[ad_1]

Elena Uve

Lower than a month in the past on June 26, 2023, I wrote a bearish piece for Looking for Alpha masking bank card large Uncover Monetary Providers (NYSE:DFS) titled Uncover Monetary: Goldilocks Misplaced.

After the market shut on July nineteenth, DFS reported second-quarter earnings outcomes and the inventory dropped 15.92% on Thursday, July 20th, its first buying and selling day after the discharge. That is Uncover’s largest single-day decline in about three years.

The corporate missed Wall Road consensus earnings estimates for Q2, reporting $3.54 in earnings per share towards the $3.71 Wall Road had anticipated. Nonetheless, earnings weren’t the most important catalyst for the sell-off – DFS additionally revealed, beginning in mid-2007, it has been misclassifying sure bank card accounts, charging retailers greater charges than agreed for processing Uncover-branded playing cards.

Because of this misclassification, the corporate has arrange a $365 million legal responsibility to offer refunds and compensation to retailers overcharged on charges, has launched an inside investigation, and paused share buybacks below its $2.4 billion share buyback authorization as a result of expire on the finish of June subsequent 12 months.

And whereas the compliance concern was the principle driver of the post-earnings sell-off in DFS, and the subject of appreciable dialogue in the course of the Q&A session of the quarterly name, DFS additionally lowered steering for internet curiosity margins (NIMs) for the 12 months. That’s due, largely, to an increase in deposit prices, which is likely one of the draw back dangers I flagged in my article final month.

After Thursday’s drop, DFS trades at about 7.7 occasions consensus earnings estimates for 2023, which appears to be like cheap given the corporate’s historic valuation vary. Nonetheless, I see the inventory as a price lure on the present time and see a draw back threat to round $80.

Let’s begin with this:

Compliance Points at DFS

As I indicated above, DFS reported it began misclassifying sure card accounts in mid-2007, leading to overcharging retailers on processing charges.

The excellent news is the ensuing error over this 16-year interval quantities to lower than 2 foundation factors (0.02%) of gross sales, so it’s immaterial to monetary outcomes for all monetary reporting durations since that point and received’t require the corporate to restate outcomes.

As well as, the surplus charges charged relate solely to retailers, not cardholders.

Whereas the $365 million legal responsibility DFS set as much as reimburse retailers is a large sum, it’s manageable at lower than 11% of the anticipated internet revenue for 2023.

Nonetheless, I imagine this revelation offers rise to a number of considerations and uncertainties that can weigh on the inventory within the coming months.

First, that is the second compliance concern DFS has confronted in lower than a 12 months.

One 12 months in the past, on its Q2 2022 earnings convention name, DFS introduced it launched an inside investigation into mortgage servicing practices and regulatory compliance associated to its roughly $10 billion personal scholar mortgage portfolio. Pending the outcomes of that investigation, the corporate additionally briefly paused its share buybacks, sending the inventory down greater than 7% on the buying and selling day after the discharge.

In a November 2022 8-Ok submitting with the SEC, DFS introduced that it had concluded the investigation and would resume its share buybacks regardless that it was nonetheless in communication with workers at its regulators and is perhaps topic to further official critiques and investigations.

In fact, the cardboard misclassification concern introduced this month pertains to the corporate’s a lot bigger bank card enterprise.

And that’s not all.

DFS additionally introduced it has acquired a proposed consent order from the Federal Deposit Insurance coverage Company (FDIC) tied to client compliance points unrelated to this misclassification concern. Consent orders usually contain an settlement between an organization and its regulator to pay a fantastic, step up compliance efforts or handle what the regulator deems unsafe banking practices.

Generally consent orders even affect an organization’s capacity to return capital to shareholders by way of repurchases or dividends.

CEO Roger Hochschild had this to say in the course of the firm’s ready remarks on the decision:

Whereas the monetary impacts of this misclassification usually are not materials, it underscored deficiencies in our company governance and threat administration. We’re in discussions with our regulators relating to these issues. We now have acquired a proposed consent order from the FDIC in reference to client compliance, which doesn’t cowl the misclassification subject. We imagine further supervisory actions may happen.

Supply: Looking for Alpha Earnings Q2 2023 Name Transcript

In brief, it’s clear this isn’t simply an remoted incident or one associated solely to its ancillary scholar mortgage portfolio. Relatively, the corporate has acknowledged there are deficiencies in its governance and threat administration practices that should be addressed and that further actions from regulators are doubtless.

Because it’s an energetic regulatory motion, administration was unable to supply a lot further element on the consent order it acquired from FDIC or the form of cures they is perhaps pressured to just accept.

Additionally, critically, DFS was unable to supply particular steering as to how lengthy the cardboard misclassification concern would take to resolve, or when it would be capable to resume share buybacks. As you may anticipate, analysts on the decision tried to tease some further element out of the corporate in a number of alternative ways however have been largely unsuccessful.

The one remark the CEO made was that there’s a hyperlink between final 12 months’s scholar mortgage compliance points, the cardboard classification concern, and the corporate’s broader compliance and threat administration points referenced within the quote above.

At a minimal, this revelation will act as a headwind, and a supply of uncertainty, for DFS inventory till there’s some concrete announcement relating to the consent order with FDIC or a resumption of share buybacks following an inside investigation of the cardboard misclassification concern.

Final 12 months, the corporate paused share buybacks for a complete of about 4 months from July to November whereas it took steps to research its scholar mortgage compliance points.

The end result was noticeable however manageable:

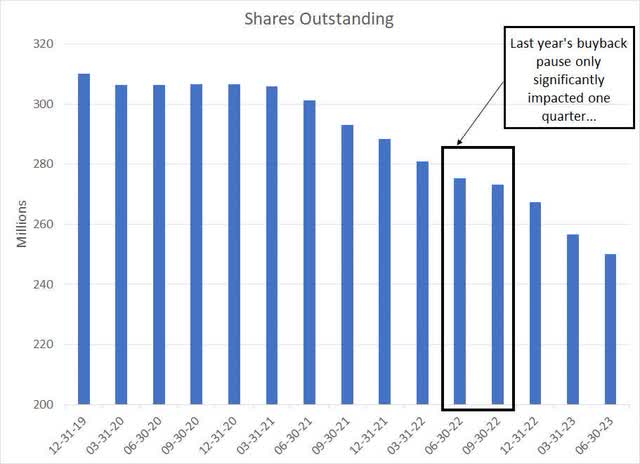

Complete DFS Shares Excellent (Bloomberg)

As you’ll be able to see, DFS has been repurchasing vital shares every quarter from Q1 2021 thus far, however the drop within the share depend slowed briefly between Q2 and Q3 2022 because of the pause in buybacks following the scholar mortgage concern.

There’s no approach to know at the moment how lengthy the present pause will final. Nonetheless, in keeping with Bloomberg, the consensus on Wall Road heading into the discharge this week was that DFS’s share depend would drop from round 250 million immediately to slightly over 240 million by the tip of this 12 months and 233 million by Q2 2023.

In fact, earnings per share (EPS) is outlined as revenue divided by shares excellent, so share buybacks have the impact of lowering the denominator of that equation and boosting EPS. The roughly 6% to 7% decline within the share depend analysts had anticipated by means of to the center of subsequent 12 months was a tailwind for EPS estimates that’s now in query.

A brief pause in share buybacks like we noticed final 12 months would have solely a minor affect on the outlook for EPS; nonetheless, if the corporate is pressured to pause or sluggish buybacks over an extended time to handle compliance points the affect could possibly be extra significant.

And it’s prone to be months earlier than we’ve further readability on this concern.

There’s an extra actual financial affect within the type of greater prices. In Q2 2023, the corporate’s working bills jumped $181 million year-over-year to $1.404 billion, up 15% year-over-year and a pair of% in comparison with Q1 2023. In the course of the name, administration famous the first driver of this enhance was a leap in bills associated to its compliance administration methods, a direct results of the compliance weaknesses administration has recognized.

Additional, DFS introduced it now expects working bills to rise within the low double-digits this 12 months in comparison with prior steering for a lower than 10% enhance. In the course of the name, the corporate clarified that steering saying it sees compliance and associated prices up round $200 million from 2022 to 2023 with an elevated degree of spend persevering with into 2024.

Yet another trade in the course of the firm’s Q2 Convention Name Q&A caught my eye:

Query: A follow-up simply on compliance having adopted Uncover for a really long-time. Popping out-of-the nice monetary disaster, there was loads — massive funding in compliance throughout the trade, together with at Uncover, has it turn into harder. I imply, I do know there’s been a quantity, fairly a couple of consent orders put out by regulators, however has it turn into — are you able to possibly give us some colour on what you are investing in compliance immediately, if it is folks or share of bills versus traditionally and has it turn into much more troublesome?

Reply from CEO Roger Hochschild: Yeah, it actually is a difficult setting, however I am not going responsible that. Proper. As I look again, I do imagine we under-invested. And that is one thing I take accountability for. However we’re very targeted on it now. And as John, I believe spotlight, that funding takes many types, proper from bringing in some extremely proficient of us throughout the compliance space, constructing out our monitoring and controls. Investments on the know-how aspect to standardize, simplify, and automate guide processes. As you consider it, compliance and lots of the oldsters, its threat administration, proper. And historically, we’ve been very sturdy round credit score threat administration, round liquidity threat administration, however haven’t essentially made the investments we would have liked, particularly because the complexity of our enterprise elevated, as we obtained into extra new merchandise. I believe there was a spot there when it comes to our capabilities and that is what we’re targeted on now.

Supply: Looking for Alpha Uncover Q2 2023 Convention Name Transcript

This query hints on the potential for the connection between monetary firms and regulators to turn into extra hostile as was the case following the Nice Recession and monetary disaster of 2007-09. Definitely, the regional banking disaster earlier this 12 months and the related collapse of Signature Financial institution and SVB Monetary has prompted calls from Washington for better regulation and better capital necessities.

CEO Hochschild allowed that the present setting is “difficult.” He then went on to do a “mea culpa,” taking the blame for the very fact DFS underinvested in know-how and compliance-related methods as its enterprise grew extra advanced through the years.

The present CEO, Roger Hochschild, has served in that function since 2018 and, earlier than that, he was COO of DFS from 2004 by means of 2018. So, he’s skilled and, through the years, DFS has been an impressive performer and one of many extra environment friendly operators within the enterprise. So, the standard of administration leads me to imagine the corporate will handle compliance inadequacies over time.

Nonetheless, at a minimal, DFS is 1 / 4 two of lowered (or non-existent) share buybacks, elevated bills, and potential regulatory fines or restrictions in an setting the place regulators are seemingly turning into extra aggressive in the direction of the trade.

The actual fact that is the second time in a 12 months DFS has opted to pause buybacks to handle a compliance concern clearly raises dangers.

That’s lots of uncertainty and a big headwind for the inventory, particularly at a time within the financial cycle when there are already considerations about internet curiosity margins and credit score high quality. I imagine these latter points may finally show extra critical than the compliance and regulatory challenges DFS at the moment faces.

And that brings me to this:

Rising Deposit Prices

Uncover is a financial institution within the enterprise of taking in deposits from prospects and loaning that cash again out, primarily within the type of bank cards but additionally private and scholar loans.

Internet curiosity revenue (NII) represents the full quantity of revenue DFS generates in curiosity prices much less curiosity paid out to depositors. The Internet Curiosity Margin (NIM) represents DFS’ revenue margins – it’s the corporate’s internet curiosity revenue divided by common mortgage balances (or common incomes belongings).

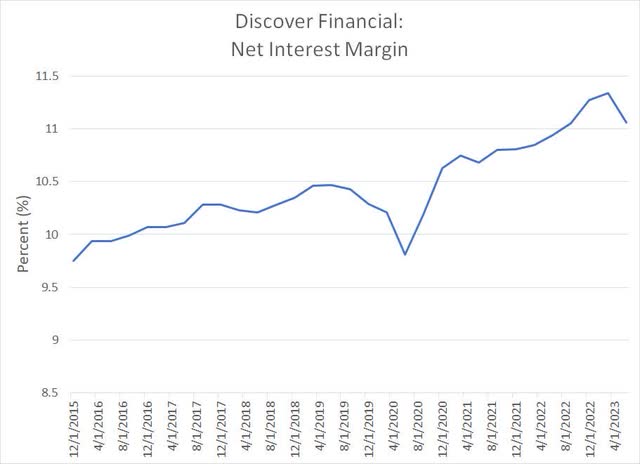

Right here’s a have a look at NIMs over the previous few years:

DFS Internet Curiosity Margin (NIM) (Bloomberg)

In This fall 2022 final 12 months, DFS’ reported NIM – primarily based on NII divided by common loans steadiness — was 11.27%, rising to 11.34% in Q1 2023. Prior steering from DFS was for NIM to be “modestly greater” in 2023 vs the total 12 months 2022 (11.04% for the total 12 months). As you’ll be able to see, DFS NIM dropped to 11.06% in Q2, and administration has adjusted its steering to “round 11%” for full-year 2023.

There are two primary drivers of NIM – the curiosity charged on loans and the curiosity paid on deposits. Each have contributed to the deterioration in DFS NIM steering for 2023 although it appears the deposit aspect of the equation was the larger mover.

Right here’s the issue:

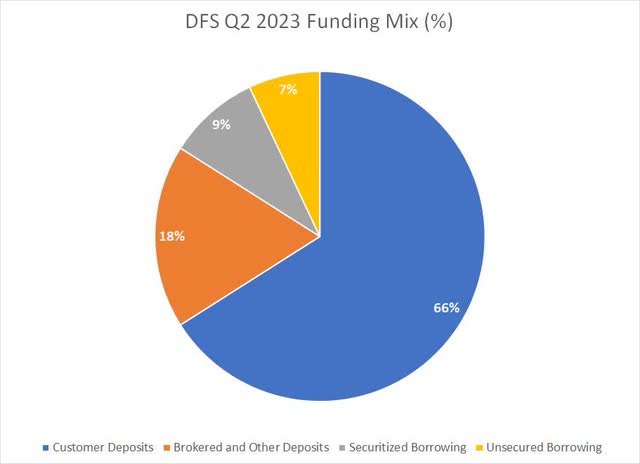

DFS Funding Combine Q2 2023 (Uncover Monetary)

This chart exhibits the corporate’s funding combine in Q2 2023. As you’ll be able to see, about two-thirds of funding got here from direct buyer deposits, which represents customers opening checking or financial savings accounts with DFS. Three years in the past, direct buyer deposits accounted for simply over half complete funding.

That is usually the most cost effective and most secure supply of funding for DFS and, over time, administration has stated it targets 70% to 80% of its funding combine from deposits.

Unsecured borrowing represents borrowing totally on the interbank market. Usually, this supply of funds carries the next price and is much less secure – for instance, this market fully dried up at occasions again within the monetary disaster of 2007-09 resulting in liquidity points at banks too uncovered to this supply of funding. Happily, unsecured lending solely accounted for about 7% of funding in Q2.

Securitized borrowing represents DFS packaging portfolios of bank card receivables into securities on the market to different monetary establishments or buyers in a lot the identical method as banks bundle portfolios of mortgages into mortgage bonds. Promoting these securities generates capital to fund DFS operations.

Lastly, there’s brokered deposits at 18% of funding. A deposit dealer is a 3rd social gathering that acts as an middleman between depositors and a financial institution. The financial institution usually sells giant deposits to the dealer who then divides these deposits into smaller chunks for resale to people or smaller banks.

It’s a simple approach to enhance funding; nonetheless, the issue is that brokered deposits are usually extraordinarily rate-sensitive – these are people seeking to earn a barely greater yield on their deposits with no long-term relationship or loyalty to the financial institution accepting their funds. Whereas customers with checking or financial savings merchandise are “sticky” as a result of they’re detest to maneuver their cash for a couple of foundation factors of additional yield, that’s not true for brokered deposits.

Two factors listed below are worrisome for my part.

First, whereas DFS’ funding combine is wholesome in the mean time, the direct-to-consumer deposit share was 70% in Q2 2022, and brokered deposits have been simply 11% in comparison with 66% and 18% respectively immediately. So, DFS is clearly relying extra on higher-cost deposits for funding than it was in the identical quarter final 12 months.

Additional, whereas direct-to-consumer deposits are extra secure and usually cheaper, that doesn’t imply prices aren’t rising. In Q2 2023, DFS famous its internet funding fee – principally the price of all these sources of funding – was up 39 foundation factors (0.39%) quarter-over-quarter primarily pushed by client deposit pricing.

As I defined in my June twenty sixth article on DFS, the yield on most cash market funds is north of 5% r and 3-month Treasury Payments yield 5.4% proper now. That compares to lower than 2.5% for each cash market funds and T-Payments one 12 months in the past in July 2022, so depositors have loads of low-risk, or risk-free, methods to generate stable yields with their extra money.

To draw deposits banks like DFS should supply aggressive yields and that spells rising prices of buyer deposits and total funding.

Here is what CFO John Greene needed to say about deposit prices in the course of the DFS Q2 2023 name:

Second, when it comes to deposit competitors, we had stated that we thought that the beta would are available someplace round 60% to 70%. What we have seen in late within the first quarter and into this quarter was our aggressive set being extra aggressive when it comes to value will increase. And as I’ve communicated up to now, we do not search to be a value chief right here. We attempt to compete on our model, our buyer providing, our digital belongings which are top notch with a purpose to appeal to deposit prospects. And we have been very profitable as you’ll be able to inform by the numbers there. However a part of the proposition can also be value. So what we’re seeing now could be betas prone to be north of 70% which is impacting internet curiosity margin to the extent I simply talked about within the steering level. So these two components are enjoying most considerably on the revised outlook.

The time period “deposit beta” refers back to the sensitivity of a financial institution’s deposit prices to brief time period rates of interest.

As a tough instance, suppose the Fed have been to lift rates of interest by 100 foundation factors (1%) over the course of 1 / 4 and a financial institution raises deposits by 50 foundation factors (0.50%) over the identical time interval. That might suggest a deposit beta of about 50%.

So, what DFS is saying right here is that their prior steering was for a 60% to 70% deposit beta relative to will increase briefly time period rates of interest and now they’re in search of “north of 70%.” That’s a serious purpose they reduce their internet curiosity margin steering.

That is to be anticipated. When charges have been ultra-low again in early 2022 and the Fed was creating deposits within the banking system by way of quantitative easing, there was little competitors for deposits. Right now, as the speed cycle has matured and charges are rising, customers have begun to acknowledge their high-yield options and banks are pressured to lift charges to retain deposits.

Even JPMorgan Chase (JPM) acknowledged this threat of their Q2 2023 name on Friday July 14th:

Query: Good morning. So I imply in your camp that ultimately customers will need extra deposit fee sensitivity right here, however I suppose what would make you alter your charges meaningfully? So the highest two banks have about 50% client market share, loan-to-deposit ratios are low, your outlook for mortgage progress, and I believe others, it is pretty sluggish, at the very least exterior of card. So I get that it’s normal sense and that is what we have seen traditionally, however there actually is this type of massive divergence amongst massive banks and everyone else the place the massive banks simply need not pay that a lot for deposits for a slew of causes. So what would make you alter that?

Reply, Jamie Dimon, CEO JP Morgan: I believe each financial institution is in a special place about what they want. And so you have got an entire vary of outcomes. However keep in mind, we do that additionally by metropolis. So you have got totally different competitors in Arizona and Phoenix than you have got in Chicago, Illinois. And we do have excessive rate of interest merchandise. So it is a mixture of all these issues. I would not name it a giant financial institution or a small financial institution. And you are going to see each time we report who type of paid up slightly bit extra for issues and who did not and issues like that. So look, guys, I might take it as a given. I believe it is a mistake. There may be little or no pricing energy in most of our enterprise and betas are going to go up. You’re taking it as a given. There is no such thing as a circumstance that we have ever seen within the historical past of banking the place charges did not get to a sure level that you just needed to have competing merchandise. And charges go from migration or direct charges or motion to CDs or cash market funds and we will need to compete for that. You already see it in elements of our enterprise and never in different elements.

Supply: JP Morgan Q2 2023 Convention Name Transcript

Turmoil within the regional banking system earlier this 12 months triggered a shake-up within the US deposit market. Whereas the FDIC ultimately stepped up and assured all deposits for SVB Monetary and Signature Financial institution, there have been fears again in March uninsured depositors – these with deposits above the $250,000 FDIC insurance coverage cap– may lose their funds as banks failed.

Bigger banks like JP Morgan are often called systemically vital monetary establishments (SIFIs) and are topic to far more stringent rules and capital necessities than smaller regional establishments. They’re thought of “too massive to fail.”

Thus, turmoil within the regional banks prompted some prospects to take away deposits from regional banks and relocate their money to SIFIs like JPM which are thought of safer:

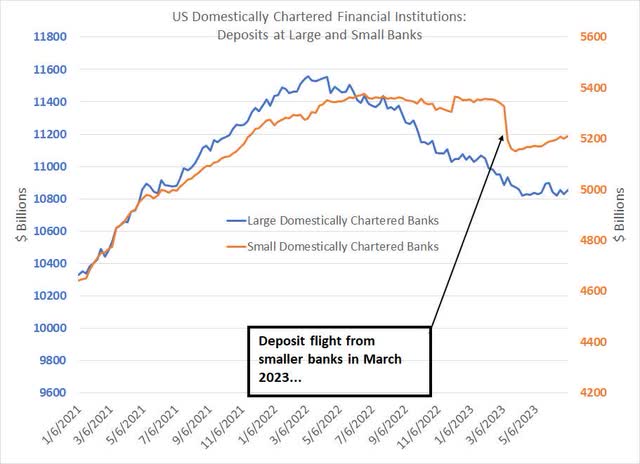

Deposits Held at US Banks (Federal Reserve H8 Report, Bloomberg)

Each Friday night after the 4:00 PM Japanese inventory market shut, the Federal Reserve releases its H.8 report that particulars all belongings and liabilities held within the US banking system.

The chart above exhibits complete deposits held at domestically chartered US banks for the reason that finish of 2020 damaged down by the most important US banks and smaller establishments.

Deposits throughout the whole banking methods have been falling for the reason that spring of 2022 because the Federal Reserve started quantitative tightening (QT); certainly, draining deposits is the aim of QT. Nonetheless, you’ll be able to see the sharp drop decrease in deposits at smaller banks in March contemporaneous with the regional banking disaster.

Deposits held by bigger banks have remained comparatively flat since that point as a result of a number of the deposits fleeing regionals merely was positioned on deposit at bigger banks like JPM.

My level is that if JPM faces rising prices to draw deposits, the scenario is even worse for smaller establishments like DFS. And CEO Jamie Dimon makes it abundantly clear that’s what’s taking place – he tells the analyst asking the query to “take it as a given” that deposit betas will rise as competitors for deposits heats up.

Valuations, Goal and Dangers

DFS, like all financials, is a cyclical firm with vital leverage to financial circumstances and the credit score cycle.

Within the final cycle from roughly 2011 by means of 2019, DFS traded in a spread from about 6.75 occasions to 12 occasions ahead earnings estimates as I outlined in my June article right here. As of Thursday’s shut, DFS offered for about 7.7 occasions ahead earnings estimates, close to the low finish of that historic mid-cycle vary.

Nonetheless, don’t be fooled, I imagine DFS represents a price lure on the present value.

First, the pause the share buybacks of indeterminate size represents a significant deterioration within the outlook for earnings per share in 2023 and 2024 for the straightforward purpose {that a} greater share depend reduces the denominator of the online revenue/shares excellent calculation. As analysts revise decrease their EPS estimates for 2023/24 accordingly that can have the impact of boosting DFS’s ahead valuation a number of on a P/E foundation.

Second, whereas the main focus of the DFS name was the corporate’s compliance points, the associated period of the pause in buybacks, and potential regulatory fines or restrictions, I imagine the larger concern over the intermediate time period is prone to be the flip within the cycle attributable to rising deposit prices and shrinking internet curiosity margins.

Lastly, throughout recessions as client spending slows and earnings contract price-to-book is a greater metric for assessing worth than value to earnings. That’s as a result of, by definition, a cyclical inventory will look low-cost close to the highs when earnings are inflated and costly close to the lows as a result of depressed profitability.

In prior financial contractions, DFS has usually troughed with a price-to-book ratio below 1.25 occasions. Present consensus for DFS’s year-end 2024 ebook worth is about $64 per share, in order that equates to a goal of roughly $80 per share, the identical goal I outlined on the finish of final month.

That also implies vital draw back for the inventory even when it is capable of resolve its compliance points on a well timed foundation.

[ad_2]

Source link