[ad_1]

ipopba

Jackson Monetary Inc. (NYSE:JXN) is a $2.8-billion market cap financial institution that primarily presents annuities to retail traders within the U.S. The corporate operates via 3 enterprise segments, in keeping with the newest 10-Q submitting [“Corporate and Other” excluded]:

Retail Annuities [72% of total sales] section presents numerous retirement merchandise, together with variable annuities, mounted index annuities, and payout annuities, distributed to high-net-worth traders and the mass market; Institutional Merchandise [5.8%] section contains Assured Funding Contracts (GICs), funding agreements, and medium-term notice funding agreements. Its monetary efficiency is dependent upon incomes a diffusion between funding charges and curiosity credited on these merchandise: Closed Life and Annuity Blocks [20.1%] section contains acquired blocks of enterprise, together with life insurance coverage and annuities. Its profitability is influenced by correct pricing, underwriting, and incomes a price of return on supporting property.

Jackson Monetary sells its merchandise via a distribution community that features unbiased broker-dealers, banks, monetary establishments, and insurance coverage brokers. The corporate was previously referred to as Brooke (Holdco1) Inc. and altered its title to Jackson Monetary Inc. in July 2020.

In Q1 2023, Jackson showcased fairly combined monetary efficiency so far as I see it. The corporate reported adjusted working EPS of $3.15, which was 7% and 24.8% decrease QoQ and YoY, respectively. Regardless of dealing with losses on working derivatives attributable to fluctuations in fairness markets and rates of interest, Jackson’s threat administration technique successfully protected unfold earnings from the impression of decrease rates of interest, in keeping with the administration’s commentary throughout the latest earnings name.

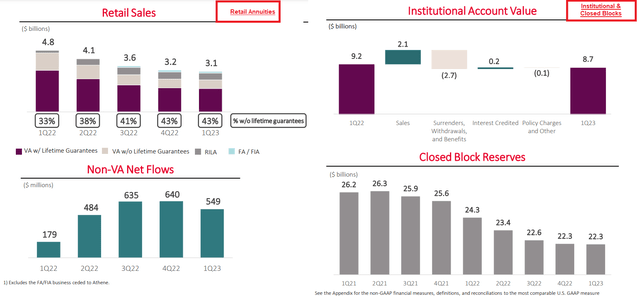

Within the Retail Annuities section, gross sales reached a considerable $3.1 billion through the quarter. Notably, variable annuity gross sales remained regular, whereas there was outstanding progress in mounted and fixed-indexed annuity gross sales. This section benefited from variable bills and decrease asset-based commissions, which led to a commendable 7% decline in working prices. Furthermore, the introduction of Registered Index-Linked Annuities (RILA) via Market Hyperlink Professional was a key contributor to the corporate’s distribution growth and diversification technique, producing spectacular gross sales of $533 million throughout Q1. The Institutional section additionally demonstrated its significance, reporting gross sales of $649 million, emphasizing its function in offering diversification advantages and supporting statutory capital technology.

JXN’s IR supplies, creator’s notes

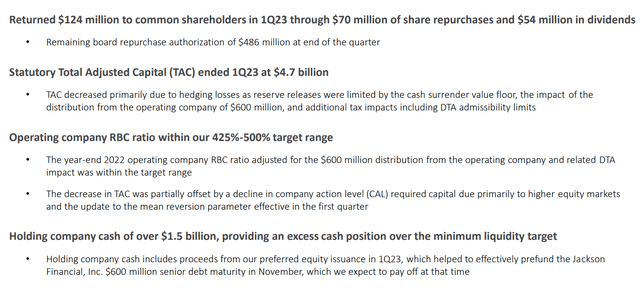

Strategically, Jackson’s give attention to capital return proved to be a cornerstone of its success. The corporate displayed a powerful dedication to its shareholders, already returning $124 million via dividends and share repurchases throughout Q1.

JXN’s IR supplies for Q1 FY2023

Transferring ahead, Jackson goals to attain an much more substantial capital return of $450 million to $550 million for the complete 12 months, reinforcing its dedication to delivering worth to its traders, in keeping with the earnings name transcript generously shared by Looking for Alpha Premium.

Additionally, JXN made strategic strikes to boost its market positioning, capitalizing on the upper rate of interest atmosphere. Enticing modifications to its conventional variable annuity product choices aligned with pricing and return necessities, creating alternatives for progress and assembly the wants of purchasers and monetary professionals. The rising success of Jackson’s RILA market – RILA 1Q23 account worth has elevated over 8x when in comparison with 1Q22 – performed a pivotal function in its distribution growth and diversification technique, forging invaluable partnerships with monetary professionals and their purchasers.

Nevertheless, administration’s constructive outlook did not impress the market a lot. Wall Avenue analysts revised their Q2 2023 estimates downward instantly after the earnings name, and the inventory itself fell greater than 15% on its Q1 report launch, persevering with its native downward development:

TrendSpider Software program, creator’s notes

Including gas to the hearth was the latest information that JXN confronted a hacking assault. In response to the 6-Okay report, it was a cybersecurity incident involving a software program vulnerability at a third-party vendor known as Pension Profit Info, LLC, which Jackson makes use of to go looking databases and establish beneficiaries for insurance coverage insurance policies. The vulnerability allowed an unknown actor to entry PBI’s programs and procure personally identifiable info of roughly 700,000 to 800,000 of Jackson’s prospects.

The corporate states that, based mostly on their preliminary evaluation, they don’t imagine the incident may have a big damaging impression on their enterprise, operations, or monetary outcomes. However in my view, the damaging sentiment itself had already fashioned and put additional stress on the JXN share.

Though the corporate is at the moment going via a collection of difficulties attributable to hedging losses on freestanding derivatives within the first quarter and cybersecurity dangers, this take a look at seems to be short-term for JXN.

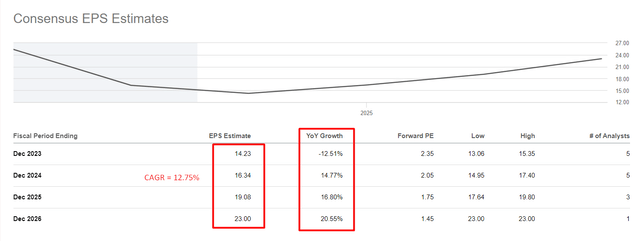

First, judging by Wall Avenue estimates, which have been falling recently, the Q1 numbers have been the low level by way of EPS. In Q2, EPS ought to be $3.49, up 10.8% QoQ and 38.65% YoY. Additionally, we see stabilization however an upward development in full-year EPS numbers over the following 4 years [CAGR = 12.75%]:

Looking for Alpha knowledge, creator’s notes

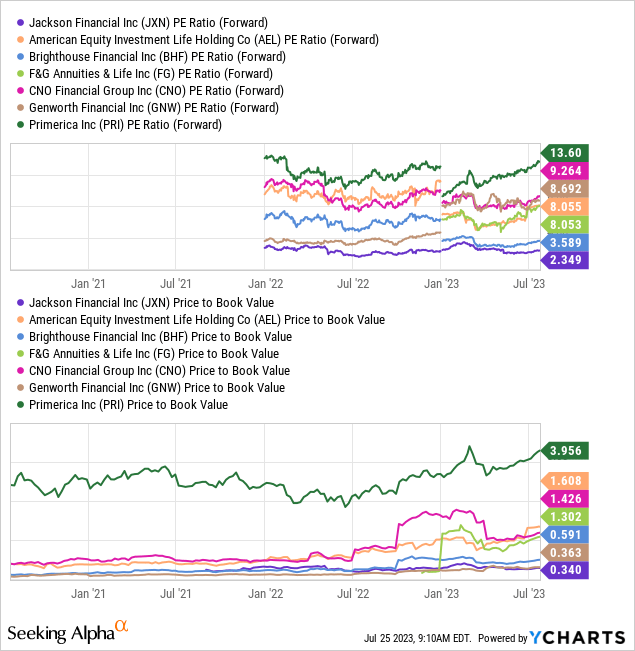

Second, JXN’s valuation is simply too low cost to disregard. And that is not as a result of the corporate’s P/E ratio is <2.4x and the corporate right this moment trades at simply 0.34 of its guide worth [the lowest multiples in its peer group].

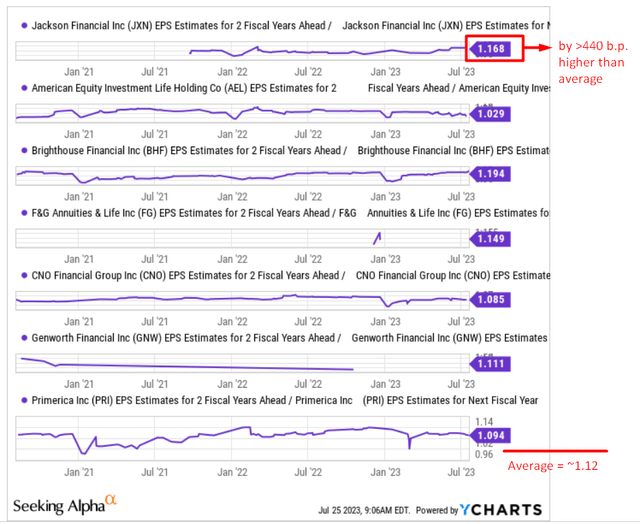

Such modest multiples may clarify the deterioration in future EPS. Nevertheless, this is not the case for JXN, as my calculations counsel that the corporate’s EPS progress price in FY2025 can be 440 foundation factors increased than its friends’ ones:

YCharts, creator’s notes

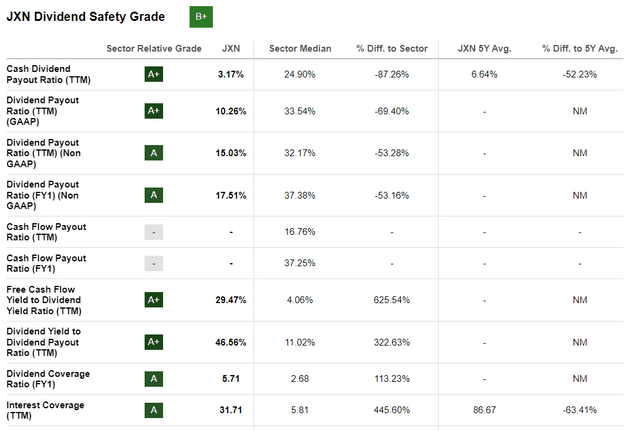

Third, if we assume that the hedging losses in Q2 and Q3 aren’t repeated on an analogous scale as in Q1, then the present next-year dividend of seven.42% seems greater than secure judging by what the dividend security ratios appear like:

Looking for Alpha Premium

Threat Components To Think about

In fact, investing in JXN inventory entails varied key dangers that I would prefer to level out earlier than concluding.

Firstly, the corporate’s enterprise is delicate to rate of interest modifications, which can impression demand and pricing for annuity merchandise, affecting income and profitability.

Secondly, market fluctuations attributable to financial circumstances, geopolitical occasions, and investor sentiment may cause the worth of JXN’s inventory to fluctuate. Moreover, being in a closely regulated business, JXN faces regulatory and authorized dangers that might have an effect on its operations and monetary efficiency. Competitors, financial downturns decreasing annuity demand, funding efficiency, credit score dangers, longevity dangers, and modifications in laws related to insurance coverage and annuities additionally pose potential impacts on JXN’s monetary efficiency and operations.

Lastly, the danger of cybersecurity breaches and knowledge theft may result in reputational harm, regulatory penalties, and monetary losses for the corporate. We do not know the true impacts of the June 2023 incident – we’ll see how JXN’s financials are doing by Q2 outcomes on August 8, 2023.

The Backside Line

Based mostly on all of the above, and regardless of all of the dangers, I feel the worst might already be over for JXN. The sharp sell-off within the inventory [-32% off-high currently] has returned JXN to the cheapness it had earlier than the outstanding rally through the second half of 2022. I feel that the continued improvement of Jackson’s RILA market, which has already proven its fruits within the first quarter, will permit the financial institution to take care of a reasonably secure place within the business and proceed to purchase its shares from the market at giant reductions to guide worth, with out forgetting the dividends.

So I price JXN as a “Purchase” right this moment.

Thanks for studying!

[ad_2]

Source link