[ad_1]

onurdongel

Sleep Nation Canada (TSX:ZZZ:CA) (OTCPK:SCCAF) is the most important mattress and bedding retailer in Canada with a strong funding thesis. The corporate has made important acquisitions over time to enhance each their on-line presence and their margins by focusing on enhancing accent gross sales. This has led to strong funding returns over time, however the inventory has confirmed to be very risky. As a big discretionary buy, mattress gross sales are seen as extraordinarily cyclical with the inventory typically falling far in entrance of any recessionary fears.

Because it stands at present ZZZ gross sales and margins are each holding nicely, however the market is telling us they may quickly fall as strain on shoppers continues to rise. That mentioned the affordable valuation of $27 and 9.5x trailing P/E has me at a impartial degree on the shares, with beneath $20 being the best purchase space for a long run shareholder.

Sleep nation has a stranglehold on the Canadian mattress and bedding house, however that may probably be described as a possible weak spot in appreciation from right here. The corporate can have bother rising additional in a market as fractured as mattresses, and won’t be increasing south of the border because the market is far more aggressive than Canada. This makes future income and earnings progress troublesome to return by, as good points are principally made by way of acquisition or productiveness good points.

Similar retailer gross sales for Q1 have been -6.2%, exhibiting some weak spot already even has the Canadian economic system has continued to develop properly. Total retail gross sales in Canada have been barely down in Q1, exhibiting ZZZ underperforming as shoppers pull again on the bigger items purchases and focus their funds on providers as a substitute. Income was solely down 0.3% to $206.5 million in Q1, partially as they benefitted from the current bedding acquisition of Silk and Snow.

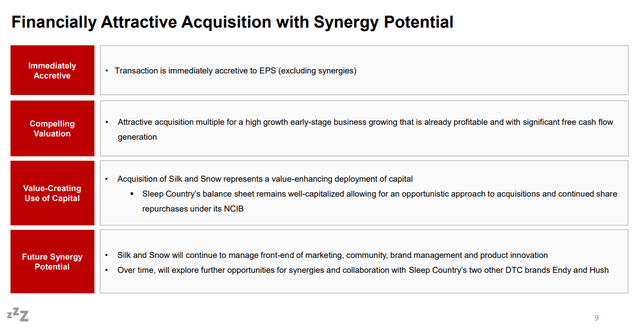

Silk and Snow (ZZZ presentation)

Mixed with the Endy (Canada’s greatest mattress in a field firm) acquisition, Hush blankets and shopping for Casper’s Canadian property, ZZZ continues to solidify its stranglehold within the house. These sensible additions of various equipment and choices has helped push these working margins from 14-15% as much as the 17 to 18% vary over the previous 3 years. They assist innovation at Sleep Nation, enhance synergies and the manufacturers help one another to extend profitability. They aim corporations which are already free money circulate constructive, so danger is small for ZZZ as they’ve all been earnings accretive throughout yr 1.

Within the quick time period, nevertheless, ZZZ earnings are coming down, with a 38.5% drop of earnings in Q1 to $11.3 million. Income estimates for 2023 and 2024 seem too excessive for Sleep Nation, with 4.5 and 4.7% anticipated income progress over the subsequent two years. I see danger to those numbers with 1-2 extra rate of interest hikes anticipated in Canada to over 5%. This may put additional strain on shoppers with a mortgage, and it is probably ZZZ won’t be able to fulfill these progress estimates. A constructive of the story is a low debt load means continued profitability in a downturn as ZZZ solely has $138.6 million in long run debt. Long run the corporate will proceed to leverage its money circulate to buy smaller corporations within the house and enhance its on-line presence.

The corporate appears reluctant so as to add many showrooms in Canada now at 290 shops as they’ve strong protection of the inhabitants. This implies long run a better portion of income can be its assortment of on-line native manufacturers like Endy or Silk and Snow. The corporate will even proceed to develop its dividend, because it elevated it most lately to $0.237 per quarter – or a strong 3.5%.

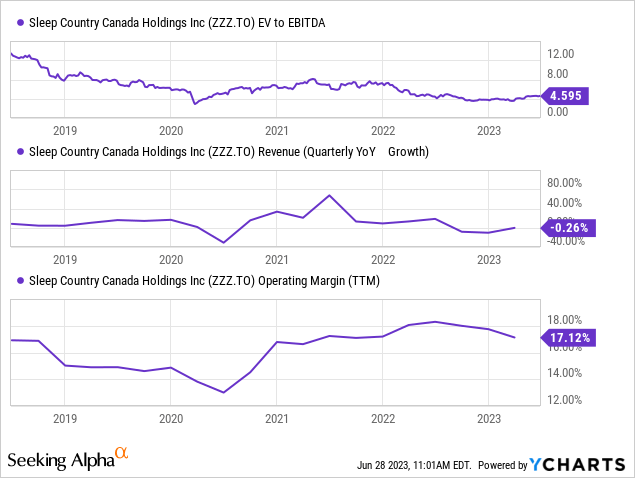

As you may see, the above valuation could be very affordable in comparison with its most necessary metrics. Income progress has slowed to zero in current quarters in opposition to exhausting comparisons however margins are nonetheless very strong with 24% EBITDA margin in the latest quarter. This has the corporate buying and selling at 4.6x EV to EBITDA, which isn’t far above its trough a number of in 2020. Nevertheless, gross sales of massive ticket gadgets ought to proceed to fall with discounting placing strain on the excessive working margins in 2023 and 2024.

At this level dangers appear skewed to the draw back primarily based on a weakening shopper and a market not prepared to present the inventory a a number of at its common of 6-7x EV to EBITDA. This may be a 33-40% acquire within the shares from the place they’re now at $26.95. The shares have rebounded with the market up to now 9 months, with a great bounce off the November 2022 low of $19.66. Nevertheless, this identify is more likely to retest these ranges if extra weak spot comes by means of within the economic system, being in such a extremely delicate sector. It’s that which is holding me on the sidelines now, as cash continues to circulate into sectors like staples and industrials in Canada the place earnings are extra steady.

Conclusion – Maintain rated

Whereas the valuation of Sleep Nation is interesting at these low ranges, it’s as a result of the market is discounting a recession in late 2023 or 2024. Greater for longer rates of interest imply massive purchases like mattresses can be pushed out later and gross sales will undergo in consequence. The corporate ought to proceed to do nicely in rising its bedding and pillow classes, however that won’t make up for lowered mattresses within the quick time period. These searching for a worth priced inventory for the time being can be higher served to take a look at the staples or infrastructure associated sectors for areas the place spending will maintain up higher in a possible recessionary situation. Those that wait are getting paid a strong 3.5% dividend however you will get higher capital appreciation in different sectors at this level within the financial cycle. In consequence I’d put this firm within the maintain class – one that might be a purchase under $20 however has important headwinds to share worth appreciation for the approaching 12 months.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.

[ad_2]

Source link