[ad_1]

Brandon Bell

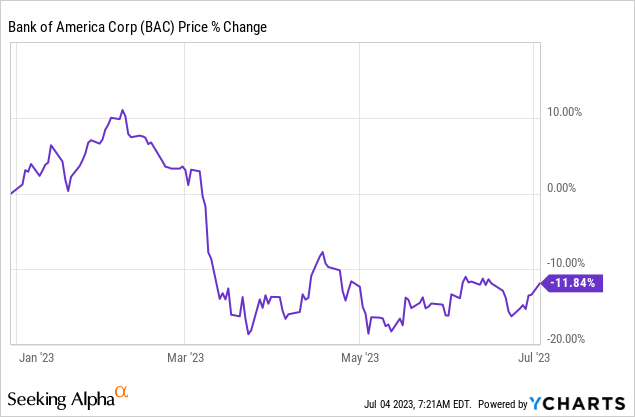

Financial institution of America (NYSE:BAC) has been negatively impacted in FY 2023, not solely by the regional banking disaster within the first-quarter, but in addition by the continuous rise in rates of interest which the Fed enacted to be able to counter the rise in client costs. The rise in rates of interest particularly resulted in a $100B+ unrealized loss within the financial institution’s bond portfolio, in response to the FDIC, a growth that continues to maintain traders on the sidelines… which I imagine is a mistake as Financial institution of America could possibly be set for a robust Q2 earnings report in July. Moreover, high tier banks like Financial institution of America have adequate liquidity, have not too long ago handed the Fed’s stress check and are beneath no stress to comprehend these unrealized losses in the event that they maintain fastened earnings investments till maturity!

Financial institution of America’s $100B+ in bond losses are principally an imaginary drawback

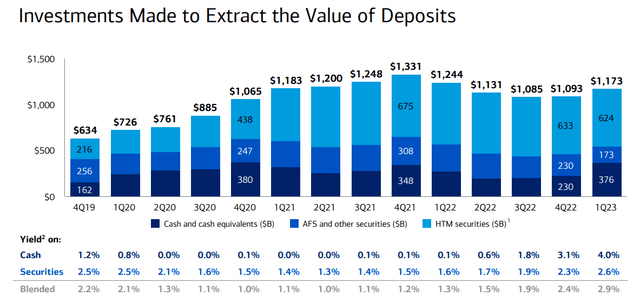

With earnings for the second-quarter simply across the nook, too many traders are nonetheless too apprehensive in regards to the sector’s massive unrealized losses as they relate to their fastened earnings portfolios. In the previous few years, banks like Financial institution of America have aggressively invested extra deposits into mortgage-backed securities in addition to bonds issued by the U.S. authorities. Nearly all of Financial institution of America’s investments have been made into held-to-maturity securities.

Supply: Financial institution of America

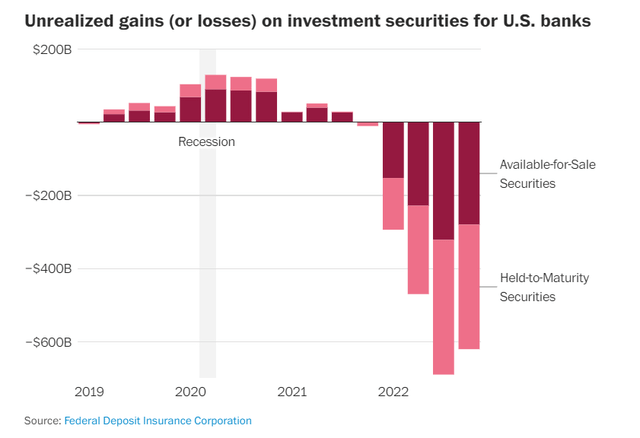

Because of the Fed elevating rates of interest, financial institution’s held-to-maturity portfolios are exhibiting massive unrealized losses on these fastened earnings investments. Financial institution of America, for example, had a $100B+ unrealized loss in its bond portfolio on the finish of the first-quarter. In complete, the FDIC reported that the banking sector was sitting on greater than $600B in unrealized losses as rising rates of interest lowered the worth of fastened earnings devices, nearly all of which associated to banks’ held-to-maturity portfolios.

Supply: Washington Submit

Now, with earnings set to be reported quickly, traders are more likely to return their deal with Financial institution of America’s unrealized losses. Nevertheless, I imagine that Financial institution of America’s unrealized losses are mainly an imaginary drawback and one which traders actually haven’t any cause to panic about forward of the Q2 earnings report.

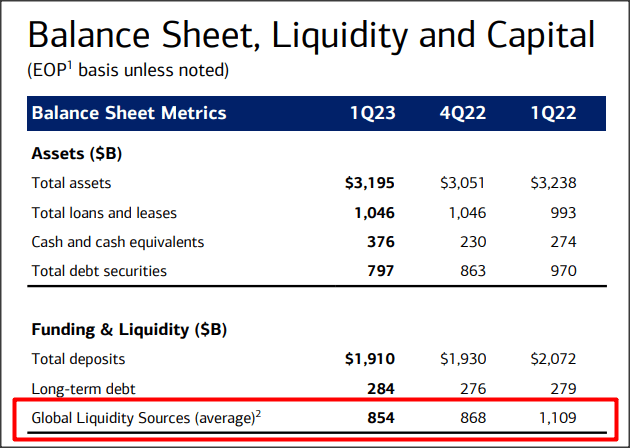

Initially, traders have been properly conscious of those unrealized losses ever since Silicon Valley Financial institution failed in March, largely as a result of it was compelled to promote securities to be able to meet deposit withdrawal requests. Financial institution of America has not seen uncommon deposit outflows within the first-quarter and is due to this fact extremely unlikely to report irregular deposit tendencies for the second-quarter.

Secondly, I do not see why Financial institution of America would have needed to promote any of its devalued HTM bonds within the second-quarter, mainly as a result of the financial institution has greater than sufficient liquidity. Financial institution of America had entry to roughly $854B in liquidity on the finish of the first-quarter.

Supply: Financial institution of America

Thirdly, Financial institution of America simply handed the Fed’s stress check, that means the financial institution has been judged by the regulator to have adequate capital within the occasion of a extreme recession. In different phrases, Financial institution of America possible had no cause in anyway within the second-quarter to liquidate a portion of its bond portfolio and incur valuation losses.

Why I imagine Financial institution of America may shock to the upside with its Q2’23 earnings sheet

Financial institution of America is because of report earnings for its second-quarter on 7/18/2023 (Pre-Market) and expectations are usually not particularly excessive after the sector was hit by a banking disaster within the first-quarter. Analysts count on the financial institution to report $0.85 per-share in Q2’23 earnings in comparison with $0.94 per-share in Q1’23. Within the final ninety days, there have been 10 EPS down-side revisions in comparison with simply 3 EPS up-side revisions, that means analysts do not count on a lot from Financial institution of America.

Nevertheless, I imagine that high tier banks on the whole will be capable of show their worth to traders by reporting resilient earnings (internet curiosity earnings) and continuous ebook worth development.

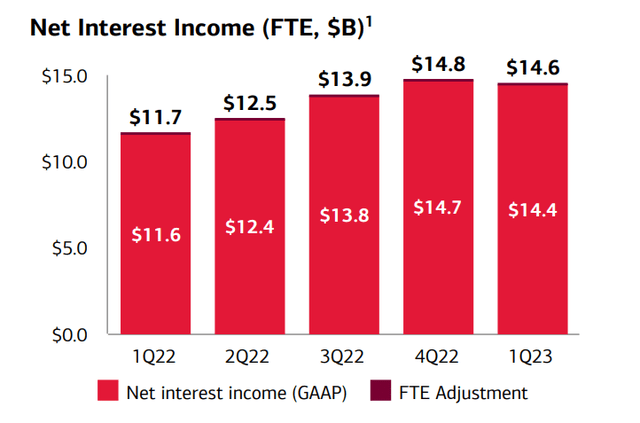

Financial institution of America generated $14.6B in internet curiosity earnings in Q1’23, exhibiting a $2.9B improve on account of mortgage development and better rates of interest. For the second-quarter, I count on Financial institution of America to report $14.3-$14.4B in internet curiosity earnings, exhibiting a possible 12 months over 12 months improve of $1.95B, at mid-point.

Supply: Financial institution of America

Financial institution of America’s valuation

I count on Financial institution of America to report a average 1-2% Q/Q improve in its ebook worth because the financial institution possible benefited from sturdy deposit and mortgage efficiency in addition to excessive rates of interest. Financial institution of America added about $1 per-share in ebook worth in Q1’23, regardless of the banking disaster. I additionally do not count on Financial institution of America to report any significant declines (gross sales) in its bond portfolio.

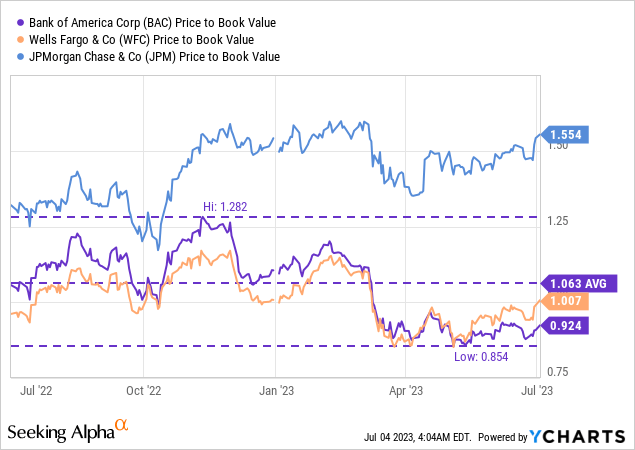

Financial institution of America has not but meaningfully recovered from the Q1’23 sell-off and shares proceed to commerce at a reduction to ebook worth… which I imagine is undeserved. As a systemically-important financial institution, Financial institution of America has a substantial benefit over regionally-oriented banks and traders ought to in the end return to reward Financial institution of America’s shares for its relative stability with a premium to ebook worth.

At present, Financial institution of America has a price-to-book ratio under 1X, versus JPMorgan Chase (JPM) and Wells Fargo (WFC): Financial institution of America trades at 0.92X ebook worth and if shares revalue to the 1-year common P/B ratio, then shares of the financial institution have about 15% upside potential. If Financial institution of America reprices to its upper-range P/B ratio of 1.28X, then shares may see as much as 39% upside potential over the long run.

Dangers with Financial institution of America

Financial institution of America has benefited from vital internet curiosity earnings tailwinds as a result of Fed elevating rates of interest within the final 12 months. The largest danger for Financial institution of America, as I see it, is the Fed really slowing the speed of rate of interest will increase as a result of it removes a strong earnings catalyst from the financial institution. I do not imagine, nevertheless, that Financial institution of America’s unrealized bond losses will have an effect on both the financial institution’s quick time period or long term earnings potential.

Closing ideas

I see Financial institution of America as a robust purchase forward of Q2’23 earnings… that are set to be launched on 7/18/2023. Financial institution of America put up a robust earnings sheet for the first-quarter, within the midst of a banking disaster, and the financial institution added about $1 per-share to its ebook worth. Because the financial institution ought to proceed to learn from increased common rates of interest and mortgage development, Financial institution of America may beat low EPS expectations, for my part. Moreover, Financial institution of America handed the Fed’s stress check final week, giving traders another reason to have faith within the financial institution’s capital and liquidity positions.

The $100B+ unrealized loss in Financial institution of America’s bond portfolio appears like an enormous drawback, however it is not, for my part: traders have to know that these losses don’t should be realized and Financial institution of America doesn’t have a strained liquidity state of affairs that might require the financial institution to liquidate (a portion of) its HTM portfolio. So long as Financial institution of America holds these investments till maturity, no unrealized loss should be acknowledged and it actually will not have an effect on the financial institution’s Q2 earnings!

[ad_2]

Source link