[ad_1]

coldsnowstorm

Thesis

We’ve got written about Company MBS earlier than, assigning Purchase rankings on a few events:

Plainly the JPMorgan asset technique workforce has learn our items, with the financial institution now recommending the Company MBS asset class as a Purchase as nicely:

Recession remained our base case,” Bob Michele, chief funding officer and head of the World Mounted Revenue, Foreign money & Commodities Group at J.P. Morgan Asset Administration, mentioned in a be aware. “Whereas the central banks are dedicated to bringing inflation all the way down to 2% and prepared to sacrifice the financial system to get to that stage, the group appreciated that it’s taking longer to work by way of a number of years of amassed coverage stimulus.” Nonetheless, main indicators proceed to see a recession because the most certainly final result.

Bearing in mind the outlook for extra central financial institution fee hikes and the inverted yield curve, “company mortgage-backed have been our prime choose,” Michele mentioned. “Whereas the technicals of Fed stability sheet runoff, FDIC promoting, and decrease financial institution demand are difficult, valuations are at their most cost-effective stage because the peak of the worldwide monetary disaster.

In essence Company MBS are AAA rated, however provide larger yields than Treasuries with an equal length. The mREIT sub-sector is a recognized market area of interest that finally ends up leveraging up this asset class anyplace from 4x to 9x to juice up returns. Sadly mREITs are extraordinarily unstable (the likes of NLY, CIM and AGNC), so a retail investor could be higher served by an outright, unleveraged place on this asset class at this stage of the financial cycle.

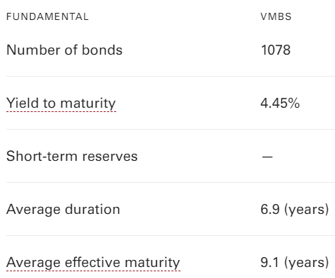

The Vanguard Mortgage-Backed Securities Index Fund ETF (NASDAQ:VMBS) is an trade traded fund targeted on the Company MBS asset class. The fund seeks to trace the efficiency of the Bloomberg U.S. MBS Float Adjusted Index, which gives a diversified publicity to intermediate-term U.S. company mortgage-backed pass-through securities issued by Ginnie Mae (GNMA), Fannie Mae (OTCQB:FNMA), and Freddie Mac (FHLMC). In impact VMBS incorporates a diversified portfolio of Company MBS bonds with a mean length of 6.9 years. The property are AAA, so the one consideration available listed here are charges.

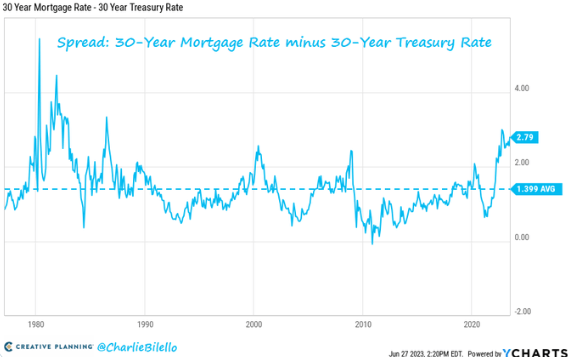

The Company MBS asset class has turn into attention-grabbing as a result of spreads on Company MBS bonds at the moment are buying and selling at historic extensive ranges versus Treasuries, particularly on the lengthy aspect of the curve:

MBS Spreads (Artistic Planning)

The above graph illustrates the unfold of 30-year Company MBS bonds versus 30-year Treasuries. The upper the unfold, the upper the yield on MBS bonds versus equal Treasuries. We are able to discover how the unfold is correlated with financial coverage – in the course of the low charges surroundings exhibited in 2020/2021, the unfold was very low.

Finally MBS bonds have query marks round their precise maturity date, as a result of pre-payments. Traditionally this function has compelled the asset class to pay wider spreads to Treasuries. We really feel the low CPR charges at the moment are priced in, and for a similar length an investor is best served by shopping for into Company MBS bonds.

Efficiency

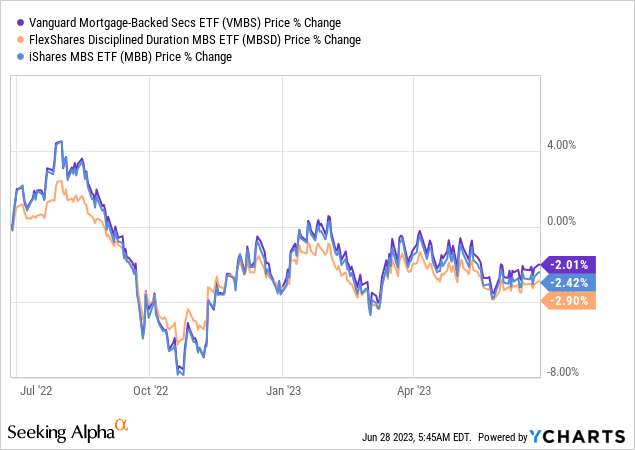

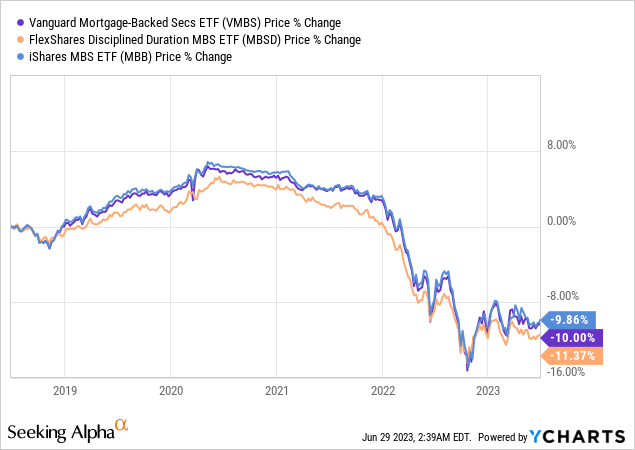

VMBS has largely carried out according to different unleveraged MBS merchandise:

We’re evaluating the fund right here with a cohort fashioned from the iShares MBS ETF (MBB) and the FlexShares Disciplined Period MBS ETF (MBSD). For the reason that begin of the financial tightening cycle, all funds have skilled deep drawdowns:

Holdings

The fund incorporates over 1,000 MBS bonds with an intermediate length:

Holdings (Fund Internet)

The asset class right here is AAA, so there aren’t any consideration for credit score danger. The biggest danger issue is represented by charges and prepayments. Prepayments have an effect on the length of the underlying MBS bonds, by growing or lowering the typical lifetime of the collateral. We’re at the moment in a excessive mortgage fee surroundings, with fewer individuals in a position to transfer as a result of the truth that they’ve locked in low charges on their mortgages. This interprets into decrease pre-payments and the next length for the MBS bonds, which is now already priced in.

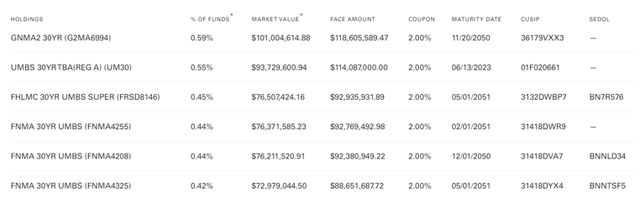

The fund doesn’t take any focus danger both, with most names under a 2% portfolio weighting:

High Holdings (fund web site)

The above signify the fund’s prime holdings as of now.

Conclusion

VMBS is an trade traded fund. The automobile goals to comply with the Bloomberg U.S. MBS Float Adjusted Index by investing in a portfolio of unleveraged company MBS bonds with an intermediate length. The fund had a deep drawdown in 2022 as a result of larger charges, however is ready to outperform going ahead. Company MBS now have virtually historic extensive spreads when in comparison with equal length Treasuries, making them a sexy asset class. VMBS solely incorporates AAA property, thus the principle danger issue right here is charges, adopted by spreads to treasuries. As per the ahead SOFR curve, we anticipate a 1% minimize in charges by the tip of subsequent 12 months (extrapolated for the 7 12 months curve level), implying a ten% plus return for VMBS within the subsequent 18 months given its length profile and present dividend yield.

[ad_2]

Source link