[ad_1]

Darren415

This text was first launched to Systematic Earnings subscribers and free trials on June 25.

Welcome to a different installment of our CEF Market Weekly Evaluate, the place we talk about closed-end fund (“CEF”) market exercise from each the bottom-up – highlighting particular person fund information and occasions – as properly because the top-down – offering an summary of the broader market. We additionally attempt to present some historic context in addition to the related themes that look to be driving markets or that traders should be conscious of.

This replace covers the interval by the fourth week of June. Make sure to try our different weekly updates overlaying the enterprise growth firm (“BDC”) in addition to the preferreds/child bond markets for views throughout the broader revenue house.

Market Motion

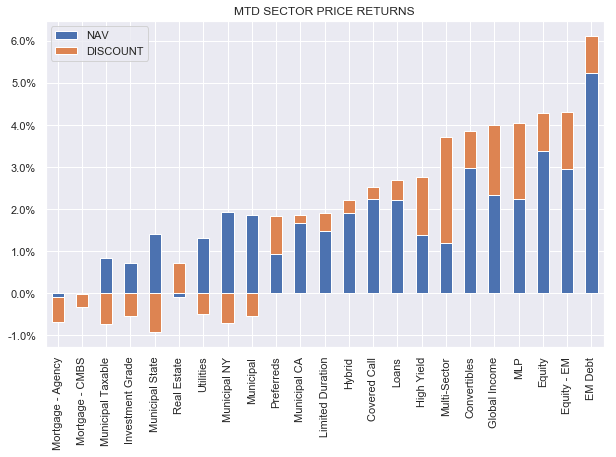

The CEF market was principally down this week as broader markets cooled off after a robust run. Month to this point, nonetheless, most sectors are nonetheless up.

Systematic Earnings

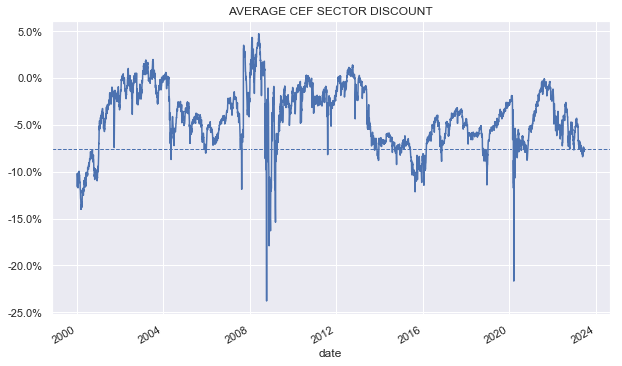

CEF reductions tightened barely, nonetheless, they’ve been very sluggish. Whereas the general CEF house is up greater than 10% off its lows late final 12 months, reductions are usually not far off their wides.

Systematic Earnings

Market Themes

The CEF market stays in style with revenue traders. Nonetheless, together with the recognition comes a good dose of complexity and with complexity come misconceptions. Often analysts be part of the membership and make primary errors as properly, which ends up in additional confusion. On this part we spotlight a few funds the place we seen a few misconceptions this week. These misconceptions are usually not purely educational however can lead traders astray of their allocation choices.

Let’s kick off with the Barings Company Traders (MCI). Right here, some traders make a class mistake by evaluating the efficiency of MCI to that of credit score CEFs.

In actuality, MCI needs to be considered as a BDC, or no less than a mixture of BDC and CEF. That is primarily as a result of MCI holds non-public credit score (with a smattering of fairness – just about the allocation footprint of BDCs). About 2% of its belongings are in public debt. Against this, credit score CEF allocation is precisely reversed. Credit score CEFs maintain nearly fully public credit score belongings with little or no or no non-public debt.

What differentiates MCI from conventional BDCs is its low stage of leverage (low even for a CEF) in addition to a scarcity of incentive charges. Evidently the corporate tends to piggyback on sponsor-led alternatives and don’t do loads of direct lending themselves which implies it could possibly run in a bare-bones low payment approach.

MCI, together with its sister fund MPV, is commonly extolled as “the perfect” or “the most effective” CEFs of their sector. When commentators use the phrase “sector” what they imply is the Excessive Yield company bond sector as a result of that is the place CEFConnect sticks it. Nonetheless, this view makes two errors.

One, a fast have a look at the fund’s precise holdings will present that it holds principally mortgage publicity and so ought to actually be in comparison with mortgage funds.

And, two, because the dialogue right here suggests, it should not actually be in comparison with CEFs holding public debt and will as a substitute be in comparison with funds that maintain non-public debt (i.e. BDCs). If we evaluate the fund to BDCs, we see that it has pretty common to barely above common efficiency over numerous intervals in complete NAV phrases. Briefly, traders who love MCI will probably be head over heels with any variety of BDCs if that they had a have a look at that house.

Transferring to the XAI Octagon Floating Fee & Different Earnings Time period Belief (XFLT), feedback about which additionally crossed our display this week.

Particularly, there’s a view that XFLT is a superb fund as a result of it buys and holds belongings at a reduction. This can be a misguided view for two causes. One, proper now the overwhelming majority of credit score securities, aside from Municipal bonds, commerce beneath par. As a sidenote, and as many traders know, Municipal bonds are sometimes issued at “spherical” coupons of 4% or 5%, fairly than at their yields resulting from a historic conference. This retains their costs elevated vs. par.

Company bonds, then again, are issued as “par” belongings i.e. with coupons matching their yields at issuance. And since company bond yields are at the moment elevated relative to the coupons at which the bonds had been issued, the typical company bond trades properly beneath par.

Floating-rate belongings like loans have costs which can be a operate of credit score spreads fairly than general yields and since credit score spreads are usually not all that vast, loans are literally buying and selling fairly near par. In Could the typical financial institution mortgage was buying and selling north of $97 and spreads have tightened a bit since then so the typical worth needs to be even larger now.

XFLT is a fund that holds CEF Fairness and financial institution loans. Out of all company credit score belongings, financial institution loans are buying and selling in any case low cost to par so it’s definitely odd to spotlight XFLT on this foundation.

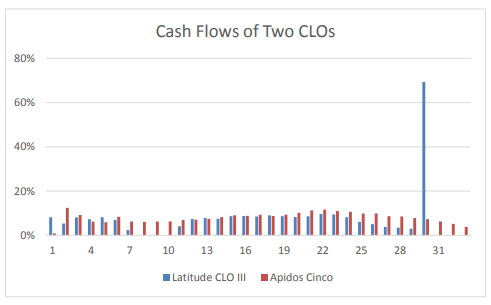

Turning to CLO Fairness, it’s definitely true that CLO Fairness securities are buying and selling properly beneath 100%. Nonetheless, in contrast to bonds and loans, CLO Fairness doesn’t mature at par.

As we identified a while again in an article targeted on CLO Fairness misconceptions, CLO Fairness cashflows are everywhere. Some CLO Fairness securities seem like annuities whereas others have a bigger payout ultimately, although nowhere close to 100%.

Moody’s

Because of this anybody shopping for CLO Fairness anticipating it to mature at par ought to get an excellent primer on the asset class. Briefly, XFLT is simply concerning the worst fund to spotlight from a reduction to par perspective as a result of half of its portfolio is buying and selling proper on high of par whereas the opposite isn’t going to mature at par.

Market Commentary

We proceed to control the goal time period CMBS-focused Invesco Excessive Earnings 2023 Goal Time period Fund (IHIT). The fund has a termination date in December of this 12 months and trades at a 6% low cost. If it terminates, it could be an amazing alternative of producing one thing like a 20% annualized return for half a 12 months. We’re not conscious of Invesco time period funds terminating or not terminating so we are able to’t use precedent right here as a information in contrast to we are able to for Nuveen funds.

One difficulty we seen is that the final reality sheet is from April of this 12 months and reveals money as 1% of the portfolio whereas the shareholder report from earlier reveals that about 14% ought to have matured by April already. This would possibly imply the fund is rotating the money into new securities which can imply they do not plan to terminate.

Clearly, CMBS is a sector that’s making everybody a bit nervous lately. Nonetheless, we have to hold issues in perspective. The general CMBS delinquency charge has moved to three.6% from 3% over the previous 12 months. That is within the context of a ten% delinquency charge throughout COVID. If we have a look at the IHIT complete NAV return over the previous 5 years, it’s round +6% complete (not annualized) which captures an enormous chunk of a market surroundings that was 3x as unhealthy as now which isn’t too unhealthy.

Brandywine World Funding Administration estimate that losses on CMBS Workplace securities may attain mid-to-high single digits, leaving investment-grade tranches largely unscathed. Recall that IHIT holds predominantly investment-grade CMBS tranches and the fund’s allocation to the Workplace subsector is a few fifth of the portfolio.

An necessary distinction is that going into COVID, CMBS was not priced for a foul final result whereas now it’s. Not solely that however short-term charges are clearly elevated relative to historical past which permits the fund to generate a excessive stage of revenue on its floating-rate belongings.

Briefly, if IHIT phrases out, it may really carry out pretty properly, significantly now that its low cost has widened out so a failure to terminate isn’t the worst factor that might occur.

[ad_2]

Source link