[ad_1]

Delta Air Strains reported document revenues and earnings within the second quarter

Demand and gasoline prices have been key elements within the firm’s robust efficiency

The inventory has soared up to now this 12 months, however will the rally proceed?

Yesterday, after the market closed, Delta Air Strains, Inc. (NYSE:) delivered a sturdy indication of restoration within the air transportation business with its second quarter . The Atlanta, Georgia-based firm achieved outstanding progress, setting new data for revenues and earnings.

Through the second quarter, Delta Air reported a powerful income of $15.6 billion, marking a considerable 12.7% year-on-year improve. Moreover, the corporate witnessed an increase in gross revenue margin, recording a gross revenue of $4.2 billion for the quarter. Delta Air’s pre-tax revenue amounted to $2.4 billion, with earnings per share reaching $2.68.

These distinctive figures underscore Delta Air Strains’ excellent efficiency in the course of the second quarter and supply encouraging indications of ongoing restoration inside the air transportation sector.

Supply: InvestingPro

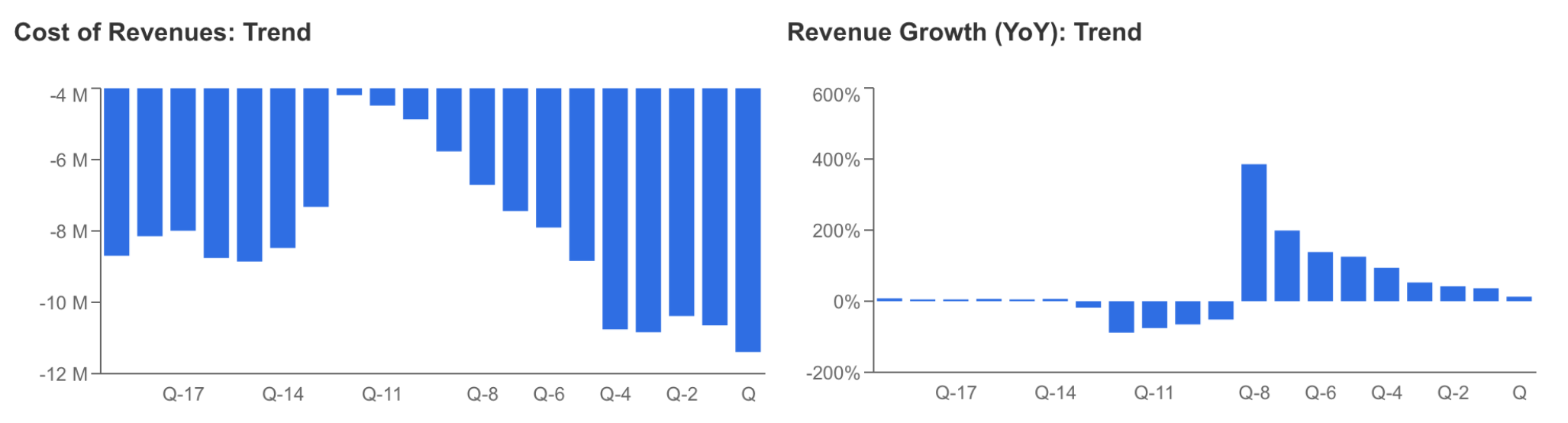

Regardless of a continued downward development in income progress, Delta Air Strains introduced document quarterly revenues. Nonetheless, the corporate successfully managed the growing business demand regardless of the rising income prices. Consequently, the airline efficiently offset the earlier quarter’s loss and achieved a web revenue of $1.8 billion.

Supply: InvestingPro

Strong Demand Boosts Earnings

Delta achieved document profitability because of the efficient administration of worldwide flights and the robust home demand within the US. The reopening of Japanese flights and the rise in transatlantic flights contributed to the recognition of transpacific and transatlantic routes amongst US residents, respectively. Consequently, worldwide revenues, which hit a low level in 2022, elevated by over 60% in comparison with the earlier 12 months. The corporate additionally highlighted the significance of the rising demand for Latin American flights, which positively impacted profitability by 20%.

Regardless of some financial challenges and the resilience of within the US, journey demand remained sturdy. Through the 4th of July vacation, the US set a document for the best variety of passenger journeys per day, with over 12 million passengers passing via US airports.

The continued buoyancy in journey demand offset the downward development in ticket costs, whereas decrease gasoline prices contributed to strong monetary outcomes. Delta Air Strains stays optimistic concerning the development persevering with all year long.

Moreover, Delta benefited from lower-than-expected gasoline prices within the first half of the 12 months, resulting in a 22% lower in fuel-related tax prices in comparison with the identical interval final 12 months. Nonetheless, personnel prices elevated by 25% in the identical interval, offsetting a few of the gasoline value financial savings. Nonetheless, the power to fulfill elevated staffing wants whereas having fun with decreased gasoline and tax prices is seen as a constructive growth for future intervals.

The corporate additionally noticed a rise in free money circulation, reaching $2.9 billion within the first half of the 12 months, enabling accelerated debt funds. Delta goals to repay over $4 billion in debt this 12 months as free money circulation continues to rise in 2023.

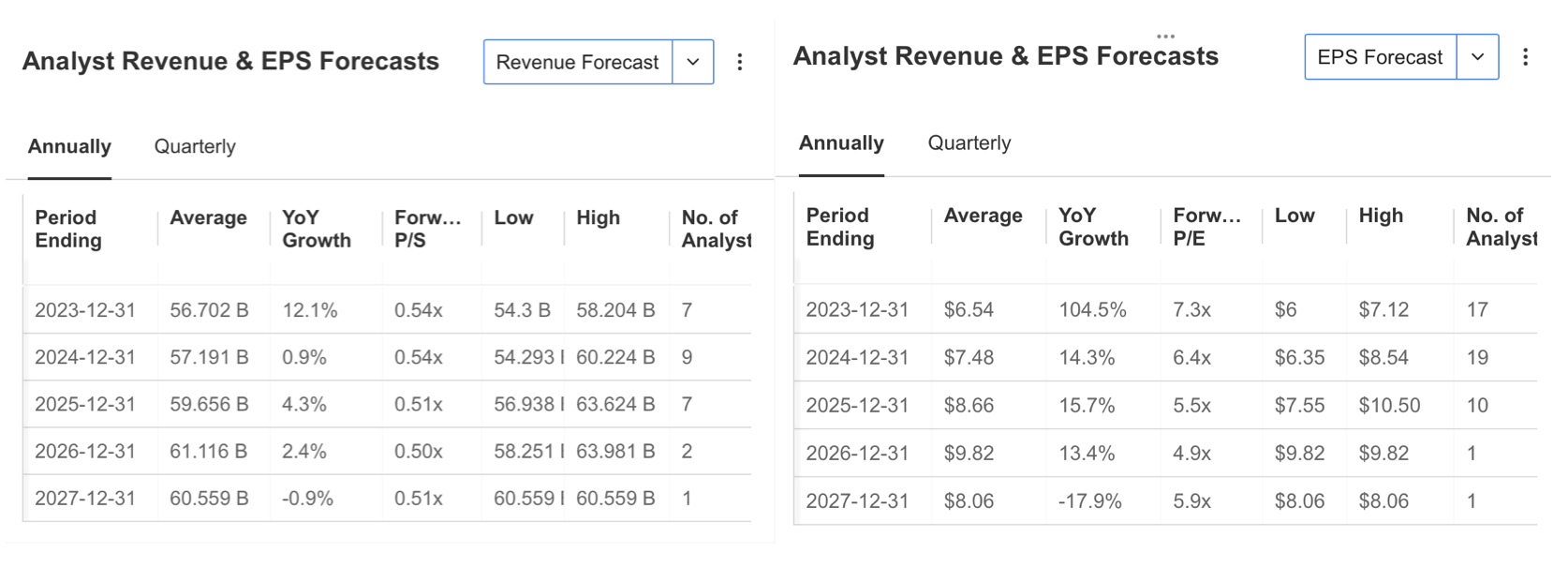

Primarily based on the constructive monetary outcomes, Delta raised its annual earnings per share steering to a variety of $6 to $7, in comparison with the earlier vary of $5 to $6. Analysts’ year-end earnings per share forecast align with the corporate’s expectation, standing at $6.54, a 12% improve above InvestingPro expectations. The income forecast for the year-end is estimated at $56.7 billion, reflecting a 12% improve.

Supply: InvestingPro

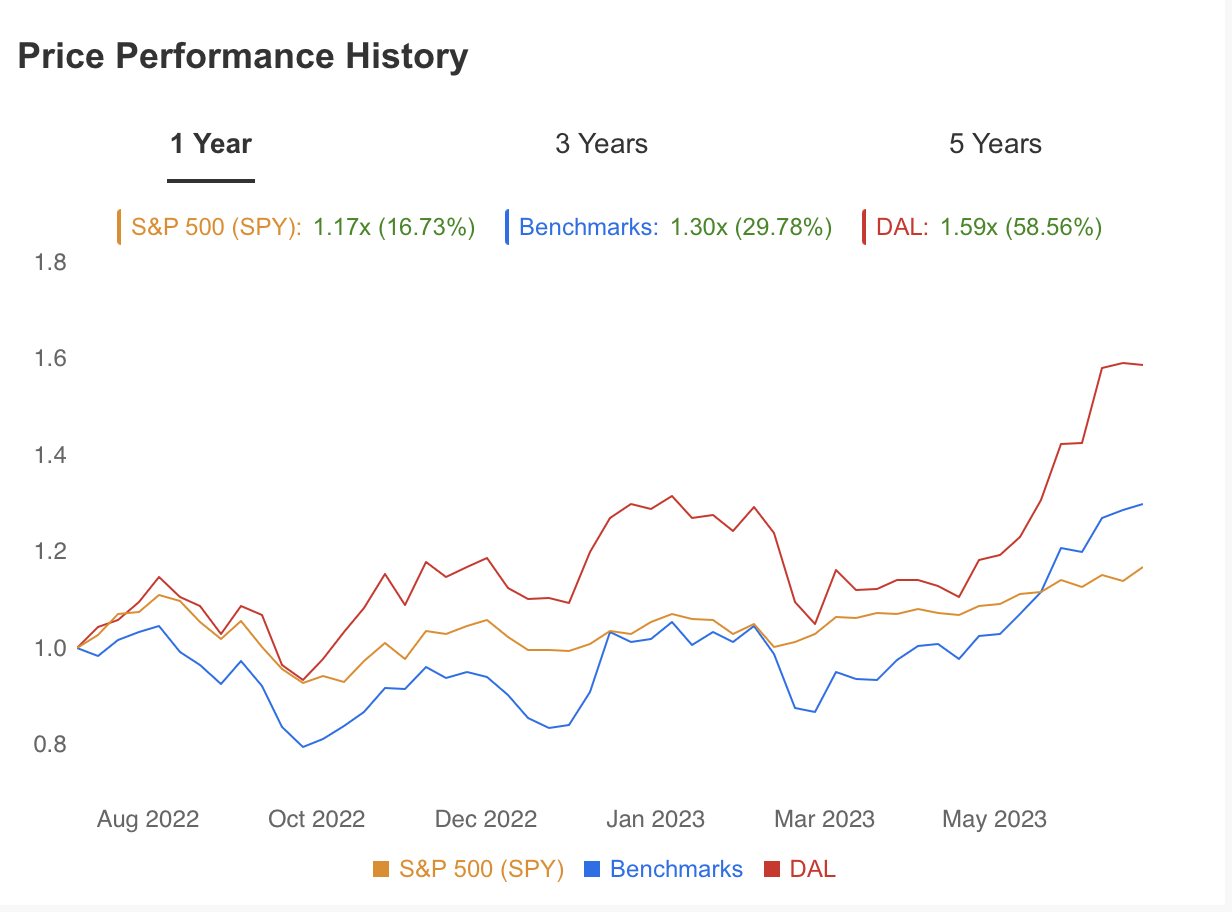

Delta’s inventory has exhibited a robust efficiency in comparison with different shares within the sector and the , exhibiting a constant upward development because the begin of the 12 months. Because the starting of the 12 months, it has gained nearly 50%, outperforming the broader market. This highlights Delta Air’s sturdy efficiency and signifies constructive investor sentiment towards the corporate.

Supply: InvestingPro

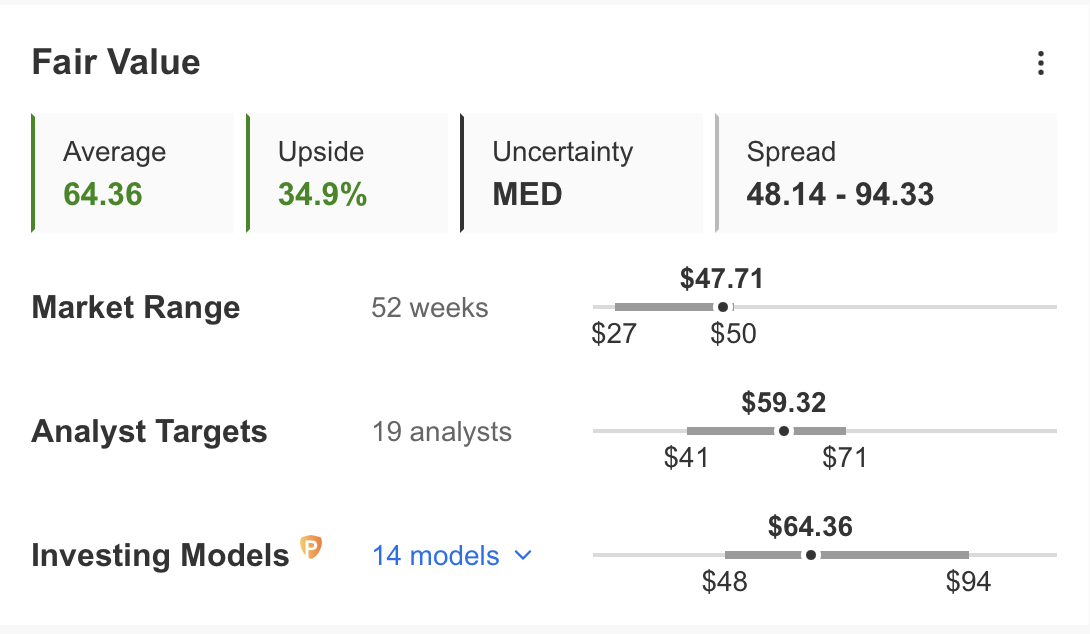

In response to InvestingPro’s truthful worth estimate, the uptrend will proceed. The truthful worth, calculated based mostly on 14 monetary fashions on the InvestingPro platform, is presently at $64.36. This information suggests the inventory is presently buying and selling at a reduction of roughly 35% in comparison with its present value of $47.

Moreover, bearing in mind the typical of 19 analyst estimates, the truthful worth is estimated to be round $60. These figures point out that there’s potential for additional progress and that the inventory could also be undervalued.

Supply: InvestingPro

Primarily based on the monetary model-based forecast and analyst projections, Delta Air Strains is anticipated to maintain its robust monetary outlook within the second half of 2023. These forecasts counsel there may be nonetheless some potential for DAL to proceed its upward trajectory.

Supply: InvestingPro

Conclusion

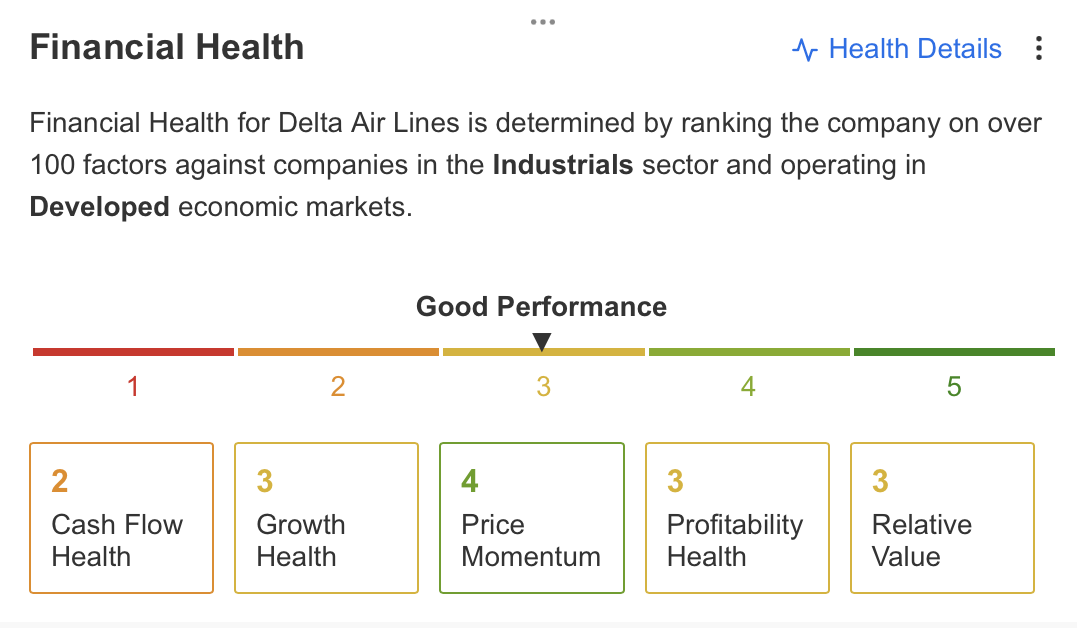

Delta Air’s general monetary state of affairs seems favorable. The corporate has exhibited robust value momentum in its inventory, indicating constructive market sentiment. Whereas the money state of affairs is regularly recovering, it has not reached the specified stage but. Delta Air’s profitability, progress, and relative worth indicators stay secure.

***

Entry first-hand market information, elements affecting shares, and complete evaluation. Make the most of this chance by subscribing and unlocking the potential of InvestingPro to boost your funding choices.

And now, you should purchase the subscription at a fraction of the common value. Our unique summer time low cost sale has been prolonged!

InvestingPro is again on sale!

Get pleasure from unimaginable reductions on our subscription plans:

Month-to-month: Save 20% and get the flexibleness of a month-to-month subscription.

Annual: Save an incredible 50% and safe your monetary future with a full 12 months of InvestingPro at an unbeatable value.

Bi-Annual (Net Particular): Save an incredible 52% and maximize your earnings with our unique net supply.

Do not miss this limited-time alternative to entry cutting-edge instruments, real-time market evaluation, and professional opinions.

Be part of InvestingPro at present and unleash your funding potential. Hurry, the Summer time Sale will not final eternally!

Disclaimer: This text is written for informational functions solely; it isn’t meant to encourage the acquisition of belongings in any approach, nor does it represent a solicitation, supply, suggestion, recommendation, counseling or suggestion to speculate. We remind you that every one belongings are thought-about from completely different views and are extraordinarily dangerous, so the funding resolution and the related danger is the investor’s.

[ad_2]

Source link