[ad_1]

martinrlee

Western Union (NYSE:WU) shares have misplaced almost half of their worth within the final two years resulting from considerations about declining monetary numbers and elevated competitors. Nevertheless, I consider it’s time to capitalize on the numerous selloff as a result of WU’s shares have the potential to generate regular worth appreciation in the long term. It additionally seems that the inventory has already bottomed out, with solely a restricted quantity of draw back threat remaining. Moreover, the corporate’s wholesome dividend yield of greater than 8% will encourage buyers to carry the inventory for the long run and watch for its worth to reverse the losses.

Enhancing Fundamentals Helps Dip Shopping for

WU Worth Change in Two Years (Looking for Alpha)

Issues about monetary development and escalating competitors have precipitated shares of Western Union to pattern downward during the last two years. The cost transaction & processing companies sector has seen a big inflow of latest fintechs in recent times, a lot of which use cutting-edge strategies to simplify cost processing for purchasers. The Western Union Firm, then again, is a well known international chief in cash switch and cost companies, providing its merchandise via agent areas and banking channels in additional than 200 nations. Along with the entry of latest gamers, evidently one of many oldest firms within the sector took a very long time to adapt to altering market situations, similar to a shift in direction of on-line companies slightly than bodily areas. In consequence, over the previous 5 years, the corporate’s income has steadily decreased, falling from about $5.5 billion in 2018 to an anticipated $4.13 billion in 2023. Equally, its earnings per share, money flows, and different monetary metrics have all suffered.

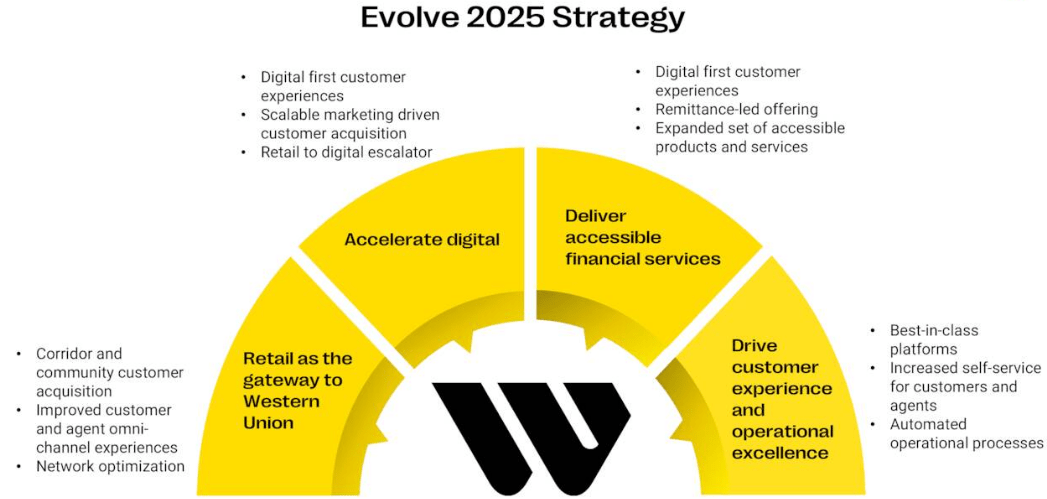

Evolve 2025 Technique (Q1 Presentation)

However, 2023 could be the final yr of monetary and enterprise deterioration. Western Union’s new enterprise technique, which emphasizes attracting new prospects, enhancing buyer retention, and enhancing core operational efficiency, has began to repay. The monetary figures for the final two quarters point out that the corporate has made progress towards attaining its major purpose of stabilizing its retail enterprise and accelerating development in its digital enterprise. For example, the corporate skilled optimistic transaction development in North America for the primary time in almost two years, whereas its Center Jap and European operations (excluding Russia) skilled a 200 foundation level enhance from the prior quarter. Transactions in Latin America elevated 100 foundation factors sequentially and by 9% yr over yr.

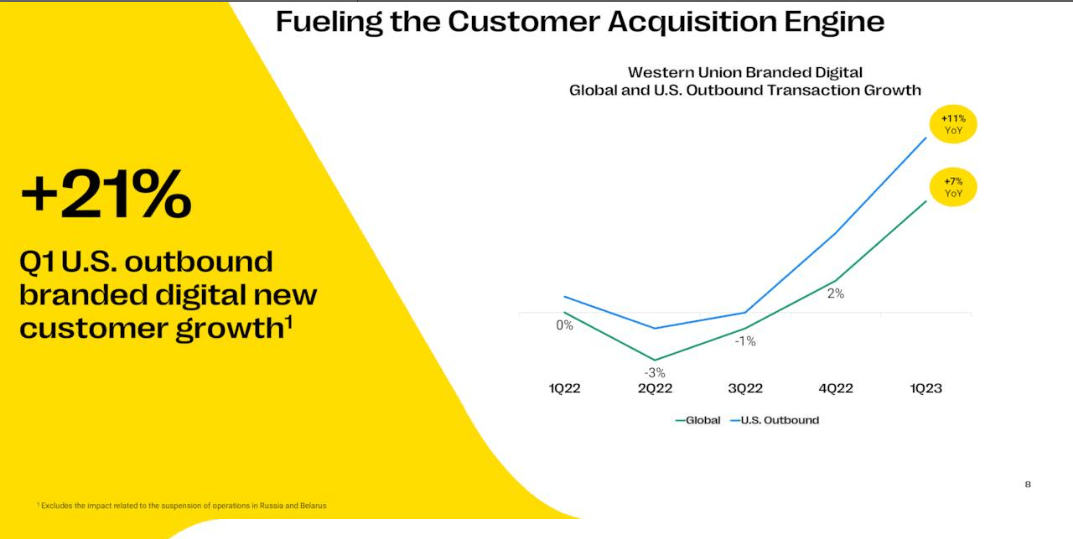

US Outbound Digital Buyer development (Q1 Presentation)

Notably, the corporate’s branded digital go-to-market program has helped to hurry up development within the digital enterprise and whole transactions. Following a 30% year-over-year enhance within the fourth quarter of 2022, the corporate noticed a 21% year-over-year enhance in US outbound branded digital prospects within the first quarter of 2023, with transactions rising 11%. Total, aside from Russia and Belarus, the corporate’s international branded digital transactions elevated by 7% yr over yr within the quarter. Outcomes are nonetheless gentle within the retail phase. Nevertheless, the corporate is now pursuing a stable plan to stabilize its retail enterprise. As an alternative of merely including extra energetic areas, the corporate is searching for to reinforce its current enterprise by decreasing transactional friction by introducing new services, integrating loyalty applications, enhancing stage and cost choices, and streamlining refunds.

Together with elevated transaction quantity, improved core operational efficiency has benefited revenues and margins. The corporate reported $1.03 billion in income within the first quarter, the slowest decline within the earlier three quarters. Income decreased by just one% yr over yr within the March quarter, regardless of a 3 proportion level detrimental affect from the suspension of operations. Furthermore, the corporate’s earnings per share of $0.43 was the very best within the final two quarters and characterize a small enhance on a year-over-year foundation if we exclude a contribution of $0.05 from enterprise options and $0.04 from operations in Russia and Belarus. For the complete 2023, Wall Avenue’s median forecast of $1.62 per share represents a mid-single-digit decline from 2023. Nevertheless, Wall Avenue anticipates regular earnings development within the upcoming years, in keeping with the corporate’s Evolve 2025 technique. Total, it seems that the corporate’s new enterprise technique is more likely to reverse the monetary deterioration and return it to a development trajectory from 2024. Subsequently, I consider the affect of detrimental occasions has already been priced in WU’s inventory within the final two years and there could be a gentle restoration within the yr forward.

Dividend is Secure

The excessive dividend yield of over 8% provided by Western Union doesn’t look like a dividend yield lure. It is because the dividend is fully funded by earnings and money flows. At the moment, the corporate pays a quarterly dividend of $0.24 per share. With earnings per share projected to be $1.62 in 2023, the corporate’s annual ahead payout ratio based mostly on earnings is round 55%. Though its dividend payout ratio is increased than the historic common within the 40% vary, it seems manageable as a result of the corporate doesn’t function in a capital-intensive business. Moreover, as the corporate’s earnings are more likely to develop sooner or later, the payout ratio will more than likely return to historic ranges.

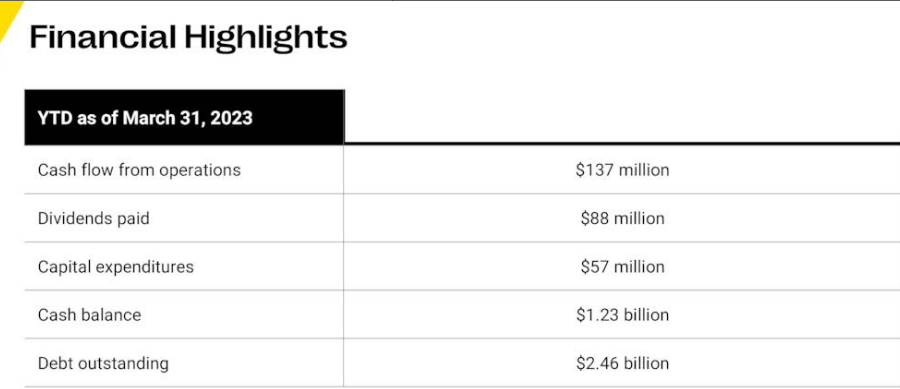

First Quarter Presentation (Looking for Alpha)

Its money flows fell to $137 million within the March quarter from $200 million the earlier yr’s quarter, owing primarily to one-time funds associated to earlier interval bills. Regardless of this, money flows from operations lined each capital expenditure and dividend funds. There shall be additional cash circulation protection because the money flows are doubtless to enhance within the upcoming years because of elevated earnings. Quantitative evaluation additionally exhibits that the corporate’s dividends are safe. Its dividend acquired excessive quant grades throughout the board, together with development, consistency, security, and yield.

Valuation and Quant Ranking

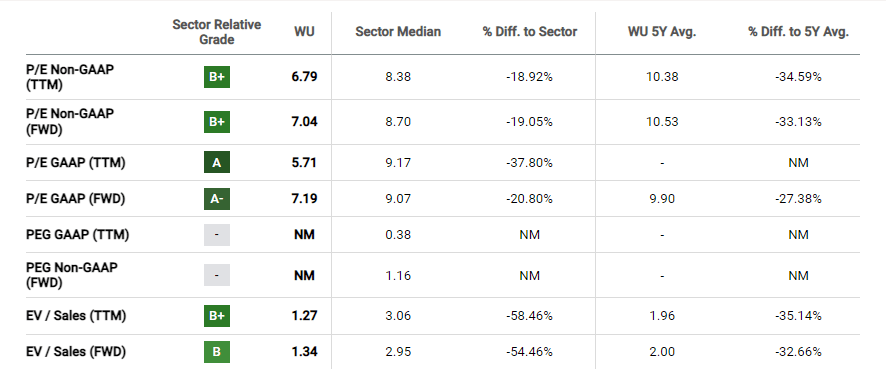

Valuations (Looking for Alpha)

Western Union seems considerably undervalued based mostly on valuations. For instance, the inventory seems undervalued based mostly on each ahead price-to-sales and earnings ratios as a result of shares fell extra shortly than analysts’ estimates for earnings and income. Moreover, the 2024 ahead price-to-earnings ratio is even decrease, at 6.90 occasions, reflecting the chance of upper earnings in that yr. This implies that Western Union inventory has a a lot increased worth than its present worth, making the selloff a shopping for alternative.

Quant Ranking (Looking for Alpha)

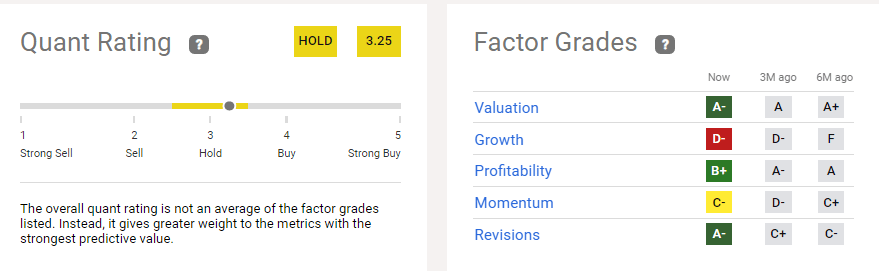

Primarily based on quantitative evaluation, Western Union inventory is on the verge of coming into the shopping for zone. Its shares acquired a maintain ranking with a quant rating of three.25. Three crucial elements, together with valuations, profitability, and revisions, acquired excessive quant rankings. Quant rankings point out that WU inventory is buying and selling at a gorgeous valuation, which is in step with what I already stated above about valuations. The quant grade for earnings revisions additionally elevated to detrimental A from C plus three months in the past, which amply demonstrates that Wall Avenue has elevated its expectations for earnings development. On the draw back, the corporate acquired a D on the expansion issue due to the decline in income and earnings over the earlier quarter. Its momentum rating has improved within the final three months, and I count on it to enhance additional as a result of shares now have restricted draw back and higher long-term development prospects.

Threat Elements to Contemplate

There are numbers of threat elements to think about relating to investing in Western Union. The most important threat is rising competitors from conventional and digital gamers. If the corporate did not implement its Evolve 2025 Technique, it might create volatility in its shares worth and dividends. Recession is one other threat that might harm remittances and different C-to-C transactions within the quarters forward.

In Conclusion

Western Union’s inventory worth drop of round 50% from latest highs represents a gorgeous shopping for alternative as a result of its fundamentals have begun to enhance because of its new enterprise technique. Its ahead valuations have additionally been flashing purchase indicators because the chance of regular development and profitability has elevated. Western Union’s excessive dividend yield is one other vital issue that makes it a superb inventory to carry for the long run and watch for its worth to return to its latest highs.

[ad_2]

Source link