[ad_1]

J. Michael Jones

Synovus Monetary Corp. (NYSE:SNV) operates as a financial institution holding firm for Synovus Financial institution; it was based again in 1888 and is headquartered in Columbus, Georgia.

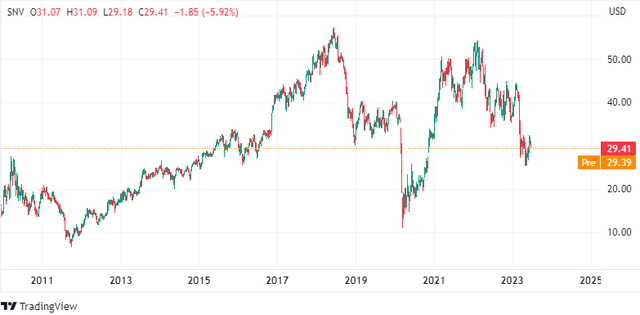

TradingView

Regardless of a slight restoration in latest weeks, the results of the banking crises triggered by SVB’s chapter are nonetheless being mirrored within the value of Synovus Monetary, which is unquestionably removed from its all-time excessive. Nevertheless, such a decline has revealed alternatives that weren’t there earlier than, together with a dividend yield of 4.80%.

As I’ll present you all through this text, at this value Synovus Monetary could also be an excellent choice, particularly for these on the lookout for excessive and sustainable dividends. However it’s most likely not for me.

Deposits High quality

For my part, deposits high quality is the primary side to think about when analyzing a financial institution, as it’s the uncooked materials on which the whole monetary construction is predicated. I’ll now present you ways Synovus Monetary is positioned on this respect.

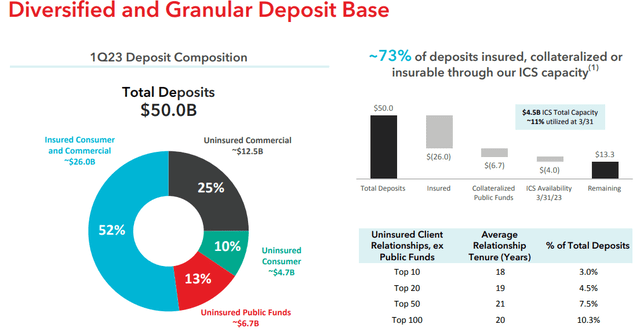

Synovus Monetary Corp Q1 2023

Initially, about 73 p.c of deposits are insured, collateralized or insurable. The deposit base is each diversified and never very concentrated, which is constructive. The truth is, the highest 100 uninsured prospects account for simply over 10 p.c of whole deposits.

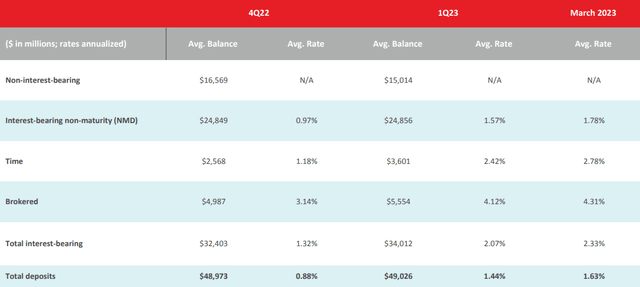

Synovus Monetary Corp Q1 2023

In all probability the least constructive side issues the price of deposits, the truth is in March 2023 the common curiosity paid was 1.63% when only some months earlier it was 0.88%. As well as, it’s also essential to say that non-interest-bearing deposits have decreased by $1.55 billion in comparison with This fall 2022, which is unquestionably an element to think about. Synovus Monetary has needed to discover different methods to switch these free funds, together with time deposits and brokered CDs, each of that are considerably dearer. Combining each deposits and loans, the general common price amounted to 2.33 p.c in March, 101 foundation factors greater than in This fall 2022.

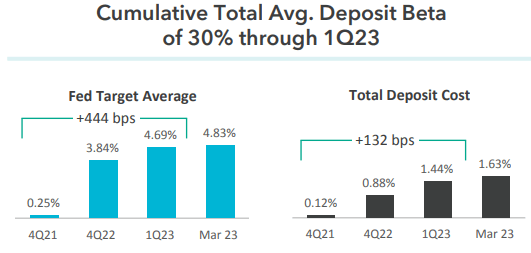

Synovus Monetary Corp Q1 2023

Evaluating the rise within the Fed Funds Price and the price of deposits, Synovus Monetary was capable of obtain a deposit beta of 30 p.c, which is an honest consequence however definitely not optimum. In accordance with the most recent Fed estimates, we are able to count on at the least two extra 25 foundation level hikes by the top of the yr, which may imply that the deposit beta may proceed to rise.

Over the previous month I’ve been analyzing many regional banks, and Synovus Monetary exhibits common outcomes when it comes to deposit prices; nothing worrisome however nothing thrilling both. For instance, there are banks like Banner that haven’t been affected as a lot by the rate of interest enhance; the truth is, it nonetheless displays a deposit price of lower than 0.30 p.c.

Incomes Asset Composition and Web Curiosity Margin

The deposits price is just not the one issue that adjusts for rates of interest; there may be additionally the yield on property.

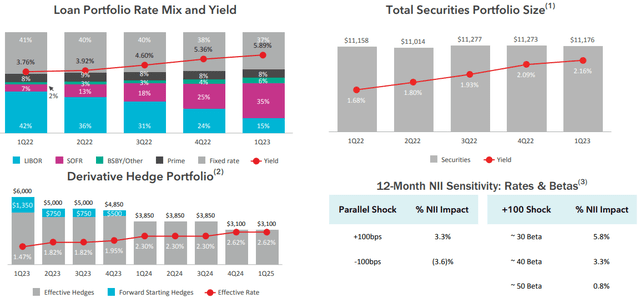

Synovus Monetary Corp Q1 2023

The mortgage portfolio charge steadily elevated every quarter and reached 5.89 p.c, which makes the rise in the price of liabilities much less bitter. On the identical time, the securities portfolio additionally offered a development in yield, though its dimension remained nearly unchanged from Q1 2022.

Though not featured on this slide, with regard to the securities portfolio it needs to be identified that, as of Q1 2023, it’s registering an unrealized lack of as a lot as $1.28 billion, a considerably giant determine. The truth is, it represents about 27 p.c of fairness. Synovus Monetary, in addition to many different banks, made main purchases of fixed-rate securities earlier than the Fed aggressively raised rates of interest, and this led to a big unrealized loss, particularly for prime period securities. If the Fed had been to chop rates of interest quite a bit, the issue would recede: the purpose is that earlier than 2024 it’s unlikely to occur. So, so long as the macroeconomic situation stays the identical, we’ve to think about this huge unrealized loss in Synovus Monetary’s steadiness sheet. The latter, after all additionally weighs on the E book Worth per share, a key metric to which every financial institution’s value per share follows.

Staying with rate of interest danger, within the final slide we are able to see the anticipated change in internet curiosity earnings (NII) as rates of interest change. A 100-basis level enhance would have a +3.30 p.c affect on NII; a 100-basis level lower would have a – 3.60 p.c affect. Briefly, the financial institution is positioned towards an extra enhance in rates of interest. Thus, ought to the Fed scale back them, on the one hand the unrealized lack of the securities portfolio could be lowered, however then again the NII would undergo.

Synovus Monetary Corp Q1 2023

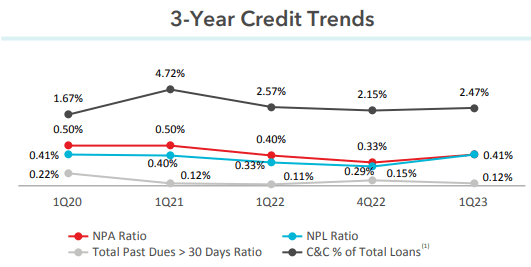

Returning briefly to the mortgage portfolio, we are able to see that in the intervening time the principle indices used for credit score danger are all in good standing. So, regardless of Synovus Monetary’s vital publicity to the CRE section, in the meanwhile, there isn’t any cause to doubt the creditworthiness of its debtors.

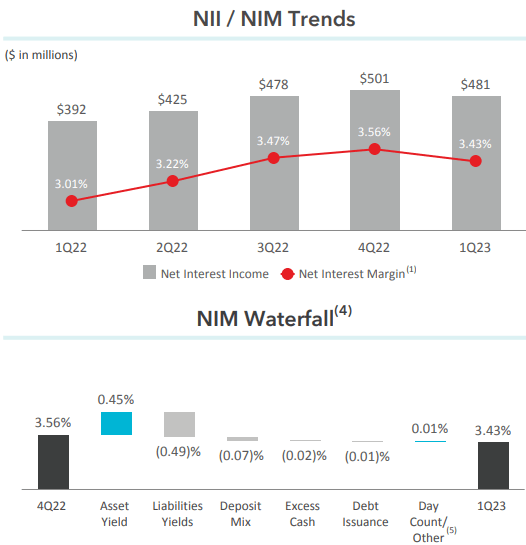

In any case, though the yield on property has improved, it has not been capable of absolutely cowl the rise in the price of liabilities. The truth is, the web curiosity margin decreased by 13 foundation factors in comparison with This fall 2022.

Synovus Monetary Corp Q1 2023

Asset yield affected +0.45%, nevertheless it was not sufficient in opposition to – 0.49%. As well as, extra money and deposit combine additionally didn’t assist Synovus Monetary; – 0.02% and – 0.07% respectively.

Dividend Evaluation

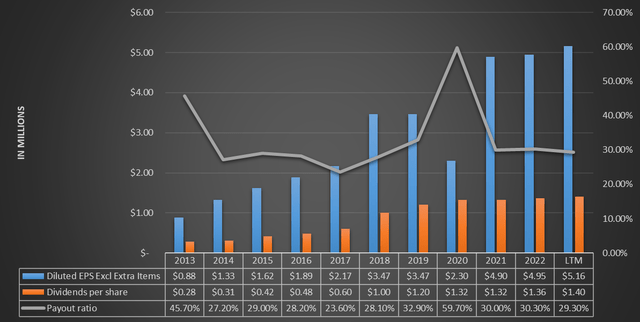

As anticipated firstly of the article, the dividend yield of Synovus Monetary appears enticing for many who choose to spend money on firms with a excessive dividend yield; on this case, we’re speaking about 4.80%. However is it sustainable?

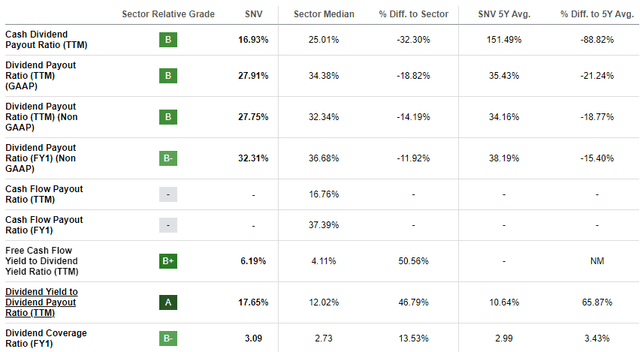

In search of Alpha

Evaluating diluted EPS with dividend per share, it’s evident that the previous are considerably greater than the latter. The truth is, the payout ratio is sort of low, solely 29.30 p.c. So even when EPS slows down within the coming years because of the long-awaited recession, in my view, administration will proceed to concern an excellent dividend anyway. In spite of everything, Synovus Monetary has a dividend yield of 4.80 p.c with a payout ratio of 29.30 p.c; if EPS dropped even 20-30 p.c, the payout ratio would nonetheless be lower than 50 p.c.

Briefly, barring any sensational unexpected occasions, I take into account the dividend to be sustainable within the coming years.

In search of Alpha

Lastly, based on In search of Alpha’s information on the dividend security, Synovus Monetary’s ratios are sometimes higher than its friends. Briefly, at the least for the second the state of affairs is steady.

Valuation

To evaluate the honest worth of Synovus Monetary, I’ll use a weighted common amongst three valuation strategies; the primary could have a weight of 40% and might be based mostly on e book worth, the second could have the identical weight however might be based mostly on EPS, and the third might be a dividend low cost mannequin with a weight of 20%. All information might be obtained from In search of Alpha.

The typical value/e book worth over the past 5 years is 1.31x; multiplying this determine by the present e book worth per share of $28.98 ends in a good worth of $37.96 per share. The typical P/E for the previous 5 years has been 10.82x; multiplying this determine by the anticipated EPS for 2023 of $4.73 (Avenue estimates), the honest worth quantities to $51.17 per share. As for the dividend low cost mannequin, the inputs might be as follows: Annual Payout (FWD) of $1.52 per share. Annual return required from the funding 15%. We’re speaking a couple of small regional financial institution, and being a really dangerous funding, in my view a excessive return is required to take this danger. Dividend development of 8% per yr. Over the previous 10 years the CAGR has been 17.79%, nevertheless I wished to incorporate a extra conservative worth. In spite of everything, the macroeconomic surroundings has undoubtedly modified from 10 years in the past.

The ensuing honest worth following these assumptions is $23.45 per share.

Summing it up, the primary two strategies present that Synovus Monetary is undervalued, particularly the one with earnings, whereas for the dividend low cost mannequin this financial institution is overvalued. Within the final methodology, the required return undoubtedly affected quite a bit, however I feel it’s unavoidable given the riskiness of the funding.

By making the weighted common of the three fashions based on the instructions I discussed earlier, the honest worth of Synovus Monetary is $40.34 per share, so the inventory is undervalued.

Last Ideas

Total, Synovus Monetary is a financial institution that has suffered from the rising price of deposits and this has affected the web curiosity margin. Unrealized losses are one other concern to observe, however I stay optimistic as a result of when the Fed reduces rates of interest this loss will disappear. In the mean time, the market is discounting these points within the value of Synovus Monetary, which is why it seems slightly at a reduction. So, the inventory is undervalued, the dividend is excessive, however why do not I spend money on it?

The reason being that like Synovus Monetary, many different regional banks are in an identical state of affairs, which leads me to keep away from investing in them. Fairly than make investments individually in all these banks with comparable traits and issues, I choose to purchase an ETF. If I’ve to spend money on a single financial institution, I need it to have peculiarities which might be out of the peculiar. On this regard, I recommend you learn my article on Banner Company, a semi-unknown financial institution that I imagine might mirror the latter description.

[ad_2]

Source link