[ad_1]

hirun

Introduction

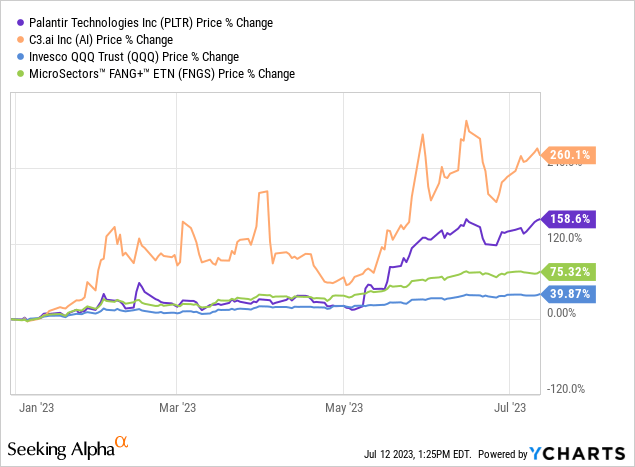

Synthetic intelligence has emerged because the red-hot funding theme of 2023, and large tech corporations (FNGS) have loved stellar runs within the first half of this 12 months amidst a wave of investor optimism within the expertise sector. On the broad market (SPX)(QQQ) [index level], the “magnificent seven” (massive tech shares) have had an outsized impression as a consequence of their humongous market capitalizations. And that is the place all of the media consideration has been centered for a number of months now. Nevertheless, a number of AI/AI-related development shares like Palantir (NYSE:PLTR) and C3.ai (NYSE:AI) are having fun with an unbelievable restoration in 2023 after an epic collapse final 12 months.

Whereas it’s exhausting to separate the wheat from the chaff within the early phases of any technological transformation, we will carry out a comparative evaluation on Palantir and C3.ai on this be aware to decipher the higher inventory to purchase proper now. Let’s dive proper in!

Palantir Vs. C3.ai: Which Inventory Is The Higher Purchase?

On this train, we are going to examine PLTR and AI shares utilizing elementary, quant issue grade, technical, and valuation evaluation. Earlier than we start our comparative evaluation, let’s briefly evaluation every enterprise.

As you could know, Palantir helps authorities organizations and personal sector enterprises construct and deploy customized software program functions/knowledge working methods that energy AI-assisted (data-driven) decision-making from conflict zones to manufacturing unit flooring. And Palantir does so by its varied AI-ready platforms – Gotham [government], Foundry [commercial], Apollo, and AIP (synthetic intelligence platform). To study extra about Palantir, confer with my previous protection on PLTR.

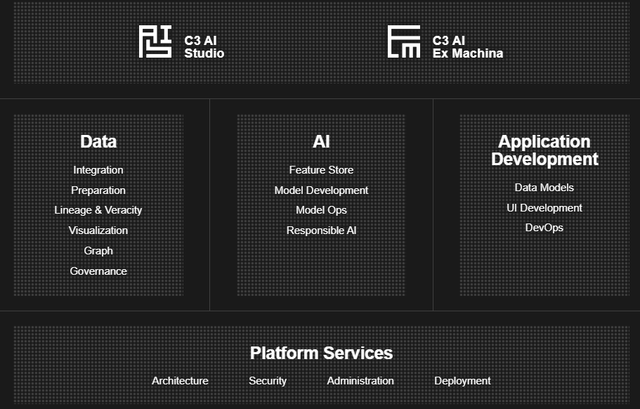

Then again, C3.ai helps organizations develop and deploy enterprise-scale AI functions by its Enterprise AI software growth platform, which incorporates growth instruments [C3 AI Studio and C3 AI Ex Machina] and a big [40+] and rising library of turnkey enterprise AI functions that tackle use-cases throughout a number of industries reminiscent of power, manufacturing, healthcare, and finance.

C3.ai Web site

If you want to study extra about C3.ai’s platform, be at liberty to confer with the corporate’s web site.

Each Palantir and C3.ai assist organizations develop and deploy AI software program options by leveraging AI/ML applied sciences to allow superior knowledge evaluation, sample recognition, and predictive capabilities, albeit in several domains. Whereas Palantir’s experience lies in knowledge integration, evaluation, and intelligence functions, C3.ai’s energy lies in enterprise AI software program, predictive analytics, and pre-built AI fashions for industry-specific options.

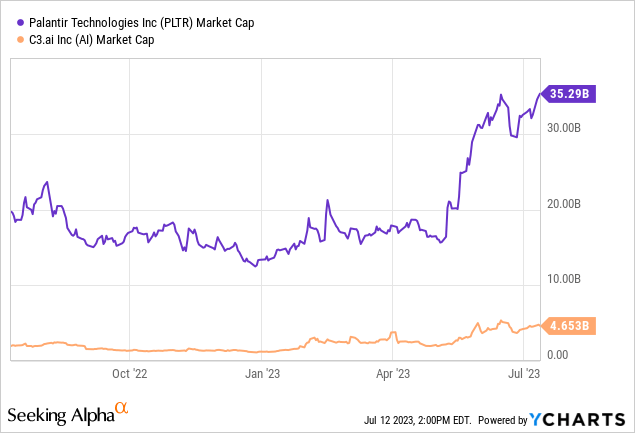

As a place to begin for this comparability, please be aware that Palantir is roughly ~7.6x the dimensions of C3.ai by market capitalization.

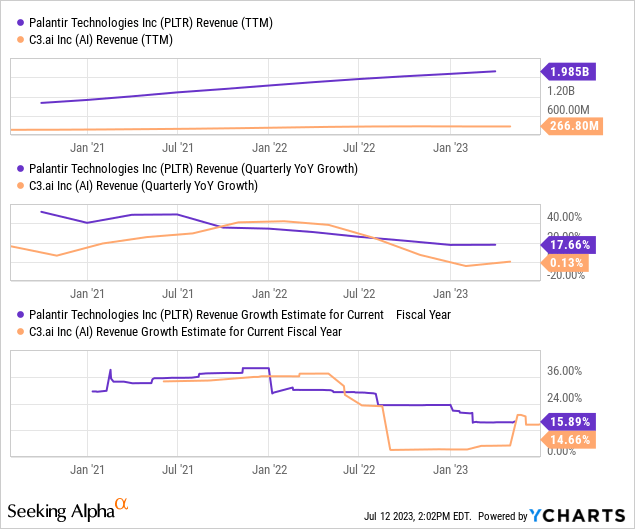

On the again of extreme macroeconomic challenges and a few idiosyncratic points, each Palantir and C3.ai have skilled vital development deceleration in current quarters. For Palantir, a slowdown in its authorities phase has damage whole income development. Then again, C3.ai’s development has flatlined primarily as a consequence of its shift to a usage-based pricing mannequin. As of writing, each corporations are projected to develop at ~15% within the present fiscal 12 months; nonetheless, Palantir is working at a a lot bigger scale.

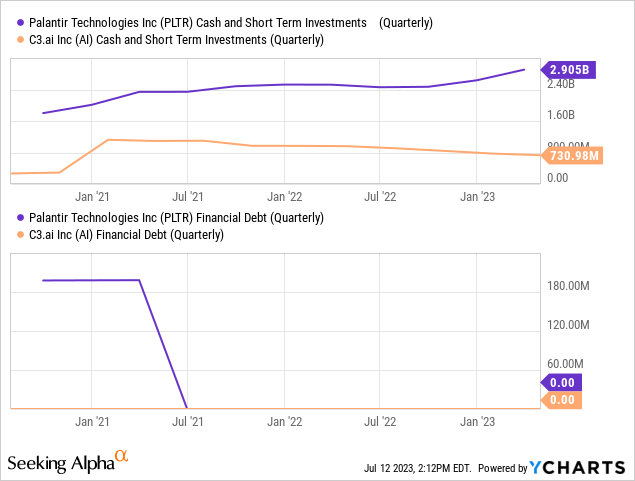

Each Palantir and C3.ai are well-capitalized companies with no debt. Nevertheless, margin developments for Palantir are far superior to C3.ai.

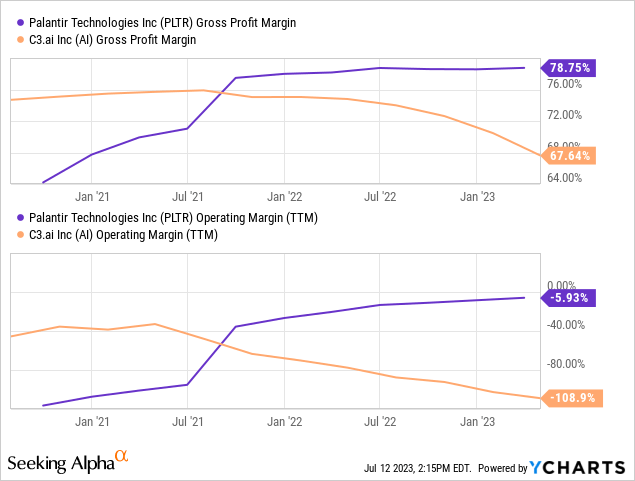

Over the past couple of years, Palantir has showcased large margin enlargement, with gross margin going from ~64% to ~79%. On the flip facet, C3.ai’s gross margin has deteriorated from ~76% to ~68%. As these companies scale, Palantir is delivering working leverage, however C3.ai will not be!

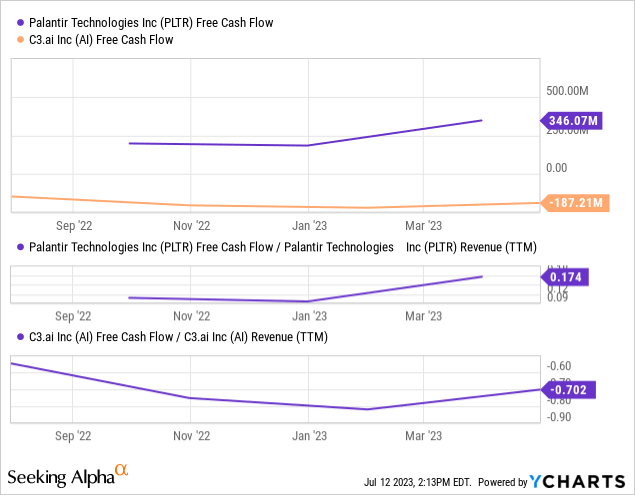

As you may observe on the chart beneath, C3.ai is a loss-making, cash-burning enterprise, whereas Palantir is massively free money movement generative. Moreover, Palantir is popping GAAP worthwhile (as evidenced by current quarterly reviews).

From a elementary perspective, Palantir is a enterprise on course, whereas C3.ai seems to be murky.

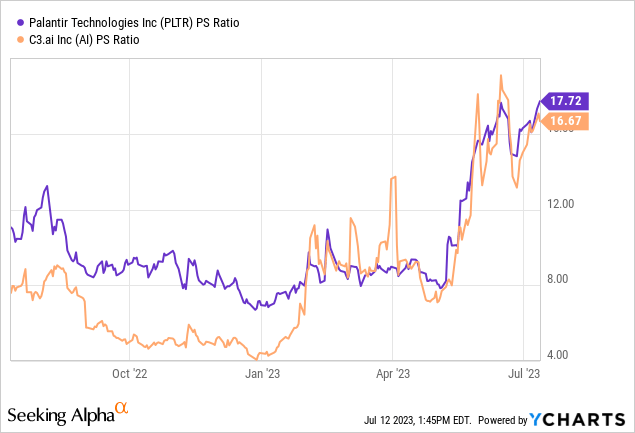

Regardless of the plain gulf of their respective monetary performances, Palantir and C3.ai are presently buying and selling at comparable P/S a number of of ~16-18x. As you could have observed, nearly all of year-to-date good points in AI and PLTR shares have been pushed by a buying and selling a number of enlargement.

Whereas such excessive buying and selling multiples are extremely questionable [and excessive] in relation to the expansion trajectories of those companies, that is a dialogue for another day. For now, let’s simply agree that, given stronger enterprise fundamentals and comparable buying and selling multiples, Palantir is a greater purchase over C3.ai primarily based on relative valuation.

Now, let’s take a look at absolutely the valuation of PLTR and AI.

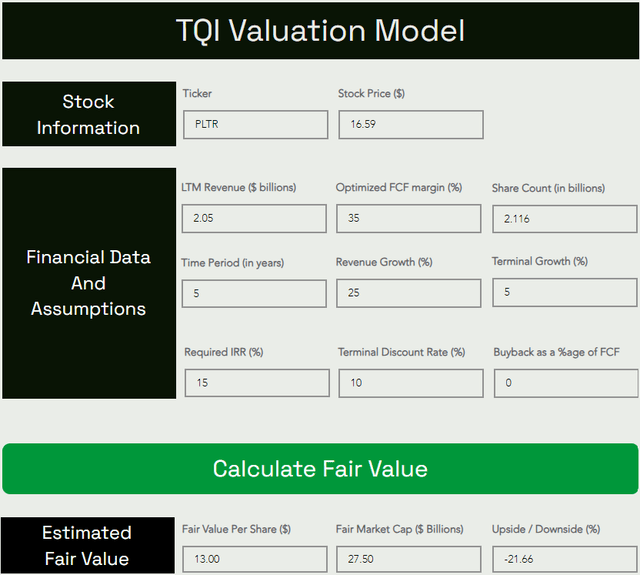

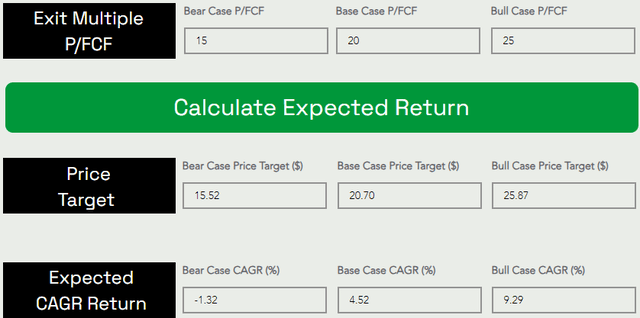

TQI’s Valuation for Palantir

TQI Valuation Mannequin (TQIG.org) TQI Valuation Mannequin (TQIG.org)

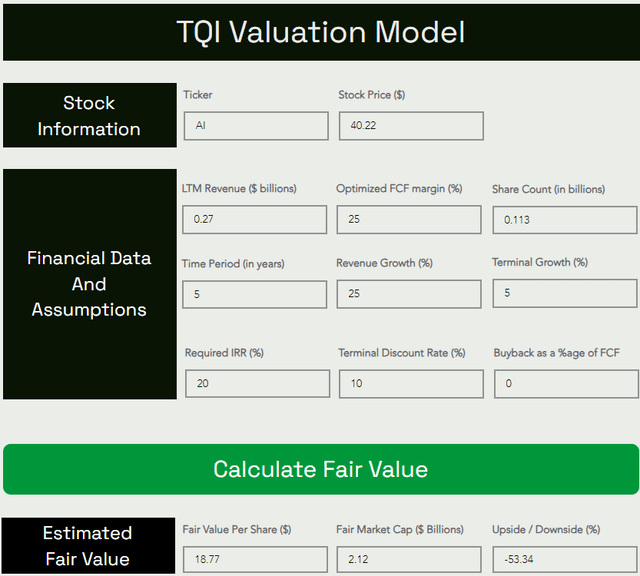

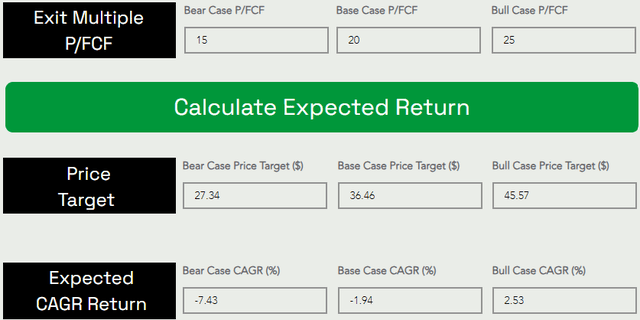

TQI’s Valuation for C3.ai

TQI Valuation Mannequin (TQIG.org) TQI Valuation Mannequin (TQIG.org)

Abstract of TQI’s valuation for Palantir and C3.ai:

Present inventory value TQI’s honest worth estimate TQI’s 5-yr value goal TQI’s anticipated CAGR return Palantir $16.59 $13.00 $20.70 +4.52% C3.ai $40.22 $18.77 $36.46 -1.94% Click on to enlarge

From a valuation standpoint, each Palantir and C3.ai are overvalued. Whereas PLTR inventory has a draw back of -21% to honest worth, AI inventory has a draw back of -53%. With 5-yr anticipated returns of each Palantir and C3.ai falling in need of my funding hurdle fee of 15%, I would not purchase any of those synthetic intelligence shares proper now. Nevertheless, if I needed to choose one, I’d go along with Palantir over C3.ai as a consequence of its decrease draw back danger and optimistic reward potential.

Quant Issue Grade And Technical Evaluation

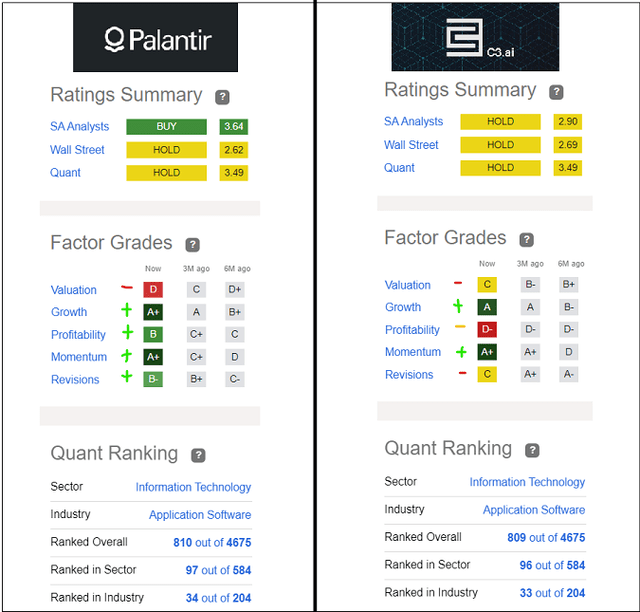

In keeping with In search of Alpha’s Quant Ranking system, each Palantir and C3.ai are rated “Maintain” with similar scores of three.49/5.

Creator, SA Quant Ranking (In search of Alpha)

Nevertheless, Palantir’s quant issue grades have improved considerably over the past six months, whereas C3.ai’s grades have been fairly combined. Clearly, Palantir is the winner right here too.

Curiously, each Palantir and C3.ai have an “A+” grade for (technical) “Momentum”; and similar-looking inventory charts:

C3.ai inventory chart (WeBull Desktop) Palantir inventory chart (WeBull Desktop)

After an epic collapse in 2021-22, AI and PLTR have jumped up considerably this 12 months. Nevertheless, each of those shares stay nicely beneath their all-time highs, and technical momentum mixed with AI hopium can drive these shares lots increased regardless of every of them getting shut or into “Overbought” (RSI>70) territory. Therefore, shorting right here could possibly be a harmful proposition.

Concluding Ideas

Barring its ticker image [AI], C3.ai has nothing working in its favor over Palantir, which seems to be superior primarily based on fundamentals, valuations, and quant issue grades as per our comparative evaluation train. Regardless of Palantir being the higher inventory right here in comparison with C3.ai, PLTR will not be a purchase both as a consequence of unfavorable danger/reward. If I had to purchase one, I’d go along with Palantir.

Whereas I do not know if we’re in an AI bubble or not, I would not brief both title (or every other particular person inventory, for that matter) as technical momentum and AI hopium can take these shares to unbelievable heights on this setting. That stated, each PLTR and AI are shares to be prevented at present ranges.

Key Takeaway: I fee each Palantir and C3.ai “Impartial/Keep away from” at present ranges.

Thanks for studying, and glad investing. Please share your ideas, considerations, and/or questions within the feedback part beneath.

[ad_2]

Source link