[ad_1]

marketlan/iStock by way of Getty Photos

Introduction

I first wrote about pharmaceutical, medical units (and shortly not) shopper well being firm Johnson & Johnson (NYSE:JNJ) in January 2023, after I in contrast it to Swiss diagnostics and prescription drugs big Roche Holding AG (OTCQX:RHHBY, OTCQX:RHHBF). I personal each shares in my portfolio, however think about JNJ the higher dividend inventory regardless of its decrease yield.

In mild of the nonetheless unresolved talc-related litigation, I took a more in-depth take a look at the matter in early March. In that article, I clarified what was then a standard false impression, specifically that Kenvue Inc. (NYSE:KVUE) – the not too long ago IPO’d Client Well being enterprise – is just not JNJ’s “dangerous financial institution.” In my final earnings preview, printed in mid-April, I shared my ideas on current occasions associated to the talc litigation (JNJ roughly quadrupled its supply to settle the claims) and supplied an replace on JNJ’s stability sheet and the litigation influence.

JNJ’s second quarter earnings report can be launched on Thursday, July 20, earlier than the market opens. Administration will host an earnings name at 8:30 a.m. japanese time. On this article, I share my ideas on the upcoming earnings launch, specializing in the continued talc litigation and the anticipated spinoff/split-off of the remaining 89.6% stake JNJ nonetheless holds in Kenvue. I present an up to date valuation and share whether or not I at present think about JNJ inventory a purchase, maintain or promote and whether or not I nonetheless intend to carry on to my potential Kenvue place.

What To Anticipate From Johnson & Johnson’s Upcoming Earnings?

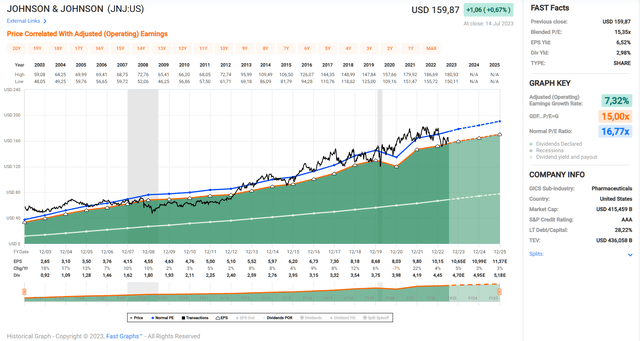

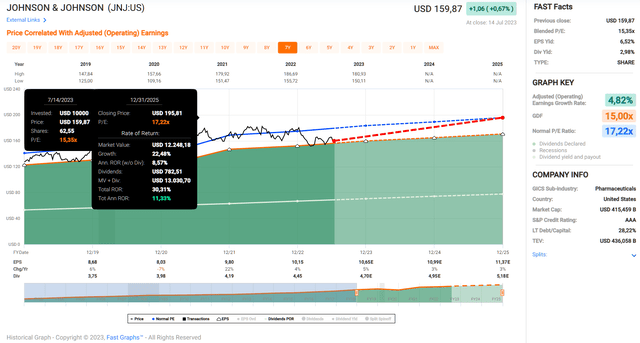

Most, if not all, JNJ traders respect the healthcare big’s nearly clockwork efficiency. On an adjusted working earnings per share foundation, JNJ has maintained a wholesome long-term progress price averaging 7.3% per 12 months over the previous 20 years, together with analysts’ two-year ahead estimates. The corporate’s robust and dependable earnings file can be mirrored in Johnson & Johnson’s share value efficiency:

Determine 1: Johnson & Johnson (JNJ): FAST Graphs chart for the 2002 to 2025 interval, primarily based on adjusted working earnings per share (FAST Graphs software)

Whereas it might be argued that it’s pretty “straightforward” to keep up a stable observe file of earnings per share (EPS) on an adjusted foundation, it’s value noting that JNJ’s progress price on a GAAP foundation is pretty comparable (6.7%). Likewise, free money circulation, whereas briefly impacted final 12 months by enter price pressures (91 foundation level decline in gross margin) and dealing capital results, continues to develop at a really wholesome common long-term progress price of seven%.

With an business big like JNJ, I’d argue that quarterly efficiency would not matter as a lot, however after all Wall Road’s deal with short-term outcomes can have a major, albeit transient, influence on the share value. On this context, I are usually cautious about including to a place simply earlier than quarterly outcomes are introduced, particularly if an organization has a historical past of lacking analysts’ estimates.

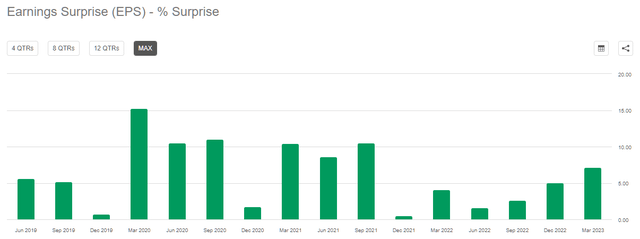

Asking what analysts predict and whether or not JNJ has beat earnings expectations in earlier quarters, the reply is already fairly apparent. Identical to the corporate’s long-term efficiency, its quarterly efficiency is like clockwork (Determine 2). Whereas it’s unlikely that administration will break with this “custom” on Thursday, one might argue that Wall Road has change into accustomed to this development and would most definitely “punish” the inventory if earnings missed even barely. It is also vital to do not forget that JNJ has missed income estimates every so often. Due to this fact, regardless of the inventory’s pretty good valuation (see under), I personally won’t be including to my place forward of the earnings report.

Determine 2: Johnson & Johnson (JNJ): Earnings per share shock over the past 16 quarters (Searching for Alpha)

JNJ inventory offered off reasonably in response to the first-quarter 2023 earnings report, and has since recovered barely from the native low of $150 to $155. On the floor, the earnings report was stable, and Johnson & Johnson’s one share level improve in steering (income and adjusted earnings) and stable dividend improve of over 5% have been reassuring.

I feel traders have change into extra cautious as a result of lowered 2025 income goal for the Pharmaceutical phase ($57 billion vs. $60 billion), though administration largely attributes the lowered steering to foreign money results. Whereas the weakening U.S. greenback in current months ought to considerably profit JNJ’s quarterly outcomes, the long-term steering remains to be an indication of decrease confidence within the drug pipeline. Due to this, and the approaching lack of exclusivity (LOE) for Stelara (ustekinumab) on the finish of 2023, I anticipate traders to stay nervous and promote the inventory on the slightest signal of earnings weak spot.

Whereas the LOE of Stelara is just not information to those that learn JNJ’s annual experiences, I’d argue that the rising market availability of a number of Humira biosimilars – e.g., adalimumab from AbbVie (ABBV) – and the affiliation with Stelara (a biologic with comparable indications) contribute to the uncertainty. Though Stelara is just not as vital to JNJ’s income as Humira is to AbbVie’s, it’s nonetheless a major contributor to Johnson & Johnson’s income, accounting for 18.5% of the Pharmaceutical phase’s 2022 gross sales, or 10.2% of consolidated gross sales.

On the litigation entrance, I’m fairly assured that LTL Administration’s renewed submitting for Chapter 11 chapter safety and elevated supply of roughly $9 billion in current worth (beforehand $2.4 billion) can be accepted, particularly given CFO Joe Wolk’s remarks in the course of the first quarter earnings convention name:

[…] we have now the assist of 60,000 to 70,000 claimants that will vote for the proposal because it’s at present introduced. However curiously, we have a small variety of plaintiff’s attorneys who do not even wish to give their claimants, the precise to vote. So we’re merely asking that they get the precise to vote.

Now from my chair as CFO, it’s unlucky that we have got to place {dollars} in the direction of, fairly frankly, baseless scientific claims. Nonetheless, litigation is inherently expensive when it is protracted and it is also inherently unsure. And when courtroom (ph) proposal actually goals to carry certainty in a really environment friendly method for all actually concerned, one thing that will in any other case take in all probability many years to resolve.

Whereas I don’t anticipate the corporate to announce a choice on the up to date reorganization plan (which it probably filed with the courtroom in mid-to-late Could), I’m nonetheless keen to listen to administration’s up to date remarks in the course of the convention name, additionally given the current $750 million belief fund established with insurers, which was negotiated with an legal professional representing “many plaintiffs’ legislation corporations” supporting LTL Administration’s up to date supply. Equally, it will likely be fascinating to study if there’s any information on the not too long ago filed movement associated to the alleged fraudulent switch of liabilities to LTL Administration.

These enthusiastic about a deeper dive into JNJ’s talc litigation course of, in addition to the function I consider shopper healthcare IPO and spinoff/split-off Kenvue performed in that course of, ought to learn my article printed in March and evaluate the extra remarks in my first quarter earnings preview from mid-April (hyperlinks within the Introduction).

Can We Anticipate Information On The (Anticipated) Distribution Of Kenvue Shares On Thursday?

In my earlier articles, I suspected that KVUE inventory may expertise a major sell-off upon its preliminary public providing (IPO), because it was incorrectly seen by some as JNJ’s “dangerous financial institution.” Due to this, and the expectation that JNJ will (most definitely) distribute its majority stake in KVUE, I’ve expressed my intention to carry on to my potential KVUE place till the mud settles.

Suffice it to say that by the point the IPO closed in Could, most if not all traders realized that Kenvue’s litigation danger was fairly restricted. And whereas it could be presumptuous to assert that my article printed in March alerted a major share of JNJ traders to this widespread false impression, I’d not underestimate the influence of the Reuters article titled “J&J to retain all talc-related liabilities from litigation in US, Canada,” printed only a week earlier than the Kenvue IPO, on April 27.

I’m a proponent of the transaction, even contemplating that JNJ has retained about 90% of the overall excellent Kenvue shares, at present valued at about $43 billion. Whereas the unique S-1 doc filed with the SEC in early January indicated that the dad or mum firm anticipated to distribute its majority stake in a tax-free transaction, there’s after all no assure that this can occur. JNJ’s not too long ago launched Q&A on the Client Well being separation supplies no additional perception, however means that JNJ might search both a spin-off (a professional rata distribution / JNJ inventory dividend as indicated within the S-1), a split-off (an change of all, some, or not one of the shareholder’s JNJ shares for KVUE shares), or a mix of each. Regardless of this uncertainty, I nonetheless consider that the corporate will break up off its Client Well being enterprise solely. In any case, it was brazenly said within the Q1 earnings outcomes remarks that the corporate stays “on observe to finish the separation of this enterprise in 2023.”

Nonetheless, I’d not anticipate information relating to distribution or change to be introduced within the upcoming earnings launch on Thursday. JNJ is restricted in its skill to commerce or change Kenvue inventory till early November, so we’ll probably have to attend a minimum of till after the Q3 earnings name in mid-October.

My Up to date Take On Kenvue Inventory

Given the inventory’s efficiency for the reason that IPO, most, if not all, traders by now understood that KVUE could be spared the lion’s share of the talc lawsuits. Now that I anticipate the inventory to proceed to commerce at a standard to excessive valuation, I’ve been entertaining the thought of promoting my shares upon receipt.

Nonetheless, whereas I do know that JNJ’s Client Well being enterprise has been a reasonably weak performer lately, I’ve not modified my choice to carry on to the potential place. Kenvue’s manufacturers (e.g., Aveeno, Neutrogena, Tylenol, Zyrtec, Listerine, Band Help, Nicorette) are well known and won’t endure from the separation. If something, the truth that JNJ is not related to these shopper merchandise might be a tailwind as a result of not apparent reference to the talc situation. Due to its measurement, Kenvue advantages from a beautiful price construction and likewise has pricing energy, as evidenced by its first-quarter 2023 outcomes. There’s undoubtedly room for margin enchancment, however the basis is powerful.

Due to this, and rising exterior visibility and investor consideration (the reasonably weak phase is not “carried” by the Pharmaceutical and MedTech divisions), I feel Kenvue can return to significant progress and ship good shareholder returns. My choice to carry on to my potential Kenvue place has not modified (however the causes for doing so clearly have).

Is Johnson & Johnson A Good Inventory To Purchase Now – And A Phrase On GLP-1 Receptor Agonists

Primarily as a result of – for my part most definitely resolved – uncertainties associated to the talc litigation and the considerably weak drug pipeline, the inventory doesn’t appear to search out sustainable curiosity amongst traders. Johnson & Johnson’s inventory has been kind of treading water since early 2021.

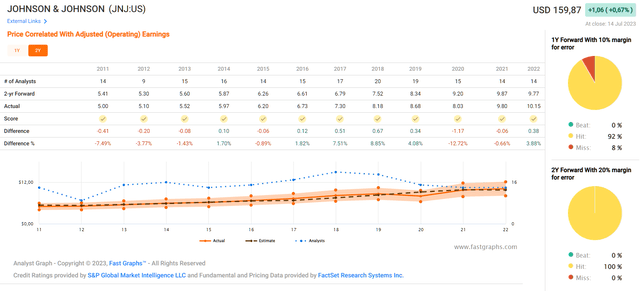

Nonetheless, as a long-term investor, I embrace durations like this because the inventory will get cheaper over time. Granted, as rates of interest have risen sharply since early 2022, so have alternative prices, however I nonetheless suppose JNJ inventory is an more and more engaging alternative. Given the excessive earnings reliability (see two-year ahead analyst scorecard in Determine 3), it is comprehensible that JNJ hardly ever suffers from sharp value declines, which can be utilized to extend one’s long-term place opportunistically.

Determine 3: Johnson & Johnson (JNJ): FAST Graphs two-year ahead analyst scorecard (FAST Graphs software)

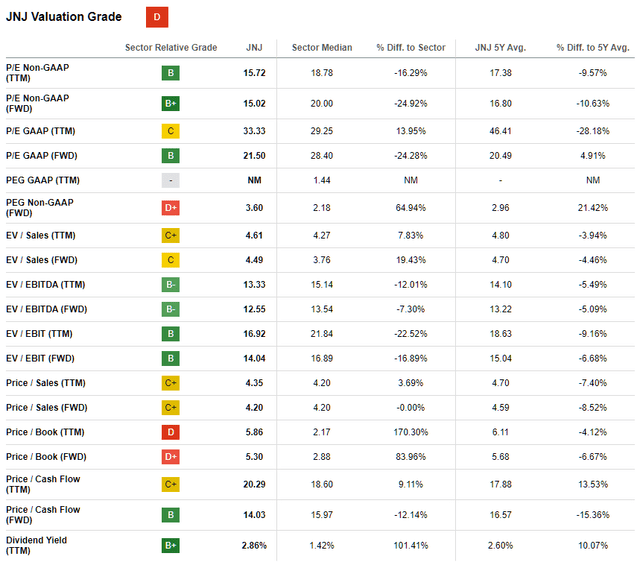

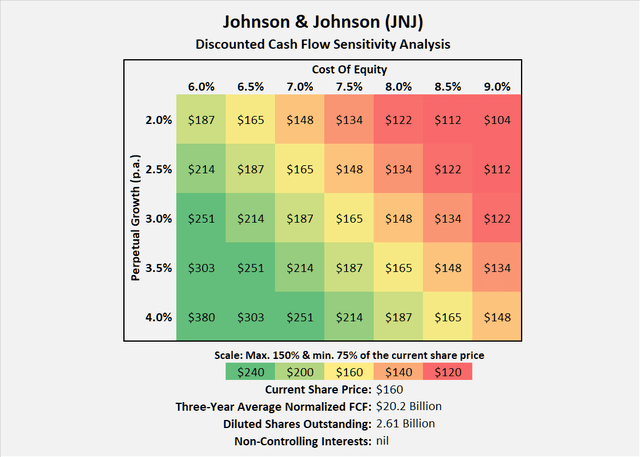

At a present value of $160, JNJ inventory trades at a blended price-to-earnings ratio of 15.4, a free money circulation yield of 4.9% (common 2020 to 2022, adjusted for stock-based compensation and dealing capital actions), and an EV/EBITDA a number of of 13.3 (TTM foundation) to 12.6 (ahead foundation). Johnson & Johnson’s dividend of at present $1.19 per share and quarter represents an annualized dividend yield of two.95%, which is sort of engaging by historic requirements. Considering the present yield on 10-year Treasuries of three.83%, traders must wait till 2028 earlier than breaking even by way of yield. Nonetheless, not like long-term authorities bonds, I’d argue that JNJ inventory is at present a fairly good inflation hedge on account of its dependable dividend progress and really manageable payout ratio of fifty% to 60% of normalized free money circulation. If JNJ maintains a 5% dividend progress price (the present five-year CAGR is 5.7%), the yield-on-cost will exceed the present yield on 10-year Treasuries by 2028.

Whereas that is arguably not a very low cost valuation, it compares fairly favorably to the historic common (Desk 1). The long-term FAST Graphs chart in Determine 1 (above), the chart primarily based on earnings for 2018 to 2022 and estimates for 2023 to 2025 (Determine 4), and the discounted money circulation sensitivity evaluation in Determine 5 additionally recommend a good valuation or a slight undervaluation.

Desk 1: Johnson & Johnson (JNJ): Valuation metrics and comparability with the sector median and five-year common valuations (Searching for Alpha) Determine 4: Johnson & Johnson (JNJ): FAST Graphs chart for the 2018 to 2025 interval, primarily based on adjusted working earnings per share (FAST Graphs software) Determine 5: Johnson & Johnson (JNJ): Discounted money circulation sensitivity evaluation, suggesting truthful valuation at a price of fairness of seven.5% and a perpetual progress price of three.0% (personal work, primarily based on firm filings and personal calculations)

A complete annualized price of return of round 11% in response to FAST Graphs sounds very stable for such a high-quality blue-chip firm, however I’d argue that the market won’t grant JNJ inventory its usually noticed slight premium valuation of round 17 occasions earnings till litigation is settled and pipeline uncertainties are resolved. One other issue negatively impacting JNJ inventory sentiment is the upcoming drug pricing negotiations, regardless that the corporate is without doubt one of the higher diversified by way of geography and property (see my first article linked within the Introduction). The upcoming negotiations might have a fabric influence on Invega (4.4% of 2022 consolidated gross sales) and Darzalex FASPRO (daratumumab and hyaluronidase, along with daratumumab a gross sales contribution of 8.4%).

And whereas I admit that I am not shopping for any extra shares till I take an in depth take a look at the second quarter outcomes, I undoubtedly favor such a inventory to fairly hyped opponents like Eli Lilly and Firm (LLY), which not too long ago surpassed JNJ because the world’s Most worthy pharmaceutical firm, largely on account of excessive expectations for its glucagon-like peptide-1 (GLP-1) receptor agonist tirzepatide (Mounjaro), which was not too long ago authorised for kind 2 diabetes (T2D) and sure quickly for weight problems. By comparability, LLY inventory at present trades at a price-to-sales ratio of over 14, a blended price-to-earnings ratio of 54, and a free money circulation yield of 1.3%. In different phrases, Eli Lilly is three to 4 occasions costlier than Johnson & Johnson.

Granted, GLP-1 receptor agonists signify a major breakthrough within the remedy of kind 2 diabetes and weight problems. Nonetheless, I’d argue that it’s more likely to be a basic case of ROIC imply reversion, given the success of Novo Nordisk’s (NVO) semaglutide, which was authorised for T2D and weight problems in 2017 and 2021 below the model names Ozempic and Wegovy, respectively. Here’s a hyperlink to an fascinating comparative research of the 2 medication that implies the prevalence of tirzepatide. Additionally, the rising competitors from Amgen Inc. (AMGN) and Pfizer Inc. (PFE, regardless of a current setback) shouldn’t be rapidly dismissed. JNJ has additionally been energetic in GLP-1 receptor agonist analysis. JNJ-54728518 was examined in a section I research in 2016, however there aren’t any present research registered at clinicaltrials.gov. JNJ-64565111 confirmed considerably promising leads to a section 2 trial (hyperlink to different registered research). Nonetheless, JNJ doesn’t at present checklist any GLP-1 receptor agonists as being in growth as of April 18, 2023.

Concluding Remarks

Johnson & Johnson will report its second-quarter outcomes on Thursday, July 20, earlier than the inventory market opens. The corporate hasn’t missed earnings per share estimates in a minimum of 16 quarters – an earnings beat on Thursday is probably going. JNJ inventory dropped after the corporate launched first-quarter outcomes, regardless of beating earnings per share and elevating steering. With Wall Road probably anticipating one other earnings beat, and given the uncertainties surrounding talc litigation and drug pipeline, I am not including to my Johnson & Johnson place regardless of the pretty compelling valuation for such a high-quality blue-chip firm.

It’s cheap to anticipate an replace on the decision of the talc litigation, as JNJ probably submitted the up to date reorganization plan to courtroom in mid-to-late Could. Issues look fairly good, for my part, and the anticipated litigation expense could be very manageable in mild of the corporate’s robust free money circulation, low debt, and anticipated distribution of the cost over 25 years.

Beforehand, I had concluded that I’d maintain on to my (potential) Kenvue place till the mud settled, because the prevailing view at the moment was that KVUE was JNJ’s “dangerous financial institution.” Given the inventory’s efficiency for the reason that IPO, I feel most if not all traders have understood that KVUE can be spared the lion’s share of the talc lawsuits. As a result of I now anticipate the inventory to proceed to commerce at a standard to excessive valuation, I’ve been entertaining the thought of promoting my shares upon receipt. Nonetheless, given the robust manufacturers, stable working basis, rising exterior visibility, and likewise the not apparent affiliation of the merchandise with the in all probability considerably tainted JNJ model identify, I feel Kenvue can return to significant progress and generate good shareholder returns.

Nonetheless, I’d not anticipate information relating to distribution or change to be introduced within the upcoming earnings launch on Thursday. JNJ is restricted in its skill to commerce or change Kenvue inventory till early November, so we’ll probably have to attend a minimum of till after the Q3 earnings name in mid-October.

Furthermore, I would not anticipate administration to out of the blue begin discussing GLP-1 receptor agonists (the AI analogy buzzword in pharma lately), regardless that JNJ’s efforts on this space date again to 2016.

From a valuation perspective, I feel JNJ inventory, which has kind of treaded water since early 2021, is more and more engaging, regardless of at present greater alternative prices. The corporate continues to develop, however the market is just not acknowledging that as a result of ongoing uncertainties. Traders want to stay affected person, however on reflection, I consider that disciplined purchases of shares in such a high-quality firm will repay.

As all the time, please think about this text solely as a primary step in your individual due diligence. Thanks for taking the time to learn my newest article. Whether or not you agree or disagree with my conclusions, I all the time welcome your opinion and suggestions within the feedback under. And if there’s something I ought to enhance or increase on in future articles, drop me a line as effectively.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.

[ad_2]

Source link