[ad_1]

Alexey Krukovsky/iStock by way of Getty Pictures

A number of fly bites can not cease a spirited horse.”― Mark Twain.

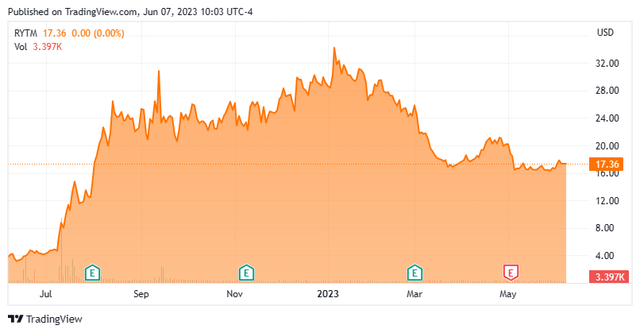

We final took a take a look at Rhythm Prescribed drugs, Inc. (NASDAQ:RYTM) in October of final yr. The corporate is within the early levels of rolling out its major drug asset imcivree, which was lately permitted in Canada. Rhythm can be evaluating this compound for brand new indications within the quickly rising weight administration drugs area. We replace our evaluation on Rhythm Prescribed drugs beneath.

Searching for Alpha

Firm Overview:

The industrial staged biopharma concern Rhythm Prescribed drugs, Inc. relies out of Boston, MA. The corporate is targeted on creating and advertising therapeutics for the remedy of uncommon genetic ailments of weight problems. At present the inventory trades for round $17.50 a share and sports activities an approximate market capitalization of $1 billion.

The corporate’s primary asset known as IMCIVREE. It is a uncommon melanocortin-4 receptor permitted for the remedy of pro-opiomelanocortin (POMC), proprotein convertase subtilisin/kexin kind 1, leptin receptor (LEPR) deficiency weight problems, and Bardet-Biedl {BBS}.

Could Firm Presentation

Rhythm continues to concentrate on the melanocortin-4 receptor (MC4R) pathway with its improvement strategy. This pathway is answerable for regulating weight and starvation.

Could Firm Presentation

The agency is trying to develop the indications that imcivree is permitted for and increase its potential goal inhabitants. In the direction of that finish, the corporate lately initiated a Part 3 research evaluating the compound to deal with acquired hypothalamic weight problems {HO}. The primary affected person on this trial was dosed within the first quarter and full enrollment of this research must be full by finish of the primary quarter of 2024. The first endpoint for this trial would be the p.c change in Physique Mass Index or BMI after roughly 52 weeks on a therapeutic routine of imcivree versus placebo. A significant distinction between BBS and bought hypothalamic weight problems people is the overwhelming majority of the latter are identified and actively engaged with the healthcare system already. This could drive a sooner advertising ramp up, if permitted for the indication. There aren’t any present FDA permitted therapies for this situation.

Could Firm Presentation

Rhythm can be evaluating Imcivree throughout 4 genetic subtypes that influence over 50,000 people within the U.S. alone. Extra information from an open-label a part of a Part 2 trial ‘DAYBREAK’ from a number of genetically-defined cohorts might be out within the second half of 2023.

Lastly, the corporate acquired a program from Xinvento in congenital hyperinsulinism (CHI). It is a pure strategic match for the corporate’s pipeline and a goal must be chosen and an IND must be filed for this program in 2024.

First Quarter Outcomes:

On Could 2nd, the corporate reported its first quarter numbers. The corporate had a GAAP lack of 92 cents a share, simply over 20 cents a share worse than expectations. Revenues did rise from simply over $600,000 in 1Q2022 to $11.5 million, a tad lower than the consensus. The corporate has now seen 300 prescriptions for imcivree to deal with BBS because it was permitted for that indication in June of 2022.

Could Firm Presentation

Administration additionally said that it continues to count on between $200 million to $220 million in Non-GAAP Working Bills in FY2023. $120 million to $130 million comprised of R&D bills and $80 million to $90 million from SG&A bills.

Could Firm Presentation

The corporate has had a few necessary launch milestones for IMCIVREE because the first quarter ended, it must be famous. The product launched in late April in Germany and received advertising approval in Canada one month in the past as properly.

Could Firm Presentation

Analyst Commentary & Stability Sheet:

Since first quarter outcomes posted, 4 analyst corporations together with Goldman Sachs and Stifel Nicolaus have reiterated Purchase/Outperform scores on the inventory. Two of those did include slight downward worth goal revisions. Worth targets proffered ranged from $35 to $52 a share. Financial institution of America maintained its Maintain ranking and $23 worth goal on RYTM.

Simply over 20% of the excellent float within the shares is presently held brief. A number of insiders have offered shares within the inventory prior to now few months. To this point in 2023, they’ve disposed of roughly $450,000 value of fairness collectively.

Could Firm Presentation

The corporate ended the primary quarter of 2023 with proper round $295 million of money and marketable securities on its stability sheet after burning by almost $40 million value of money to help operations within the quarter. The corporate has no long-term debt. Administration has said that funding in place will carry it into 2025.

Verdict:

The present analyst agency consensus has the agency dropping simply over $3. a 25share in FY2023 at the same time as revenues soar some 180% to round $66 million. They venture revenues to rise over 90% in FY2024 and for losses to be minimize to only north of $2.50 a share.

Could Firm Presentation

The corporate has quite a few milestones calendared for the remainder of 2023. A current research predicted People pays $10 billion for weight reduction medicines yearly by FY2027, a 378% rise from FY2023 projected gross sales. Due to this fact, Rhythm is concentrating on a major and fast-growing market.

Rhythm is making some progress with its rollout of imcivree and in attempting to develop its potential permitted indications. It’s clearly a big market that’s seeing spectacular development.

That stated, Rhythm Prescribed drugs’ money burn is regarding, which might be a key cause one out of each 5 shares are held brief. The corporate is prone to do a capital increase over the subsequent 12 months given its present burn price. Due to this fact, till Rhythm Prescribed drugs, Inc. makes extra progress boosting gross sales and reducing that burn price, RYTM inventory solely deserves a small “watch merchandise” place for aggressive traders inside a well-diversified biotech portfolio.

The wishbone won’t ever exchange the spine”― Will Henry.

[ad_2]

Source link