[ad_1]

The massive US shares dominating markets and traders’ portfolios have surged dramatically greater in current months. That highly effective run has fueled widespread greed and complacency, leaving common bullishness in its wake. This just-finishing Q2’23 earnings season reveals whether or not main US firms’ underlying fundamentals assist such euphoric outlooks. These firms are thriving, however dangerously costly.

The mighty flagship soared 19.0% between mid-March to late July. That thrust large US shares again into formal bull-market territory, with that SPX powering up 28.3% at finest above mid-October’s bear-market low. That left the US inventory markets simply 4.3% below early January 2022’s all-time file excessive. It’s no marvel euphoria reigns as we speak after such a formidable efficiency, these inventory markets are on fireplace.

Naturally, traders love chasing such sturdy upside momentum within the large US shares, speeding to pile in. However after any outsized surge shortly catapults inventory markets to seriously-overbought ranges, warning is so as. In mid-July the SPX rocketed 12.9% above its baseline 200-day shifting common, really-stretched ranges technically. That portended a rebalancing selloff, and the S&P 500 is already down 2.6% August-to-date.

The core mission of investing is multiplying wealth by shopping for low after which later promoting excessive. Alternatives for the previous are lengthy gone after such a robust run. That has left large US shares buying and selling at very-high costs relative to their underlying company earnings. Valuations are excessive, working deep into formal bubble territory. That makes shopping for in excessive as we speak and hoping to promote even greater later to higher fools fairly dangerous.

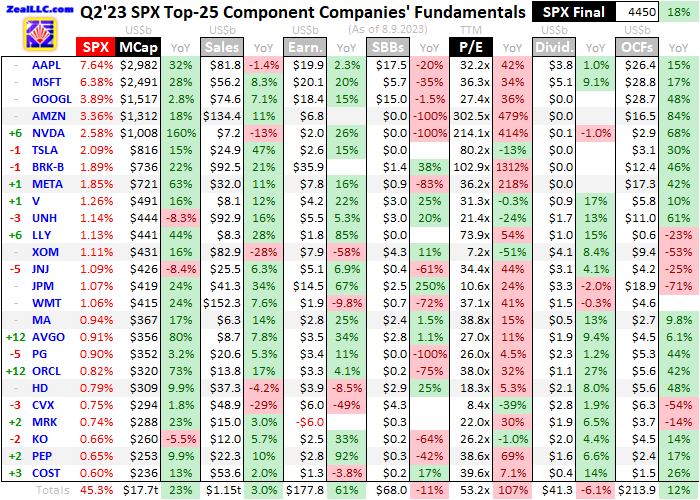

The massive US shares’ new Q2’23 outcomes spotlight how extremely costly these main firms have not too long ago grow to be. For twenty-four quarters in a row now, I’ve analyzed how the 25 largest US firms that dominate the SPX fared of their newest earnings seasons. These behemoths commanded a dumbfounding 45.3% of the SPX’s complete market cap exiting Q2. Their latest-reported key outcomes are detailed on this desk.

Every large US firm’s inventory image is preceded by its rating change inside the S&P 500 over the previous 12 months because the finish of Q2’22. These symbols are adopted by their shares’ Q2’23 quarter-end weightings within the SPX, together with their monumental market capitalizations then. Market caps’ year-over-year adjustments are proven, revealing how these shares carried out for traders impartial of manipulative inventory buybacks.

These have been off the charts for years, fueled by the Fed’s earlier zero-interest-rate coverage and trillions of {dollars} of bond monetizations. Inventory buybacks are misleading monetary engineering undertaken to artificially enhance inventory costs and earnings per share, maximizing executives’ large compensation. Taking a look at market-cap adjustments slightly than stock-price ones neutralizes a few of inventory buybacks’ distorting results.

Subsequent comes every of those large US shares’ quarterly revenues, exhausting earnings below typically accepted accounting rules, inventory buybacks, trailing twelve-month price-to-earnings ratios, dividends paid, and working money flows generated in Q2’23 adopted by their year-over-year adjustments. Fields are left clean if firms hadn’t reported that individual information as of mid-week, or if it doesn’t exist like unfavorable P/E ratios.

Proportion adjustments are excluded in the event that they aren’t significant, primarily when information shifted from constructive to unfavorable or vice-versa. These newest quarterly outcomes are essential for American inventory traders, together with anybody with retirement accounts, to know. They illuminate whether or not the US inventory markets are basically sound sufficient to proceed powering greater in coming months, or whether or not a selloff is overdue.

Whereas this current bull run has confirmed very sturdy producing ubiquitous bullishness, it’s fairly unhealthy internally. Not solely are large US shares’ valuations at bubble extremes, this advance has been extremely slim. Huge capital has flooded into fewer shares, leaving the S&P 500 top-heavy with file ranges of focus. Exiting Q2, once more the highest 25 SPX firms alone accounted for 45.3% of its complete market cap.

This bull market has been overwhelmingly led by the standard beloved mega-cap-tech market darlings, now referred to as the Magnificent Seven. They embody Apple (NASDAQ:), Microsoft (NASDAQ:), Alphabet (NASDAQ:), Amazon (NASDAQ:), NVIDIA (NASDAQ:), Tesla (NASDAQ:), and Meta Platforms Inc (NASDAQ:). These elite giants alone weighed in at a colossal 27.8% of the SPX’s whole market capitalization. For all intents and functions, they successfully are the US inventory markets. Few different firms matter a lot.

There’s little doubt the M7 have superior companies, or they wouldn’t have grown so giant. However there’s a sturdy groupthink element to fund managers more and more allocating extra capital to them. These guys can’t afford to lag their friends’ performances, or traders flee. So when the lion’s share of market positive aspects are concentrated in a handful of firms, skilled traders must chase them or danger falling behind.

They’re paying any value for these high-flying shares, ignoring how costly they’ve grow to be relative to underlying fundamentals. That upside-momentum-is-all-that-matters technique works for some time in bulls, however it isn’t sustainable. Ultimately all traders prepared to purchase excessive get totally deployed, exhausting their capital firepower for purchasing. That leaves solely sellers, quickly sparking and fueling main snowballing selloffs.

Other than their excessive bubble valuations, the large US shares’ Q2’23 regarded good. However the costs traders pay for shares actually matter. Historical past has confirmed in spades that typically shares bought at relatively-low costs in comparison with underlying company earnings have far-higher odds of subsequently rallying to hefty positive aspects. However shares purchased at excessive multiples of their earnings usually quickly roll over into sizable losses.

Total the SPX prime 25’s complete revenues final quarter climbed 3.0% year-over-year to $1,153.5b. However that’s overstated as a result of composition adjustments. Over this previous 12 months, wholesale retail big Costco (NASDAQ:) climbed into these rarefied ranks, pushing out giant biopharmaceutical AbbVie (NYSE:). However COST runs a high-volume low-margin enterprise, with far-higher gross sales than ABBV. Costco did $53.6b in its offset Q2, dwarfing AbbVie’s $13.9b.

Excluding the previous from Q2’23 and the latter from Q2’22, the remainder of the large US firms truly noticed their gross sales stoop 0.5% YoY. That isn’t a lot, however bubble valuations are much more precarious with out quick progress. There was an enormous bifurcation in revenues too, with these Magnificent Seven mega-cap techs seeing gross sales surge an incredible 8.2% YoY to $411.1b. These behemoths are largely nonetheless rising at huge scales.

The remainder of the large US firms together with COST and ABBV solely noticed Q2 revenues edge up 0.4%. In the event that they have been buying and selling at regular valuations that may be wonderful, however little progress is problematic at bubble ranges. This was skewed low although by high-revenue oil super-majors, with Exxon Mobil (NYSE:) and Chevron (NYSE:) struggling brutal 28.3% and 28.9% YoY gross sales plunge. That was nearly solely as a result of fast-falling costs.

In quarterly-average phrases, these collapsed 32.3% YoY with Q2’23’s working below $74 per barrel. A significant driver of that was the Biden Administration’s colossal 41% drawdown of the US Strategic Petroleum Reserve. That flooded world markets with an additional 291m barrels of crude oil. Had oil costs not plunged a lot, large US shares’ complete revenues would’ve regarded higher. However even a few M7 shares noticed slumps.

Mighty Apple dominates the S&P 500 with a staggering 7.6% of its market cap. Its revenues final quarter slipped a slight 1.4% YoY on product gross sales together with iPhones falling 4.4%. Ominously that was AAPL’s third quarter in a row of declining revenues, turning into a pattern. There’s no means Apple’s inventory ought to commerce means up at 32.2x trailing-twelve-month earnings if gross sales aren’t rising, implying an even bigger selloff is looming.

As goes Apple, so goes the remainder of the SPX. And Apple’s retreating gross sales might show a canary within the coal mine for different large US shares. Individuals love their iPhones, with many surveys revealing they’re the final issues we’d hand over. But with raging inflation forcing the costs of life’s requirements far greater, persons are more and more cash-strapped. Extra of their incomes are conscripted to pay for meals, shelter, and vitality.

Whereas they gained’t stop shopping for iPhones, they’ll possible maintain their present ones longer. Even delaying iPhone upgrades a 12 months or two would dramatically hit Apple’s gross sales. Loads of large US shares have discretionary merchandise, the place prospects may simply select to purchase them much less usually or in no way. The ensuing slowing, stalling, or reversing income progress poses severe draw back dangers forward for these bubble-valued inventory markets.

One of many major drivers of the S&P 500’s highly effective 19.0% surge at finest since mid-March was this new synthetic intelligence mania. The chief of that was NVIDIA, which designs highly effective graphics processing chips for computer systems that are perfect for AI work. NVDA inventory skyrocketed 106.8% in that brief span, enjoying the main position in inciting bullish psychology. That left it buying and selling at an absurd 214.1x earnings exiting Q2.

That meant it could take over two centuries at present earnings ranges merely for NVIDIA to earn again the inventory value traders have been paying for it. With a a number of like that, this firm certain as heck ought to have been rising gangbusters. But its precise gross sales within the final reported quarter which is offset from calendar ones fell a steep 13.2% YoY. NVDA had the worst big-US-stocks income efficiency outdoors of oil shares.

So this shrinking market chief’s excessive a number of actually isn’t justified. There’s additionally a superb likelihood the current AI craze stuffed NVIDIA’s order guide with unsustainably-large demand that can wilt. A number of years in the past that occurred through the cryptocurrency craze. NVDA’s gross sales soared on GPU demand for mining crypto however then plunged when that dried up. Outsized AI demand may tremendously retreat too when this inventory bubble pops.

The massive US shares’ bottom-line accounting earnings regarded unbelievable final quarter, rocketing up 61.1% YoY to $177.8b. That was regardless of Exxon Mobil and Chevron seeing their large earnings crash by 57.6% and 48.7% on these plunging oil costs. But that comparability is severely skewed by big funding conglomerate Berkshire Hathaway’s unrealized inventory positive aspects and losses, which have to be flushed by way of revenue statements.

Within the comparable Q2’22, Berkshire Hathaway (NYSE:)reported $66.9b in “funding and spinoff contract” losses because the SPX fell 16.4% rolling over right into a bear market. Final quarter that reversed massively to a $33.1b achieve with the US inventory markets surging 8.3% greater. The simplest option to alter for that is merely to exclude Berkshire’s radically-volatile earnings from each quarters. That leaves large US shares’ earnings grimmer, falling 7.9% YoY.

Once more that features a stunning bifurcation between the M7 mega-cap techs and the remainder of the SPX prime 25 ex-BRK. The M7’s earnings soared an incredible 27.7% YoY to $77.5b, these firms are nonetheless minting cash. However the 17 next-biggest US firms noticed earnings plunge 31.0% to $64.3b. Even when these two oil super-majors are additionally excluded, earnings nonetheless dropped an unpleasant 19.9% YoY to $50.4b which is troubling.

This raging inflation spawned by the Fed greater than doubled the US cash provide in simply a few years if already eroding company earnings. Corporations are being compelled to pay greater enter and labor prices, but can’t cross alongside all these value hikes to pinched shoppers. Leading to falling earnings forcing valuations even greater, a clear-and-present hazard for inventory markets already buying and selling deep into harmful bubble territory.

Company inventory buybacks final quarter have been additionally fascinating, with the general SPX-top-25 quantity sliding 10.8% YoY to $68.0b for the bottom since This fall’20. These beloved M7 shares are closely reliant on plowing their colossal working money flows into manipulative inventory buybacks led the best way, plunging 30.7% YoY to simply $39.0b. Slowing buybacks are bearish for shares, as they’ve lengthy been the largest supply of demand.

The M7 didn’t slash buybacks as a result of their working money flows have been waning, these truly soared an outstanding 34.1% YoY to $123.6b in Q2’23. So the mega-cap techs’ managements might notice their inventory costs are means too excessive and overdue to appropriate exhausting. Or they might be constructing their colossal money hoards fearing a coming financial slowdown will adversely affect their operations. Neither is nice information.

Whereas we’re on OCFs right here, the next-biggest 18 US firms excluding the biggest US financial institution JPMorgan Chase (NYSE:) noticed theirs plunge 31.9% YoY to $109.2b final quarter. Like Berkshire’s earnings, large banks have super-volatile money flows partially pushed by markets and buying and selling. However booting out these oil super-majors which noticed OCFs plunge, the remaining 15 largest US firms nonetheless loved sturdy 23.5% YoY progress to $74.6b.

So general the SPX-top-25 shares’ Q2’23 outcomes proved slightly good, a formidable feat given the stiff headwinds the US financial system is dealing with. However inventory markets’ future efficiency once more closely depends upon inventory costs. If traders are paying an excessive amount of shopping for in actually excessive, they’re far more more likely to see large losses earlier than large positive aspects. The valuations these elite market leaders are buying and selling at are nose-bleedingly excessive.

Total these large US shares’ common trailing-twelve-month price-to-earnings ratios exiting June ran means up at 53.2x, hovering up 107.4% YoY. Understand that the historic honest worth for US inventory markets over the previous century-and-a-half or so is simply 14x earnings. Twice that at 28x is the place formal inventory bubbles start. Large US shares are almost double that due to the AI craze and hopes the Fed’s violent rate-hike cycle is ending.

These excessive overvaluations are concentrated in these market-darling Magnificent Seven shares, as their common TTM P/Es skyrocketed 172.1% YoY to an eye-popping 104.1x exiting Q2’23. That isn’t simply skewed excessive by NVIDIA’s loopy 214.1x, however Amazon is means again as much as 302.5x. Even with out these ugly outliers, the opposite 5 mega-cap techs nonetheless averaged 42.5x. These are actually priced-for-perfection multiples.

In the meantime, the 18 next-biggest US shares are additionally properly into formal bubble territory, averaging 33.4x TTM P/Es which blasted up 61.0% YoY. Berkshire is the outlier right here as a result of its colossal unrealized funding losses over this previous 12 months. However even excluding that, the remainder of these firms nonetheless averaged bubblicious 29.3x multiples leaving final quarter. This stock-market bubble actually isn’t restricted to these mega-cap techs.

With the S&P 500 simply surging up 19.0% in solely 4.6 months to seriously-overbought ranges stretching means as much as 12.9% above its 200dma, as we speak’s bubble valuations are a serious drawback. And so they may very properly balloon even greater as company earnings come below growing stress as inflationary value will increase linger and fester. Since earnings actually leverage gross sales, slowing or falling revenues will exacerbate earnings declines.

Finally, inventory costs all the time normalize to mirror some affordable a number of of their underlying company earnings. That portends one other main selloff looming within the coming months with inventory costs so darned excessive relative to earnings. So traders ought to be cautious of increasing their capital allocations to those largest US shares. A significant SPX selloff nearing or exceeding the 20% new-bear threshold is rising more and more possible.

With these lofty inventory markets riddled with euphoric and complacent psychology, nonetheless means overextended technically, and inventory costs deep into harmful bubble territory, draw back dangers are mounting. This bull run’s major catalysts are quickly eroding too. That AI mania has largely run its course, and the Fed’s violent rate-hike cycle nearing or at its finish is already priced in. Inventory costs must imply revert again to actuality.

Traders can hedge a few of this selloff danger in counter-moving gold and its miners’ shares, which are inclined to surgeon steadiness when inventory markets materially weaken. American inventory traders’ gold allocations are nearly zero as we speak, far under the 5% to 10% thought of prudent for hundreds of years. And gold and gold shares are actually nice buys, actually overwhelmed down after this newest SPX bubble sucked in a lot limelight and capital.

[ad_2]

Source link