[ad_1]

Netflix’s income missed expectations in Q2, however revenue per share exceeded estimates

The inventory dropped after the earnings report however continues to be up 48% YTD

However, it nonetheless trades at a reduction to its truthful worth, in accordance with InvestingPro

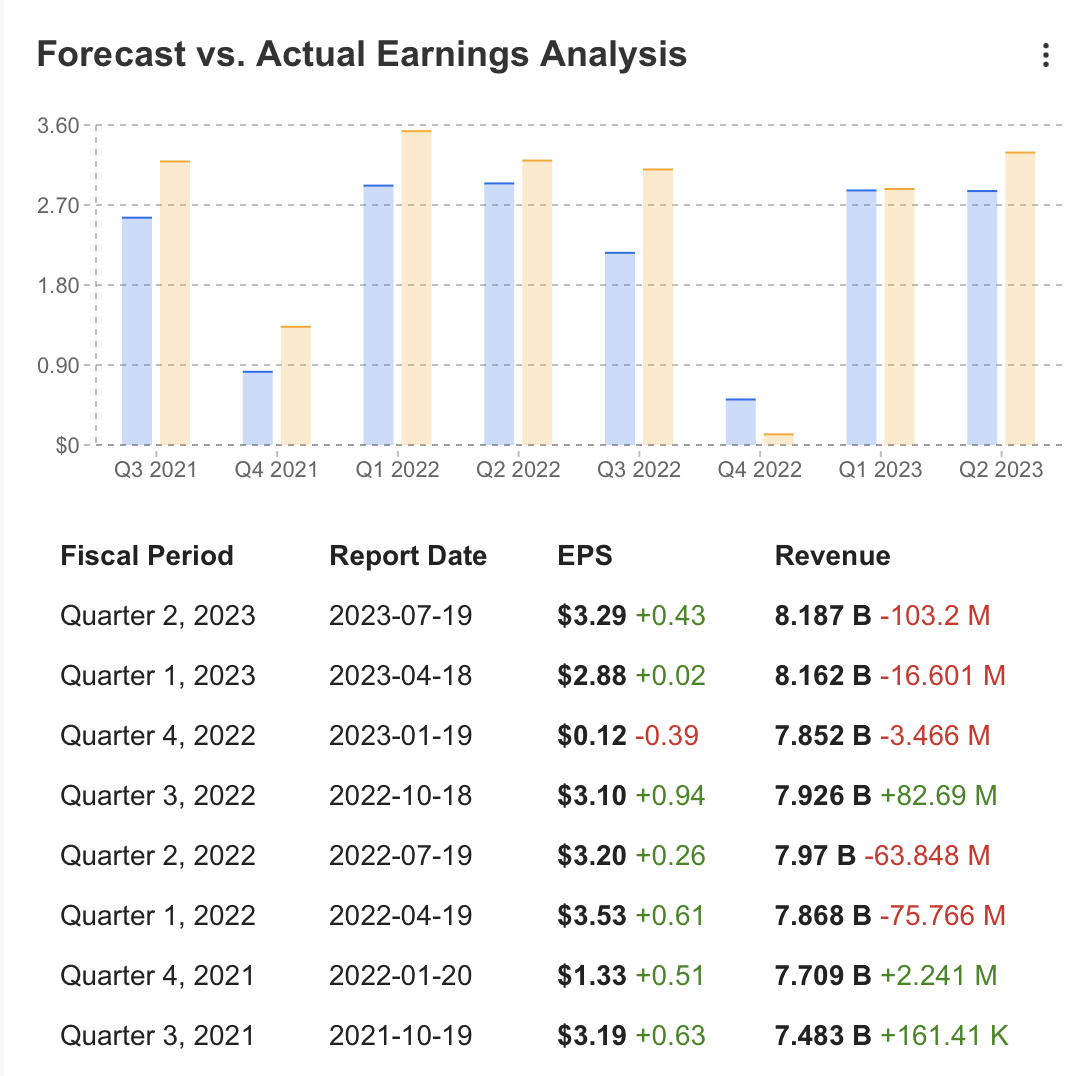

Earlier this week, Netflix (NASDAQ:) disclosed its second quarter , however to the dismay of buyers, the income fell in need of estimates.

The disappointing outcomes sparked a unfavourable response from Wall Avenue, prompting an 8.5% decline within the inventory. The reported income for the second quarter was $8.19 billion, lacking expectations by roughly $100 million.

Supply: InvestingPro

Netflix, regardless of saying income beneath expectations, managed to shock buyers with its revenue per share, which exceeded the InvestingPro forecast. The corporate reported a revenue per share of $3.29, surpassing the anticipated worth of $2.84 by a powerful 15%.

Supply: InvestingPro

The inventory skilled a pointy decline after the earnings report, which will be attributed to each lower-than-expected development and buyers cashing of their earnings. Nonetheless, regardless of the setback, the streaming big’s inventory has been on an uptrend because the second half of the earlier 12 months, boasting a powerful 48% enhance in worth because the starting of this 12 months.

To fight the growing competitors within the broadcasting trade, Netflix has adopted new methods to take care of its market share. One current instance is the introduction of an marketed content material tariff, providing a less expensive value whereas aiming to extend promoting revenues alongside the variety of subscribers. With this method, Netflix expects income development to select up tempo within the latter half of the 12 months.

As of June, the corporate had reached a powerful 238.4 million subscribers, gaining practically 6 million subscribers this quarter, far surpassing the expectations of 1.9 million. Regardless of the challenges confronted by the trade and the current disappointing earnings report, the general outlook stays optimistic, fueled by confidence in its strategic imaginative and prescient.

One vital problem is the continuing strike by Hollywood actors and writers, which has resulted in delays in quite a few film and tv productions. Nonetheless, because of its world broadcast manufacturing dynamics, Netflix is healthier positioned to navigate this problem in comparison with its opponents. Moreover, decreased funds for canceled broadcasts may probably enhance Netflix’s money stream by as much as $5 billion.

Trying forward, the forecasts for the rest of the 12 months are optimistic. Whereas income development for the final three months elevated by 2.7% in comparison with the identical interval final 12 months, it was perceived as gradual development. For the upcoming third quarter, Netflix is anticipating $8.5 billion in income, aligning with the forecast on the InvestingPro platform. The corporate’s major aim is to speed up development, though Q2 gross sales and Q3 income projections fall beneath some market forecasts. Nonetheless, Netflix cautioned that reaching this development would possibly take time.

Notably, 21 analysts have revised their views upwards on the platform, reflecting optimistic sentiment. The income expectation for the subsequent quarter stands at $8.51 billion, with an earnings per share forecast of $3.49.

Supply: InvestingPro

Long term forecasts for income and earnings per share on an annualized foundation are as follows:

Supply: InvestingPro

Income development for the corporate is predicted to be pushed by pricing changes, a rise in subscriber quantity, and a lift in promoting income. Though the promoting tariff, launched in November final 12 months, might not make a big contribution this 12 months, a gradual enhance is anticipated over time.

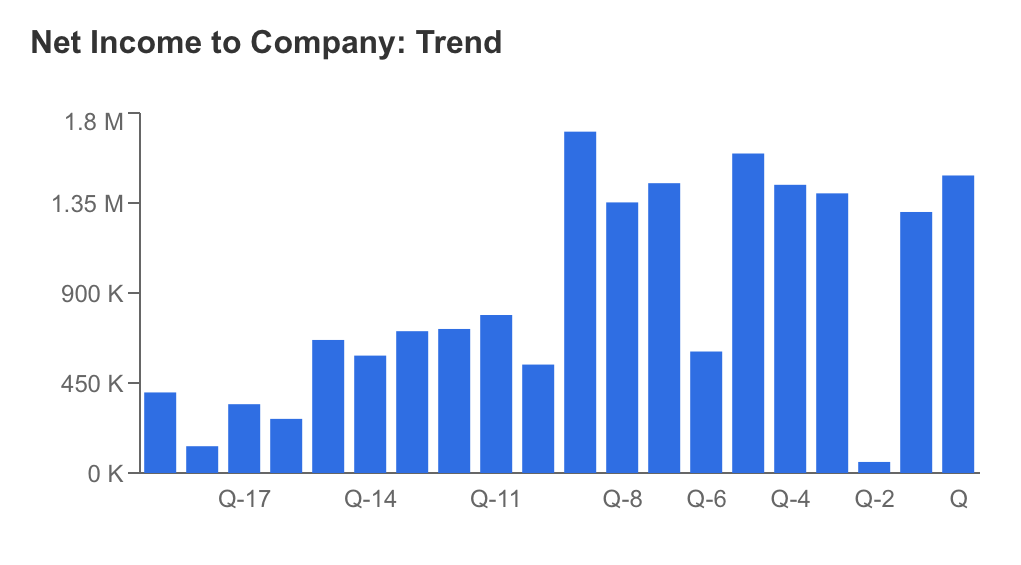

The Q2 outcomes showcased notable highlights within the firm’s profitability development and a substantial enhance in free money stream, reflecting optimistic developments in its monetary efficiency.

Supply: InvestingPro

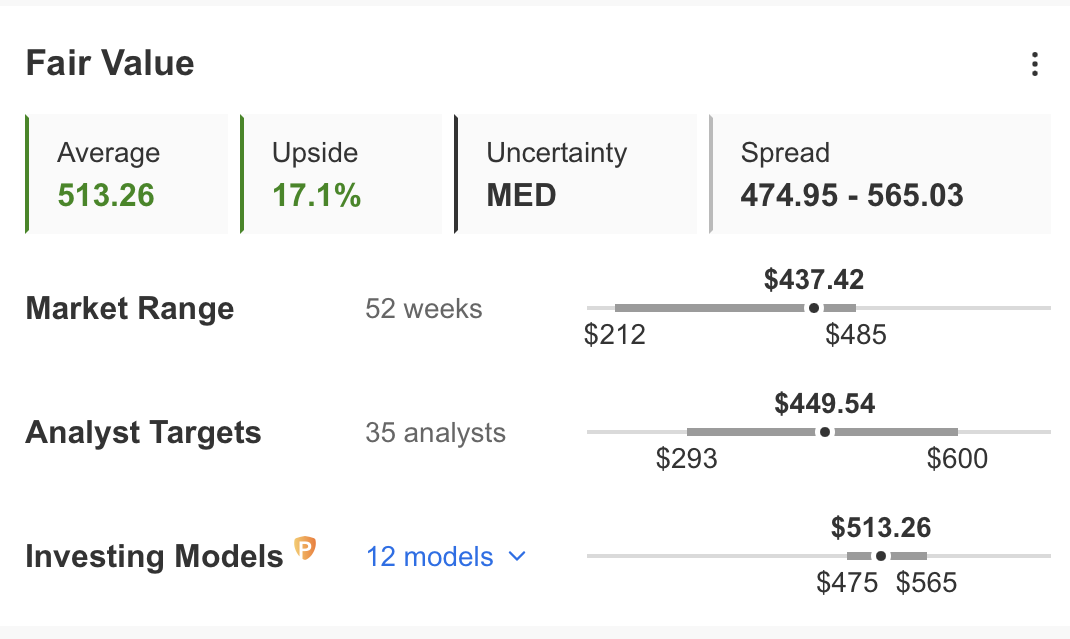

On the InvestingPro platform, the truthful worth estimates for NFLX point out a price of $513, calculated based mostly on 12 totally different fashions. This estimation means that the inventory is presently buying and selling at a 17% low cost in comparison with its present market value.

Moreover, contemplating the typical value forecast offered by analysts, the projected value stands at $450.

Supply: InvestingPro

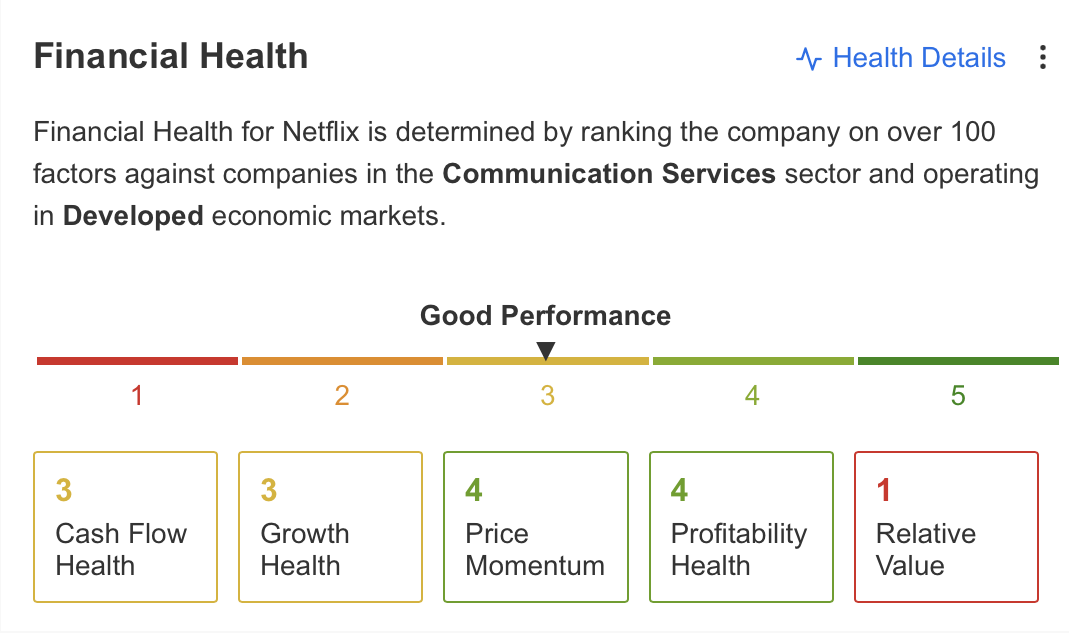

Netflix’s financials present a optimistic total outlook, with the corporate sustaining good efficiency. The share value momentum and profitability stay sturdy, whereas money stream and development are at common ranges presently. Nonetheless, the corporate continues to face challenges associated to its relative worth, which is seen as a hindrance to additional progress. Regardless of these obstacles, Netflix continues to reveal a wholesome efficiency in numerous points of its enterprise.

Supply: InvestingPro

The slowdown in income development is certainly seen as a regarding issue for Netflix. Nonetheless, buyers will intently observe the corporate’s dedication to specializing in development methods to deal with this situation. One other downside for buyers is the absence of dividend distribution.

Regardless of persistently rising its subscriber base, Netflix may not instantly obtain the income ranges that mirror this growth. Because of this, the corporate’s efficiency might proceed to be beneath scrutiny by long-term buyers, contingent on its skill to maintain regular development and navigate challenges throughout the trade. The corporate’s future prospects and its skill to beat sector-specific obstacles will play a vital function in figuring out its attraction to long-term buyers.

Netflix: Technical Outlook

The inventory has been in a optimistic development and in restoration mode over the previous 12 months. This restoration comes after a big and fast decline skilled within the first half of the earlier 12 months.

Taking a better have a look at the technical chart, it seems that the upward momentum has been progressively lowering over the previous month. Nonetheless, so long as the inventory maintains its help stage at round $430, the upward development may probably proceed.

However, there’s a important resistance stage at a median of $490, which has been performing as a big hurdle not too long ago. If the inventory manages to shut above this worth persistently on a weekly foundation, it could sign a powerful potential for additional upward motion. In such a situation, the inventory may intention for increased value ranges throughout the vary of $580 to $690 within the coming intervals.

Furthermore, the upward intersection of EMA (Exponential Shifting Common) values, together with the break of the $370 resistance in Could, provides energy to the general bullish development. In case of a possible correction, $370 may grow to be a key help stage to observe for.

***

Entry first-hand market knowledge, elements affecting shares, and complete evaluation. Benefit from this chance by subscribing and unlocking the potential of InvestingPro to boost your funding choices.

And now, you should buy the subscription at a fraction of the common value. Our unique summer season low cost sale has been prolonged!

InvestingPro is again on sale!

Get pleasure from unbelievable reductions on our subscription plans:

Month-to-month: Save 20% and get the flexibleness of a month-to-month subscription.

Annual: Save an incredible 50% and safe your monetary future with a full 12 months of InvestingPro at an unbeatable value.

Bi-Annual (Net Particular): Save an incredible 52% and maximize your earnings with our unique internet provide.

Do not miss this limited-time alternative to entry cutting-edge instruments, real-time market evaluation, and professional opinions.

Be a part of InvestingPro at present and unleash your funding potential. Hurry, the summer season sale will not final without end!

Disclaimer: Please notice that this text is only informational and doesn’t intention to advertise or encourage the acquisition of any property. It isn’t a solicitation, provide, advice, recommendation, counseling, or suggestion to spend money on any manner. We wish to remind you that each asset carries a excessive stage of threat and must be thought of from numerous views earlier than investing determination. The accountability of assessing the related dangers and investing determination lies solely with the investor.

[ad_2]

Source link