[ad_1]

asbe/E+ through Getty Pictures

June 22, 2023, proved to be a very implausible day for shareholders of Overstock.com (NASDAQ:OSTK). After information broke that the corporate had agreed to amass sure property from now defunct retailer Mattress Bathtub & Past (OTCPK:BBBYQ), shares of the corporate spiked, closing up 17.3% for the day. Whereas I agree that this maneuver will seemingly be worth accretive for the enterprise, I additionally assume that buyers shouldn’t get too excited proper now. Basically, the image for the corporate has worsened over the previous a number of quarters and it’s unclear whether or not it may possibly return to the type of profitability it skilled in 2020 and 2021.

An attention-grabbing however opaque alternative

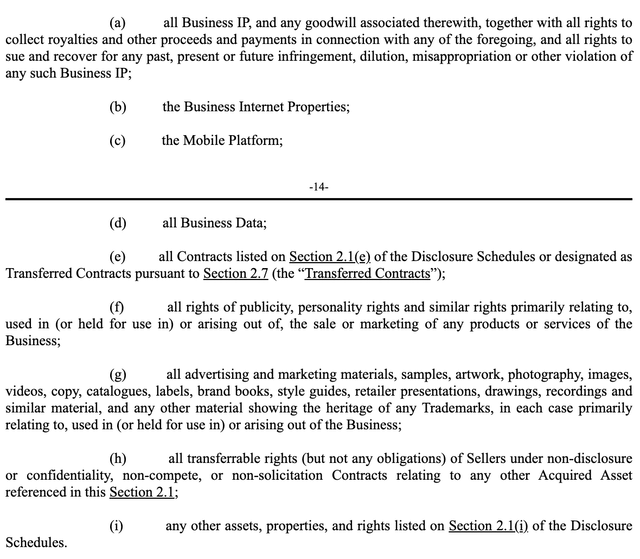

On June 22, information broke that Overstock’s bid to amass sure property related to bankrupt retailer Mattress Bathtub & Past had been accepted. In trade for a money fee of $21.5 million, Overstock.com will obtain the entire enterprise IP (mental property), mixed with all rights to gather royalties and different proceeds and funds in reference to mentioned IP, that has beforehand been owned by Mattress Bathtub & Past. This implies all mental property that has been owned or licensed solely to the bankrupt retailer.

Overstock.com

With few minor exceptions, the transaction additionally contains the entire Web properties owned by Mattress Bathtub & Past, its cell platform, enterprise knowledge, sure contracts, promoting and advertising supplies, and extra. You’ll be able to see a complete itemizing of what is included on this association within the picture above. It’s value mentioning that there are some property that won’t switch over. These are referenced as ‘excluded property’ within the settlement. However particular particulars haven’t been made publicly obtainable as of this writing. Most definitely, it should embrace some software program, logos, and a few choose Web properties.

Sadly, the gathering of property being acquired is one thing of a black field presently. Nevertheless, a few of the most essential property might embrace buyer knowledge and call info. That alone might be extremely helpful for Overstock.com in its advertising efforts shifting ahead. It must be talked about that the sale doesn’t embrace possession over the Buybuy Child model that can be offered off separate from this association. That specific set of properties is probably going value billions of {dollars}, however solely time will inform how that shakes out.

There was some hypothesis as to what the monetary impression might be for Overstock.com ensuing from this asset buy. Curtis Nagle, an analyst from Financial institution of America (BAC), as an illustration, estimated that for every 1% of Mattress Bathtub & Past income, the corporate might see its income develop by 3% and its adjusted EBITDA climb by $10 million. Traders could be clever to understand that any such estimates to this impact are extremely speculative at this level, particularly as a result of we don’t know how Overstock.com will make the most of the property it is buying.

My very own opinion on the matter is that the corporate seemingly will profit from this transaction. The market undoubtedly thinks so. The market capitalization of Overstock.com shot up $164.9 million in response to this maneuver. Contemplating that Mattress Bathtub & Past generated income of $5.34 billion throughout its newest accomplished fiscal 12 months, it isn’t troublesome to think about Overstock.com having the ability to seize not less than that a lot worth as time goes on. Those that are bearish relating to the transaction, nonetheless, could make the case that there’s little true worth in something related to the defunct retailer. Within the final three fiscal years that it operated, it noticed income lower by practically half from $9.23 billion to $5.34 billion.

There are specific model names related to Mattress Bathtub & Past which can be more likely to switch over to Overstock.com as a part of this association. These embrace the non-public label manufacturers that Mattress Bathtub & Past owned up thus far. However when you think about that, beginning in late 2022, the retailer started slashing away at its non-public label enterprise, reducing the variety of labels that it had by a 3rd, it is unlikely that there’s a substantial amount of worth on that entrance. That alone is stunning since non-public label manufacturers ought to, by definition, have greater revenue margins than identify manufacturers {that a} retailer can promote. That additionally tells me that the true worth from this buy could be within the knowledge versus something model associated.

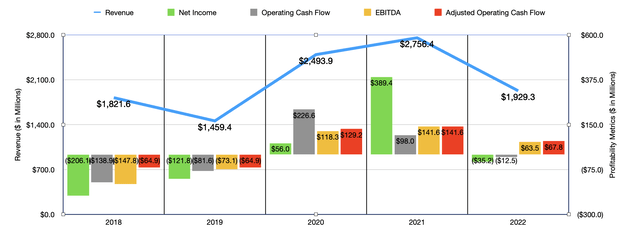

Creator – SEC EDGAR Knowledge

Whereas some constructive response from the market was justified because of this improvement, I do not imagine that this modifications the image relating to Overstock.com one iota. As you’ll be able to see within the chart above, gross sales of the corporate plunged in 2022 in comparison with what they have been in 2021. This prompted earnings for the corporate to break down, with the corporate turning from a web revenue of $389.4 million in 2021 to a web lack of $35.2 million final 12 months. Different profitability metrics additionally took a beating throughout this time.

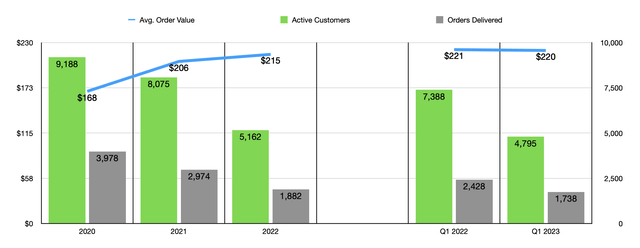

Creator – SEC EDGAR Knowledge

There was one major driver behind this gross sales decline. And this was a considerable lower within the variety of lively prospects that the corporate had. The quantity dropped from 8.08 million in 2021 to five.16 million final 12 months. Despite the fact that the typical worth of an order grew throughout this time from $206 to $215, the drop in lively prospects resulted in a plunge within the variety of orders acquired from 2.97 million to 1.88 million.

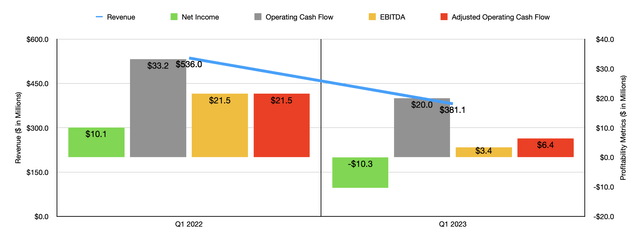

Creator – SEC EDGAR Knowledge

To make issues worse, this downward development continues. Throughout the first quarter of 2023, income for the corporate totaled $381.8 million. That is a significant distinction in comparison with the $536 million reported the identical quarter final 12 months. The agency went from producing a web revenue of $10.1 million to producing a web lack of $10.3 million. And simply as was the case with 2022 relative to 2021, the opposite profitability metrics for the corporate collapsed as effectively. This was pushed by an additional decline within the variety of lively prospects from 7.39 million to 4.80 million, whereas the variety of orders acquired fell from 2.43 million to 1.74 million. On this case, the typical worth of an order did drop modestly, whereas the variety of orders per lively buyer declined.

To some extent, this elementary worsening will be chalked as much as present financial situations. Nevertheless, administration has been very direct about what they assume a few of the points are. One of many major points is the truth that, throughout the COVID-19 pandemic, the corporate exploded in recognition due to social distancing insurance policies and authorities stimulus. Now that the pandemic is lengthy since over, the corporate is returning to extra normalized situations. That is relatively problematic as a result of, for those who have a look at knowledge from each 2018 and 2019, income, earnings, and money flows for the corporate are all considerably within the damaging. If we’re returning again to that as the brand new regular, then it should seemingly be a foul recipe for shareholders.

Creator – SEC EDGAR Knowledge

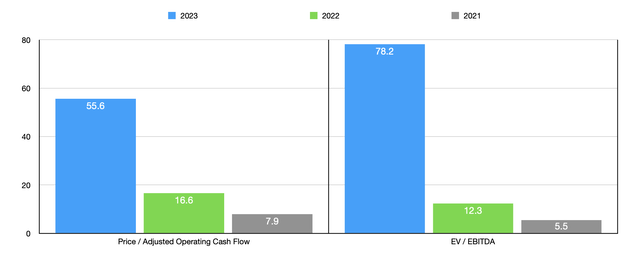

Even within the occasion that the corporate can stabilize at ranges just like what it’s seeing immediately, shares look very costly. By annualizing monetary outcomes seen within the first quarter of this 12 months, as an illustration, we might anticipate adjusted working money movement for the corporate of $20.2 million and EBITDA of solely $10 million. As you’ll be able to see within the chart above, this could end in shares of the corporate buying and selling at very lofty multiples on a ahead foundation. We must see enterprise stabilize at ranges seen in 2021 or 2022 for the corporate to be both undervalued or pretty valued. And proper now, that appears not possible primarily based on the information in entrance of us.

Takeaway

I perceive why the market bought enthusiastic about this attention-grabbing maneuver made by Overstock.com. It in all probability did justify some optimism from the funding neighborhood. However investing will not be about short-term wins which can be pretty small within the grand scheme of issues. Fairly, it must be in regards to the long-term image. And all the information that we’ve at our disposal immediately means that the long-term outlook for this ecommerce play is lower than excellent. Given this view, I’d argue that the corporate warrants a ‘promote’ ranking presently.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link