[ad_1]

robstyle/iStock by way of Getty Pictures

Fast Introduction To Enterprise Improvement Firms

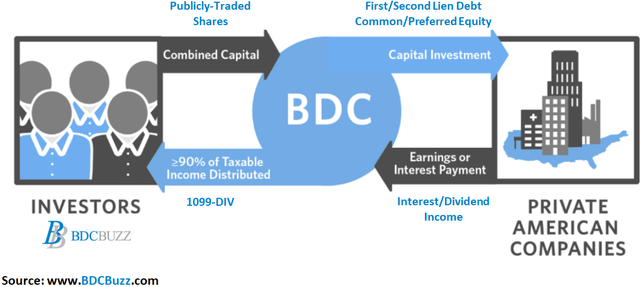

Enterprise improvement corporations (“BDCs”) make investments shareholder capital in privately-owned, small- and medium-sized U.S. corporations producing revenue from secured loans and capital beneficial properties from fairness positions, very like enterprise capital or non-public fairness funds. Anybody can spend money on BDCs as they’re public corporations traded on main inventory exchanges.

BDC Buzz

The three largest errors that new BDC traders make are:

Specializing in historic dividend protection as a substitute of projected dividend protection which is closely reliant on portfolio credit score high quality. Not taking the time to dig into portfolio credit score high quality and assess which investments might doubtlessly have a damaging influence on earnings and NAV per share. Not understanding why BDCs commerce at completely different costs and considering that price-to-NAV is the one measure to discover a “whole lot.” Please see the top of this text for a fast dialogue of how BDCs are valued.

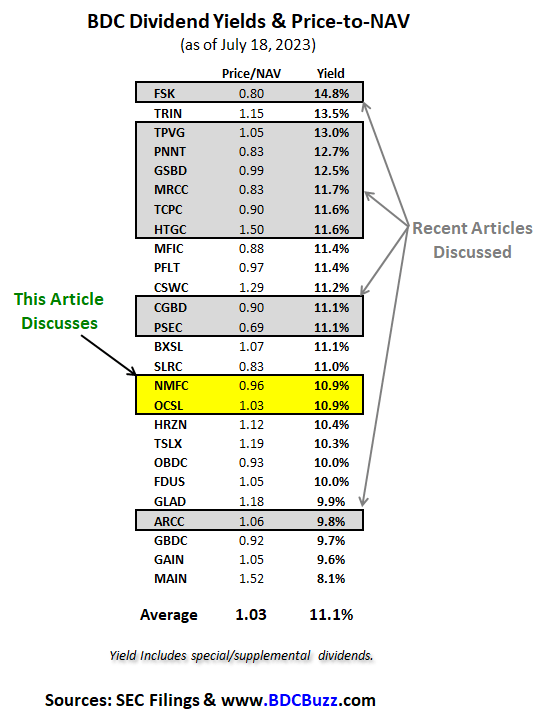

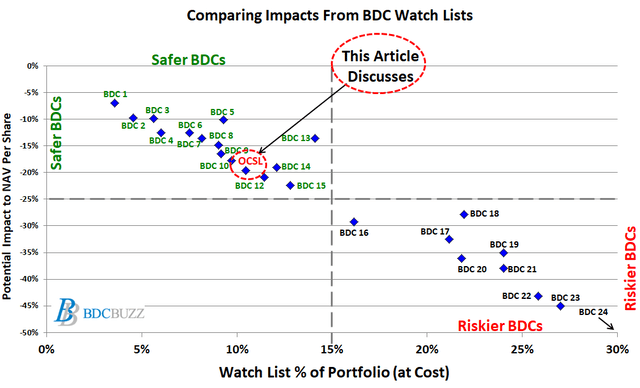

This text discusses dividend protection for Oaktree Specialty Lending (NASDAQ:OCSL) and New Mountain Finance (NASDAQ:NMFC) which presently have dividend yields of round 11% together with supplemental dividends (mentioned under). On the finish of the article, I decide one in all these BDCs and evaluate the potential influence on web asset worth (“NAV”) per share assuming that 100% of its watch listing investments (together with non-accruals) defaulted with 0% restoration.

BDC Buzz & SEC Filings

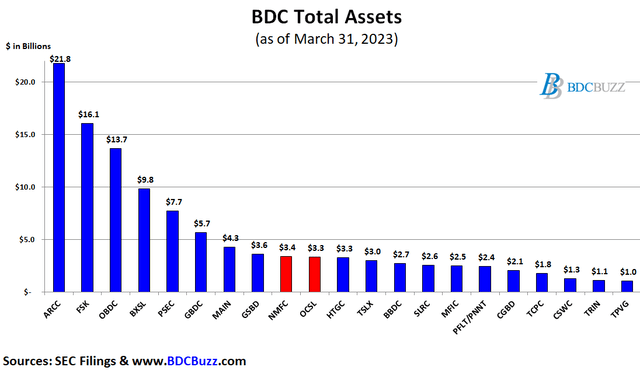

Please word that the BDCs within the chart above account for round 90% of the overall property and market capitalization for the sector. During the last six weeks, we mentioned the portfolio credit score high quality and/or dividend protection for a lot of of them together with Ares Capital (ARCC), FS KKR Capital (FSK), Prospect Capital (PSEC), Goldman Sachs BDC (GSBD), Hercules Capital (HTGC), PennantPark Floating Fee Capital (PFLT), PennantPark Funding (PNNT), TriplePoint Enterprise Development (TPVG), Monroe Capital (MRCC), and BlackRock TCP Capital (TCPC) within the following articles:

BDC Buzz & SEC Filings

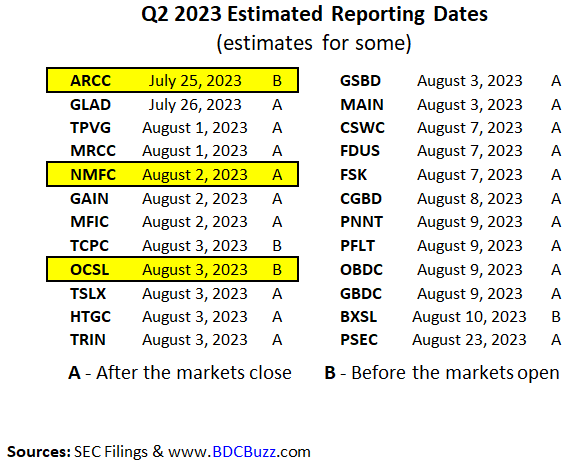

Later this week, we’ll focus on dividend protection for ARCC which is reporting Q2 2023 outcomes subsequent week:

BDC Buzz & SEC Filings

Evaluating Dividend Protection

As talked about earlier, one of many largest errors that BDC traders make is specializing in historic dividend protection as a substitute of projected dividend protection which is closely reliant on portfolio credit score high quality. Every quarter I replace the monetary projections for every BDC with base, finest, and worst-case situations to check the sustainability and/or adjustments to the present dividends. Beneath I focus on most of the drivers used for projecting dividend protection.

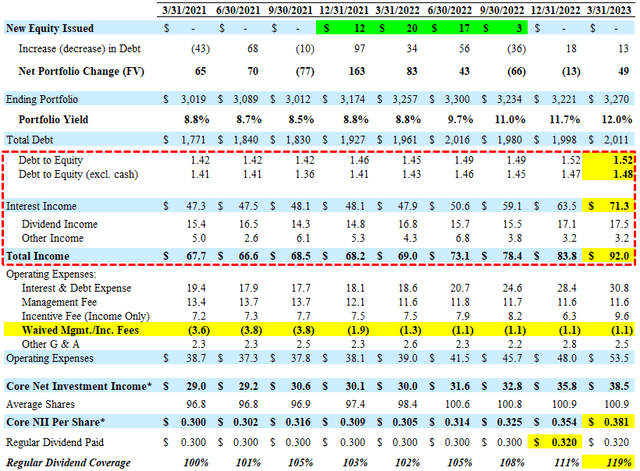

NMFC

NMFC’s dividend yield has been constantly coated, with a defensively positioned portfolio and administration that reveals increased high quality indicators together with waived administration charges and a look-back characteristic for the capital beneficial properties portion of the inducement price. Nevertheless, NMFC doesn’t have a best-of-breed price construction as a consequence of revenue incentive charges not making an allowance for realized or unrealized losses.

Beforehand, the corporate diminished its quarterly dividend from $0.34 to $0.30 beginning in Q2 2020, which was predicted in earlier stories. On the time, the corporate had spillover or undistributed taxable revenue (“UTI”) which is often used for short-term dividend protection points. Please don’t depend on UTI as an indicator of a “secure” dividend.

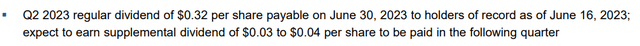

In November 2022, NMFC elevated its common quarterly dividend to $0.32 per share and administration has “dedicated to paying quarterly dividends of a minimum of $0.32” via Dec. 31, 2023, with further price waivers. There is a good probability that administration would prolong the price waivers, however will doubtless not be wanted:

The funding adviser has dedicated to a administration price of 1.25% for the 2023 calendar 12 months. We have now additionally pledged to cut back our incentive price if and as wanted throughout this era to totally help the $0.32 per share quarterly dividend. Primarily based on our ahead view of the earnings energy of the enterprise, we don’t anticipate to make use of this pledge. You will need to word that the funding adviser can’t recoup charges beforehand waived.

NMFC has adopted a formula-based quarterly supplemental dividend program in an quantity to be decided every quarter calculated at 50% of earnings in extra of the common dividend.

For Q1 2023, NMFC reported between my base and best-case projections as a consequence of higher-than-expected dividend revenue whereas sustaining increased leverage partially offset by continued decrease different revenue, masking its dividend by 119%. In Might 2023, the corporate reaffirmed its common quarterly dividend of $0.32 per share plus a supplemental dividend of $0.03 per share paid in Q2 2023.

BDC Buzz & SEC Filings

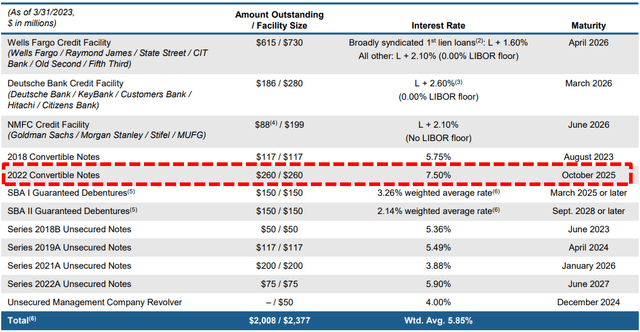

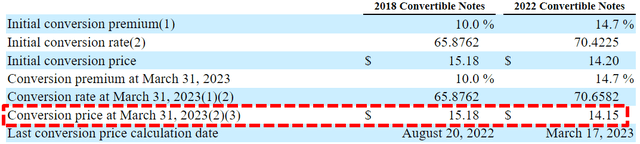

In November 2022, NMFC issued $200 million of its 7.50% convertible notes due Oct. 15, 2025, and used the proceeds to launch a young supply for its current 5.75% Convertible Notes. On March 14, 2023, the corporate issued an extra $60 million of convertible notes to repay the 2018 unsecured notes which have been taken into consideration with the up to date projections.

NMFC

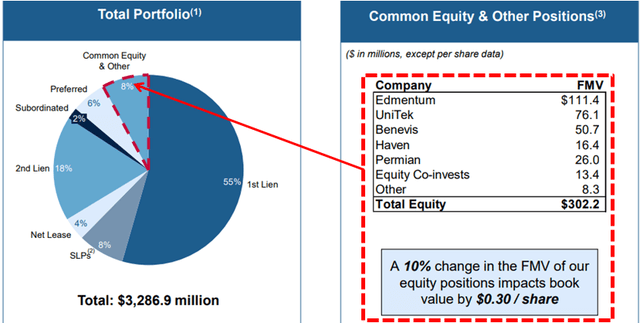

These 2022 notes are presently convertible at $14.15 per share which is just round 7.7% above the present NAV and may very well be an overhang on NMFC’s inventory value. Additionally, as proven in a earlier chart/desk, “a ten% change within the FMV or our fairness positions impacts guide worth by $0.30 per share” implying that further appreciation of those investments might drive NAV nearer to the conversion value.

SEC Filings

Throughout This autumn 2022, its $46 million first-lien place in Haven Midstream was repaid and there’ll doubtless be one other $10 million or $0.10 per share of realized beneficial properties in Q2 2023 as a consequence of a current fairness distribution:

Q. “Did you say you acquired a $10 million distribution from one in all your fairness investments, did get that accurately? After which, in that case, what funding was that from and the way ought to we anticipate that to be accounted for within the second quarter?”

A. “Yeah, you probably did hear that accurately. So this was from our Haven place, which was an fairness distribution, along with the funds that we now have already acquired via Q1. This was one which we acquired on this previous Friday for an extra $10 million and so that can present up as an fairness distribution in Q2. It is going to be a realized acquire.”

NMFC beforehand had round $36 million or $0.35 per share of web realized beneficial properties principally associated to web lease investments, as administration was within the strategy of “decreasing general publicity with the purpose of reinvesting gross sales proceeds into core technique of a floating fee defensive growth-oriented non-public credit score.” Nevertheless, during the last 10 years, NMFC has skilled web realized losses of round $31 million or $0.31 per share (utilizing the present share depend). NMFC’s web asset worth (NAV or guide worth) has declined by solely $0.92 per share since 2012 as a consequence of offsetting unrealized beneficial properties and over-earning the dividend. Additionally, there is a good probability that a lot of its fairness positions will respect over the approaching quarters and will drive upcoming realizations to be reinvested into income-producing property:

We have now vital management over the monetization of UniTek, Benevis, Permian. It meant it’s value noting we’re a minority and we’re in with others. And I might say that, whereas it’s not an ideal M&A atmosphere, I feel, sponsors do wish to — and different consumers, frankly, are getting keen to purchase good, well-performing property. I feel we talked about that UniTek and Permian had been two on this listing which can be rising properly and have some actually compelling structurally advantageous tailwinds and so we’re — we predict that amongst this listing, there may very well be one other title on this listing that over the medium time period we might search to exit.”

NMFC

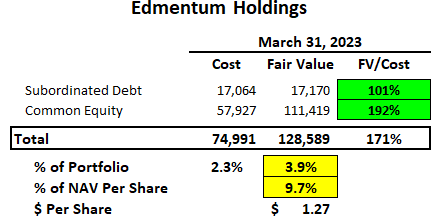

Administration mentioned its funding in Edmentum on the current name because it continues to be marked increased and now accounts for nearly 4% of the portfolio truthful worth (as proven under).

Edmentum could be very nicely positioned to learn from the tendencies in synthetic intelligence. Edmentum is a digitally native supplier of curriculum and evaluation primarily for the Okay-12 market. And since they’re digitally native, they’ve been – they’re software program first they usually have been fascinated about AI for a very long time and their most up-to-date product included non-generative AI in a cloth means, and within the current months, the corporate has been actually entrance footed on incorporating a generative AI into the product set. We promote to districts. So the districts, they don’t transfer as rapidly as a 14-year-old child when it comes to embracing ChatGPT for evaluation and curriculum. However they’ll get there. And so it’s humorous, proper now, what they’re requesting from Edmentum is to simply accept the requesting something and most aren’t, however they’re requesting assistance on the plagiarism aspect and the place they might capable of present that. However as we glance out two years or three years, we do consider that the largest driver goes to be the power to evolve evaluation past recitation results and writing papers. And we consider there are methods to make use of our software program to permit districts to supply an efficient reply to that, in addition to utilizing our software program to supply personalised tutors to kids. So longwinded reply, however we’re fairly excited in regards to the potential of generative AI to be a tailwind for Edmentum going ahead.”

BDC Buzz & SEC Filings

There’s an opportunity for one more dividend enhance again to the earlier stage but additionally may very well be used for continued supplemental dividends. The dividend yield of 11% proven earlier assumes that the corporate maintains the common dividend plus $0.10 per share of supplemental dividends paid yearly.

We anticipate to proceed to considerably out earn our $0.32 per share base dividend at present rates of interest, if all different elements maintain fixed. Given our earnings of $0.38 per share this quarter, we’ll make our first variable supplemental dividend within the quantity of $0.03 per share. This is the same as half of the Q1 quarterly earnings in extra of our base dividend of $0.32. This extra $0.03 dividend will elevate the overall dividend to $0.35 per share all in for this quarter, which is on the excessive finish of the vary. Our supplemental dividend program pays out a minimum of 50% of any earnings in extra of the common dividend. Since our Q1 earnings exceeded the common dividend by $0.06 per share, we’re paying a supplemental dividend of $0.03 per share alongside the Q2 common dividend.”

Primarily based on Q2 2023 earnings expectations, the Q3 supplemental dividend will doubtless be $0.03 to $0.04 per share:

NMFC

NMFC

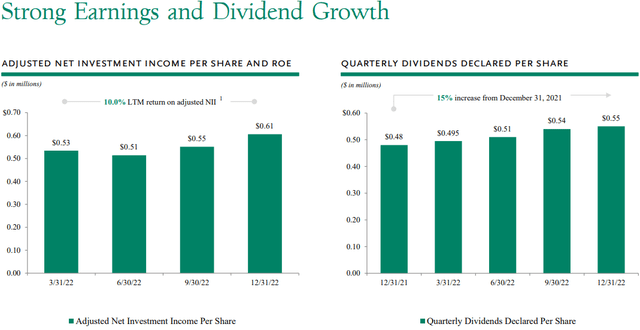

One in every of my major considerations is the necessity for increased quantities of leverage (debt-to-equity) to cowl its common dividend in addition to beforehand realized losses. Additionally, NMFC has increased quantities of non-cash payment-in-kind (“PIK”) curiosity revenue that has traditionally been round 10% to 12% of complete curiosity revenue however elevated to virtually 13% for Q1 2023, and must be watched.

OCSL

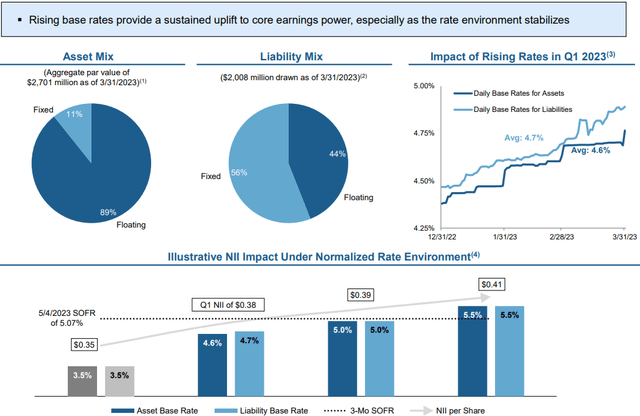

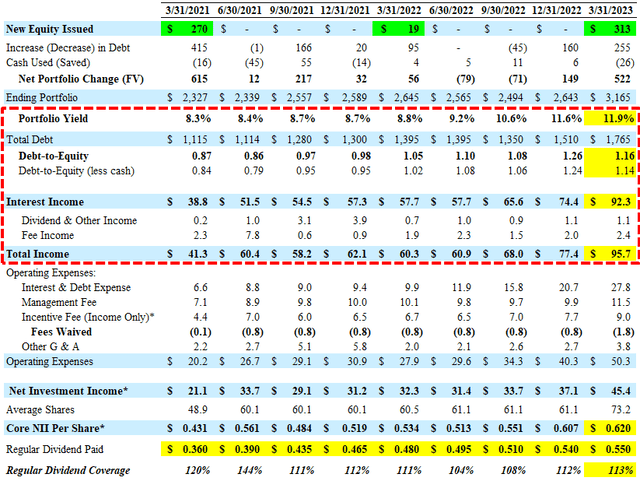

OCSL has elevated its common quarterly dividend 11 occasions, from $0.285 (Q2 2020) to the present 0.550 per share:

Given the sturdy general earnings, our Board maintained our quarterly dividend at $0.55 per share. As a reminder, that is practically double our pre pandemic quarterly run fee of $0.285. We have been very conservative in our strategy to the dividend. This quarter, the adjusted funding revenue was $0.62, the dividend was $0.55. So I feel there’s lots of conservatism in that. However simply owing to uncertainty and volatility out there with out prudent simply to – let’s simply form of maintain it at $0.55 for this quarter. We have now elevated it actually virtually double the pre pandemic. However at this level, the dividend yield on NAV is north of 11%. Our ROE for the quarter was north of 12.5%. So we really feel superb in regards to the dividend protection, superb in regards to the earnings and the ROE, however simply form of given all of the uncertainty on the market it appear to make sense to only maintain at $0.55. In order that’s actually form of how we thought in regards to the dividend for this quarter.”

OCSL

Just like different BDCs, throughout 2022, administration determined to payout portion of its extra earnings/beneficial properties to keep away from excise tax and “return the capital to the shareholders.” I am anticipating the corporate to pay one other particular dividend in This autumn 2023 that can doubtless be introduced later this 12 months.

From earlier name: “Our Board additionally declared a particular distribution of $0.14 per share (or $0.42 per share split-adjusted), primarily on account of elevated taxable revenue. It is the primary time we have paid this dividend. However at finish of the day, the choice was, let’s return the capital to the shareholders. Let’s not pay the excise tax. There may be an excise tax like 4%. So, in essence, let’s return all of the capital to the shareholders, allow them to redeploy it as they see match moderately than form of utilizing it to construct that or fund internally and pay the tax. I do know a few of our friends do various things. However for us, it was – let’s keep away from the excise tax, let’s pay the distribution to the shareholders. We checked out what our taxable revenue was for the 12 months, what we would want to pay out to attempt to decrease or outright keep away from that excise tax, and that is the place we shook out.”

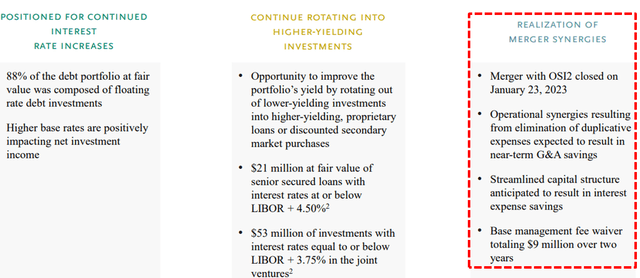

In January 2023, the corporate accomplished the merger with OSI2 which is generally optimistic for OCSL shareholders, together with $572 million of latest investments at truthful worth and the $9 million of price waivers beginning in Q1 2023, simply because the earlier waivers from the OCSI finish.

We efficiently closed our merger with OSI2 in January and we consider the mix will end in vital advantages for the mixed firm and substantial long run worth for our shareholders. With greater than $3.3 billion of property, the mixed firm has extra monetary flexibility and better scale, whereas adhering to our worth pushed funding technique. We additionally anticipate realizing operational synergies in addition to curiosity expense financial savings from streamlining our capital construction. As well as, we’re benefiting from diminished administration charges for the following two years at Oaktree, our supervisor has agreed to waive $9 million of base administration charges in complete, $6 million within the first 12 months and $3 million within the second 12 months.”

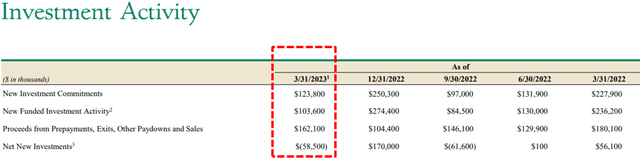

For calendar Q1 2023, OCSL reported between its base and finest case projections masking its dividend by 113% with one other enhance in portfolio yield from 11.6% to 11.9% partially offset by decrease portfolio funding exercise leading to decrease leverage (debt-to-equity) that’s now firmly inside its revised focused ratio of 0.90 to 1.25, presently at 1.14 (web of money), down from 1.24 (previous to the merger).

OCSL

There was a significant discount within the quantity of payment-in-kind (“PIK”) revenue, from 7.9% to 4.3% of complete revenue. OCSL has a superb historical past of credit score high quality and continues to spend money on bigger corporations that may doubtless outperform in a recessionary atmosphere, so the next quantity of PIK is suitable, however I’ll proceed to look at over the approaching quarters.

BDC Buzz & SEC Filings

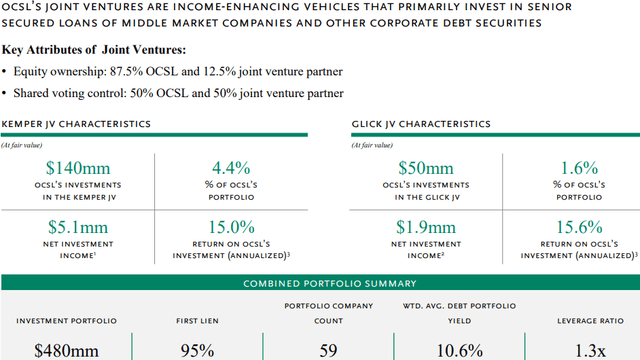

Dividend protection ought to proceed to enhance as a consequence of increased portfolio yield, sustaining increased leverage, continued rotation into increased yield investments, elevated returns from its Kemper and Glick joint ventures, and the current merger with further price waivers.

Armen Panossian, CEO and CIO: “OCSL achieved sturdy leads to the second fiscal quarter, pushed by stable adjusted web funding revenue generated from wider spreads on new originations and the influence of upper base charges on our predominantly floating fee mortgage portfolio. We additionally continued our technique of rotating out of public debt investments and redeploying capital into our sturdy pipeline of compelling and higher-yielding non-public credit score alternatives. Furthermore, we had been delighted to efficiently shut our merger with OSI2 on January 23, 2023, which marked one other vital spotlight of the quarter. We’re excited to leverage the advantages of the mixed firm, which we consider will generate substantial long-term worth for our shareholders. These optimistic outcomes underscore our dedication to delivering sturdy risk-adjusted returns, and we consider we’re positioned to maintain this momentum sooner or later.”

OCSL

BDCs are anticipated to learn from tightened lending insurance policies and doubtlessly elevated banking rules, which can doubtless embrace stronger capital and liquidity requirements for sure banks. BDCs have a definite benefit over banks in that they’ve “everlasting fairness capital” and are usually not topic to “runs on the financial institution,” which might result in the pressured liquidation of undervalued property. The current instability within the banking sector is more likely to have a substantial impact on BDCs, leading to continued enchancment in yields on new investments and a wider vary of funding alternatives. In consequence, BDCs can proceed to be very selective of their new funding selections. Earlier this month, OCSL administration talked about the extra lender-friendly atmosphere with higher phrases, together with stronger covenants (safer investments) and better general yields taken into consideration with the best-case projections:

The current failures of Silicon Valley Financial institution, Signature Financial institution and First Republic together with the emergency sale of Credit score Suisse in Europe might additional tighten monetary circumstances, even when the Fed seizes rate of interest hikes. In actual fact, in accordance with Fed information, banks have already tightened their lending requirements because the failures. Whereas we aren’t predicting a extreme recession or a cloth failure of the banking system, we predict the occasions of the previous quarter recommend that market volatility will proceed and thus prudent credit score traders with accessible capital might be nicely positioned. This creates potential development catalyst for OCSL, we consider non-public credit score funds might have vital and presumably lengthy lasting alternatives to fill the lending gaps ensuing from the financial institution’s lack of ability to satisfy demand. In the end, we consider the fallout from all of this can doubtless profit these non-public lenders reminiscent of Oaktree which have enough scale to supply debt financing for giant scale transactions. The chance units widened on account of that sort of stress or misery. After which on the giant banks, one ought to anticipate the regulatory oversight of what they do and the way they use their stability sheets to earn syndication charges will take a toll. I feel on condition that unsteady equilibrium that seems to be the case within the broadly syndicated mortgage market, we’re discovering the very best alternatives in supporting giant sponsors in doing new offers. That is in all probability the very best danger adjusted return that we’re seeing within the non-public credit score market presently. First lien offers with very giant sponsors working a 60% fairness test and paying us 12% in an organization that has $75 million to $700 million of EBITDA. The variety of offers has declined in that zip code versus a 12 months or two in the past, however the high quality of these offers is meaningfully higher at present than it was a 12 months or two in the past. So we’re fairly enthusiastic about that chance.”

OCSL

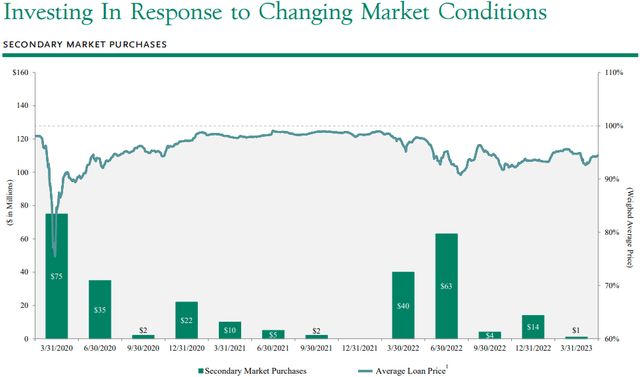

Throughout calendar Q1 2023, OCSL exited one other $40 million of lower-yielding property that can doubtless be reinvested via its new non-public direct lending fund:

We have now, clearly, a really lively publicly traded guide at Oaktree throughout our platform and consider relative worth in public versus non-public daily frankly. So we noticed some good alternatives in non-public. We took these alternatives moderately than leaning into public, given the energy out there there. We additionally additional superior our technique of rotating out of public debt investments and redeploying capital into enticing and better yielding non-public credit score alternatives. Through the quarter after the OSI2 merger, we additionally had some low yielding property each in OCSL and from OSI2 that we bought all through the quarter given the energy within the public markets. So we’re capable of promote upwards of $40 million within the publics to make room for future privates as nicely, all within the excessive 90s.”

Additionally, there’ll doubtless be increased (or a minimum of maintained) earnings from its joint ventures:

The Kemper JV had $393 million of property invested in senior secured loans to 56 corporations, down from $409 million final quarter, primarily pushed by exits from two investments. The JV generated $3.2 million of money curiosity revenue for OCSL within the quarter, up from $2.6 million within the fourth quarter on account of the portfolios proceed sturdy efficiency and the influence of rising rates of interest on floating fee investments. We additionally acquired a $1.1 million dividend in step with the primary quarter dividend. Leverage on the JV was 1.4 occasions at quarter finish, unchanged from the prior quarter. The Glick JV had $131 million of property as of March 31, down from $138 million at Dec. 31. These consisted of senior secured loans to 39 corporations. Leverage on the JV was 1.2 occasions at quarter finish and we acquired $1.5 million value of principal and curiosity funds on OCSL subordinated word within the Glick JV in the course of the quarter.”

OCSL

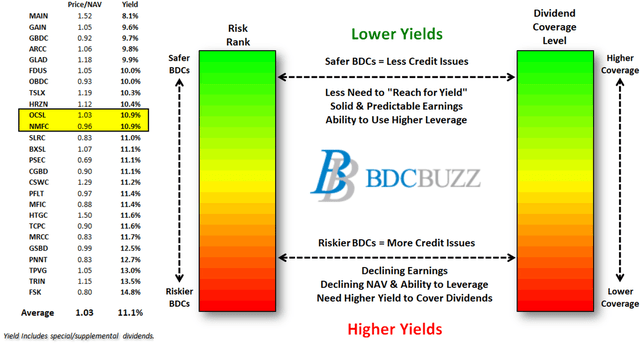

BDC Valuations

There are very particular causes for the costs that BDCs commerce driving increased and decrease dividend yields principally associated to portfolio credit score high quality and dividend protection potential (not essentially historic protection). BDCs with higher-quality credit score platforms and administration sometimes have higher-quality portfolios and traders pay increased costs. This drives increased multiples to NAV and decrease yields.

BDC Buzz

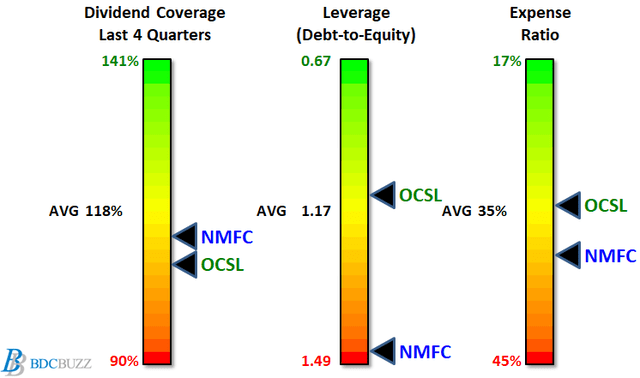

The charts under evaluate a couple of metrics for OCSL and NMFC together with dividend protection during the last 4 quarters, leverage or debt-to-equity, and expense ratios. As talked about earlier, please don’t focus solely on historic dividend protection particularly in comparison with projected protection. NMFC has barely higher historic protection but additionally a lot increased leverage (debt-to-equity) implying that OCSL has the power to develop its portfolio and earnings over the approaching quarters. Additionally, OCSL has frequently elevated its dividend which is partially accountable for decrease protection. For these causes, I consider that OCSL is the higher selection for dividend protection going ahead.

BDC Buzz

BDC Buzz & SEC Filings

OCSL’s watch listing investments might be mentioned in a following article and presently account for 10.5% of the portfolio (at price) which incorporates its non-accrual investments and Athenex, Inc. that is still virtually absolutely valued. Nevertheless, on Might 14, 2023, Athenex filed for Chapter 11 (partially because of the FDA’s rejection of its breast most cancers candidate oral paclitaxel) after reaching an settlement with its lenders to maneuver ahead with an expedited sale strategy of its property. The expedited gross sales course of is predicted to conclude by July 1, 2023.

The next chart exhibits the potential influence on NAV per share for every BDC, assuming that 100% of watch listing investments (together with non-accruals) defaulted with 0% restoration. That is the worst-case situation for this group of investments. The biggest NAV declines during the last 4 quarters had been principally BDCs with bigger quantities of watch listing investments. Subscribers who consider the financial system is headed for a “onerous touchdown” with a deep, broad, and/or prolonged recession ought to give attention to the BDCs nearer to the highest left nook.

BDC Buzz & SEC Filings

OCSL Necessary Issues:

The next are most of the optimistic issues for OCSL, a few of that are mentioned on this article:

Constant historic and projected dividend protection Latest merger was an environment friendly methodology of elevating fairness capital and decreasing leverage, in addition to bettering scale and portfolio variety, with increased first-lien Significant discount within the quantity of PIK revenue, from 7.9% to 4.3% of complete revenue $9 million of further price waivers beginning in Q1 2023 Elevated its common dividend 11 occasions, from $0.285 to the present 0.550 per share plus particular dividend in This autumn 2022 Potential particular dividend in This autumn 2023 (doubtless introduced later this 12 months) Continued rotation out of lower-yielding property (reinvested into increased yields) Elevated returns from its Kemper and Glick joint ventures Funding grade rankings by Moody’s (Baa3) Secure, Fitch (BBB-) Secure First-lien investments elevated from 54% to 75% of the portfolio truthful worth (final 5 years) NAV per share has elevated by 11.6% during the last 5 years Extremely diversified portfolio of 165 portfolio corporations with the highest 10 accounting for round 20% of the portfolio at truthful worth The quantity of “watch listing” investments stay round 9% of the portfolio truthful worth (11% at price) which is healthier than common Wonderful historical past of credit score high quality and persevering with to spend money on bigger corporations that may doubtless outperform in a recessionary atmosphere Clear/clear administration when discussing portfolio credit score high quality and measured strategy when elevating and deploying capital Possible diminished non-accruals leading to an improve again to “Tier 1”

The next are most of the damaging issues for OCSL, most of that are mentioned on this article:

SiO2 Medical Merchandise and The Avery had been added to non-accrual standing at round 2.3% of the portfolio truthful worth (2.4% of debt investments) Its watch listing funding in Athenex, Inc. filed for Chapter 11 (on Might 14, 2023) after reaching an settlement with lenders to an expedited sale strategy of its property Web realized losses of $9 million or $0.13 per share during the last two quarters, principally as a consequence of exiting a few of its watch listing investments A lot of its watch listing investments have been marked decrease during the last two quarters A few of its watch listing investments are presently marked barely increased than different BDCs with the identical place Comparatively increased quantity of Stage 2 property (round 10% of the portfolio) leading to NAV volatility 83% of borrowings are at variable charges ( factor if charges head decrease) Potential promoting stress associated to OSI2 shareholders in search of liquidity Lack of ‘complete return’ hurdle or “look again” provision when calculating revenue incentive charges to guard shareholders from capital losses

[ad_2]

Source link