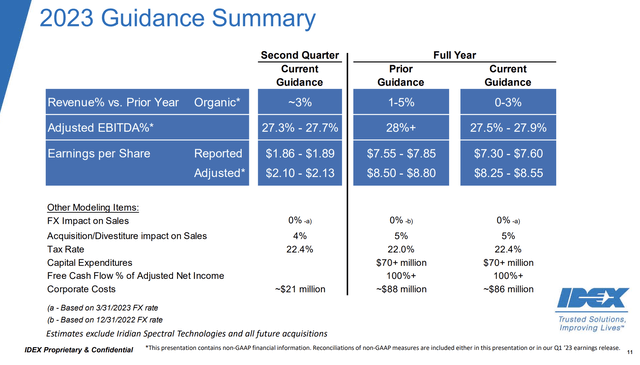

Because of the stock recalibration and quantity affect within the HST phase, IDEX revised its full-year adjusted 2023 EPS steering from $8.25 to $8.55.

The highest-line challenges, internet of the cost-containment plan, are anticipated to drive a $0.25 adjusted EPS headwind for the yr.

IDEX Company

IDEX additionally introduced its intent to amass Iridian Spectral Applied sciences for CAD 150 million ($111 million). This acquisition is anticipated to enrich and develop IDEX’s present companies inside HST.

Additionally, associated to HST stock points, the corporate famous that order consumption is firming up within the again half of the yr, with planning and strategies being adjusted accordingly. Whereas market circumstances might differ, these elements present a level of confidence within the path to normalization.

*If* financial development bottoms going into subsequent yr, I consider that IDEX Corp may gain advantage from power in all segments and comfortably rise past its all-time excessive.

With that stated, the valuation is honest. Shares are buying and selling at roughly 18x NTM EBITDA.

IEX’s present consensus value goal is $230, which means roughly 10% inventory value upside. I agree with that, given the present circumstances.

Traders keen on shopping for IEX as a long-term dividend development traders ought to search for an entry near $180. I consider {that a} market correction might push IEX shares into the $180 to $190 vary. At that time, I actually just like the long-term threat/reward.

Evidently, ready for higher costs comes with dangers of lacking long-term upside if the inventory would not fall that far. Nonetheless, given my view on the financial system, it is a threat I am keen to take.

Takeaway

IDEX Company presents an interesting alternative for traders looking for high-quality compounders within the industrial sector. Regardless of the present financial slowdown, enticing shopping for alternatives might come up within the coming months.

IEX’s dividend observe report, although with a low yield, showcases constant development and excessive money conversion, making it a complete return star. The corporate has by no means reduce its dividend, and its inventory has outperformed the market with low volatility.

IEX’s capital deployment priorities align with its long-term targets, together with natural development, focused M&A, dividend payouts, and opportunistic share buybacks.

A wholesome stability sheet and expectations of surging free money stream additional bolster its place.

Whereas IEX’s present valuation is honest, affected person traders would possibly think about an entry level nearer to $180, balancing long-term potential with potential market dangers.

[ad_2]

Source link