[ad_1]

Market centered on long-term Tesla story amid competitors and tighter margins.

Optimistic surprises in income, partnerships, and regulatory credit might offset shrinking margins in H1.

Tesla’s file manufacturing in Q2 raises questions on gross sales sustainability and potential dangers.

When analyzing Tesla’s (NASDAQ:) Q2 earnings tomorrow, the market gained’t be notably centered on the short-term implications of declining income development and better price of revenues within the EV large’s stability sheet.

As an alternative, analysts might be keener to evaluate whether or not the long-term Tesla story stays on observe within the face of accelerating competitors and tighter margins.

Which means, as in , a unfavourable EPS shock could be simply offset by the message that, regardless of the nonetheless difficult 2023, a shiny 2024 is on the horizon. Actually, Tesla is anticipated to expertise a 13% lower in earnings throughout fiscal 2023, however there may be optimism for a powerful restoration with a projected 33% surge in FY24, leading to earnings of $4.70 per share. Moreover, the corporate’s complete gross sales are anticipated to exhibit exceptional development, with a projected 23% improve this 12 months and an extra 25% climb in FY24, reaching an estimated $125.81 billion.

Furthermore, there may be an expectation that the Austin-based large will present it has been capable of hold enhancing its income combination in H2, signaling higher resilience in opposition to a doubtlessly slowing international shopper economic system in H2.

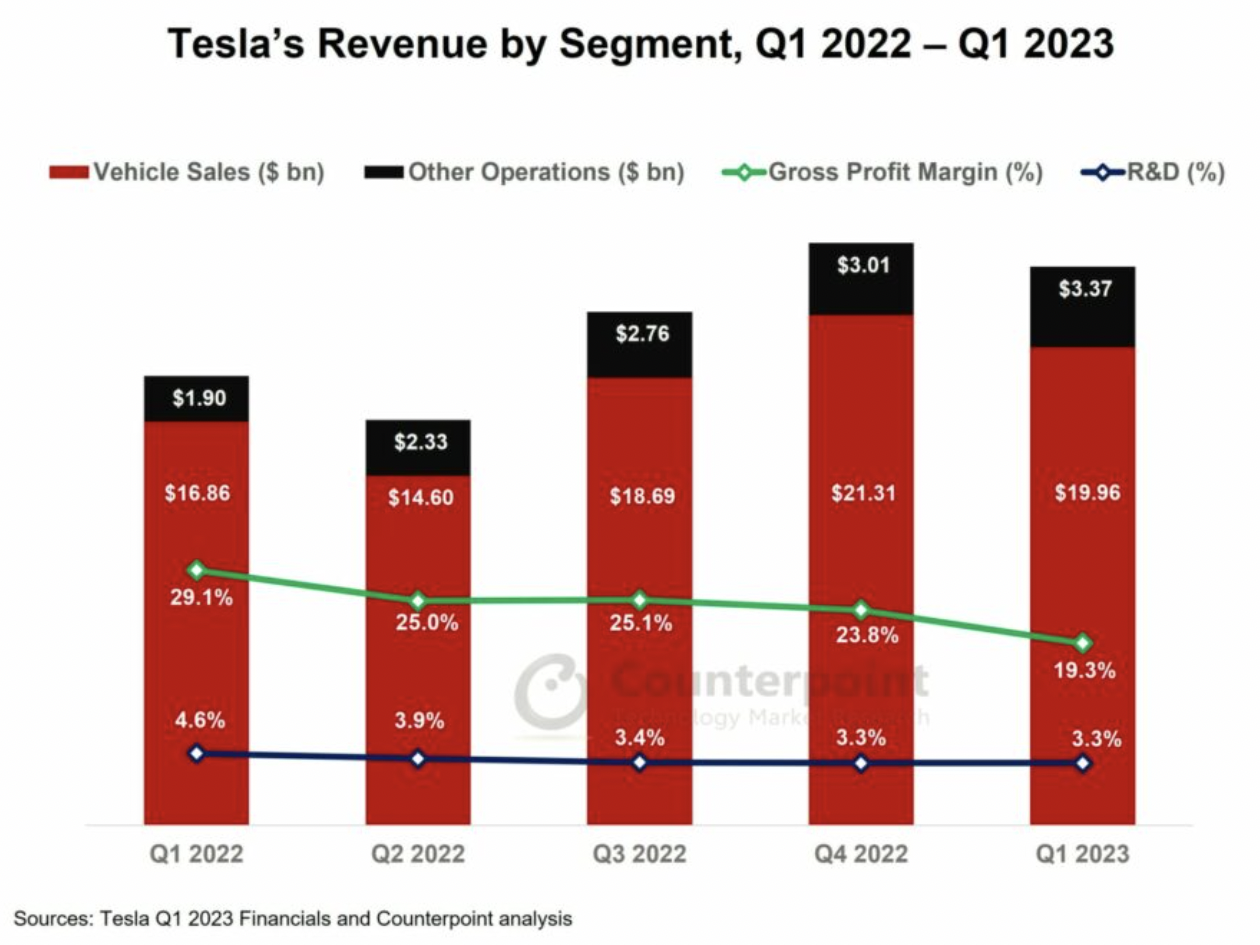

Supply: Counterpoint Evaluation, Tesla

In that sense, optimistic shock in income from automotive gross sales, optimistic developments on the partnership facet—particularly relating to the adoption of Tesla’s North American Charging Commonplace, and a slowing lower in income incoming from regulatory credit might shadow the truth that margins will doubtless hold shrinking in 2023.

On high of that, Tesla shielded itself from a deeper selloff with the on Monday that it had constructed the primary Cybertruck at its Austin Giga Plant. Buyers might be eager to find Elon Musk’s manufacturing plans and estimates for the futuristic-looking SUV on the post-earnings name.

This backdrop, on high of a conservative 0.82 EPS estimate, spells warning for Tesla bears going into tomorrow’s report. Nonetheless, with the potential for a shock skewed to the upside and with margins steadily shrinking, I discover it unlikely that we are going to see any main strikes on the report.

Supply: InvestingPro

Nonetheless, with the market pricing in a brighter 2024 on the again of enhancing monetary circumstances, betting in opposition to Tesla at this level — whereas right from a basic perspective — could show a expensive recreation.

But when it’s not a superb time to brief the inventory regardless of its 78X a number of, is it a superb time to purchase it? To reply that query, let’s take a deeper have a look at the corporate’s fundamentals with InvestingPro.

Can Tesla’s Automobile Gross sales Maintain Up With Document Manufacturing?

Within the second quarter, Tesla manufactured a complete of 479,700 automobiles, a file for the EV large. Furthermore, the corporate achieved important progress when it comes to deliveries, with a complete of 466,140 models delivered in Q2. This determine represents a powerful 83% improve in comparison with the identical interval final 12 months, in addition to a ten% development when in comparison with the earlier quarter.

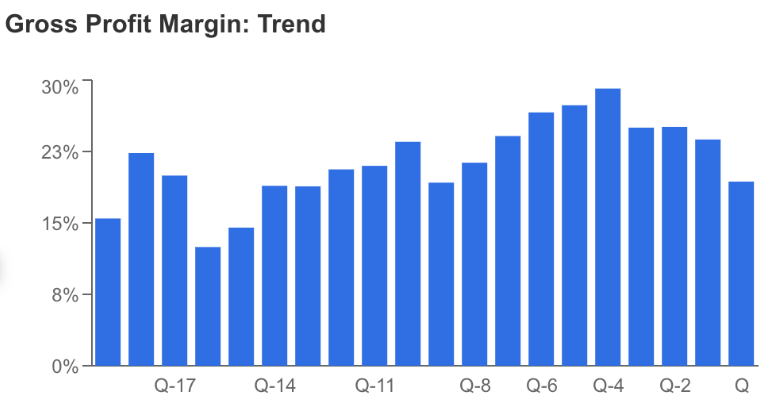

Nonetheless, these numbers got here on the again of shrinking margins, because the Elon Musk-led firm needed to concurrently reduce costs and improve manufacturing prices. Now, the projected gross margin for Tesla in Q2 is anticipated to lower to 17.5% QoQ — and that’s after one other 10% decline in Q1.

Supply: InvestingPro

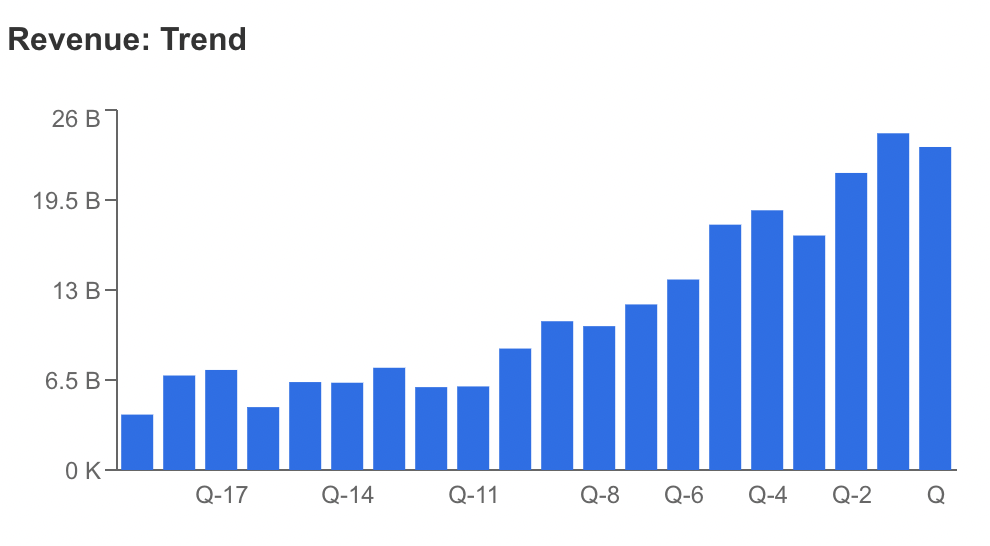

Regardless of that, analysts anticipate that Tesla’s Q2 revenues might surpass the consensus determine of $24.68 billion.

Furthermore, the Cybertruck, which is anticipated to enter manufacturing in September, might herald round $7-8 billion in annual revenues if it achieves a ten% market share within the U.S. pickup truck market.

The Semi Vehicles alone might contribute round $12.5 billion in annual revenues, given the aim of manufacturing not less than 50,000 models yearly.

Regardless of these stable development projections, nevertheless, dangers akin to a possible slowdown in demand, elevated competitors, and regulatory points shouldn’t be missed.

Furthermore, manufacturing of the Mannequin 2 stays delayed. Any developments in that space could possibly be one other potential catalyst for development.

Fundamentals

Tesla’s Q1 2023 outcomes present a complete income of $23.3 billion, representing a 24% improve 12 months over 12 months.

Supply: InvestingPro

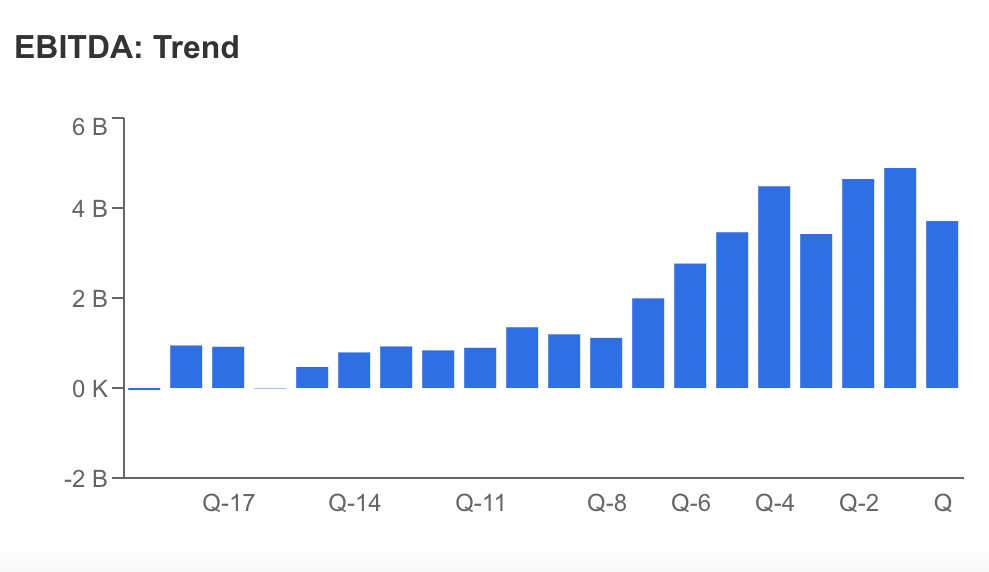

Nonetheless, the corporate’s gross margin underneath typically accepted accounting rules (GAAP) declined by nearly ten share factors from Q1 2022, and its free money movement fell by 80% 12 months over 12 months. Together with that, the corporate’s EBITDA margin has additionally bounced again after peaking just lately.

Supply: InvestingPro

That’s primarily pushed by a number of simultaneous components, akin to:

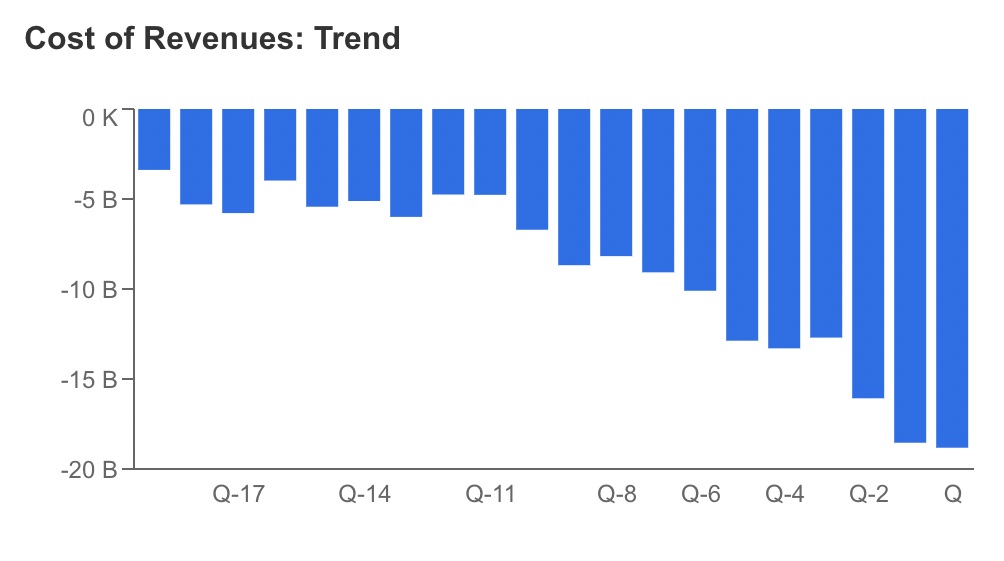

The rising price of revenues:

Supply: InvestingPro

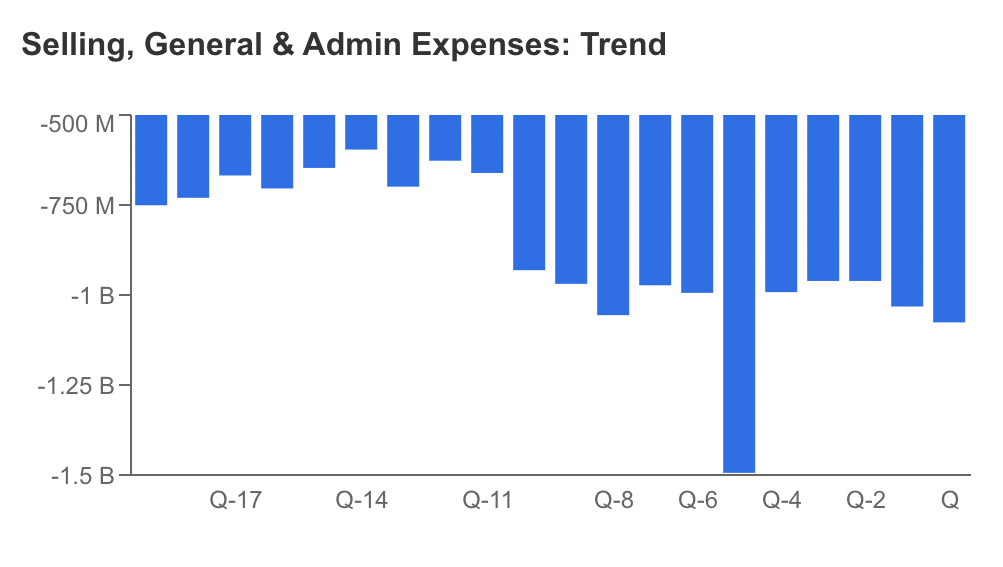

Stubbornly excessive price of labor:

Supply: InvestingPro

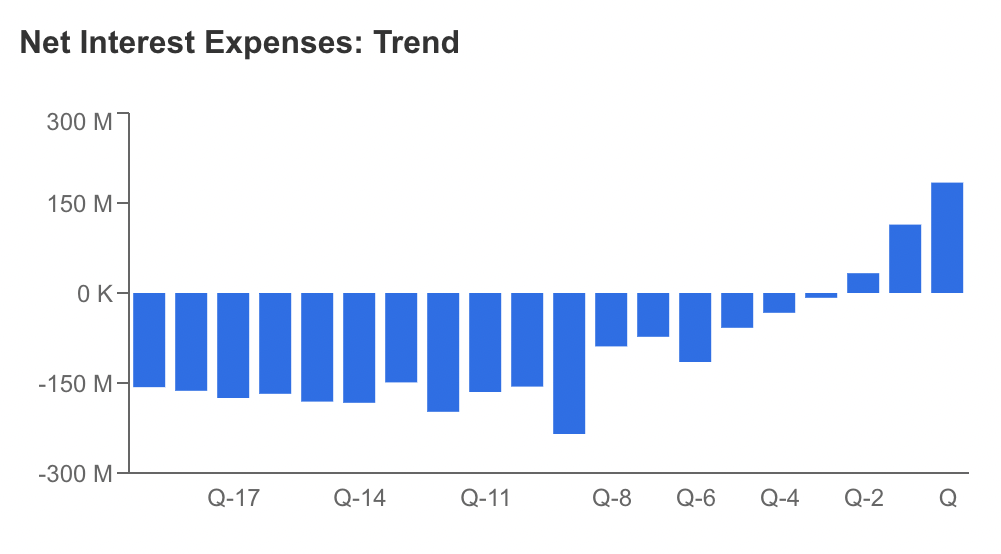

And rising web curiosity bills:

Supply: InvestingPro

Going into Q2 earnings, Wall Avenue banks have responded to those figures by lowering their goal costs for Tesla. As a consequence, the inventory has had 20 unfavourable EPS revisions over the past 90 days and solely two optimistic.

On the optimistic facet, nevertheless, inside Tesla’s Q1 investor deck, the corporate famous that regardless of value reductions in its automobiles, it’s centered on working leverage because it scales and expects ongoing price discount.

This technique is just not new and has been utilized by firms like Domino’s Pizza within the Seventies and Apple (NASDAQ:) within the early days of the iPhone. These firms aimed to compensate for decrease unit gross sales with increased volumes. Nonetheless, in contrast to Domino’s or Apple prospects, who can grow to be repeat patrons, Tesla customers sometimes don’t purchase new vehicles as regularly.

Buyers ought to be conscious that Tesla’s margins could proceed to contract within the brief time period. Such contractions might restrict Tesla’s means to put money into new services.

Subsequently, understanding how the decline in money movement is affecting the corporate’s long-term development might be essential in upcoming quarters.

Technicals and Value Goal

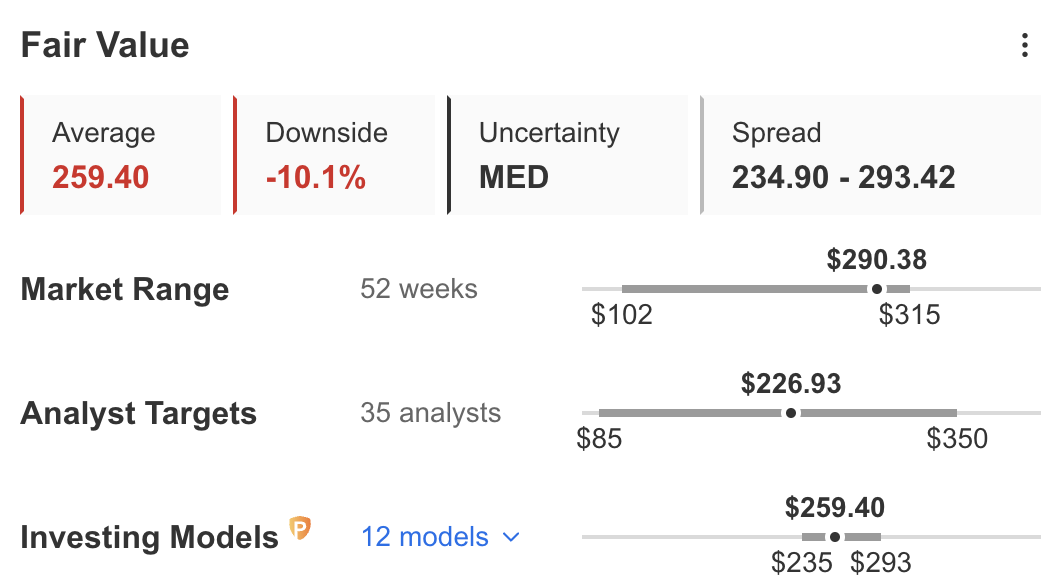

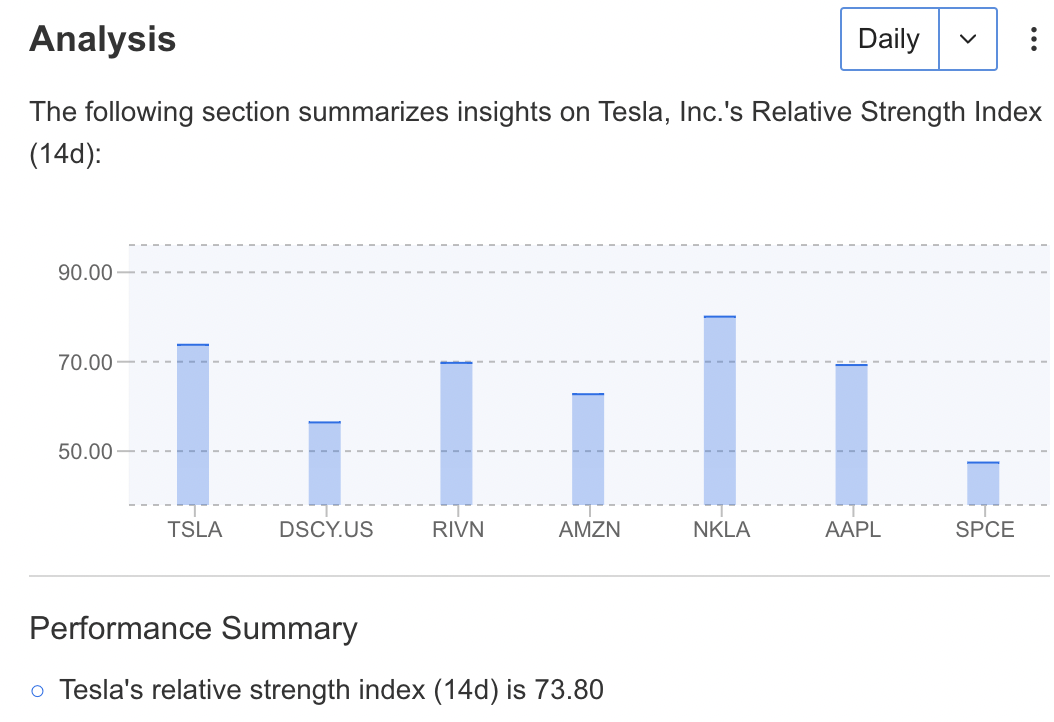

Based on InvestingPro, Tesla has all the best attributes to continue to grow within the close to future aside from its value momentum. That is why analysts predict a ten% draw back from present ranges.

Supply: InvestingPro

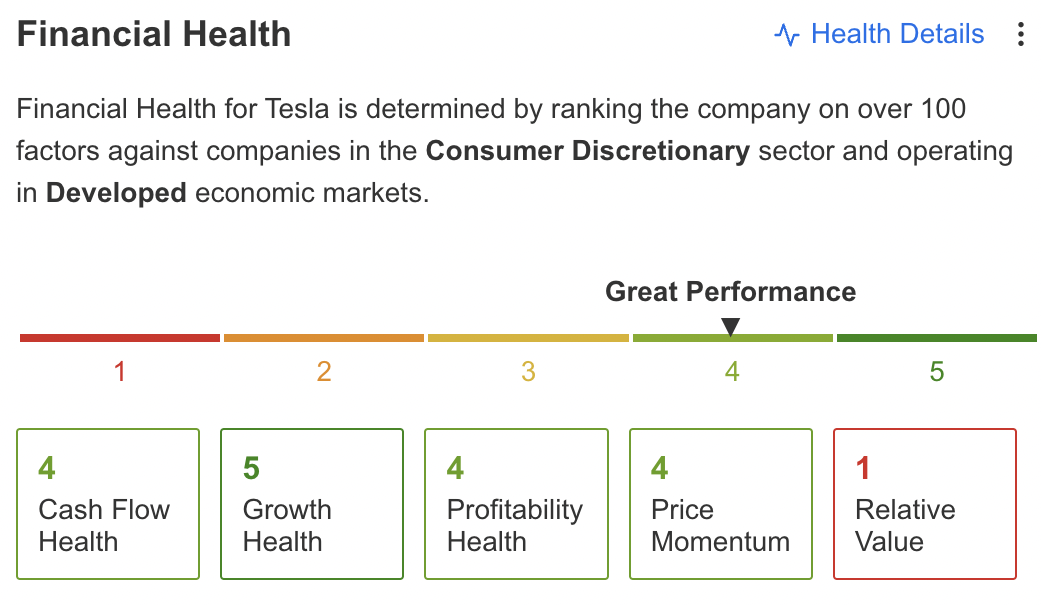

That very same subject reveals up within the inventory’s Monetary Well being rating. Whereas all the symptoms level to a optimistic outlook for the corporate, the relative worth has the bottom potential rating of 1.

Supply: InvestingPro

From a technical standpoint, Tesla’s 14-day RSI is at a really excessive 73.80, implying that the inventory is deep in overbought territory.

Supply: InvestingPro

Backside Line

Whereas it’s doubtless that Tesla’s earnings tomorrow gained’t look so optimistic from a quarter-on-quarter perspective, the small print might inform a really completely different long-term story for the inventory. In that sense, traders ought to preserve their imaginative and prescient broad when making any strikes primarily based on the earnings report.

There’s no argument that Tesla is a extremely overvalued inventory. Nonetheless, it’s poised to take care of the optimistic long-term momentum for so long as it retains exhibiting enhancing effectivity. Betting in opposition to Elon Musk when monetary circumstances are enhancing has proved a really harmful recreation as soon as and will proceed to be within the foreseeable future.

A transfer towards the decrease $200 might sign a shopping for alternative for these keen to trip the curler coaster.

Tesla Stories: What to Count on?

***

Disclosure: The writer doesn’t personal Tesla inventory.

[ad_2]

Source link