[ad_1]

Editor’s be aware: Looking for Alpha is proud to welcome Jevic Kandolo as a brand new contributor. It is simple to grow to be a Looking for Alpha contributor and earn cash in your greatest funding concepts. Energetic contributors additionally get free entry to SA Premium. Click on right here to search out out extra »

Blade_kostas/iStock through Getty Pictures

The leisure automobile business, through which THOR Industries (NYSE:THO) operates, has a historical past of cyclical shopper demand pushed by financial and demographic situations.

For the fiscal 12 months ending 2023, THOR Industries has skilled difficult situations. The corporate had anticipated a dip in income for the 12 months’s second quarter, consistent with the seasonal drop in RV gross sales throughout winter months. Nevertheless, this 12 months, the corporate has been hit by a downturn that surpasses typical seasonal patterns. This downtrend has lasted all year long, marking a pointy 25% year-on-year drop thus far.

Whereas THOR stays an organization of appreciable worth, this sudden dip this 12 months provides a layer of uncertainty to its future efficiency. Regardless of the corporate’s inherent worth, the present circumstances have led to a probably inflated valuation, making it much less engaging for instant funding. Due to this fact, a ‘maintain’ advice for THO inventory is the prudent plan of action at current.

Promising But Unexciting in FY23

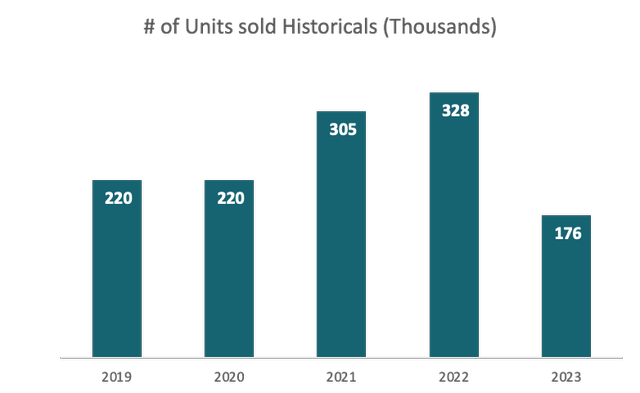

In FY23, Thor Industries confronted appreciable operational challenges. Unit gross sales sharply declined from roughly 328,000 in FY22 to round 176,000 in FY23, marking a virtually 50% lower. But, surprisingly, income solely fell by 25%. This discrepancy suggests the corporate’s strategic maneuver to promote fewer models at significantly larger costs, efficiently cushioning the blow on revenues. This development continued all year long, with unit gross sales failing to regain misplaced momentum however income remaining comparatively regular, largely because of the profitable implementation of this high-pricing technique. Thor’s resilience in managing these headwinds underscores its capacity to adapt to market situations and extract most worth.

Moreover, the expansion within the European market represents a major untapped potential for Thor. As international journey restrictions loosen up post-COVID, the RV market may see a major increase, particularly in areas like Europe, the place the tradition of street journeys and outside holidays is on the rise. The profitable navigation on this market means that Thor is well-positioned to reap the benefits of this development, probably resulting in vital progress in unit gross sales and income.

Whereas Thor Industries showcased outstanding resilience and strategic adaptability in FY23, there’s purpose to mood expectations for the close to future. The RV growth pushed by pandemic-era demand was distinctive, and its contribution to Thor’s latest progress trajectory cannot be overstated.

Consequently, projecting this extraordinary demand ahead is not real looking. The present compound annual progress charge, factoring within the post-COVID panorama, does not paint a bullish image for Thor’s valuation over the following 3 to five years. Due to this fact, whereas Thor’s strategic strikes and potential within the European market are spectacular, they won’t suffice to maintain an aggressive progress narrative within the medium time period.

Monetary Evaluation

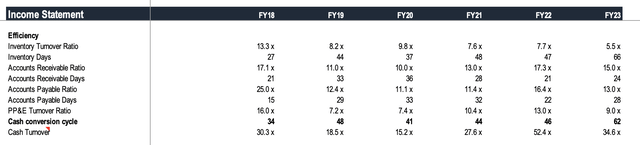

Ratio evaluation—Earnings assertion workbook (detailed spreadsheet obtainable right here)

SEC Filings & personal calculation

From an effectivity standpoint, THOR went via an general development of considerably diminished stock effectivity, regardless that the corporate nonetheless carried out barely higher than nearly all of its friends. Its Money Conversion Cycle elevated from 34 to 62 days in 2023 (virtually doubled), implying an extended time is required to transform stock and different sources into money. Although it deteriorated, it’s nonetheless doing higher than its shut competitor Winnebago: 64, and even Polaris:65, and Tenting World Holdings: 148 (retrieved on GuruFocus). The money conversion cycle enhance shouldn’t be very alarming as of now; nonetheless, it means that THOR has a tougher time promoting off its stock 12 months after 12 months.

From a liquidity perspective, THOR’s present ratio fluctuates between 1.4 and 1.8x. It is a wholesome stage, indicating that the corporate has greater than sufficient sources to cowl its short-term liabilities.

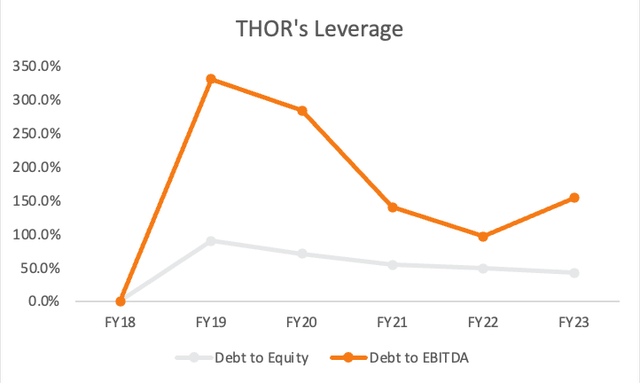

SEC Filings & personal calculation

From a leverage and solvency perspective, the Debt to Fairness ratio has been persistently reducing from 90% to 42.1%. This implies the corporate is utilizing much less debt to finance its progress, lowering its danger profile. Furthermore, Debt to EBITDA, Regardless of fluctuations, has seen a lowering development. This suggests the corporate is changing into more and more able to paying again its money owed with its earnings.

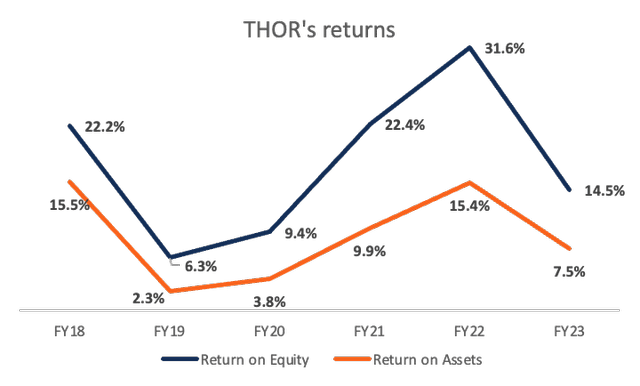

SEC Filings & personal calculation

From a Return perspective, THOR has not been capable of ship absolute returns over the past 5 years, regardless that it was topic to some volatility. The overall Asset Turnover Ratio reveals that the corporate’s effectivity in utilizing all its belongings to generate income has been considerably unstable and declining from the excessive in 2018. This can be the case due to its aggressive acquisition technique up to now, which administration should mood in consequent years. Relating to Return on Fairness, it fluctuated over the following few years, reaching its peak at 31.6% in 2022 earlier than dropping to 14.5% in 2023. Compared to the business, each ratios beat round 80% of the businesses within the Autos & Elements business (Gurufocus).

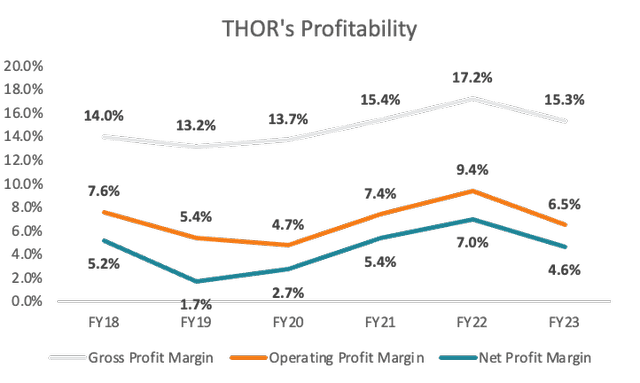

SEC Filings & personal calculation

In the case of profitability, we will see that THOR operates on razor-thin edge margins; nonetheless, it has by no means misplaced cash since its inception. Their margins fluctuated a bit since 2018 however stayed throughout the similar vary.

The underside line is THOR is a financially wholesome firm as a result of it has been worthwhile, not overly leveraged, can cowl its short-term and long-term obligations with its earnings, and since they’ve supplied absolute returns to its shareholders.

Valuation

To provide you with a good worth of THOR business share value, I used a Comparable Firm Evaluation to see how the corporate measures as much as its friends and Discounted Money Move Evaluation to search out an intrinsic worth vary. So let’s begin with the comparable firm evaluation.

Looking for Alpha & personal calculation

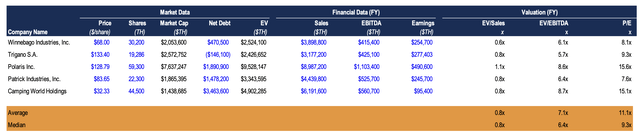

For this evaluation, I recognized corporations that function in comparable markets or share operational traits with THOR. These included Winnebago Industries (WGO), Trigano S.A.(OTC:TGNOF), Polaris Inc. (PII), Patrick Industries (PATK), and Tenting World Holdings (CWH).

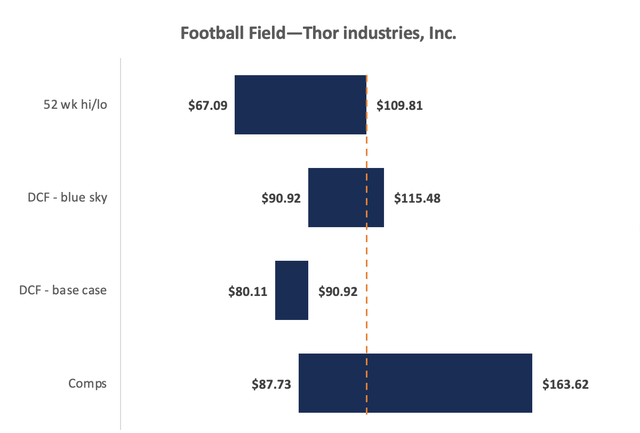

Subsequent, I made up my mind three necessary metrics for comparability: EV/Gross sales, EV/EBITDA, and the P/E ratio. Making use of the median values of those ratios from the chosen comparable corporations to THOR’s financials, I derived an estimated enterprise worth for THOR, offering a tough gauge of its market worth. The outcomes, based mostly on median values, recommended the next implied share costs: $163.62 (utilizing EV/Gross sales), $116.59 (utilizing EV/EBITDA), and $87.73 (utilizing the P/E ratio). Primarily based on this evaluation, we will infer that the market values THOR Industries anyplace between 87.73$ to 163$ per share. (Detailed spreadsheet of comp tables obtainable right here.)

The Comp Evaluation technique, although helpful, has some limitations. It does not take into account an organization’s precise price (intrinsic worth), focusing as an alternative on present market values. Consequently, it typically emphasizes short-term features, presumably lacking long-term plans or draw back dangers. These shortcomings make it useful to pair this technique with the Discounted Money Move evaluation.

SEC Filings & personal calculation

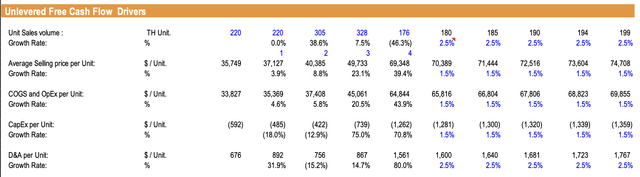

On this discounted money circulation evaluation, we forecast five-year money flows, accounting for five key variables:

(1) Unit Gross sales Quantity: It is a direct indicator of market demand and gross sales effectiveness, thereby closely impacting income.

(2) Common Promoting Value per Unit: It mirrors the corporate’s pricing technique and market notion of its merchandise, additionally considerably influencing income.

Different components thought of embody (3) COGS and OpEx per unit, (4) CapEx per unit, and (5) depreciation & amortization per unit, giving us perception into prices, capital expenditure, and asset utilization. For accuracy, I used conservative progress charges throughout these variables.

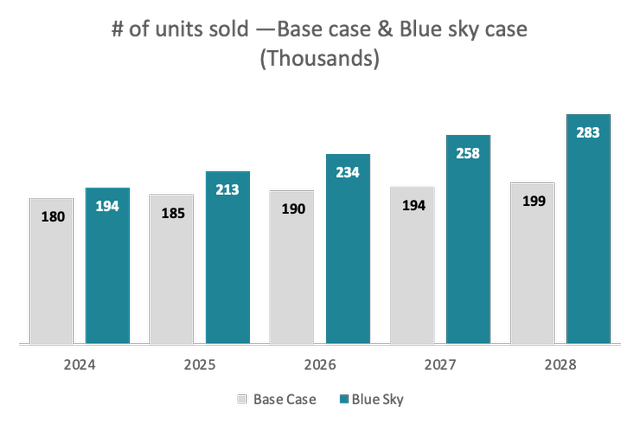

Within the base case state of affairs, I undertaking a modest 2.5% annual progress charge in unit gross sales, taking into consideration the unpredictable nature of unit gross sales lately. My assumption is rooted within the expectation that the corporate will rebound from its present efficiency and persistently improve its unit gross sales 12 months on 12 months via 2028. The common promoting value per unit witnessed a notable surge of 39.4% this 12 months, which made choosing an acceptable progress charge fairly difficult. My goal was to keep away from any distortion within the outcomes; therefore a much less aggressive charge appeared a extra cheap alternative. As such, I settled on a 1.5% enhance in value for each the bottom case and blue sky situations over the forecast interval. This 1.5% increment can also be mirrored within the projections for COGS and OpEx per unit, aligning with their previous tendencies that appeared to parallel the value will increase. When it comes to CapEx per unit, I assumed a constant progress charge of 1.5%, which suggests a sustained stage of expenditure over the approaching 5 years. For depreciation and amortization per unit, the sample over the past 5 years has been irregular. As the corporate’s previous investments may now be in peak depreciation years, this may result in depreciation prices outpacing present CapEx. That is the rationale behind choosing a barely larger progress charge of two.5% for depreciation and amortization.

In probably the most optimistic, or ‘blue sky,’ state of affairs, I keep all current assumptions apart from one vital change: I anticipate a ten% year-over-year enhance within the variety of models bought.

SEC Filings SEC Filings & personal calculation

We then calculate the free money circulation for the agency (FCFF) earlier than discounting these future money flows at a charge of 12.50%, the corporate’s value of Fairness, given its present capital construction. Past our projection interval, I assumed money flows would develop at a secure 3.74% charge (US T-BILLs long-term common), yielding the terminal worth.

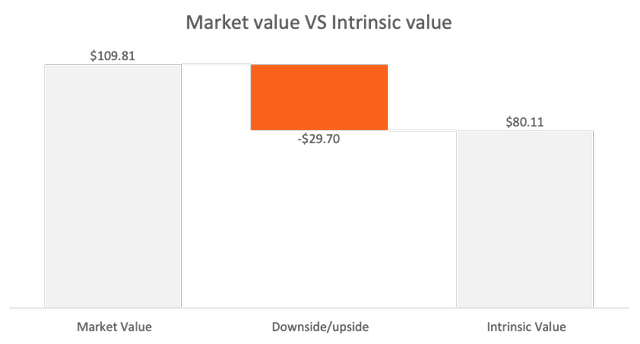

Including collectively the current values of the projected money flows and terminal worth offers us the enterprise worth. For the bottom case, I obtained a good worth vary of $80.11—$90.92, which is about $29.70—$18.89 overvalued in comparison with the July twenty second closing value of $109.81:

(To ascertain the vary, I factored in a 5% enhance in models bought, which yielded a good worth of $90.92).

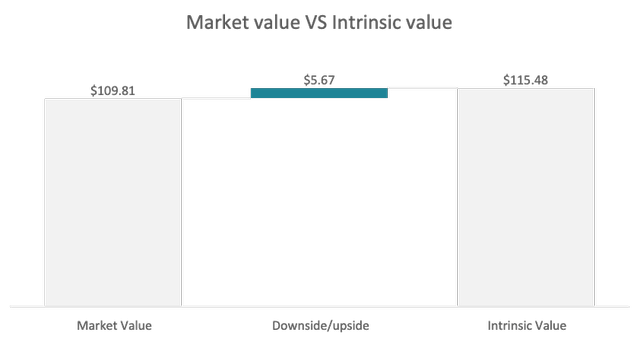

SEC Filings & personal calculation

Within the blue-sky state of affairs, which assumes extra favorable future situations, akin to accelerated progress within the variety of models bought, the honest worth vary is estimated to be between $90.92 and $115.48. This suggests that on the decrease finish of this vary, the corporate’s shares are nonetheless overpriced by $18.89, whereas on the higher finish ($115.48), the corporate’s shares can be undervalued by $5.67 in comparison with the July twenty second closing value. This means a skewness in the direction of an overvaluation. (Detailed spreadsheet of DCF obtainable right here.)

SEC Filings & personal calculation

Valuation Abstract

SEC-Filings and personal computations

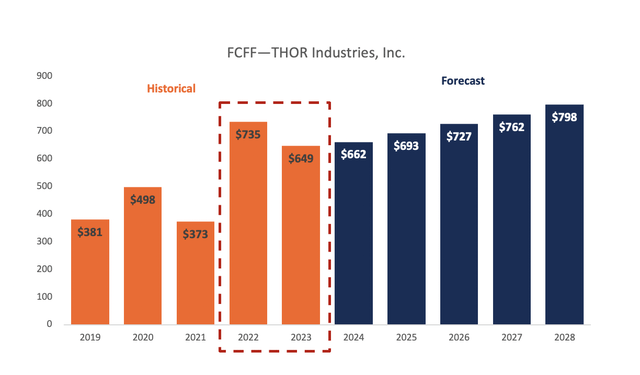

This chart presents the historic information and projected values for the Free Money Move to the Agency (FCFF) in my base-case state of affairs. The projections are closely influenced by the current efficiency of the free money flows, that are displayed as rising 12 months over 12 months.

The draw back danger of this assumption is that the present efficiency of free money flows could not essentially proceed in the identical sample sooner or later.

SEC Filings & personal calculation

Funding Dangers

Cyclical Nature of the RV Business: Just like different shopper discretionary sectors, the RV business is closely cyclical and extremely delicate to macroeconomic components akin to modifications in shopper confidence and disposable revenue. In intervals of financial decline or uncertainty, customers could delay or forego RV purchases, resulting in a lower in gross sales quantity for THOR Industries. This was seen within the monetary disaster of 2008 and will probably recur throughout different intervals of financial downturn. Aggressive Market Atmosphere: The RV business is extremely aggressive, with quite a few established producers and new entrants. THOR Industries faces intense competitors from each home and worldwide corporations which will have bigger sources or may innovate quicker. This aggressive panorama may affect THOR’s market share and profitability.

Takeaway

Whereas Thor Industries showcased resilience and flexibility in FY23, the RV growth in the course of the pandemic could not lengthen into the long run. Regardless of the corporate’s strategic initiatives and potential within the European market, they won’t be ample to help an aggressive progress narrative over the following 3-5 years. Thus, a ‘maintain’ stance on THO inventory appears probably the most prudent plan of action at current.

[ad_2]

Source link