[ad_1]

LauriPatterson/E+ through Getty Pictures

Intro

MamaMancini’s Holdings, Inc. (NASDAQ:MMMB) is a US-based firm that makes a speciality of the manufacturing and distribution of ready, frozen, and refrigerated meals merchandise. The corporate’s product choices embody beef and turkey meatballs, beef meatloaf, rooster parmesan, and way more. MamaMancini’s sells its merchandise to varied supermarkets, mass-market retailers, meals retailers, and distributors.

The target of this text is to offer a complete evaluation of MMMB’s monetary efficiency and its potential for development. We’ll conduct a radical evaluation of MMMB’s income and profitability patterns, its capacity to generate free money circulate, and the general monetary energy indicated by its steadiness sheet. As well as, we’ll make use of a reduced money circulate evaluation to estimate MMMB’s intrinsic worth, providing precious insights to traders who’re contemplating MMMB as a possible funding alternative within the present market.

Efficiency

In the world of investments, figuring out firms with a monitor report of constant development, a powerful steadiness sheet, and spectacular profitability is a key goal for traders. One such firm that deserves consideration is MMMB.

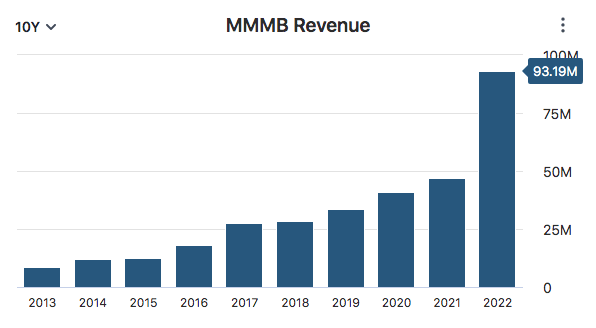

MMMB has displayed outstanding income development over the previous decade, a testomony to its success in capturing market alternatives and increasing its enterprise. Analyzing the information, we observe that MMMB achieved a constant streak of development over the past 10 years. Throughout this era, the corporate’s income surged from $9 million in 2013 to $93 million in 2022, representing a complete development of practically 1000% over the last decade. A excessive development charge is essential for firms because it displays their capacity to draw prospects, acquire market share, put money into innovation, and generate greater returns for traders.

Information by Inventory Evaluation

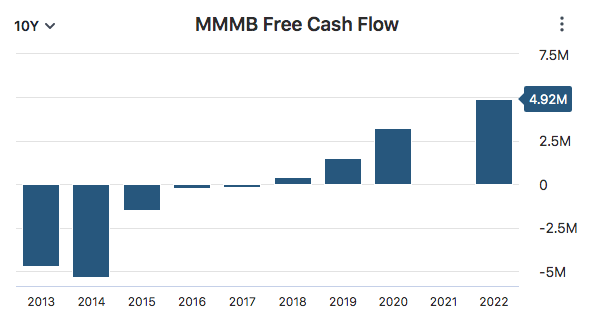

Along with income development, MMMB has persistently demonstrated robust free money circulate era. Free money circulate represents the excess money an organization generates after assembly its working bills and capital expenditures. Inspecting the information, we discover that MMMB maintained optimistic free money circulate over the past 5 years, permitting the corporate to fund its development initiatives and reward shareholders. The corporate’s capacity to generate optimistic free money circulate, reminiscent of $4.92 million in 2022, showcases its monetary energy and capability to reinvest within the enterprise for future development.

Information by Inventory Evaluation

MMMB demonstrates accountable monetary administration, contributing to a stable steadiness sheet. Two essential metrics used to guage its steadiness sheet energy are the debt-to-equity (D/E) ratio and the present ratio. The D/E ratio measures the proportion of debt to fairness, with decrease values indicating a diminished reliance on debt financing. MMMB’s D/E ratio of 0.89 displays a conservative debt administration method, minimizing monetary danger and establishing a secure basis for development. Nonetheless, whereas the present ratio of 1.41 signifies MMMB’s capacity to fulfill short-term obligations effectively, an excellent greater present ratio would additional strengthen the corporate’s liquidity place. This would supply MMMB with enhanced resilience to navigate unexpected challenges and capitalize on rising alternatives.

MMMB has exhibited various ranges of profitability over time, as mirrored in its return on fairness (ROE) information. ROE serves as a measure of the corporate’s capacity to generate earnings from shareholders’ investments. Upon analyzing the information, it’s evident that MMMB achieved an ROE of 20% or greater in simply 3 of the previous 10 years, indicating ineffective capital utilization throughout these intervals. You will need to be aware that MMMB additionally skilled unfavorable ROE in 5 of the final 10 years, highlighting potential challenges and areas for enchancment. A excessive ROE stays essential because it signifies the corporate’s functionality to optimize returns on invested capital, appeal to investor curiosity, and foster long-term worth creation.

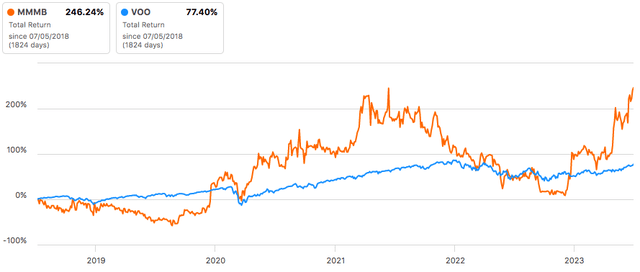

To evaluate MMMB’s efficiency relative to the broader market, we evaluate its 5-year whole return with that of the S&P 500 index. MMMB has achieved an impressive whole return of 246% over the previous 5 years, outpacing the S&P 500’s return of 77%. This comparability demonstrates MMMB’s capacity to ship superior returns to its traders, reflecting the corporate’s robust development trajectory and profitable execution of its enterprise technique.

Information by In search of Alpha

Outlook

MMMB’s first quarter earnings outcomes exceeded expectations, with an earnings per share (EPS) of $0.04, surpassing estimates by $0.03. The corporate additionally reported income of $23.12 million, reflecting a year-over-year development of 5.91% and surpassing expectations by $770.82 thousand. These outcomes point out a powerful efficiency for MMMB within the first quarter, demonstrating optimistic momentum and development in each earnings and income.

These robust outcomes might be attributed to MMMB accelerating and increasing its present manufacturers. MMMB continues to execute its aim of increasing its present household of manufacturers with the latest launch of Mama’s Creations, a platform model for worldwide delicacies, which has obtained optimistic evaluations from retailers and shoppers.

Wanting forward MMMB is predicted to proceed its development trajectory within the coming fiscal intervals. Analysts mission an EPS estimate of $0.16 for the fiscal interval ending in January 2024, indicating a major year-over-year development of 166.67%. The ahead price-to-earnings (PE) ratio stands at 20.13, suggesting optimistic market expectations for MMMB’s future efficiency. Wanting even additional forward to January 2025, analysts anticipate additional development, estimating an EPS of $0.22, reflecting a year-over-year enhance of 37.50%. These projections point out optimistic expectations for MMMB’s continued development and efficiency within the upcoming fiscal intervals.

Future development shall be powered by MMMB’s aim to proceed to develop its present manufacturers. Moreover, MMMB is strategically utilizing consumer-driven innovation to enter new events, cohorts, and channels. The introduction of the In-a-Cup portfolio expands the corporate’s product choices to cater to new shopper wants. Past natural development the corporate is actively contemplating potential acquisitions to fill gaps in its portfolio. The corporate goals to turn out to be a one-stop store for deli ready meals, addressing the rising market demand for high-quality, handy, and inexpensive meal options.

The way forward for MMMB does seem like vibrant, although there’s a main danger to proudly owning this enterprise, majority of MMMB’s revenues are concentrated in just a few prospects. Within the fiscal yr ending on January 31, 2023, MMMB’s gross revenues had been primarily derived from two prospects, accounting for about 37% of the entire. Equally, within the previous fiscal yr ending on January 31, 2022, income relied on three prospects, representing roughly 58% of the entire. The potential lack of these main prospects would have a considerable affect MMMB’s income and will adversely have an effect on general monetary efficiency.

MMMB might want to do every little thing essential to preserve its main prospects joyful which is why the corporate is targeted on strengthening the group and tradition. MMMB emphasizes the significance of hiring, selling, and retaining expertise for long-term success. The corporate is investing in its individuals and constructing a consumer-focused tradition, as demonstrated by shopper focus teams, firm city halls, and a shopper immersion lab. Constructing a greatest in school group will improve service ranges to the corporate’s main purchasers making MMMB a stickier firm that is tough to maneuver on from. Throughout MMMB’s 2024 first quarter earnings name the corporate’s CEO, Adam Michaels, shared his ideas on rising the client base.

We’re equally excited in regards to the hiring of extra gross sales capabilities, significantly with the latest rent of our new West Coast gross sales lead. We’ll proceed to recruit best-in-class expertise to develop our ft on the road to take our gross sales attain to the following degree, leveraging our passionate following and recent, clear merchandise to extra aggressively promote into each new and present prospects.

Primarily based on the spectacular first quarter earnings outcomes and the corporate’s strategic initiatives, it’s our perception that MMMB’s development will stay robust sooner or later. MMMB’s deal with accelerating and increasing its present manufacturers, in addition to leveraging consumer-driven innovation, positions them nicely to seize new market alternatives and cater to evolving shopper wants. Moreover, the corporate’s consideration of potential acquisitions to fill portfolio gaps highlights a proactive method to fueling development.

Valuation

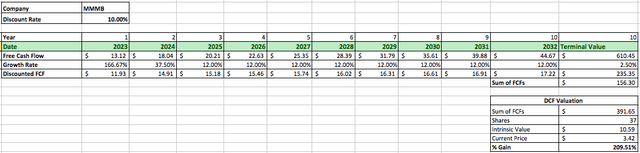

We’ll make the most of the discounted money circulate (DCF) evaluation, our most well-liked technique of assessing an organization’s worth, to guage MMMB’s true price. This method includes figuring out the current worth of MMMB’s projected future money flows as a way to derive its intrinsic worth.

To start the evaluation, we’ll begin with MMMB’s earlier yr’s free money circulate of $4.92 million. We’ll apply the typical analyst earnings development charge of 166% for 2023, then we’ll apply development charge of 37.5% for 2024 based mostly on common analyst earnings estimates. MMMB is a small firm and predicting MMMB’s future free money flows past the following two years presents challenges as a consequence of uncertainty and restricted visibility. Nonetheless, given the corporate’s robust historic efficiency, which exhibited a mean annual free money circulate development charge of 86% since 2018, we’ll make the most of a extra conservative development charge of 12% for the next 8 years, which appears greater than truthful.

To be able to calculate the terminal worth, we’ll make use of a conservative perpetual development charge of two.5%. Making use of a reduction charge of 10%, which accounts for the long-term return charge of the S&P 500 with dividends reinvested, we decide MMMB’s intrinsic worth to be $10.59. This means that MMMB might at present be considerably undervalued, probably providing traders a acquire of 209% in comparison with the corporate’s present market worth.

Writer’s Work

Conclusion

MamaMancini’s Holdings, Inc. has demonstrated a powerful income development over the previous decade. The corporate’s deal with increasing its present manufacturers, coupled with strategic consumer-driven innovation and potential acquisitions, positions MMMB for future development. The primary quarter earnings outcomes exceeded expectations, reflecting optimistic momentum and development in earnings and income. Analysts mission substantial year-over-year EPS development for the upcoming fiscal intervals, indicating optimistic expectations for MMMB’s continued efficiency.

Whereas there’s a danger related to the focus of revenues from a couple of main prospects, MMMB is actively targeted on strengthening its group and tradition to reinforce buyer satisfaction. The corporate’s dedication to hiring, selling, and retaining expertise, in addition to its funding in a consumer-focused tradition, additional assist its long-term success.

Primarily based on the spectacular monetary outcomes, development prospects, and strategic initiatives, it’s our opinion that MMMB’s development will stay robust sooner or later. Furthermore, MMMB seems undervalued, as decided by a reduced money circulate evaluation. The evaluation suggests a major potential acquire for traders in comparison with the present market worth. With an intrinsic worth of $10.59, indicating a possible acquire of 209%, MMMB presents a horny funding alternative.

[ad_2]

Source link