[ad_1]

TERADAT SANTIVIVUT

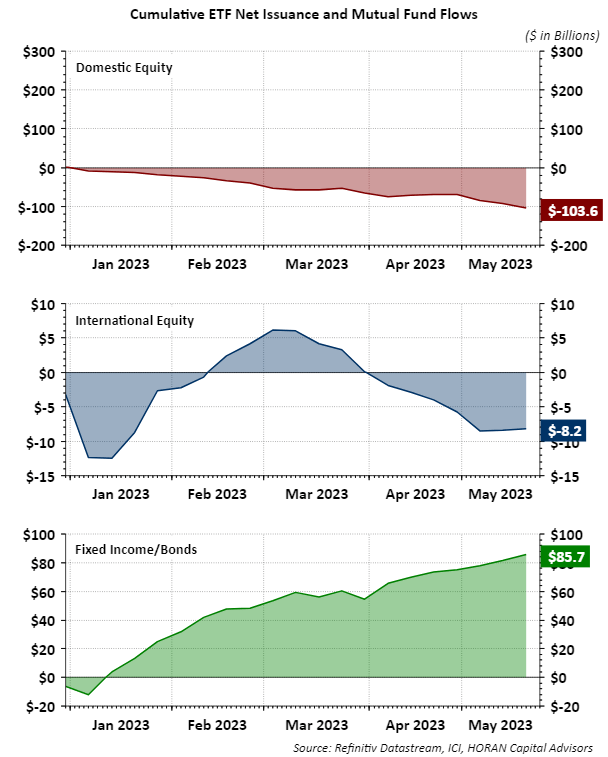

Sometimes I be aware the economic system just isn’t the market and vice versa. Being conscious of this distinction has confirmed essential this 12 months because the S&P 500 Index is up 12.37% by Friday’s (6/2/2023) market shut. A lot of the latest financial commentary has centered on predicting when the U.S. economic system goes into recession, some stating by year-end. Undoubtedly the Fed’s aggressive rate of interest hikes during the last 12 months or so are anticipated to have a slowing influence on financial exercise and they’re. The damaging information stream has weighed on traders, and their funding actions appear to verify this. Despite robust returns for the market, traders have been web sellers of shares primarily based on mutual fund and ETF flows as seen beneath.

Refinitiv Datastream, ICI, HORAN Capital Advisors

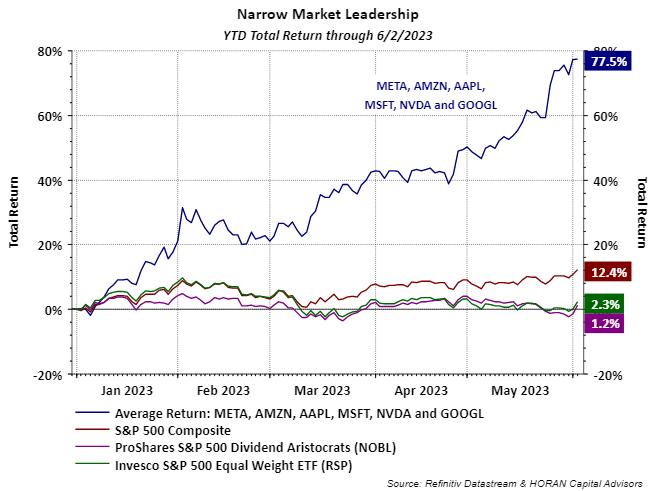

Despite the blended financial information, the fairness market continues to maneuver increased. Distinctive to the market this 12 months is the narrowness of the advance, each within the variety of shares collaborating within the transfer increased in addition to a restricted variety of asset courses collaborating. Because the beneath chart exhibits, the common return of simply six shares, Meta Platforms (META), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), and Alphabet (GOOGL), is a optimistic 77.5%. The S&P 500 Index is represented by the maroon line and the inexperienced line represents the Invesco S&P 500 Equal Weight ETF (RSP). On this index, every inventory is weighted the identical, and the return of every inventory contributes equally to the calculation of the ETF’s return. Primarily, the two.3% return represents the common return of shares within the S&P 500 Index. The purple line represents S&P’s Dividend Aristocrats (NOBL) which consists of firms which have elevated their dividend yearly for a minimum of the final 25 years. Firms that may obtain this document are usually higher-quality ones. The year-to-date whole return for the Dividend Aristocrats is 1.2%.

Refinitiv Datastream, HORAN Capital Advisors

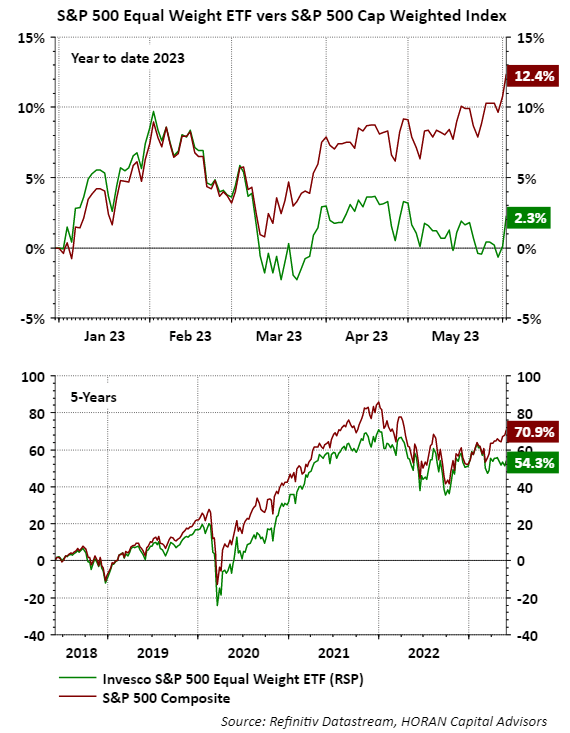

In wanting on the return of the cap-weighted S&P 500 Index in comparison with its equal-weighted counterpart, largely the 2 indexes transfer in the identical course as seen within the second panel within the beneath chart. The highest panel is the year-to-date return and for the reason that finish of March, the equal-weighted index has really declined.

Refinitiv Datastream, HORAN Capital Advisors

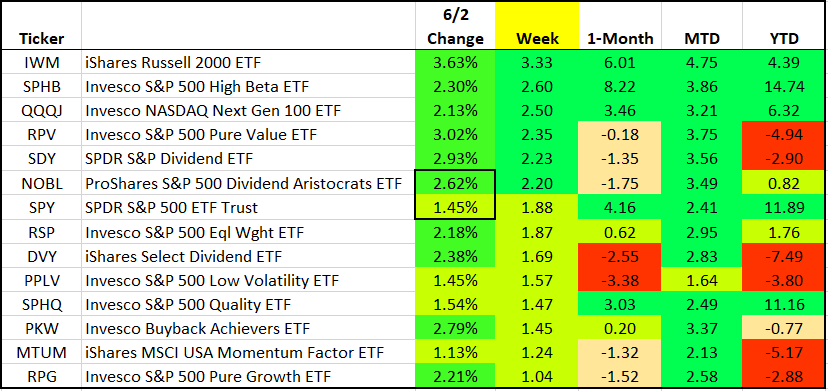

Traditionally, when return gaps like this develop, the equal-weighted index return is extra more likely to catch as much as the cap-weighted index return as a broader variety of shares start collaborating within the advance. Actually, final week’s market return often is the starting of the lagging shares and asset courses starting their catch-up transfer. Because the beneath desk exhibits, among the elements and asset courses which can be lagging this 12 months had been one of the best performers final week. Small firm shares had been up 3.33% on the week but solely up 4.39% this 12 months. The Dividend Aristocrats had been up 2.20% and outpaced the S&P 500 Index. The Aristocrats’ weekly return was all generated on Friday when these dividend shares had been up 2.62%.

Creator

In abstract, investor bullish sentiment is blended however bullish sentiment as measured by the American Affiliation of Particular person Buyers stays low. Investor actions don’t appear overly bullish, besides presumably for curiosity in synthetic intelligence shares. The narrowness of the market this 12 months could also be one other contrarian market signal as effectively with the lagging shares now starting to hitch available in the market advance.

Authentic Put up

Editor’s Word: The abstract bullets for this text had been chosen by In search of Alpha editors.

[ad_2]

Source link