[ad_1]

Dilok Klaisataporn/iStock through Getty Photographs

(This text was co-produced with Hoya Capital Actual Property.)

On November 12, 2021, along side the Hoya Capital Earnings Builder (hereafter HCIB) market service, I launched the ETF Dependable Retirement Portfolio (hereafter ETFRRP).

For monitoring functions, the official inception date of the portfolio was November 9, 2021. The acquisition costs used had been the closing costs from yesterday, November 8, 2021. We selected $500,000 because the opening worth of the hypothetical portfolio, as we felt this quantity maybe struck a pleasant median as being consultant of an investor who subscribed to a service equivalent to HCIB.

On January 19, 2023, I supplied the 2022 This fall and full-year replace on the portfolio, in addition to my funding outlook for 2023.

Right here is how I summarized that replace:

Briefly, as may be seen, This fall was stable for this pretty conservative portfolio, with a acquire of seven.98%. This minimize the total loss for the yr to 12.18%, versus the 18.66% YTD loss I reported in Q3. I can precisely report that dividends on the portfolio had been $13,006 for calendar-year 2022, or an total dividend return of two.60%.

Attributable to an prolonged European trip in April, I used to be unable to finish the Q1 replace that I might have usually offered. Nevertheless, I’ve one display screen seize exhibiting the ending stability at March 31, 2023, and can briefly reference and incorporate this slightly later.

For a whole dialogue of the idea behind the preliminary portfolio development, in addition to the beginning stability and positions, please be happy to reference the articles referenced above. Within the subsequent part, nevertheless, I’ll provide an abbreviated overview of key knowledge factors and ideas to put a groundwork for the efficiency replace that’s in the end the topic of this text.

Portfolio Construction And Themes

Based mostly on funding outlooks from a number of respected sources, listed here are the important thing themes that drove portfolio development.

A bias towards worth shares within the U.S. – Of late, a comparatively small subset of U.S. development shares has considerably outperformed just about each different asset class. Varied analyses recommend that worth shares might provide a greater danger/reward profile transferring ahead. The return from U.S. equities could also be solely marginally larger than bonds – Notably for retirees, discovering a stable stability of danger/reward is worthy of consideration. I try to search out this stability in my portfolio. Superior development alternatives might come from exterior the U.S. – A mid-year 2021 replace from Vanguard forecast Euro-area shares as probably outperforming their U.S. cousins by roughly one-half p.c; a spread of two.9% – 4.9% versus 2.4% – 4.4%. And rising markets supplied even larger potential, albeit with extra volatility and danger.

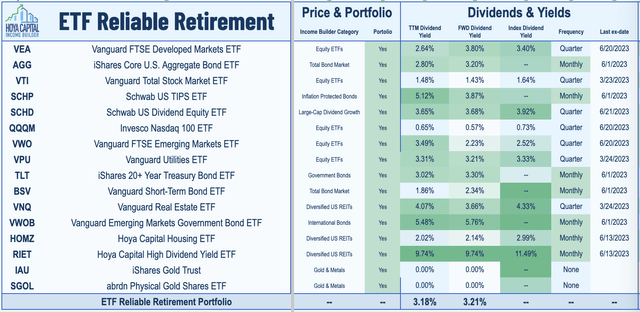

Beneath, I’ve reproduced the desk of exchange-traded funds (“ETFs”) included within the portfolio. Nevertheless, the weightings are proprietary to subscribers of Hoya Capital Earnings Builder.

ETFRRP by ETF Monkey (Hoya Capital Earnings Builder)

At a excessive degree, the portfolio is comprised of 5 asset lessons:

U.S. Shares Overseas Shares Bonds/TIPS Actual Property Gold.

As a conclusion to this part, I would be aware that, whereas a excessive dividend degree was not the first focus of this portfolio, 7 of the 14 dividend-producing ETFs pay dividends month-to-month, with the remaining 7 paying quarterly. The 2 gold-backed ETFs, in fact, pay no dividends.

2023 H1 Replace: The place The Rubber Meets The Street

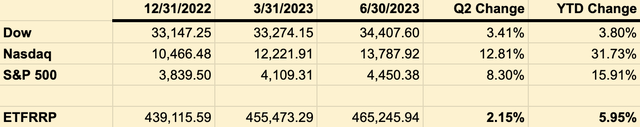

Within the graphic under, I provide a complete overview of how the ETFRRP has carried out, in contrast with main U.S. market averages.

ETFRRP by ETF Monkey YTD vs. Market Averages (Writer-Generated Spreadsheet)

Briefly, as may be seen, my conservatively-positioned portfolio generated comparatively modest returns for the primary half of 2023, with an total acquire of 5.95%. As can be detailed in a graphic a bit later within the article, dividends for the portfolio had been $5,922 throughout this era. Thus, the full return of the portfolio was comprised of 4.6% positive aspects and 1.35% dividends.

As a reference level, my private portfolio had a YTD acquire of 5.63% by way of Q2. This displays that reality, for higher or worse, every thing that I write about in addition to advocate on this portfolio carefully displays the construction and philosophy of my private portfolio.

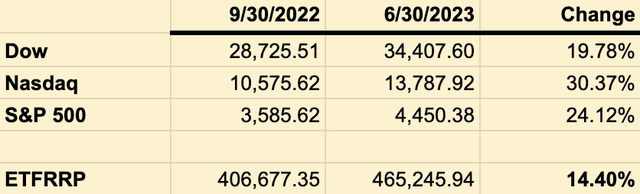

For this report, I made a decision to incorporate yet another reference level for consideration. Typically talking, U.S. markets established their current lows roughly the center of October, 2022. Because of this, my Q3 report from final yr is of some curiosity in evaluating how my portfolio has carried out since these lows.

ETFRRP by ETF Monkey vs. Market Averages – Since Q3 2022 (Writer-Generated Spreadsheet)

With a complete return of 14.40% since that time, discover myself happy with these total outcomes.

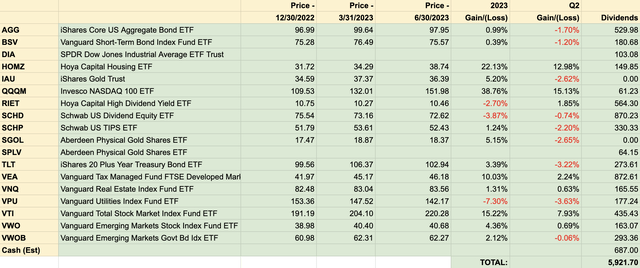

However, I’m not as proud of the comparatively modest returns generated by the portfolio through the first half of 2023. As an help in analyzing this, with the assistance of GOOGLEFINANCE capabilities I put collectively a complete spreadsheet, breaking out the outcomes by ETF. A pleasant characteristic of this specific graphic is that it exhibits each the worth motion in addition to the dividends generated by every ETF. Take a look, after which I’ll provide only a few temporary feedback.

ETFRRP – Efficiency By ETF (Writer-Generated Spreadsheet)

For those who look down the ‘2023 Achieve/(Loss)’ column, it turns into clear why the efficiency of this well-diversified efficiency was considerably mediocre. Whereas the S&P 500 index soared by 15.91% throughout this era and the Nasdaq index rocketed upwards to the tune of 31.73%, solely 4 of the 16 ETFs within the ETFRRP registered double-digit positive aspects. The opposite 12 ETFs did no higher than roughly 5% positive aspects, and three truly misplaced worth through the interval.

The one main change I made within the portfolio was primarily based on this text I wrote again on January 30. I did an ETF swap within the ETFRRP, changing Invesco S&P 500 Low Volatility ETF (SPLV) and SPDR Dow Jones Industrial Common ETF (DIA) with Invesco NASDAQ 100 ETF (QQQM) and Schwab US Dividend Fairness ETF (SCHD). Curiously, this resolution has turned out to be a blended bag by way of efficiency, at the very least thus far. Whereas QQQM was my #1 performer for the interval, SCHD struggled for the primary time in fairly an extended whereas, truly registering a loss through the interval lined by this report.

Lastly, curiosity rate-sensitive asset lessons continued to endure throughout this era. On the whole, the ETFs that had been by far my worst performers all bore some relation to this issue.

2023 Second Half Funding Outlook

In my final abstract of the portfolio, I referenced my article The World Of 4,818 Faces An Unsure Future, written in August, 2022. In that article, I posited that persevering with inflation in addition to geopolitical shocks had been going to mix to make it difficult for the S&P 500 to regain that all-time excessive of 4,818, achieved on January 14, 2022.

Whereas this triggered the outcomes produced by the ETFRRP to be lower than spectacular through the first half of 2023, I proceed to imagine within the underlying rationale that causes me to place the fund the way in which I do.

Listed below are simply a few causes I imagine this to be the case.

First, current developments proceed to level to the idea that the combat towards inflation is way from over.

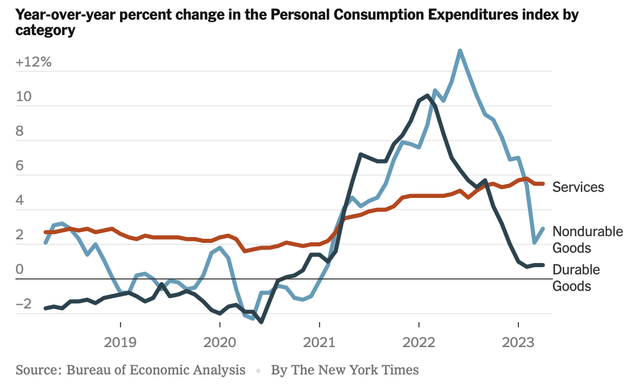

A current article in The New York Occasions featured this graphic.

Private Consumption Expenditures (PCE) Index By Class (The New York Occasions)

The road to note is the purple line, representing the portion of the PCE index referring to Companies. Whereas it’s completely the case that the Items portion of the PCE index has skilled declines of late, the Companies portion is proving considerably cussed. As Jerome Powell has identified on a number of events, this specific part of inflation may be the toughest to interrupt as a result of wages make up the most important price in delivering these companies. Associated to this, wage positive aspects in the newest jobs reviews proceed to be sturdy.

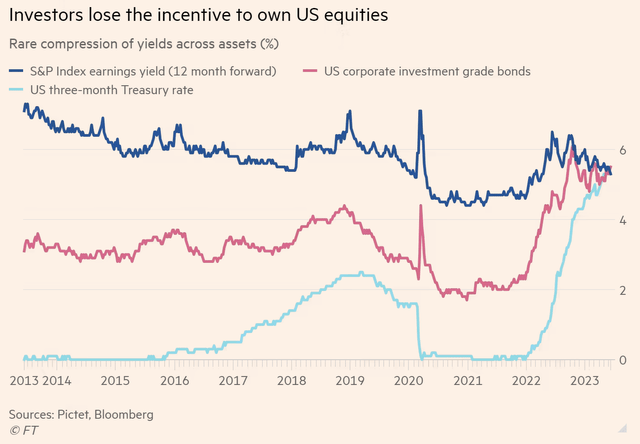

This is a second motive. The substantial rate of interest will increase carried out by the Fed over the previous yr have triggered an enormous enhance within the returns on risk-free money. Moreover, whereas these similar will increase have contributed to the poor value returns on bonds that contributed to the considerably mediocre efficiency of the ETFRRP of late, the inverse of that’s that the yield on such bonds has risen.

The place does that each one go away us? Take a look at this current graphic.

Yields On US Equities, Money, and Bonds (Monetary Occasions – Bloomberg)

Primarily, the yields on U.S. equities, money, and bonds have arrived at a degree the place they’re roughly equal nowadays. This will likely properly function a headwind with respect to future inventory returns.

Because of this, my view for the second half of 2023 continues to be that investors-and particularly conservative investors-would do properly to remain conservatively positioned and well-diversified.

What are some takeaways?

Maintain an affordable portion of your portfolio in money, with a purpose to make the most of alternatives which can current themselves. First rate returns are very possible available from bonds, with one of the best danger/reward profile coming on the brief finish of the period spectrum. Overseas equities started to awake from slumber through the first half of 2023 and I imagine this may increasingly properly proceed. Due to this fact, keep a pleasant stability between international and U.S. equities.

I am going to cease there for now. I hope this piece has proved to be of some use, providing a perspective to contemplate. I might love to listen to from you within the feedback under!

[ad_2]

Source link