[ad_1]

Harlz/iStock by way of Getty Pictures

The relative affordability of the median new dwelling offered within the U.S. was little modified in Could 2023.

That is not completely true. It worsened barely due to a mix of things.

Mortgage charges ticked up by lower than a tenth of a p.c to common 6.43% in the course of the month, which mixed with a rise within the median value of recent houses offered to make them slightly extra expensive for a family incomes the median revenue within the U.S.

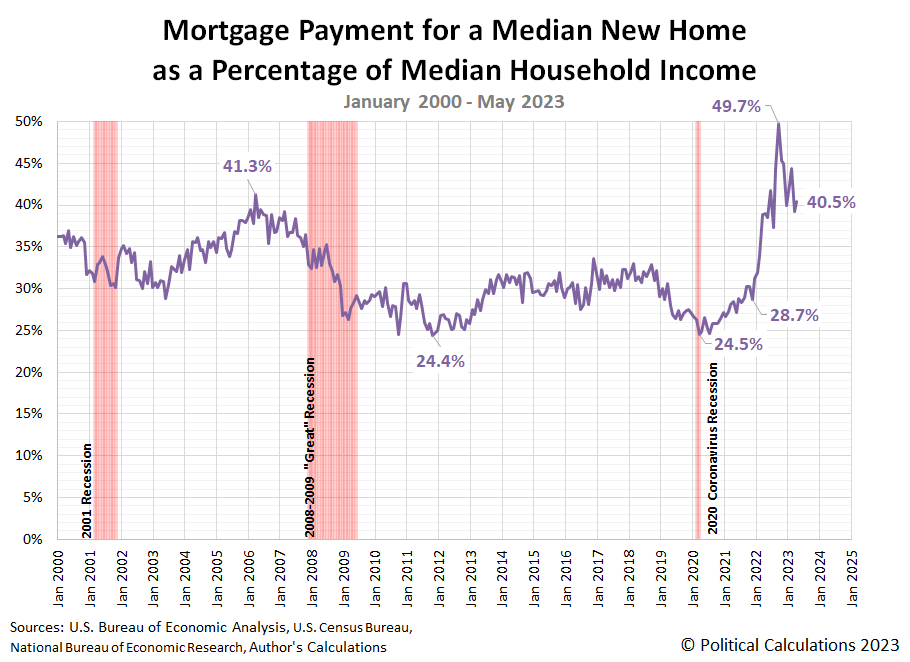

The online impact of those adjustments was to extend the quantity {that a} fully-financed mortgage cost for the median new dwelling offered within the U.S. prices. In Could 2023, the preliminary estimate of that determine rose to 40.5% of the median American family’s month-to-month revenue.

This estimate is effectively above the brink of 36% of family revenue that marks the normal restrict of affordability for proudly owning a house, assuming the owners don’t have any different debt. This determine can also be effectively above all-but-the-peak of relative unaffordability that prevailed in the course of the housing bubble years of the early 2000s.

The next chart reveals how Could 2023’s relative affordability matches among the many knowledge for the twenty first century to this point:

We’re not the one ones mentioning how comparatively unaffordable new houses have change into.

Individuals on the lookout for a brand new dwelling are going through the least inexpensive market ever, in line with knowledge from the Mortgage Bankers Affiliation.

The group’s Buy Functions Fee Index (PAPI) elevated 0.5% in April to a report excessive of 172.3. The next studying signifies declining borrower affordability situations, because of both growing mortgage quantities, rising mortgage charges, or a lower in earnings.

“This hit a brand new report as a result of not solely have curiosity not retreated from the excessive 6s, however the typical utility quantity has jumped, all sooner than incomes have grown,” Edward Seiler, MBA’s affiliate vice chairman for housing economics, informed Insider.

Nowadays, what passes for enchancment within the relative affordability of recent houses has all taken place as new houses have remained much more unaffordable than they have been when the housing bubble peaked!

References

U.S. Census Bureau. New Residential Gross sales Historic Knowledge. Homes Offered. [Excel Spreadsheet]. Accessed 26 June 2023.

U.S. Census Bureau. New Residential Gross sales Historic Knowledge. Median and Common Sale Worth of Homes Offered. [Excel Spreadsheet]. Accessed 26 June 2023.

Freddie Mac. 30-12 months Fastened Charge Mortgages Since 1971. [Online Database]. Accessed 26 June 2023. Be aware: Ranging from December 2022, the estimated month-to-month mortgage price is taken as the typical of weekly 30-year standard mortgage charges recorded in the course of the month.

Authentic Put up

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.

[ad_2]

Source link