[ad_1]

Tomorrow, long-standing dividend corporations will announce their earnings.

Forward of the earnings, Colgate-Palmolive inventory is present process a consolidation

In the meantime, Proctor & Gamble inventory faces resistance, and AstraZeneca inventory has first rate upside potential

As earnings season begins to wind down for the expansion giants, it’s time for buyers to show a few of their consideration again to the dividend-paying worth giants of the market, with Colgate-Palmolive (NYSE:), AstraZeneca (NASDAQ:), and Procter & Gamble (NYSE:) all poised to ship necessary stories over the subsequent few market periods.

Forward of the report, Colgate-Palmolive’s inventory has been present process consolidation for over two months, indicating anticipation of a possible breakout following tomorrow’s earnings.

In the meantime, AstraZeneca’s inventory has confronted challenges pushed by damaging sentiment surrounding scientific trial outcomes. Buyers can be intently watching the forthcoming earnings report for potential insights concerning this.

Lastly, Procter & Gamble continues to keep up its fame as a stalwart defensive firm, sustaining stability through the years and interesting to buyers in search of a defensive addition to their portfolio.

Let’s take a more in-depth have a look at every of those corporations individually to evaluate their monetary efficiency going into earnings.

1. Colgate-Palmolive: Time to Break Out of Consolidation?

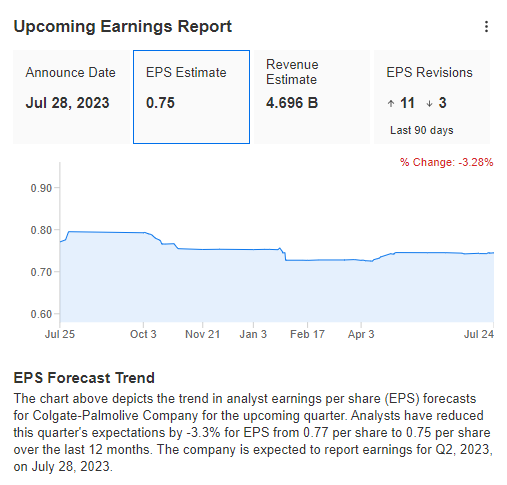

Colgate-Palmolive, a well known client staples firm, is gearing as much as unveil its extremely anticipated third-quarter 2023 outcomes this Friday. Market forecasts counsel that the corporate’s earnings per share are anticipated to succeed in $0.75, accompanied by spectacular revenues of $4.696 billion.

CL Upcoming Earnings

Supply: InvestingPro

For over two months, the inventory has remained in a neighborhood consolidation section, making a state of affairs the place better-than-forecast readings in tomorrow’s report may probably set off a breakout in an upward path.

CL Worth Chart

Wanting on the larger image, the inventory continues to be following a long-term uptrend, albeit inside a broader correction sample. This means that regardless of the short-term consolidation, the general trajectory of the inventory stays optimistic, and there may be potential for a rally.

CL Worth Chart

Breaking the higher restrict of the long-term flag formation, on this case, can be essential for the continuation of the uptrend.

2. AstraZeneca’s Inventory Has Continued to Climb

Earlier this month, AstraZeneca launched a report on the outcomes of a scientific trial for a brand new lung most cancers drug developed in collaboration with Japanese firm Daiichi Sankyo (TYO:). Nonetheless, the findings disillusioned buyers as they did not verify a clinically important consequence.

The drug was additionally anticipated to match or surpass the success of its predecessor, Enheret, which raised hopes amongst buyers.

However, AstraZeneca stays decided to proceed the research and plans to submit a complete report back to regulatory authorities for evaluate. Regardless of the preliminary setback, the corporate holds optimism for the drug’s future potential.

Relating to earnings per share, the projections have remained unchanged for the reason that Q1 , with the present studying at $0.97 per share, in comparison with the earlier determine of $0.96. Curiously, the market has seen patrons making up a number of the losses, suggesting a possible continuation of the upward development.

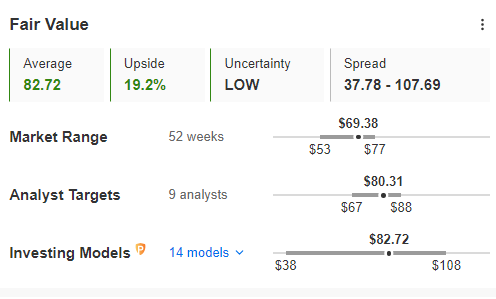

The truth is, truthful worth assessments present almost 20% upside potential for the inventory, indicating a optimistic outlook. Regardless of the current challenges within the scientific trial, buyers might discover causes to stay hopeful in regards to the firm’s prospects going ahead.

AZN Truthful Worth

Supply: InvestingPro

3. Procter & Gamble Inventory Faces Resistance

Procter & Gamble is a well known and extremely regarded client staples firm. Famend for its sturdy model presence available in the market, it serves as a dependable selection for a defensive portfolio place.

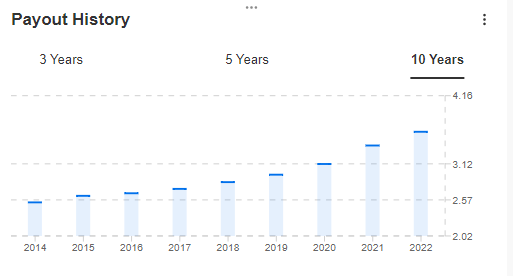

One notable side of Procter & Gamble is its spectacular dividend cost historical past, which stands because the longest among the many three corporations analyzed. Over the previous decade, the corporate has constantly elevated its dividends, additional including to its enchantment to income-seeking buyers.

With its strong fame, steady efficiency, and constant dividend progress, Procter & Gamble continues to be a lovely choice for buyers in search of a dependable and defensive addition to their portfolio.

PG Dividend Payout Historical past

Supply: InvestingPro

Tomorrow’s earnings are more likely to present a continuation of the current development the place earnings per share deviations have been comparatively small. Buyers can be paying shut consideration to any steerage or forecasts supplied by the corporate for future reporting durations, as these can have a big affect on market sentiment.

The present base state of affairs means that the upward development will proceed, and if the inventory manages to interrupt via the $158 per share stage, it may open the trail for an try to succeed in the historic highs set in the beginning of final yr.

PG Worth Chart

***

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel, or suggestion to take a position as such it isn’t supposed to incentivize the acquisition of belongings in any means. As a reminder, any kind of asset is evaluated from a number of factors of view and is very dangerous and, subsequently, any funding determination and the related threat stays with the investor. The writer owns the shares talked about within the evaluation.

[ad_2]

Source link