[ad_1]

lindsay_imagery

The Fed examine implies a serious recession

The lately printed Fed examine (Distressed Corporations and the Giant Results of Financial Coverage Tightenings by Ander Perez-Orive and Yannick Timmer) finds that 37% of US non-financial corporations are presently shut to default, or as they outline in monetary misery, and it is a “stage that’s increased than throughout most earlier tightening episodes because the Nineteen Seventies”.

The examine concludes:

With the share of distressed corporations presently standing at round 37 p.c, our estimates counsel that the latest coverage tightening is prone to affect funding, employment, and combination exercise which are stronger than in most tightening episodes because the late Nineteen Seventies. The results in our evaluation peak round 1 or 2 years after the shock, suggesting that these results could be most noticeable in 2023 and 2024.

What this means is that the present financial coverage tightening will possible trigger a recession a lot deeper and longer than every other recession because the Nineteen Seventies, together with the 2008 GFC, based mostly on the proportion of corporations which are in misery already. Extra importantly, the disaster is feasible in 2023/2024.

Why? The examine means that “the energy of the transmission of financial coverage is determined by the mixture distribution of agency monetary misery”. The authors additional clarify their speculation:

Our speculation is that following a coverage tightening, entry to exterior financing deteriorates extra for corporations which are in misery than for wholesome corporations, whereas following a coverage easing, exterior financing circumstances don’t change appreciably sufficient for the 2 teams of corporations to set off a differential response. Consequently, funding and employment usually tend to fall for distressed corporations than for wholesome corporations following tightening shocks, however to reply weakly and equally to easing shocks for each forms of corporations. A corollary of this mechanism is that borrowing falls considerably extra for distressed than for wholesome corporations after tightening shocks, and that borrowing for each forms of corporations doesn’t reply considerably to expansionary shocks.

Principally, the financially distressed corporations have restricted entry to capital throughout the financial coverage tightening cycles, which causes them to chop funding and scale back the headcount. Clearly, the extra corporations in monetary misery, the bigger the mixture impact on financial exercise.

However do not count on the eventual financial easing to finish the disaster. The speculation above states that borrowing does reply considerably to expansionary shocks. That is as a result of the disaster answer is a perform of bailouts and financial stimulus, in coordination with financial stimulus.

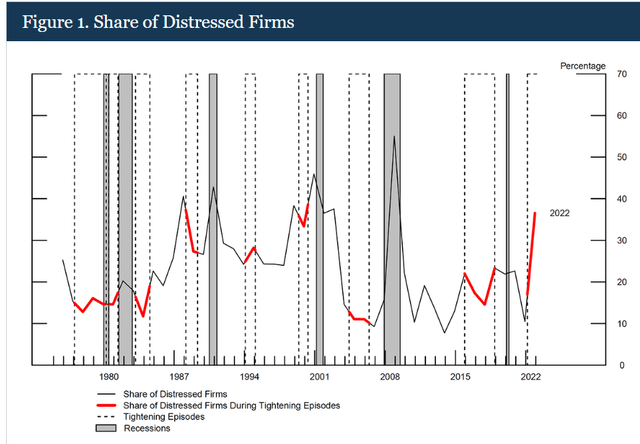

The chart

As you’ll be able to see from the chart under, throughout the Nineteen Seventies, and early Eighties episodes of financial coverage tightening, the proportion of distressed corporations was pretty low, at sub 20%. Equally, throughout the episodes 2005-2007 and 2016-2019, the proportion of distressed corporations was additionally pretty low, with a considerably increased share throughout the 1994 episode. The one comparable durations to the present scenario have been the financial tightening episodes of 2000 and 1989, when the proportion of corporations in misery additionally reached practically 40%.

The Fed

Trying on the chart above, two issues stand out.

First, throughout the financial tightening episode 2005-2007 solely about 10% of US non-financial corporations have been in misery, however that quantity grew to over 50% on the peak of the 2008 recession.

Second, the present financial coverage cycle began with solely about 10% US non-financial corporations in misery, however that quantity rapidly grew to 37% with the information ending in 2022.

How unhealthy will or not it’s?

We all know that the present financial coverage tightening episode continued in 2023, past the examine’s information time-frame, and we additionally know that the Fed is anticipated to proceed mountain climbing. So, there are two key questions:

What’s the present variety of US corporations in misery, for 2023, if the quantity was 37% in 2022? If the pattern continued, and there’s no motive to count on in any other case, the quantity could possibly be nicely over 40% already. What share of US non-financial corporations can be in misery by the point the Fed ends the financial coverage cycle, and what is going to the proportion be when the recession hits? Based mostly on the pattern, the proportion is prone to exceed 50%, probably nicely past the 2008 quantity.

Principally, these numbers counsel that the forthcoming monetary disaster could possibly be extra extreme than the 2008 Nice Monetary Disaster, not less than based mostly on the proportion of corporations close to default. And that helps the important thing discovering of the examine that “the latest coverage tightening is prone to affect funding, employment, and combination exercise which are stronger than in most tightening episodes because the late Nineteen Seventies”.

Implications

Provided that 37% of US non-financial corporations could possibly be close to default, and that this share may enhance to above 50%, it is cheap to count on that many of those corporations may default. Thus, we could be going through a serious credit score crunch.

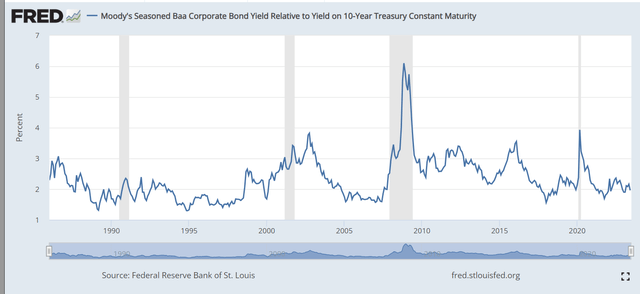

Nevertheless, the credit score spreads are presently very slender, with the BBB-10Y unfold under 2%, implying there are little credit score worries within the bond market presently.

Properly, we had the identical scenario previous to the 2008 GFC. Observe, at the moment there have been lower than 20% of US corporations close to default, however the quantity spiked over 50% because the recession hit in 2008, with the comparable sharp spike in BBB-10Y credit score unfold.

Thus, we’re possible in the same scenario, besides there have been already 37% US corporations in misery in 2022, thus the credit score unfold must be a lot increased already. That is possible an inefficiency that could possibly be explored. Credit score threat is presently artificially low, and it’s prone to spike a lot increased.

FRED

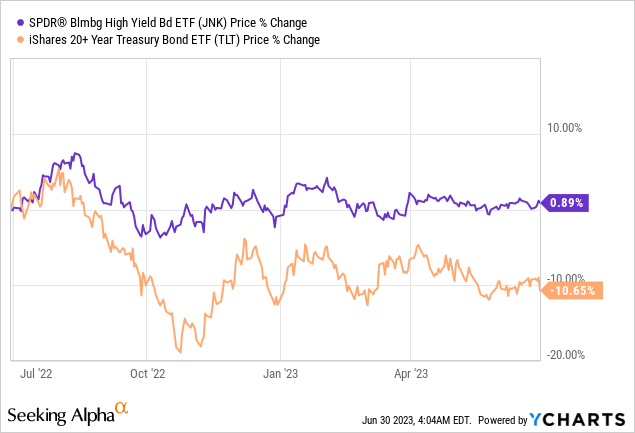

The plain commerce right here is to brief US excessive yield company credit score, and one option to do it’s by shorting (JNK) SPDR® Bloomberg Excessive Yield Bond ETF.

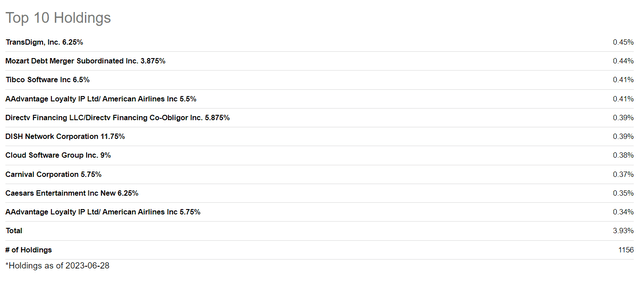

JNK consists of 1156 bonds rated under funding grade or BBB. Thus, many of those bonds are possible issued by corporations in monetary misery, and plenty of are prone to expertise a downgrade or perhaps a default because the recession hits. These are the highest 10 holdings:

Searching for Alpha

What’s extra attention-grabbing is that JNK is sort of flat during the last 12 months, up by 0.89%, whereas iShares 20+ Yr Treasury Bond ETF (TLT), which is an ETF that features solely longer-term US Treasury Bonds, is down by 10.65%. Thus, alternatively, the commerce could possibly be executed by shorting JNK and shopping for TLT, which is particularly a wager on widening credit score unfold, excluding the rate of interest threat.

Conclusion

It looks as if we’re in “calm earlier than the storm” when trying on the credit score spreads, identical to in 2008. However we aren’t, the storm is already right here. Based mostly on the Fed’s examine, 37% of US non-financial corporations have been already close to default in 2022.

[ad_2]

Source link