[ad_1]

In instances of market turbulence, secure insurance coverage firms are nice funding choices

A few of them supply stability to portfolios throughout risky instances, together with respectable long-term returns

Let’s delve into the technicals and fundamentals of three such shares

InvestingPro Summer time Sale is on: Try our large reductions on subscription plans!

The insurance coverage business is predominantly related to worth firms with the potential for secure long-term returns and elevated resistance to market turbulence. As we search defensive positions for our funding portfolios, directing consideration towards the insurance coverage sector turns into worthwhile.

Among the many notable contenders is Primerica (NYSE:), a longtime model working in each the US and Canadian markets. The corporate’s core operations revolve round promoting insurance policies and insurance coverage merchandise via a community of full-time and part-time brokers. Over the previous yr, Primerica’s inventory value has proven an upward trajectory, reaching historic highs of round $196 per share.

Primerica Inventory Chart

Apart from Primerica, two different firms that seem intriguing within the insurance coverage business are UnitedHealth Group (NYSE:) and Markel (NYSE:). These firms exhibit favorable circumstances for development from each technical and basic views. Let’s check out the three firms, one after the other:

1. Primerica

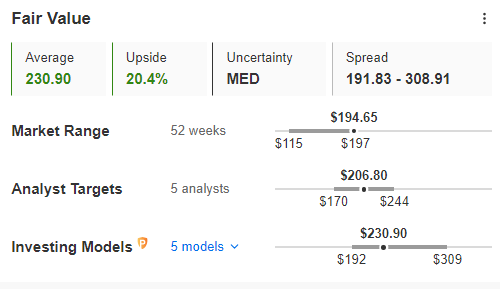

Primerica, specifically, demonstrates the potential to surpass the $200 mark and set up new all-time highs. Over the previous few weeks, the corporate has been actively testing historic peak ranges, laying the groundwork for a possible breakthrough. The truthful worth index additional helps this upward momentum, suggesting a positive state of affairs of surpassing the $200 barrier and reaching new milestones round $230 per share.

Primerica Honest Worth

Supply: InvestingPro

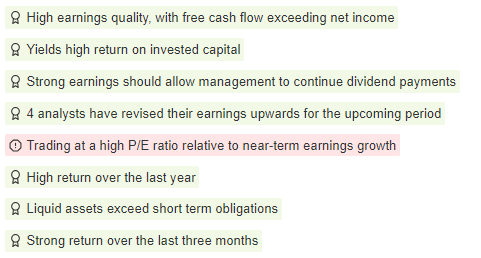

Analyzing the excellent abstract of basic highlights, it turns into evident that the bullish perspective holds quite a few compelling arguments in its favor.

Primerica Elementary Highlights

Supply: InvestingPro

Lengthy-term buyers ought to discover it significantly vital that the corporate has persistently maintained a file of dividend funds for 13 years. This and its strong earnings efficiency counsel a promising outlook for Primerica.

2. UnitedHealth Group

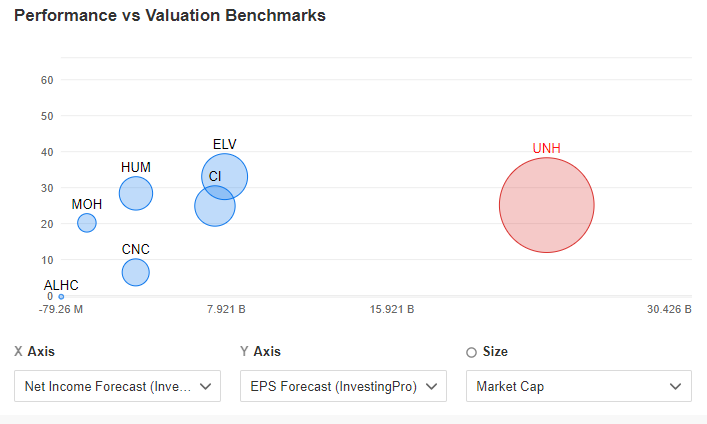

UnitedHealth Group emerges with a horny outlook amidst competitors. As a US-based firm working within the medical companies sector, together with insurance coverage gross sales, it distinguishes itself by way of capitalization and projected revenue development. The corporate is anticipated to surpass $23 billion in internet revenue yearly, in comparison with $20.63 billion in 2022.

Supply: InvestingPro

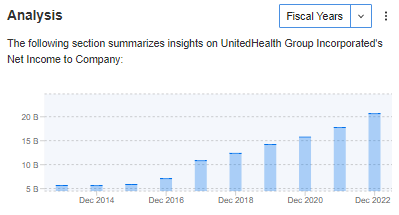

Ought to these forecasts materialize, it could signify the continuation of the constructive development that has endured since 2014. From a technical standpoint, a pivotal issue could be efficiently breaching the numerous resistance degree across the $500 vary. Such a breakthrough might probably pave the way in which for a check of this yr’s file highs.

Annual Internet Income

Supply: InvestingPro

3. Markel

As an insurance coverage firm, Markel presents specialised insurance policies in areas equivalent to skilled legal responsibility, marine security, and pure disasters. With geographical diversification spanning North America, Europe, Asia, and the Center East, the corporate advantages from a broad market attain. Markel Group has efficiently established its area of interest and goals to develop its enterprise operations additional.

Amidst a protracted consolidation section that has endured for over two months, there seems to be a discernible triangle formation. In idea, such a formation usually indicators a possible continuation of the upward development, suggesting extra good points might be within the playing cards for the inventory.

Markel Each day Chart

A breakout to the upside will function the catalyst for subsequent upward motion, probably resulting in a gradual ascent towards the worth ranges achieved earlier this yr in January.

Entry first-hand market knowledge, components affecting shares, and complete evaluation. Benefit from this chance by visiting the hyperlink and unlocking the potential of InvestingPro to reinforce your funding selections.

And now, you should buy the subscription at a fraction of the common value. So, prepare to spice up your funding technique with our unique summer season reductions!

As of 06/20/2023, InvestingPro is on sale!

Get pleasure from unimaginable reductions on our subscription plans:

Month-to-month: Save 20% and get the pliability of a month-to-month subscription.

Annual: Save an incredible 50% and safe your monetary future with a full yr of InvestingPro at an unbeatable value.

Bi-Annual (Internet Particular): Save an incredible 52% and maximize your earnings with our unique internet supply.

Do not miss this limited-time alternative to entry cutting-edge instruments, real-time market evaluation, and professional opinions.

Be a part of InvestingPro at present and unleash your funding potential. Hurry, the Summer time Sale will not final eternally!

Disclaimer: This text was written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel, or suggestion to speculate, neither is it meant to encourage the acquisition of property in any manner.

[ad_2]

Source link