[ad_1]

Nikada

Introduction

As an investor in dividend progress shares, I at all times search new alternatives to put money into income-producing property, primarily shares. I have a tendency so as to add to current positions after I discover them attractively valued. I additionally use market volatility to my benefit by beginning new positions to diversify my holdings and improve my dividend revenue for much less capital.

The monetary sector is engaging because the enterprise setting could be very suspicious of monetary establishments. Traders are anxious about unrealized losses that will pose an issue if shoppers withdraw their deposits. That is after I consider specializing in secure, extremely regulated, systematically vital monetary establishments may be helpful, and Morgan Stanley (NYSE:MS) is one in all them.

I’ll analyze Morgan Stanley utilizing my methodology for analyzing dividend progress shares. I’m utilizing the identical methodology to make it simpler to match researched firms. I will look at the corporate’s fundamentals, valuation, progress alternatives, and dangers. I’ll then attempt to decide if it is a good funding.

In search of Alpha’s firm overview reveals that:

Morgan Stanley supplies monetary services to firms, governments, monetary establishments, and people within the Americas, Europe, the Center East, Africa, and Asia. It operates by way of Institutional Securities, Wealth Administration, and Funding Administration segments. The Institutional Securities phase gives capital elevating and monetary advisory providers. The Wealth Administration phase gives monetary advisor-led brokerage, custody, administrative, and funding advisory providers, self-directed brokerage providers, monetary and wealth planning providers, and office providers, together with inventory plan administration annuity and insurance coverage merchandise. The Funding Administration phase supplies fairness, mounted revenue, alternate options and options, and liquidity and overlay providers.

Fundamentals

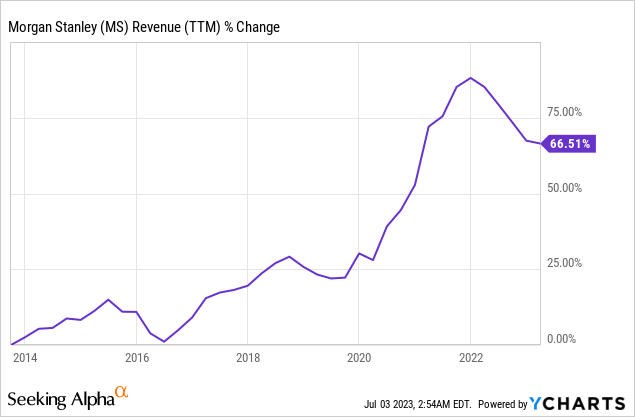

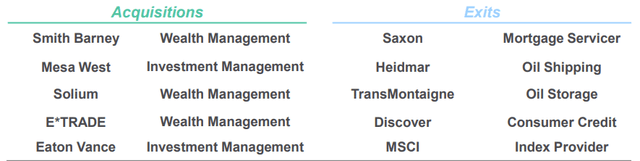

The revenues of Morgan Stanley have elevated by 66% over the past decade. Like different funding banks, the corporate loved a peak yr in 2021, but regardless of the slight decline, it nonetheless has proven regular progress over the long run. The corporate grows organically by reaching extra purchasers and managing extra property by way of acquisitions corresponding to Eaton Vance and E-Commerce, which allowed the financial institution to supply extra providers to the mainstream inhabitants. Sooner or later, as seen on In search of Alpha, the analyst consensus expects Morgan Stanley to continue to grow gross sales at an annual charge of ~4% within the medium time period.

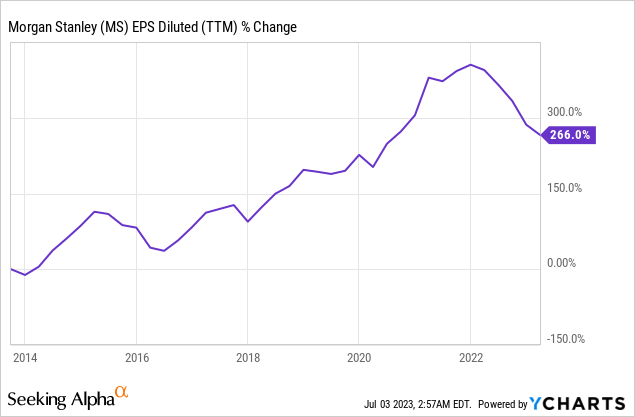

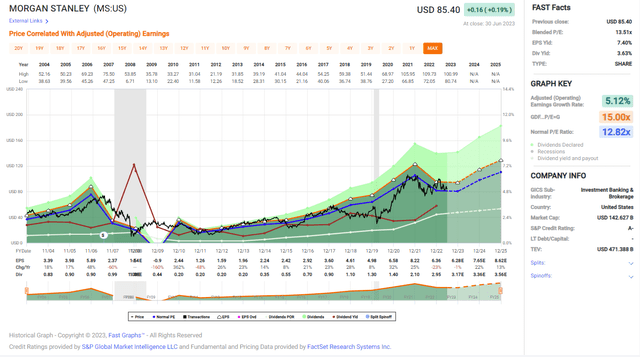

The EPS (earnings per share) elevated quicker over the identical decade. The EPS elevated by 266% after peaking in 2021, just like the revenues. Morgan Stanley managed to greater than triple its EPS because it expanded its AUM (property beneath administration) with out rising prices considerably concurrently. The improved margins, greater gross sales, and buybacks supported EPS progress. Sooner or later, as seen on In search of Alpha, the analyst consensus expects Morgan Stanley to continue to grow EPS at an annual charge of ~9.5% within the medium time period.

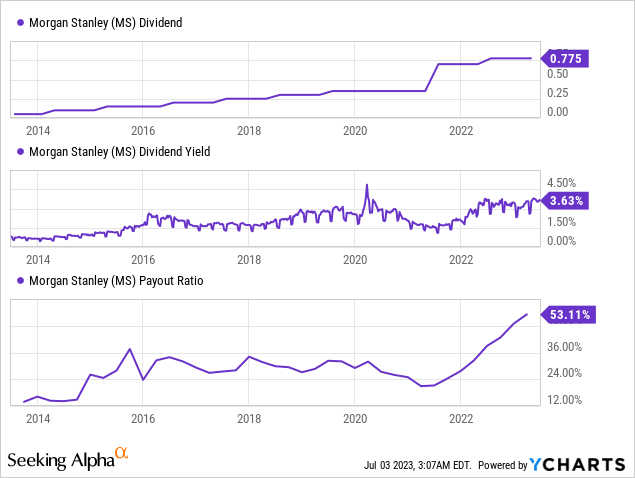

The dividend of Morgan Stanley has simply been raised following the 2023 stress assessments. The corporate introduced that it intends to extend the dividend by a further 9.7%. It would convey the dividend yield nearer to 4%, which is extremely engaging for a rising blue chip. The dividend appears protected because the payout ratio is between 50%-60% regardless of the EPS decline from the 2021 peak. The corporate has not lowered the dividend for the reason that monetary disaster and is now appearing extra conservatively to make sure it will probably help it.

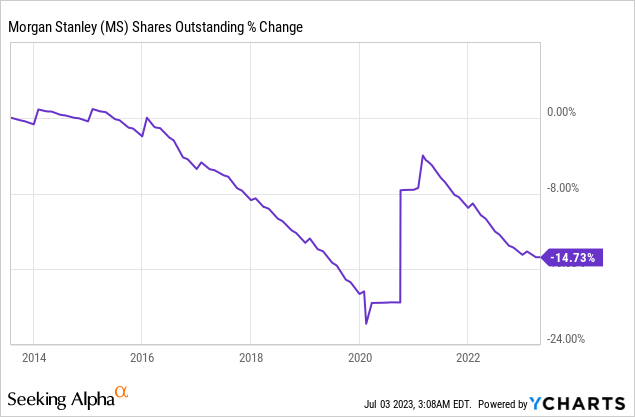

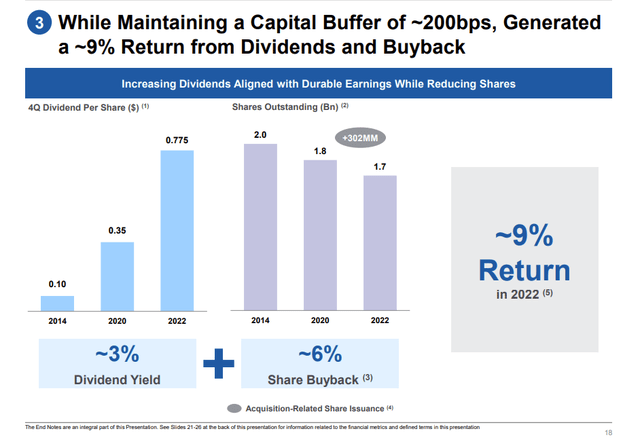

Along with the dividend, the corporate has been shopping for again its shares aggressively over the past decade. The corporate intends to purchase again a further $20B value of inventory following the 2023 road check. Over the past decade, it has decreased the variety of shares excellent by 15% regardless of issuing shares to fund its E-Commerce acquisition. Buybacks are extremely environment friendly when the share worth is low.

Valuation

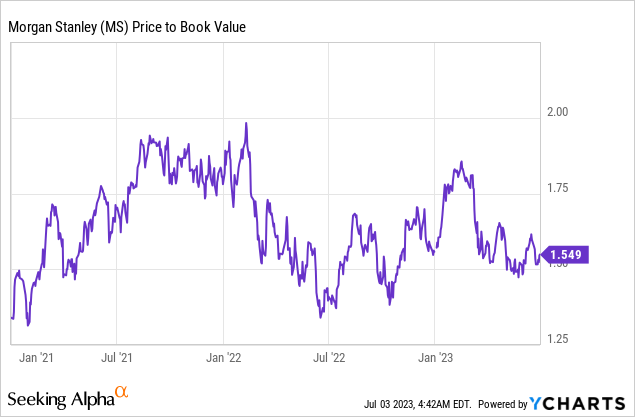

Essentially the most helpful metric for a monetary establishment’s valuation is its price-to-book ratio (P/B ratio). Morgan Stanley is buying and selling for 1.5 occasions its e book worth, which aligns with the corporate’s valuation for the reason that pandemic’s recession ended. Whereas the valuation would not appear out of contact in comparison with the final 30 months, it’s important to notice that some friends like Goldman Sachs commerce for one time their e book worth.

The graph under from Quick Graphs reveals that Morgan Stanley is pretty valued primarily based on the P/E (price-to-earnings) ratio. Over the past decade, the common P/E ratio was 12.8, whereas the present one stands at 13.5 when utilizing the 2023 EPS forecasts. The forecasted progress charge is 9.5%, greater than the expansion charge over the past 20 years, which stood at 5%. Due to this fact, it looks like the inventory is pretty valued and even gives some margin of security as the expansion charge is quicker whereas the valuation is comparable.

Quick Graphs

Alternatives

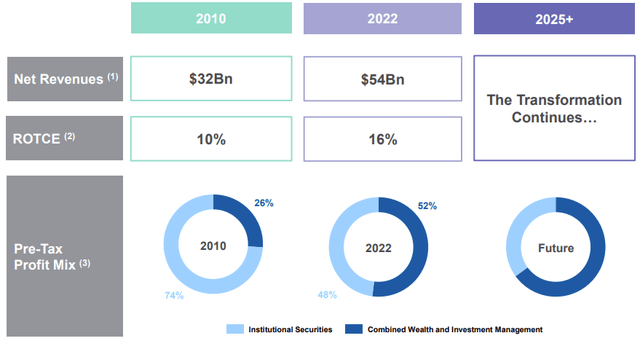

The funnel that Morgan Stanley is constructing is a big progress alternative for the corporate. The corporate invests strategically to lean tougher in direction of wealth and funding administration than funding banking. It turns the corporate right into a extra diversified establishment with extra purchasers. The corporate created many income streams in several markets by including to that geographical diversification.

Morgan Stanley

To do that, Morgan Stanley has invested closely in making a funnel that may entice youthful traders and accompany them as they develop till they want the providers of the wealth administration unit. Morgan Stanley gives mainstream traders its E-trade platform, offering them with retirement options by way of their workplaces. Due to this fact, as soon as a shopper “graduates” and has sufficient capital for wealth administration, Morgan Stanley can simply entice him. The corporate has shed non-core companies to concentrate on that funnel throughout that interval.

Morgan Stanley

A powerful capital foundation permits the corporate to take care of its regulatory requirement whereas returning capital to shareholders. The corporate has handed the stress assessments of 2023 regardless of the difficult setting. In 2022, it has returned greater than 9% to shareholders through buybacks and dividends. With the present 2023 plan, Morgan Stanley is poised to return a further ~10% when wanting on the present worth, and that is earlier than the room for EPS progress sooner or later.

Morgan Stanley

Dangers

The primary danger is the competitors, because the funding banking realm is extremely populated with giants corresponding to Goldman Sachs (GS) and JPMorgan (JPM), and the funding and wealth administration realm can also be extremely aggressive with one-stop-shops like funding banks, but additionally different personal banks each international and home. Due to this fact, traders should contemplate that Morgan Stanley is energetic in a discipline the place each phase could be very aggressive.

The second danger is the slowdown within the financial system we’re already coping with. We see fewer actions in terms of mergers and acquisitions. I don’t anticipate a right away change as rates of interest are greater, which makes funding more difficult. In Q1 2023, the slowdown affected Morgan Stanley because the funding banking phase revenues dropped by 24%, because the markets noticed fewer M&A exercise and IPOs.

If the slowdown turns right into a recession, we might even see an much more vital drop in Morgan Stanley’s revenues and EPS. In a recession, we’re prone to see the inventory market plunge. When the general public is afraid, it tends to be much less energetic, that means fewer charges for the corporate. It additionally signifies that the property beneath administration will shrink as nicely. Traders can also want to put money into safer and low-fee merchandise corresponding to cash market funds throughout a recession. It might considerably have an effect on the corporate’s prime and backside traces.

Conclusions

To conclude, Morgan Stanley is a blue chip firm that managed to develop prime and backside traces and gas dividends and buybacks. The corporate has a number of progress alternatives specializing in wealth administration and the funnel that results in it. These alternatives come when the share worth is truthful, with a little bit of a margin of security when the long run.

There are dangers to the funding thesis, primarily because of the more difficult enterprise setting and the competitors. Nevertheless, I consider that Morgan Stanley is well-positioned to cope with these challenges and, subsequently, proceed to develop and provide traders a double digits return within the medium time period. I charge Morgan Stanley a BUY and consider it fits most dividend progress traders.

[ad_2]

Source link