[ad_1]

pidjoe

Funding Thesis

Companhia Energética de Minas Gerais (NYSE:CIG), or just Cemig, has skilled a outstanding restoration since 2019, reaching an appropriate leverage stage, bringing operational bills and loss ranges inside regulatory limits, and demonstrating effectivity beneficial properties. Contemplating the unsure state of affairs for privatization and the corporate’s funding plans, my strategy is for buyers to carry onto Cemig shares in the interim and intently monitor its efficiency.

Furthermore, the corporate shifted investments in the direction of the distribution phase, leading to increased capital expenditures in comparison with the earlier cycle. These initiatives have led to optimistic outcomes and strengthened Cemig’s monetary place.

A possible privatization of Cemig is below dialogue, however the course of is extra complicated in comparison with different related circumstances, like Companhia Paranaense de Energia’s (ELP). Whereas a privatization could possibly be useful for Cemig’s funding program and technique, I wouldn’t depend on it as the only objective to purchase or maintain the corporate’s shares, for the reason that entire course of is proving to be fairly unpredictable.

Trying forward, Cemig is predicted to proceed focusing its investments on the distribution division, with a deliberate annual funding of roughly R$ 3.7 billion throughout the 2023-2027 cycle. Moreover, Cemig holds a portfolio of era initiatives with a possible capability of over 11.2 GW, which could possibly be realized within the coming years.

A quick description of Cemig

Companhia Energética de Minas Gerais is a Brazilian electrical energy firm based in 1952 and headquartered in Belo Horizonte, Minas Gerais. It is among the largest energy firms in Brazil and operates within the era, transmission, and distribution of electrical energy.

Technology: Cemig’s era portfolio (Cemig GT) contains a mixture of hydroelectric, thermal, and wind energy crops. They’ve a considerable variety of hydroelectric crops, which profit from Brazil’s plentiful water sources. Cemig additionally has thermal energy crops that use varied fuels reminiscent of pure fuel, coal, and oil. Moreover, they’ve been investing in renewable vitality sources, together with wind and solar energy (Cemig SIM).

Transmission: Cemig owns and operates an intensive community of transmission traces (Cemig GT), that are accountable for transporting electrical energy from energy crops to distribution networks. These transmission traces play a vital position in guaranteeing a dependable and steady provide of electrical energy throughout completely different areas.

Distribution: Cemig’s distribution phase (Cemig D) includes the supply of electrical energy to finish customers. The corporate operates an enormous distribution community that covers a good portion of Minas Gerais and serves tens of millions of consumers, together with residential, business, and industrial customers.

Worldwide Operations: Cemig has expanded its operations past Brazil and has investments in different international locations. They’ve participated in energy initiatives in international locations reminiscent of Chile, Colombia, and Brazil’s neighboring international locations.

Sustainability Initiatives: Cemig is dedicated to sustainability and has applied varied initiatives to cut back its environmental impression. They intention to extend the share of renewable vitality of their era portfolio, promote vitality effectivity, and have interaction in accountable practices of their operations.

Cemig is a publicly traded firm listed on the São Paulo Inventory Alternate (Ibovespa: CMIG3) and the New York Inventory Alternate (CIG). As I write this text, Cemig has a market cap of $6.90 billion, an annual income (TTM) of $6.9 billion, $796 million in web earnings (TTM), and a 5-year common dividend yield of two.80%.

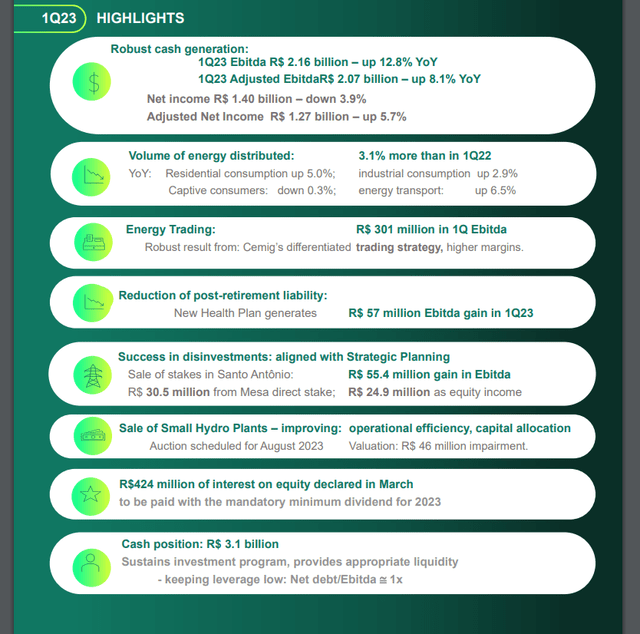

A fast snapshot of the most recent outcomes

Cemig achieved good monetary ends in the primary quarter, with a recurring EBITDA of R$ 2.1 billion, an 8% improve in comparison with the earlier 12 months. In line with the earnings name, the corporate expressed optimism in regards to the outcomes for the remainder of 2023. Resulting from Cemig’s huge enterprise diversification, particularly within the areas of distribution, era, and buying and selling, it has managed to generate robust money flows and optimistic outcomes, with over R$ 1.3 billion in revenue, a 5.7% improve in comparison with the earlier 12 months.

The corporate talked about the divestment of minority shareholders, particularly the sale of belongings reminiscent of Santo Antonio, Retiro Baixo, and Baguari. These divestments are anticipated to be concluded within the second or third quarters of 2023, pending obligatory approvals. Alternatively, Cemig had a major funding program, with a plan to speculate R$ 5.4 billion in 2023. The corporate highlighted the significance of those investments, significantly in Cemig SIM and era, that are anticipated to be accomplished within the second half of the 12 months and generate worth for shareholders.

Cemig’s 1Q 2023 highlights (Investor Relations)

Regarding ESG dedication, Cemig emphasised its dedication to sustainability, working with a 100% renewable matrix. The corporate is concerned in related sustainability indexes and has a social tariff program benefiting 1.3 million households. The corporate talked about the optimistic results of lowering post-retirement liabilities, transferring third-party contracts, and specializing in legal responsibility administration and debt renegotiation. It additionally highlighted the expansion in Cemig D’s vitality market and efforts to cut back losses and delinquency charges. The corporate reported working effectivity inside regulatory limits and powerful money era.

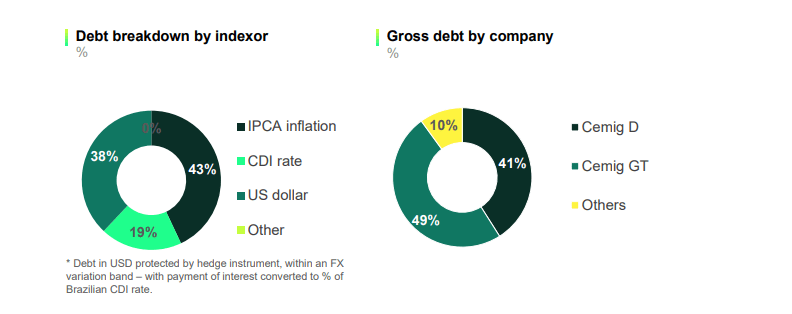

In terms of leverage ranges, Cemig mentioned its debt profile and talked about efforts to handle liabilities, significantly associated to Eurobond. The corporate’s leverage remained under 1x, supporting its funding program. Along with that, there was a discount in EBITDA and web revenue for Cemig GT, primarily because of the migration of buying and selling exercise to Cemig H. Nonetheless, when contemplating the displacement of EBITDA, the corporate highlighted an EBITDA of R$ 1.032 billion for Cemig GT within the first quarter. Total, the earnings name highlighted optimistic monetary outcomes, divestments, investments, sustainability efforts, and operational achievements for Cemig.

Cemigs’s debt breakdown (Investor Relations)

Cemig’s current and related developments till now

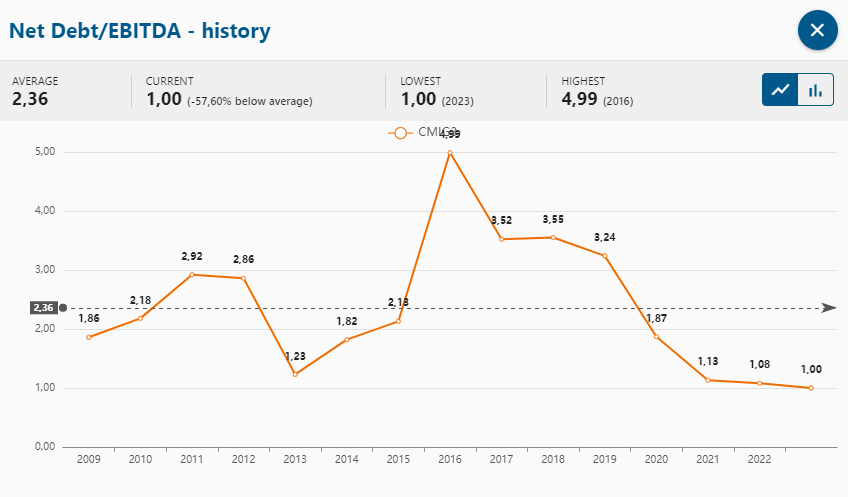

To be trustworthy, I’m fairly shocked by the pace of Cemig’s restoration throughout the cycle that started in 2019. Since then, the corporate has achieved an appropriate leverage stage (Internet Debt/EBITDA ratio dropped from 5x to 1x), in addition to introduced operational bills and loss ranges inside their respective regulatory limits, consolidating beneficial properties with effectivity.

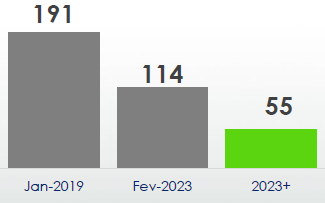

StatusInvest

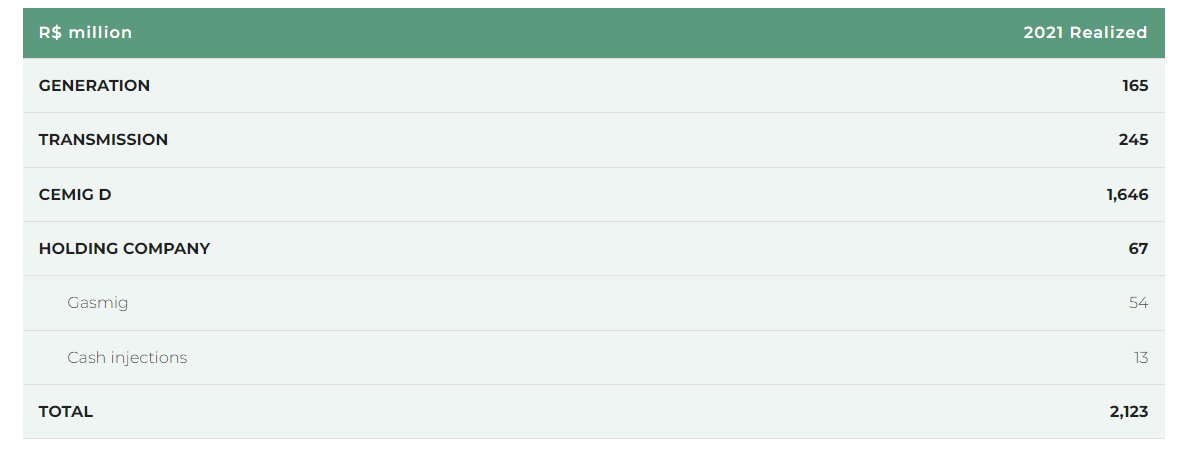

Among the many initiatives that facilitated this transformation, I can spotlight a higher give attention to operations in Minas Gerais, lowering investments in minority holdings that the corporate doesn’t have correct management over the belongings (a complete of R$ 34 billion was invested on this method between 2009 and 2018). Moreover, investments began to give attention to distribution (averaging R$ 2.8 billion per 12 months between 2019 and 2022, 7 occasions increased than the 2009-2018 cycle). The graph under illustrates the composition of the corporate’s Capex in 2021.

Cemig’s Capex construction for 2021 (Investor Relations)

With the identical focus, the corporate had a money influx of R$ 2.1 billion from gross sales of minority stakes and from outdoors Minas Gerais since 2019 (primarily from Mild, Renova, Santo Antônio Energia, Ativas, and Axxiom). This averted the necessity for investing R$ 1.9 billion in these companies, along with an accumulation of R$ 1.1 billion in tax credit.

Cemig’s stake in firms after divestments (variety of firms) (Investor Relations)

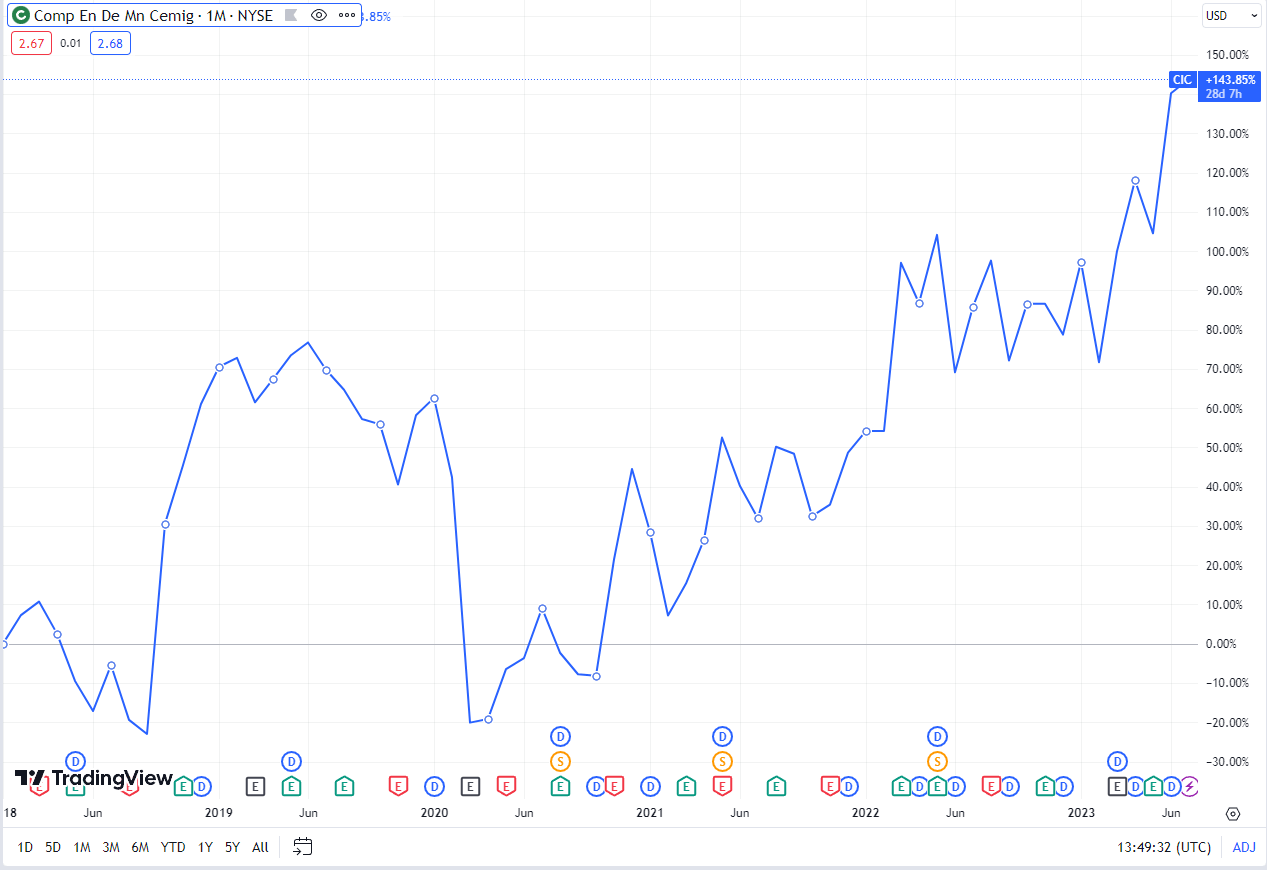

The consequence achieved by the shareholder was a complete return (contemplating appreciation and dividends) of 253% in BRL and 143% in USD between 2018 and 2022. It’s value noting that, in the long term, returns are typically consistent with optimistic transformations in firms, particularly once they grow to be so evident by the evolution of outcomes and danger mitigation.

Cemig’s complete return since 2018 (TradingView)

Potential privatization is below dialogue

In Minas Gerais, the privatization of state-controlled belongings must undergo a referendum. With a view to change this requirement, which might tremendously complicate the method, the federal government wants the approval of a related two-thirds majority of state deputies (48 out of 77).

The state of affairs, regardless of the federal government’s good intentions and administration in the mean time, is far more complicated than that of Copel’s in Paraná, the place there isn’t a requirement for a referendum. In Copel’s state of affairs, a broad authorities base ensured the snug approval of the invoice that was voted on, which strengthened the case for possible privatization to make sure the total renewal of essential energy crops. This example is sort of just like Cemig’s, who can be experiencing expiring contracts. The issue is that Cemig is going through extra obstacles within the course of, so it won’t be capable to heap the advantages in time.

Having mentioned that, a privatization could be very optimistic for the consolidation of Cemig’s present funding program and technique (will discuss it within the subsequent part). Nonetheless, the corporate remains to be surrounded by a excessive diploma of unpredictability that I don’t advise buyers playing on, so it’s finest if we keep on with points that we will analyze with extra precision.

What we will anticipate from the corporate within the close to future

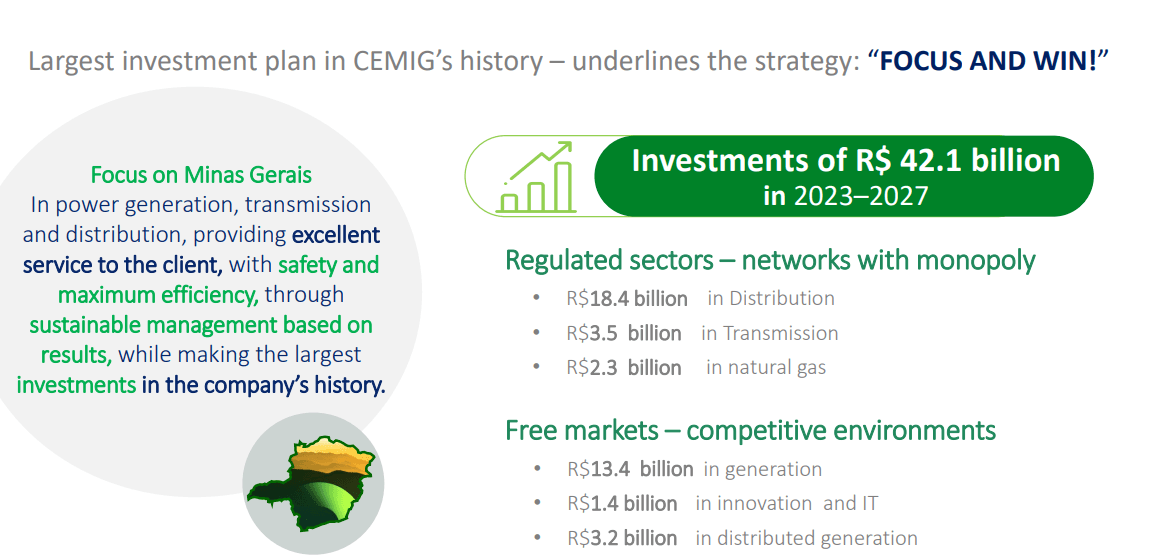

I’ve a powerful perception that the corporate will proceed to focus its investments on the distribution division, because it has a deliberate annual funding of roughly R$ 3.7 billion on this phase alone throughout the 2023-2027 cycle. Investments within the vary of R$ 1.2 billion have already been contracted for era and transmission departments, the place the corporate needs to speculate a median of R$ 3.3 billion and R$ 700 million per 12 months inside the cycle, respectively. This contains R$ 900 million for the development of 170 MWp of solar energy and R$ 308 million for transmission reinforcement and enchancment works, which can incrementally improve the Receita Anual Permitida (RAP, or Annual Allowed Income).

In line with the Cemig’s capital expenditure part on its official web site, the entire portfolio of investments quantities to R$ 42.1 billion for the interval of 2023-2027. In my view, that is fairly doable and reasonable, contemplating that the corporate generates a comparatively excessive EBITDA, which might be sufficient to fund these expansions whereas sustaining a wholesome leverage stage. To offer you a reference, let’s run a fast calculation:

The corporate’s EBITDA for the 12 months 2022 was R$ 6.9 billion, so if we estimate a conservative improve of 15% per 12 months, the outcomes would sum as much as a determine of round R$ 44.4 billion by 2027, which is increased than the funding plan. It is essential to notice that this complete doesn’t account for the present money stability. All in all, the funding plan appears to be like sound and I consider it should generate nice returns to the shareholders.

2023 2024 2025 2026 2027 EBITDA (R$) 7.93B 9.12B 10.49B 12.06B 13.87B Click on to enlarge

Cemig’s funding plan (Investor Relations)

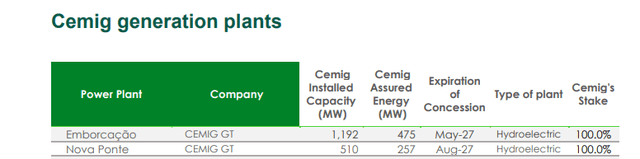

The corporate remains to be anticipated to compete for roughly R$ 50 billion in transmission investments to be auctioned between 2023 and 2024. Moreover, it holds a portfolio of over 11.2 GW in era initiatives that could be achieved within the coming years. I don’t have to say that this pipeline is sort of essential, as Cemig has round 31% of its put in capability (1.7 GW) expiring attributable to concession contracts that finish in 2027 (Emborcação and Nova Ponte energy crops).

If privatized, Cemig could have the benefit of totally renewing the contracts upon cost of a bonus. In any other case, it’s going to solely be capable to renew the concessions upon accepting to promote belongings, handing over roughly half of the capability and likewise paying proportional charges.

Low value multiples and a glance on previous returns

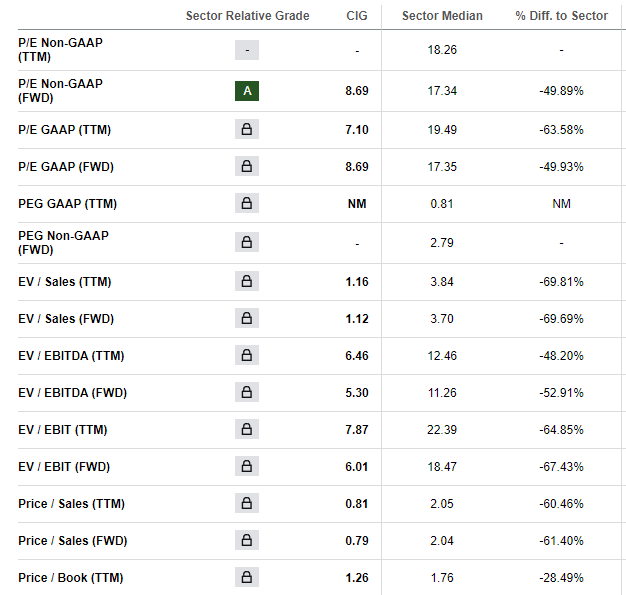

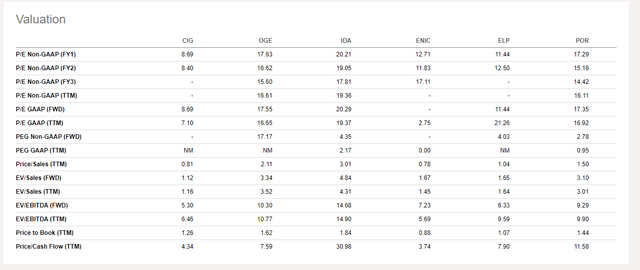

Along with the corporate’s and my forecasts within the earlier part, it is also essential to level out that Cemig is at the moment “cheaper” than its friends when utilizing value multiples comparability. As we will see from the desk under (first picture), there’s not one single value metric that’s above the sector median, exhibiting that Cemig may be certainly the underpriced alternative for now. One other attention-grabbing reality is that this value distinction is certainly not a light one, with most of them being -60% decrease than the sector’s common, indicating a stable margin of security for the corporate.

Cemig’s value multiples in opposition to friends within the sector (Looking for Alpha)

The sector median we’re speaking about right here is the Utilities sector, so this comparability is together with firms like OGE Power Corp. (OGE), IDACORP, Inc. (IDA), Enel Chile S.A. (ENIC), Companhia Paranaense de Energia (ELP), Portland Basic Electrical Firm (POR) and others. Under is a desk evaluating Cemig’s key value multiples in opposition to the friends I’ve simply talked about.

Cemig’s value multiples in opposition to friends within the sector (Looking for Alpha)

Concerning the corporate’s returns for the previous 5 years, we will see that they had been fairly beneficiant to shareholders, amounting to a complete of +95.11%. Working a fast CAGR calculation, this determine implies a annual return charge of +14.30%, not a bagger but in addition removed from a modest one. I consider the following years may also reward holders which have the endurance to stay to the share as the corporate implements its funding plan. In terms of vitality firms, particularly in Brazil, now we have to know that issues go slower than with firms in different sectors, that is why you hardly ever discover a bagger or explosive returns briefly timeframes. “Sluggish however regular” is the motto right here.

Cemig’s complete returns over the previous 5 years (Looking for Alpha)

Potential dangers

Though I consider Cemig is a good maintain case for now, buyers needs to be conscious that there are potential dangers concerned as you keep on with the shares. In my opinion, two are of utmost relevancy and needs to be made conscious of so buyers know what they’re coping with.

The primary one is said to Cemig’s partial put in capability of 31% (1,702 MW) which is counting on concession contracts expiring in 2027. So, we won’t deny that this determine is sort of essential to the corporate’s income era, and to know that it is counting on concession renewals is certainly a facet to concentrate to. In terms of concessions, nothing is definite, and we’ll have to only sit, wait, and hope for excellent news regarding this subject.

Emborcação and Nova Ponte energy crops (Investor Relations)

The opposite main danger I would prefer to level out is inherent to Cemig’s profile. As a state-owned firm, we all know that generally the federal government’s pursuits usually are not all the time aligned with the shareholders’, and a few may think about the present populist 4-year mandate of President Lula a pink flag. As a local Brazilian myself, I do know that Brazil doesn’t have an excellent historical past relating to enterprise interference. So, proudly owning a state-owned firm like Cemig is figuring out that you’re uncovered to the State of Minas Gerais utilizing the corporate’s sources for no matter it deems match, which could not essentially be useful to the shareholder.

This government-related danger can be immediately linked to the sector’s danger. The utility sector in Brazil, particularly the vitality one, is closely regulated and overseen by the federal government, posing nice enterprise limitations to the businesses that function on this business. Along with that, vitality tariff variations are all the time unpredictable, and for the reason that firm’s revenues depend on that, we will anticipate no less than delicate volatility on this enterprise phase.

In abstract, buyers ought to take the dangers talked about above with warning and perceive that they could have an effect on the forecast offered on this thesis, besides, I’m on the optimistic aspect and I consider Cemig now has extra ups than downs, thus a maintain case for it however not optimistic sufficient for a purchase.

Conclusion

Undoubtedly, the current historical past is shocking not solely because of the capabilities of Cemig’s present administration, but in addition as a result of we will see the soundness of the electrical firms’ enterprise fashions. On a number of events, main firms within the sector have gone by intervals of worth destruction that, if had occurred in different industries, would definitely lead to everlasting capital loss. However, they managed to bear agile restructuring when the pursuits of managers and shareholders had been aligned.

Cemig’s planning for the 2023-2027 cycle could be very sound, contemplating the challenges that it faces. The corporate can develop with higher predictability by investing in its distribution community to reap the advantages of tariff revisions sooner or later, as a substitute of specializing in transmission auctions which will proceed to supply unattractive returns attributable to excessive ranges of competitors.

It is essential to level out that Cemig faces vital dangers associated to its concession contracts expiring in 2027, which make up a considerable portion of its present put in capability. The uncertainty surrounding the renewal of those concessions is a key side to watch. Moreover, being a state-owned firm exposes shareholders to the potential interference and conflicting pursuits of the federal government, significantly in mild of the present political local weather. The closely regulated nature of the Brazilian utility sector and the unpredictability of vitality tariffs additionally contribute to potential income volatility.

Contemplating all components, particularly the unsure state of affairs for privatization, I consider that the best choice in the mean time is to carry onto the inventory for some time longer and watch it intently.

[ad_2]

Source link