[ad_1]

hh5800

Fremont, California-based Amprius Applied sciences (NYSE:AMPX) began buying and selling in the summertime of 2022 by way of a merger with a clean verify firm from the identical SPAC sponsor that introduced solid-state lithium-ion battery maker QuantumScape (QS) public two years prior. The corporate types a part of the surge of pre-revenue lithium-ion battery know-how corporations that embraced the inventory on the again of investor hype, hope, and euphoria across the transition to low-carbon applied sciences and the pick-and-shovel tickers that might help this transition. The bull case is easy. Amprius is constructing dense lithium-ion batteries for a lot of purposes from electrical autos, to aviation, to wearable tech. The corporate’s batteries have been chosen by AeroVironment (AVAV) for its Switchblade 300 Block 20 loitering missile system.

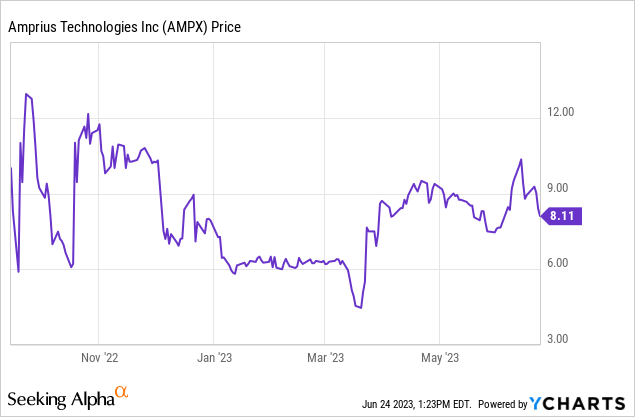

This can be a broadly pre-revenue firm whose latent worth is being constructed round its know-how, potential business traction, and goal market. The $670 million market cap firm recorded income of $680,000 for its final reported fiscal 2023 first quarter, a gross lack of $3.4 million, and a web lack of $9.1 million. That is in opposition to frequent shares which have staged a marked 81% restoration from their post-IPO low. The prize right here is the rising market from the worldwide automotive shift in the direction of EVs. That is as a mix of federal and state subsidies, a sustained enlargement of EV charging infrastructure, and altering client preferences for extra sustainable and environmentally pleasant transportation drives materials year-over-year development in EVs bought.

Excessive-Vitality And Excessive-Capability Lithium-Ion Batteries

Critically, I feel some speculative publicity to futuristic battery know-how corporations is prudent. However bears who type the 4.25% brief curiosity would in fact spotlight that this can be a near-zero income ticker buying and selling at a close to $700 million market cap and that realized free money outflow of $7.7 million throughout its first quarter. This has positioned the corporate’s liquidity $64.2 million place in view as a Fed funds fee hiked to its highest stage since 2008 at 5% to five.25% has inverted beforehand buoyant investor sentiment towards tickers in high-growth however loss-making sectors. Amprius is seeking to commercialize its high-density silicon anode lithium-ion batteries.

The corporate was based by two Stanford College professors in 2008. Its title is an aggregation of amperage and Prius, a hybrid automobile from Toyota that was one of many first mass-market autos to make use of lithium-ion batteries. The intention is the 100% substitute of graphite anodes with lighter silicon anodes which are capable of retailer extra vitality in the identical quantity of house. The corporate has additionally said that its batteries will be manufactured from current manufacturing traces, decreasing the necessity for advanced bespoke manufacturing traces that demand excessive capital expenditure.

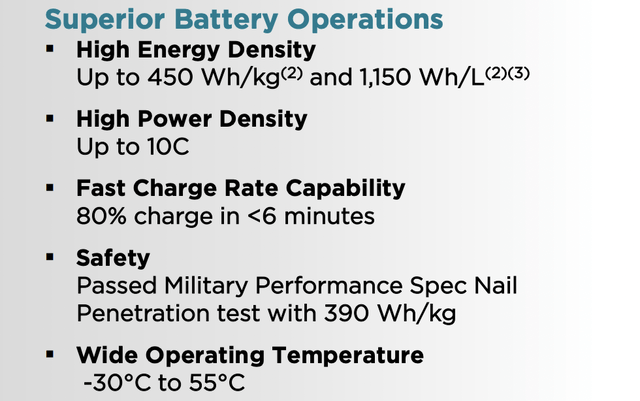

Its batteries can attain as much as 450 watt-hours per kilogram and 1,150 watt-hours per liter. Battery know-how is underneath fixed inventive destruction and evolution however Amprius compares extraordinarily favorably to the typical density of present lithium-ion batteries at round 150 to 250 Wh/kg and 300 to 700 Wh/L. Nonetheless, silicon is liable to extra expansive quantity enlargement than graphite. This may result in mechanical stress and trigger materials electrode degradation or cracking. Amprius claims to have solved this by way of silicon nanowires that enable quantity enlargement with out binders, graphite, or any inactive supplies.

Amprius Applied sciences June 2023 Investor Presentation

The corporate shipped its batteries to twenty clients throughout the first quarter however didn’t disclose the scale of its order e book throughout its first quarter earnings name. And while administration did state that the pipeline of companions continues to develop, will probably be good to see extra granularity round order numbers in future earnings.

A Future Electrified World

Strides in battery know-how assist push ahead electrified tech, decreasing prices and different inherent boundaries to their adoption. EVs for instance have had their comparatively poor vary and charging occasions cited as causes for brand spanking new automobile patrons sticking to ICE autos. Critically, vary anxiousness nonetheless stays sticky even in opposition to what’s now a generational buildout of EV charging infrastructure from corporations like Electrify America, ChargePoint (CHPT), Shell’s Volta (SHEL), and Tesla’s (TSLA) Supercharger community. Infrastructure is 50% of the battle to get ICE drivers to modify to EVs. Therefore, Amprius might assist increase the broader adoption of EVs by facilitating quicker charging, increased vitality density for an extended vary, and higher security together with higher efficiency in a variety of temperatures.

This electrification types a core a part of the worldwide drive in the direction of a low-carbon financial system. The 2022 Inflation Discount Act was revolutionary by way of its sheer scale with tax credit for EVs and native battery manufacturing set to spice up the market the corporate is chasing while decreasing its general money outlay profile. Amprius is ready to obtain manufacturing tax credit for its proposed 775,000 sq. foot gigawatt-scale Colorado facility. The manufacturing unit is concentrating on 2025 for its begin of operations, was awarded a $50 million cost-sharing grant from the 2021 Bipartisan Infrastructure Legislation, and can initially see 500 MWh of manufacturing capability in its first part with the potential of this being expanded to five gigawatt-hours. An funding at this level is extremely speculative however Amprius is working in a fast-growing and expansive market.

[ad_2]

Source link