[ad_1]

Maksim Safaniuk/iStock Editorial by way of Getty Pictures

Deere & Firm(NYSE:DE) is far more than a tractor producer throughout the agriculture sector. Deere is revolutionizing the agriculture sector by putting in self-driving capabilities is its giant equipment tractors, making them the Tesla (TSLA) of agriculture.

The corporate lately reported a stable quarter, however the inventory was unable to retest the 2022 highs, as a substitute falling and now discovering themselves 10% under its 52-week excessive.

Since final masking the inventory, DE shares are up almost 30%, and though I nonetheless am an enormous believer within the inventory long-term, the present valuation has me ready on including shares proper now. Whereas self-driving ought to add to each the highest and backside line extra over time, I’m selecting to be affected person to search for a greater entry level.

On this piece we are going to take a better take a look at these latest quarterly outcomes, the standing of the enterprise, the corporate dividend, and its present valuation.

Robust Latest Outcomes

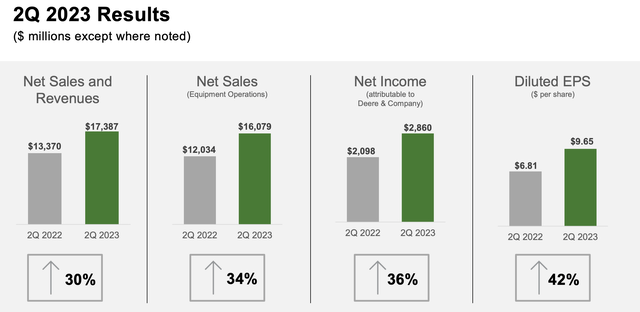

The economic sector has been hitting on all cylinders and Deere has been proper there within the thick of it. Deere lately reported robust earnings to again up its efficiency, displaying no indicators of slowing, but. Here’s a nearer take a look at the corporate’s Q2 earnings:

Internet Revenues of $17.4 billion Internet Revenue of $2.9 billion EPS: $9.65 per share

DE Q2 Presentation

Revenues of $17.4 billion had been a 30% enhance yr over yr. The manufacturing and precision ag section generated revenues of $7.8 billion, which was a rise of 53% yr over yr.

EPS of $9.65 per share in the course of the quarter was a 42% enhance yr over yr.

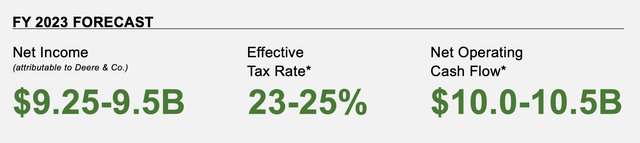

Through the quarter, administration once more elevated their 2023 steering after one other robust quarter for the corporate. Internet revenue is predicted to come back in between $9.25 billion and $9.5 billion with web working money circulate of $10.0 to $10.5 billion.

DE Q2 Presentation

Outdoors of the robust efficiency that the corporate reported, which had been above analyst expectations, traders appear happy to see that provide chain points are largely behind them.

Because the pandemic, many firms that bought merchandise noticed large provide chains points. Within the early components of the pandemic, firms noticed an absence of stock, which then flipped to firms having an excessive amount of stock that they needed to eliminate at discounted costs.

Administration attributed two predominant drivers to the outperformance in the course of the quarter, first being that the corporate’s factories noticed their most effective quarter of execution for the reason that starting of the pandemic. Secondly, administration attributed the robust quarter to the shortage of provide chain associated points. With factories operating extra easily, the corporate skilled fewer manufacturing inefficiencies, stating that Q2 the corporate noticed the bottom stage of manufacturing value inflation since 1Q, 2021. A extra environment friendly provide chain saved prices down and margins up.

Expertise Inside Agriculture

Deere is making nice strides to be a sport changer inside their respective sector. In spite of everything, there isn’t a extra land being made as of late, so the significance of effectivity is vital throughout the farming and agriculture sector.

Deere launched its totally autonomous self-driving tractor on the 2022 CES, which was an enormous breakthrough throughout the farming sector. This add on, though expensive for farmers, over time it might assist remedy the shortage of labor in addition to assist convey down wages expense.

Deere is aiming to ship a completely autonomous, battery-powered electrical ag tractor to the market by 2026.

Deere

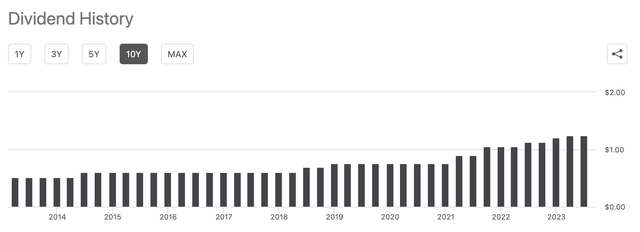

Plowing Up Dividend Development

Deere has lengthy been referred to as a stable firm that pays a protected and rising dividend. Over the previous 10 years, the dividend has grown from $2.04 in 2013 to $5.00 per share in 2023. That is progress of 145%.

In search of Alpha

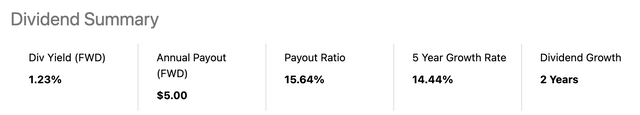

Deere presently pays an annual dividend of $5 per share which equates to a dividend yield of 1.2%. The payout ratio may be very low at 15% and the corporate has a five-year dividend progress charge of 14%.

In search of Alpha

Purchase, Promote, or Maintain

John Deere has been an important inventory to personal over the previous few years, however it is usually making a reputation for itself within the dividend neighborhood. Over the previous few years, Deere has elevated the dividend over 10% per yr.

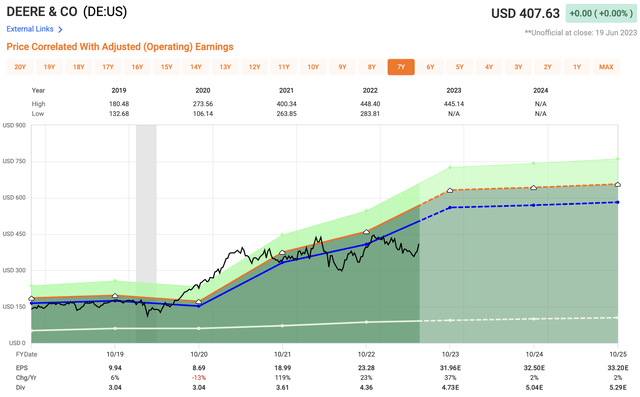

Analysts are searching for DE to generate EPS of $31.96, which equates to an earnings a number of of 12.7x. For comparable functions, shares of DE have traded at a a number of of 17.5x over the previous 5 years and nearer to 16x the previous decade, suggesting shares are presently undervalued.

Quick Graphs

Though the corporate does seem undervalued, given my present place within the inventory and the anticipated financial headwinds, I’m content material on taking a wait and see strategy. This by no means sways my conviction in regards to the inventory shifting ahead, and if I weren’t within the place already, I might perceive desirous to provoke a small place at present ranges. In spite of everything, I do want time available in the market over making an attempt to time the market.

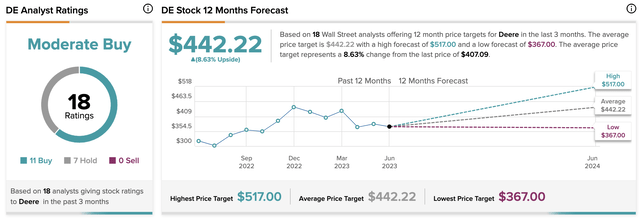

The typical analyst value goal is $442, which suggests solely 8% upside from present ranges over the course of the following 12-months.

Tipranks

Investor Takeaway

Deere & Firm is trying to revolutionize the agriculture sector with its driverless expertise. The corporate simply reported a powerful quarter on bettering efficiencies, which benefited from much less provide chain disruptions.

Deere has a powerful steadiness sheet with an A credit standing mixed with a rising dividend.

What dangers does this agriculture large face? Within the near-term, if the economic system does in truth slowdown as many count on and companies begin to minimize prices additional, spending on a lot of Deere’s merchandise could also be pushed out a yr or extra, negatively impacting the economic large. As well as, they’re rolling out a really subtle product in self-driving, one thing we now have seen the likes of Tesla run into points with for years. That would positively get in the way in which for DE as properly with their self-driving tractors.

Though the inventory appears to be like barely low cost at latest ranges, there seem like rising headwinds throughout the sector as a result of a slower shifting economic system, which might negatively affect industrials. Lengthy-term, DE is a superb firm, however short-term headwinds might be coming.

Disclosure: This text is meant to supply info to events. I’ve no information of your particular person targets as an investor, and I ask that you simply full your individual due diligence earlier than buying any shares talked about or really helpful.

[ad_2]

Source link