[ad_1]

Chip Somodevilla

The TJX Corporations, Inc. (NYSE:TJX), is likely one of the main off-price attire and residential fashions retailer within the U.S. and worldwide.

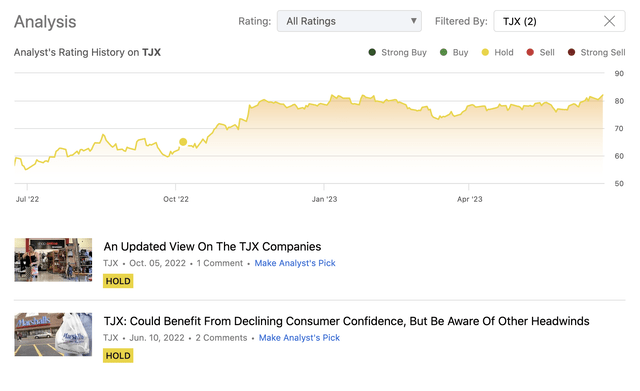

To date, now we have printed two articles about TJX on Searching for Alpha, score the corporate’s inventory as “maintain” each occasions. Since then, pushed by the rally in late 2022, TJX’s inventory worth has elevated considerably, outperforming the broader market. Up until now, in 2023, the agency’s inventory worth has remained comparatively flat.

Ranking historical past (Creator)

At this time, we’ll give an up to date view on TJX, focusing totally on the agency’s profitability and effectivity to observe up on our earlier writings.

As a recap, listed here are the details from our previous articles:

TJX could also be well-positioned to be the low-cost retailer of alternative, as a consequence of its big selection of high quality model choices. Difficult macroeconomic scenario, together with elevated freight and labour prices, resulting in contracting margins. Unfavourable FX atmosphere. Excessive stock ranges.

All of those factors have a direct or oblique affect on each the top- and backside line outcomes of the corporate, due to this fact it is very important take note of their developments over time and their potential future impacts.

We’ll begin our dialogue right this moment, by trying on the agency’s profitability over time.

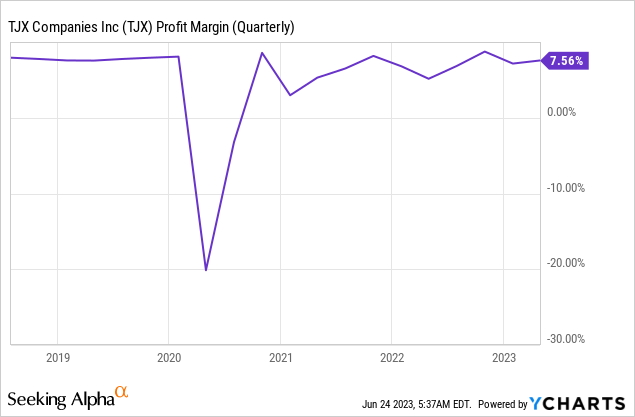

Profitability

To judge TJX’s profitability, we can be utilizing the web revenue margin as our main measure. It’s the ratio between web earnings and income, and is a extensively used indicator of profitability. The next chart reveals the corporate’s web revenue margin over the previous 5 years. Excluding the sharp drop through the starting of the pandemic, the agency’s profitability stayed comparatively steady.

Generally, we wish to see profitability staying steady or rising over time. Contemplating the difficult macroeconomic atmosphere, a steady margin over the previous years can positively be handled as a gorgeous achievement.

Trying ahead, now we have to know which elements might affect this measure and the way.

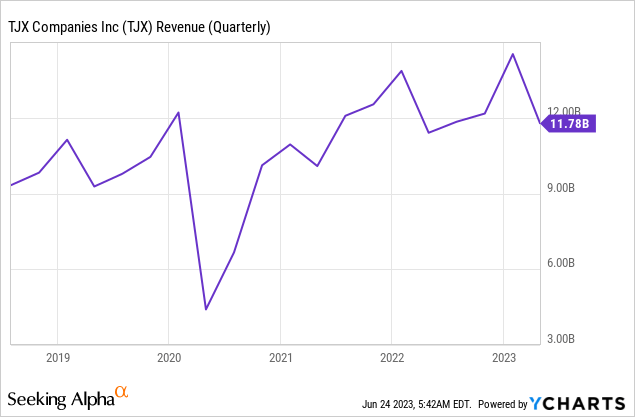

Beforehand we claimed that in occasions of low client confidence off-price retailers may even see an uptick in demand for his or her merchandise, as customers are prone to change to decrease value options to save cash. Whereas there have been ups and downs when it comes to income up to now quarters, gross sales are nonetheless at or above pre-pandemic ranges.

Additional, client sentiment continues to stay poor. Whereas there was an uptick because the lows in 2022, the readings stay across the ranges seen through the 2008-2009 monetary disaster, properly under the pre-pandemic ranges.

U.S. Client confidence (Tradingeconomics.com)

Primarily based on these figures, we don’t anticipate a big decline in demand within the coming quarters.

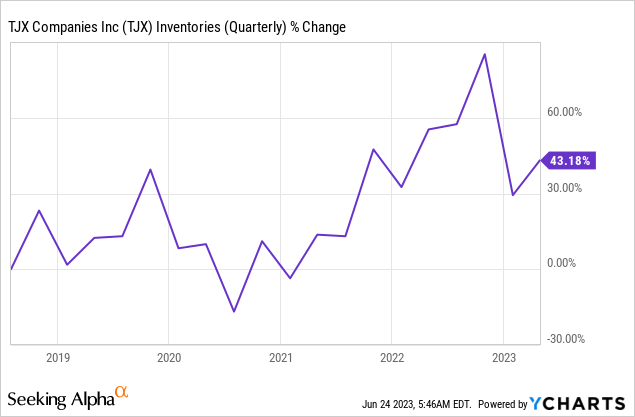

Additionally, now we have been elaborating on the potential detrimental impacts of the excessive stock ranges in our earlier writings. We highlighted potential issues with extra stock. To eliminate extreme or out of date stock, important reductions could also be needed, which might finally result in a contracting revenue margin.

It’s positively constructive to see, nonetheless, that TJX has managed to cut back its stock ranges considerably, with out having a serious affect on the web revenue margin.

Final, however not least, we have to level out two latest information, which additionally improve our confidence within the steady profitability of the agency within the close to future:

The corporate’s potential aggressive edge over its opponents on the present market atmosphere. The hike of the complete 12 months forecast after the Q1 outcomes.

All in all, we imagine that TJX stays a gorgeous candidate from a profitability standpoint, within the present atmosphere.

Effectivity

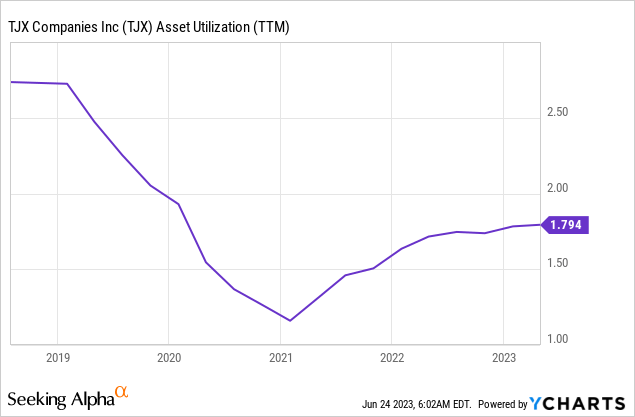

A extensively used effectivity measure is the asset turnover, or asset utilization. It’s the ratio between income and complete belongings, and measures how effectively the corporate makes use of its belongings to generate gross sales. Similar to with the revenue margin, we usually favor to see bettering or steady developments.

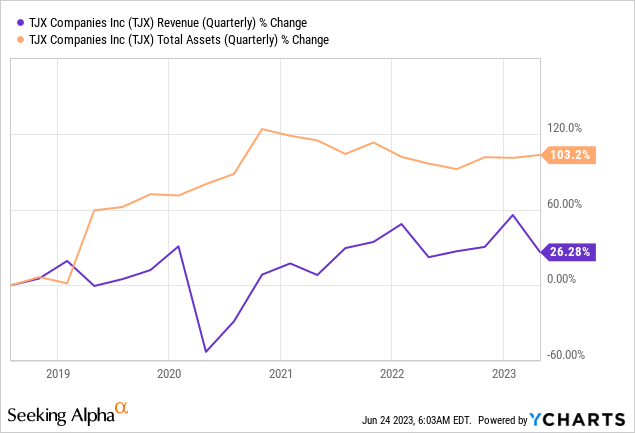

Asset turnover has dropped sharply in 2019 and 2020, however since its backside in early 2021, it has saved bettering regularly. The explanation for the decline has been that the expansion in complete belongings has outpaced the income progress.

At this level, there are two elements which have to be examined. First, what has triggered the expansion in complete belongings, and second, are the income figures consultant or they might be manipulated/inflated.

Whole belongings

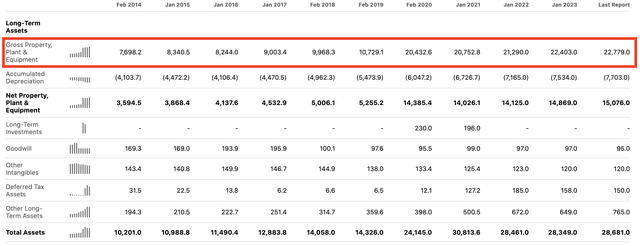

The bounce in complete belongings has been pushed by the rise in PPE in 2019/2020.

Lengthy-term belongings (Searching for Alpha)

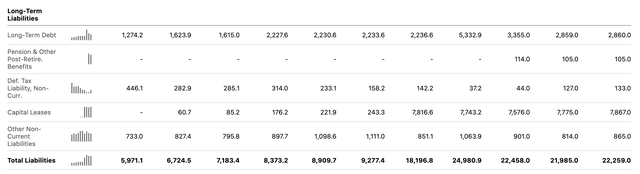

That is additionally carefully associated to the rise within the quantity of capital leases discovered within the long-term liabilities part of the steadiness sheet.

Long run liabilities (Searching for Alpha)

Income

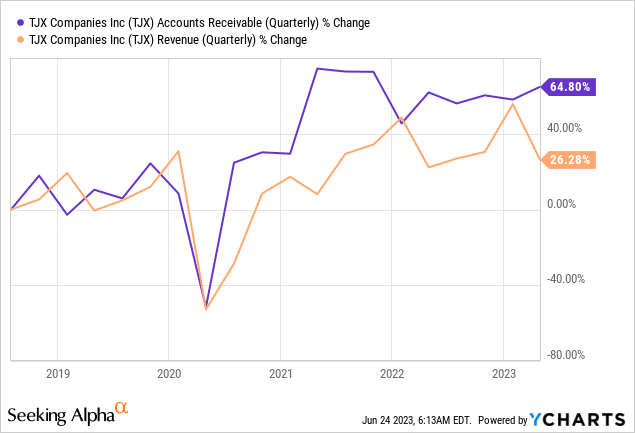

A method to establish potential manipulation of the gross sales figures is to check the income progress with the expansion in accounts receivable. If the accounts receivable develop sooner than the income, it might imply that the agency is attempting to promote extra on credit score to tug ahead demand from future durations, or it might need modified its income recognition practices.

The chart above reveals that accounts receivable have been rising at a barely increased tempo within the latest quarter. Whereas the divergence is just not giant at this level, we should keep watch over this growth within the close to future.

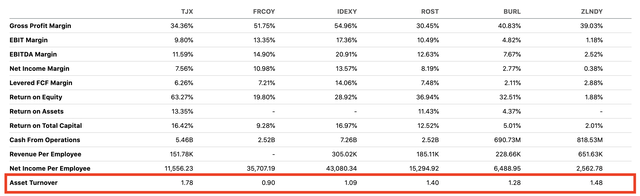

Now, to place TJX’s effectivity into perspective, the next desk compares the agency’s asset turnover with these of its opponents and friends. Amongst this group, TJX has essentially the most enticing asset turnover ratio.

Comparability (Searching for Alpha)

Conclusions

All in all, we imagine that TJX is a well-run firm, which has fared fairly properly within the latest quarters regardless of the difficult macroeconomic atmosphere. The agency seems to be enticing each from a profitability and an effectivity standpoint. Trying ahead, the agency’s aggressive and the upward revised full 12 months outlook additionally present some confidence for the close to time period.

The one query that continues to be now, does it justify an improve from our earlier impartial score?

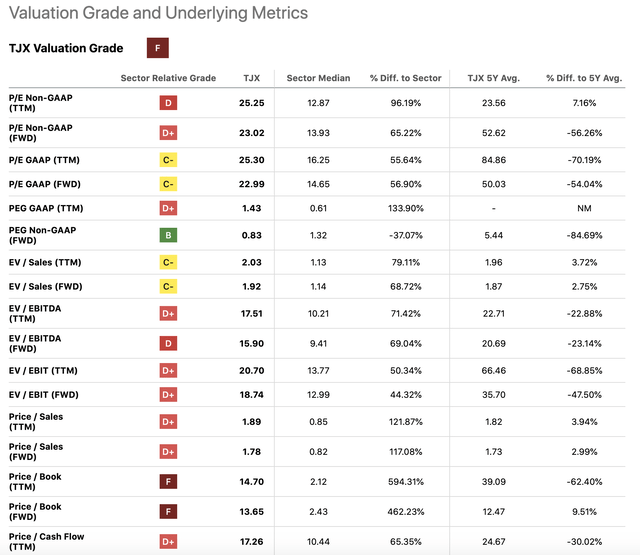

TJX nonetheless seems to be overvalued in comparison with the buyer discretionary sector median. Nevertheless, this will not be a good comparability, as a result of different firms within the sector could also be rather more negatively impacted by the macroeconomic atmosphere than TJX. For that reason, we imagine that TJX deserves a premium over the median, particularly once we take into account its profitability and effectivity too.

Valuation metrics (Searching for Alpha)

However, we imagine {that a} P/E a number of of 25x for an off-price retailer is simply too excessive. We want to see the inventory worth pulling again to the $60s, earlier than we might rethink upgrading the inventory to a “purchase”.

[ad_2]

Source link