[ad_1]

Montes-Bradley

Thesis

The US Treasury 6 Month Invoice ETF (NASDAQ:XBIL) is a brand new providing within the quick dated treasury fund area. As per its literature:

The funding goal of the US Treasury 6 Month Invoice ETF (the “UST 6 Month Invoice Fund”) is to hunt funding outcomes that correspond (earlier than charges and bills) typically to the value and yield efficiency of the ICE BofA US 6-Month Treasury Invoice Index (G0O2).

In impact this fund appears to be like to trace the efficiency of 6-month treasury payments on a relentless maturity foundation. There’s a distinction between buying a 6-months treasury outright and shopping for XBIL. For those who purchase a treasury outright, you principally lock-in the yield and expertise a pull to par as you strategy the maturity date. As a reminder T-Payments are low cost securities, and the distinction between the acquisition worth and the par quantity is the accrued curiosity, often realized upon maturity (except you promote the safety earlier). Conversely, through XBIL one is topic to the prevailing yield for the respective tenor:

The US Treasury auctions a brand new 6-Month Treasury invoice every week. The public sale will decide the coupon fee of every new on-the-run1 be aware. As soon as the public sale is full and will be settled, XBIL will promote the at the moment held, outdated 6-Month US Treasury and roll into the newly issued 6-Month US Treasury.

The fund doesn’t maintain on to the 6-months invoice till maturity, or assemble a ladder with securities that give the fund a period that’s equal, however simply rolls each week the on the run 6-months T-Invoice:

On-The-Run refers back to the periodic transition to the most-recently auctioned Treasury invoice, be aware, or bond of a acknowledged maturity, which is known as the “on-the-run” or “OTR” safety of that maturity, happens on in the future. An OTR safety is probably the most lately issued of a periodically issued safety (versus an off-the-run safety, which is a safety that has been issued earlier than the latest difficulty and remains to be excellent).

The ‘On-the-Run’ idea is essential for longer dated Treasury bonds, however much less so for T-Payments. It is crucial for Treasury bonds as a result of company bonds with sure tenors get priced off treasuries. So to illustrate IBM (IBM) costs a brand new 10-year company bond. The mechanics of the funding grade market is to cite a selection for the brand new company bond versus the ‘On-the-Run’ Treasury. So IBM may theoretically worth its bond at T+150bps, that means the on the run 10-year treasury yield plus 150 bps. By pricing this fashion, the syndication course of ensures patrons haggle across the credit score unfold the deal ought to pay (i.e. the 150 bps) somewhat the danger free charges element which is able to fluctuate. Nonetheless, no bonds worth on 6-months T-Payments.

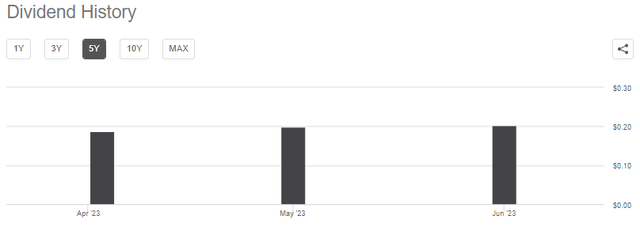

Artificial Dividend

Though the fund technically doesn’t obtain a dividend (bear in mind T-Payments are low cost devices), it manages to create an artificial one:

Dividend Historical past (Looking for Alpha)

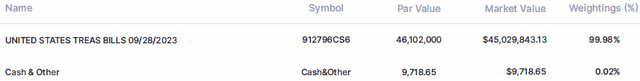

The trade traded fund holds some money to handle inflows and outflows, and the identical pool of capital is utilized to disburse a month-to-month dividend that carefully resembles prevailing 6-months yields:

Holdings (Fund Truth Sheet)

The money doesn’t come out of skinny air nonetheless, for the reason that construction realizes mark to market positive factors each time it rolls into new on-the-run T-Payments. Give it some thought this fashion – absent any adjustments in prevailing charges, the fund holds a 6 months T-Invoice for per week. When it will get offered there’s a pull to par impact for the reason that instrument solely has 5 months and three weeks left when it comes to tenor. That pull to par is mirrored in the next worth obtained for the instrument.

Whereas it’s arduous to segregate that impact given the fixed fluctuation in rates of interest, over time the impact of the weekly pull to par will get mirrored within the fund’s NAV.

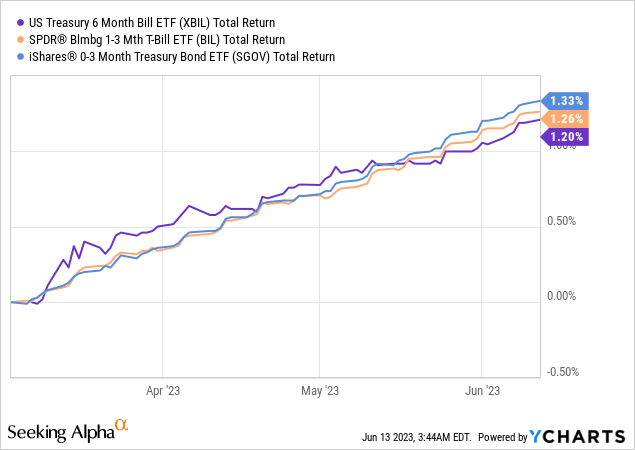

Efficiency

In its quick lifespan the fund compares favorably with different quick time period devices:

We will see from the above graph how the whole return for XBIL matches what we extract from funds such because the SPDR Bloomberg 1-3 Month T-Invoice ETF (BIL) or the iShares 0-3 Month Treasury Bond ETF (SGOV).

Use Circumstances

In our thoughts this fund has extra of an institutional use somewhat than a retail use. Or to phrase it otherwise, this isn’t essentially a great clip the yield purchase and maintain instrument. In our thoughts it’s extra of a constructing block for varied trades or commerce concepts. What the fund does very nicely versus its friends is isolate the 6-months level within the yield curve (given its fixed maturity function). So if an investor needs to construct a steepener of flattener for varied factors within the curve (to illustrate 6-months versus 2-year), it might use XBIL since it’s a fixed maturity tackle the purpose within the curve. Equally, if there’s an noticed correlation with a specific market sector or particular person inventory, the investor can use XBIL to create a relationship (lengthy TSLA and quick XBIL as a pair commerce for instance – theoretical commerce, not a commerce thought).

Equally, as soon as an choices market develops round XBIL, packaging the 6-months level in an ETF format permits buyers to make use of choices with a purpose to speculate strikes within the entrance finish of the curve.

Conclusion

XBIL is a brand new fund within the treasuries area. The automobile goals to isolate and observe the value and yield efficiency of the ICE BofA US 6-Month Treasury Invoice Index. This principally represents an publicity to fixed maturity 6-months treasury payments. The automobile achieves its objective by rolling each week into the newly issued 6-months T-Invoice. The fund has constructed an artificial dividend, since T-Payments are low cost devices and thus don’t pay any distributions till maturity. We contemplate this fund extra of a constructing block for correlation trades or choices trades somewhat than a pure purchase and maintain instrument, though it compares favorably from a complete return perspective to SGOV and BIL in 2023.

[ad_2]

Source link