[ad_1]

xavierarnau/E+ through Getty Photos

In my opinion, Perdoceo Training Company (NASDAQ:PRDO) affords an inexpensive upside from present ranges. The inventory worth has room to enhance as the corporate undergoes a big enterprise mannequin transformation. As well as, the valuation seems to again up my thesis. Let me stroll you thru this potential alternative.

Firm Overview

Perdoceo Training Company affords instructional companies via for-profit on-line instructing. Perdoceo gives levels from Affiliate to Doctorate degree in addition to skilled programs. Via its two accredited establishments, Colorado Technical College (CTU) and The American InterContinental College System (AIUS), the corporate affords a variety of levels, primarily specializing in Enterprise Research, IT, and Well being Training.

Trade and Enterprise Evaluation

First, I’ll depict some fundamental numbers concerning the firm’s college students and {industry}, earlier than diving into the basics. Importantly, based mostly on its enrollments, we all know that 68% of scholars are over 30, whereas 76% are in Enterprise Research and round 68% did so on the Bachelor degree. All of the above knowledge depicts what sort of shopper the corporate is servicing, and the way it can have an effect on its market presence enlargement.

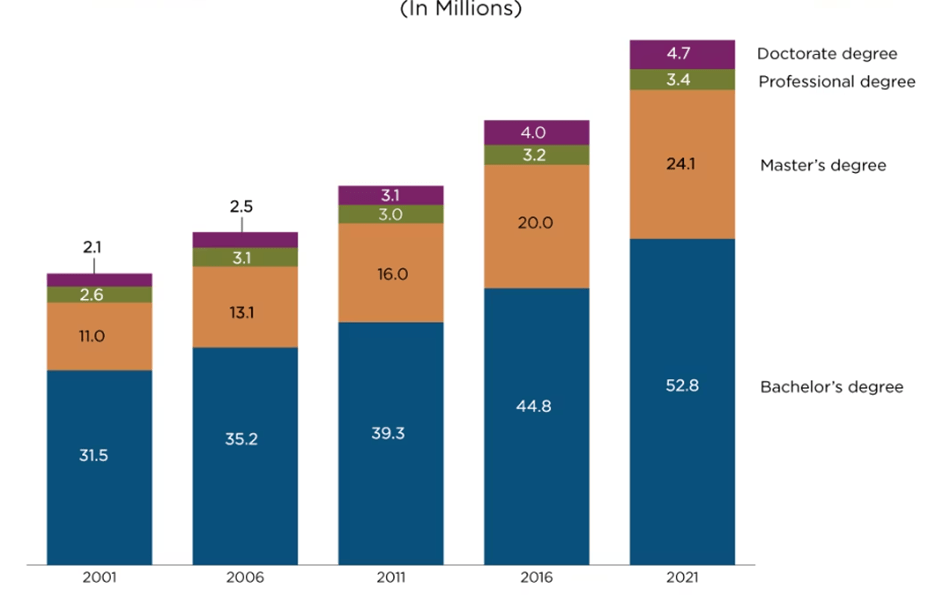

When diving into the education-student knowledge within the US, I discovered some encouraging tendencies. In response to census.gov, on the finish of 2021, round 62.2% of the inhabitants 25 and older had an Affiliate’s diploma as its highest degree of college accomplished – in different phrases, solely 38% obtained a bachelor’s or larger. Thankfully, that’s altering, as depicted within the determine under, and that development will proceed to rise, as many states have pledged to realize 60% of working adults with a university diploma. Importantly, in line with the most recent 10-Okay, within the US there have been 25.3 million college students enrolled in a college diploma by the top of 2021.

Diploma statistics ( https://www.census.gov/library/visualizations/2022/comm/a-higher-degree.html)

Whereas the net development has helped accessibility in training, a development that PRDO has taken benefit of, the prices stay there. Since Bachelor’s levels are the preferred amongst Perdoceo’s college students and Enterprise Research stay the highest class, I’ll take a BSBA as the bottom case. This may assist us comprehend the next breakdown and comparability vs different establishments. At CTU and AIUS, the general value of the net program prices round $62,100 or $340 per credit score hour charged each quarter. Whereas in line with US Information, the common on-line credit score hour worth rounds $333, this additionally accounts for public faculties, and these faculties whereas traditionally cheaper cost out-of-state charges. PRDO’s charges additionally come up cheaper than different for-profit training organizations as proven later.

Persevering with with the enterprise training assumption, the rankings supplied by Area of interest.com give 117 for CTU and 380 for AIUS out of 1243 for the perfect faculties for enterprise in America. Realizing these two faculties have not too long ago entered the net scope isn’t dangerous for the value. As for particular person survey evaluations, whereas blended, I discovered that each faculties get a 3.3-3.8 out of 5 stars rating for probably the most half. I imagine the corporate is doing a good job on the instructional degree, whereas the {industry} tendencies appear favorable.

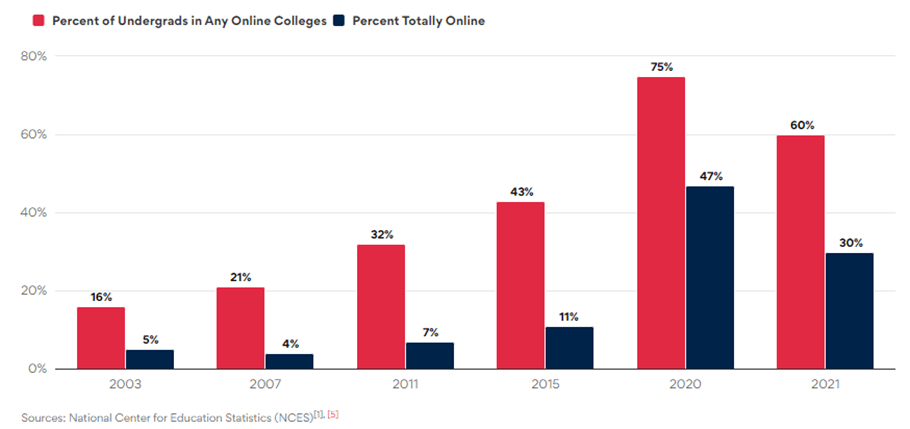

The training enterprise has been turning its focus to on-line training. I will likely be leaving the large open on-line programs (MOOC) {industry} apart, specifically Coursera, Udemy, and the kind, as these firms don’t give attention to accredited diploma applications. On-line training programs have taken a step ahead, and for-profit organizations appear to be main the race. In response to the most recent knowledge from Nationwide Heart for Training Statistics (NCES), in 2021 faculties enrolled about 5.6 million absolutely on-line college students – 450,000, roughly 8% of complete on-line college students, entered the for-profit faculty class. Trying again in time, I discover the development posted by NCES to be optimistic, fueled by the % spike in the course of the pandemic yr.

On-line training progress (NCES)

Including some shade to the sub-industry, for-profit establishments had 649,000 absolutely on-line college students enrolled on the finish of 2021. Throughout that yr, CTU and AIUS enrolled 40,400 college students, which leads to roughly a 6% market share by that normal. Importantly, US Information reported that CTU and AIUS are the third and 4th largest on-line establishments by pupil depend – solely behind Liberty College (LU) (115,000) and Arizona State (ASU) (62,551).

Monetary Evaluation

Diving into some monetary figures, the monetary evaluation will prove optimistic. I’ll use the most recent 5-6 yr interval for the primary a part of the monetary evaluation. That is as a result of change of technique applied by the corporate to modify in the direction of a web based mannequin for its training companies. Earlier than that, the corporate run varied portfolios of in-person campuses and had much less presence within the on-line training {industry}.

In consequence, it’s useful to notice that the brand new method is to run an asset-lite enterprise mannequin with low Capex. The newest Capex determine has not surpassed the $13M threshold over the past 5 fiscal years, and administration expects that quantity to be roughly 1-2% of revenues sooner or later. All of it whereas PPE stays a small portion of its steadiness sheet, presently at $50 million, and has by no means been over $76 million throughout the identical interval.

During the last 5 years, its Money and ST Investments place has elevated from $228M to $510M, primarily as a result of inside money era from operations. Notably, money movement from operations (CFO) over the past three fiscal years (2020-22) was $179 million, $191 million, and $148 million respectively, due to a wholesome internet earnings origination. As of 1Q23, present property quantity to $585 million, for a present ratio of 4.3x and comparably nearly ⅔ of its market cap. Moreover a change from money to ST investments within the final yr of $229 million, the administration group has began a conservative roll-up technique.

Speaking about long-term debt, the corporate has an extended historical past of low leverage. Over the last 15 fiscal years, the corporate has not relied upon leverage to fund operations. Moreover, present property have traditionally been no less than 1.0x instances over complete liabilities – and the present ratio has by no means been decrease than 1.5x instances. Consequently, the administration group has constructed the pliability to help natural development initiatives, comparable to expertise upgrades whereas in search of M&A alternatives out there.

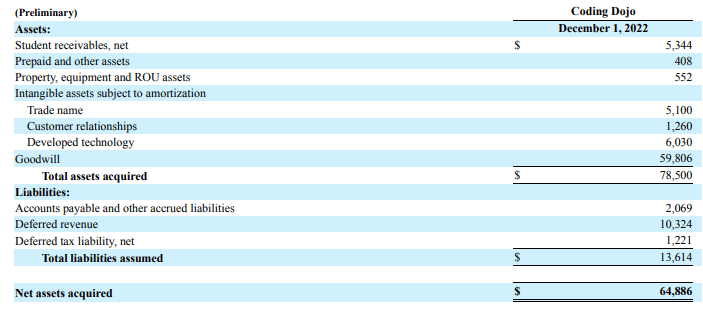

The corporate accomplished two acquisitions in 2022, specifically CalSouthern and Coding Dojo. These two acquisitions are to be paid in money for $84 million. In consequence, Goodwill has elevated to $243 million, up from $162 million on a YoY foundation. Coding Dojo was bought for nearly $65 million, and it’s now reported beneath the CTU section of the corporate. Coding Dojo reportedly had $35 million in revenues for 2022 – which means a purchase order worth of lower than 2x EV/Rev. Following the breakdown of the acquisition given by the corporate, word that goodwill is a mirrored image of the income development alternatives as outlined within the newest 10-Q.

Coding Dojo acquisition breakdown (PRDO’s 10-Q)

The Coding Dojo acquisition was a strategic transfer trying to increase its instructional choices within the laptop science and expertise areas. Coding Dojo additionally affords a expertise platform that allows on-line studying, a transfer in the direction of a extra various content material providing by PRDO. Importantly, the platform has a mean ranking of 4.4 stars – in line with coursereport.com, including some high quality content material to the course choices. Alternatively, the CalSouthern acquisition will report earnings beneath the AIUS section, whereas the establishment primarily affords instructional programs in behavioral sciences and enterprise administration.

Now let’s flip the web page to the profitability aspect of the enterprise. The administration group, whereas being conservative in its funding and operations, can also be actually centered on reaching wholesome bottom-line margins. Once more, this comes on account of sturdy pupil retention, and modern advertising and marketing methods, comparable to de company partnership program.

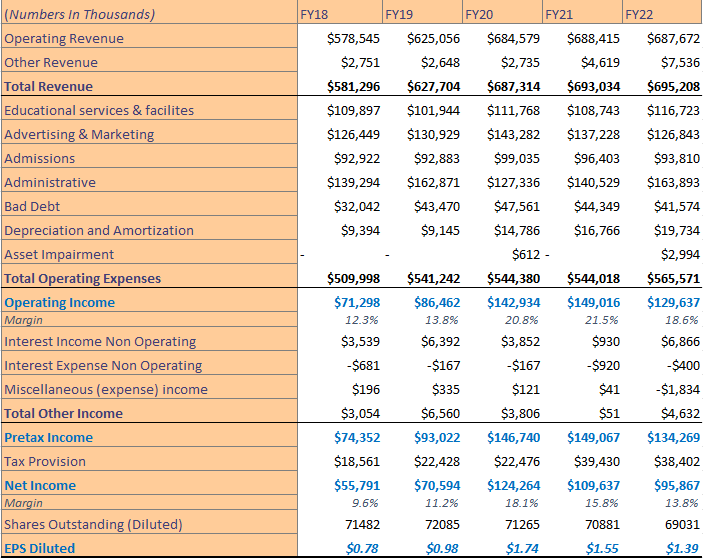

Ranging from the highest line, the general enhancing tendencies within the for-profit on-line training {industry} paired with the person technique of the corporate, has resulted in income development. As of FY18 complete revenues reached $581 million, whereas the most recent fiscal yr quantity got here at $695 million. Showcasing how the distant system and its benefits are right here to remain. Shifting ahead, know that in almost 1 of each 2 instructional establishments, there will likely be finances will increase for On-line program growth. Income within the On-line Training market is anticipated to expertise a 9.5% CAGR via 2027, Statista says. That accounts for MOOC studying and different extra speedy segments within the {industry}, however will probably be illustrative in our forecasts by the point I worth the inventory.

To observe, I’ll discover a bit additional intimately the corporate’s margins. Traditionally, the administration group has used working earnings as a proxy for profitability. Bear in mind the progress made between EBIT and Revenue margins. Coming again to the most recent 5-year interval pattern – see how the working margin has improved from 12.3% in FY18 to 18.6% within the newest fiscal yr. Equally, the revenue margin has climbed from 9.6% to 13.8% in the identical interval.

Within the snapshot under, observe how the general figures play over the pattern interval. After navigating via the ups and downs, the corporate has reached an improved degree of profitability, managing even higher working efficiencies. The query stays whether or not these margins proceed to increase supported by modest income development.

5-year earnings assertion outcomes (PRDO’s 10-Ks)

Intuitively the corporate’s revenues come from direct pupil funds. But, training prices have more and more change into extra unaffordable and adults are taking over debt to pay for it. Whereas tuition and charges are the highest sources of income, there must be an asterisk on these sources of money. As an example, Company partnerships have labored properly, at CTU and AIUS, 23.9% and 5.2% of complete pupil enrollments come from such. Different funding sources come from Title IV Program funding, which by year-end 2022, it represented about 79% of all tuition money receipts. Nevertheless, the very important query is to know what proportion of that cash isn’t collected as a result of dangerous debt.

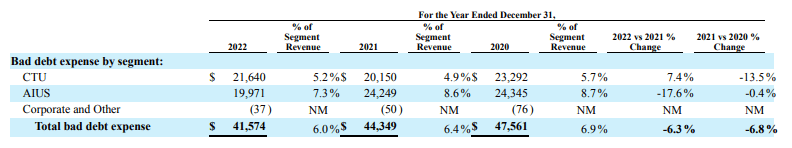

Under, there’s a clear enchancment in dangerous debt expense as % of revenues – primarily as a result of an enchancment throughout the AIUS monetary assist program. As of 1Q23, dangerous debt expense improved to five.5% of revenues, serving to to decrease total working bills.

Unhealthy debt expense as % of income 3-year interval (PRDO’s 10-Okay)

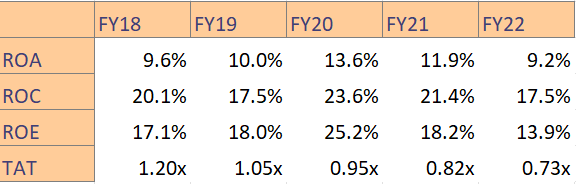

Conversely, these enhancements haven’t translated into higher ratios. Within the desk under, observe a glimpse of the talked about ratios. As an example, ROC has not improved on the tempo of the working margin, partly as a result of steadiness sheet enlargement (property have climbed from $482 million to $963 million within the 5 years). The roll-up technique might want to help larger profitability to spice up these ratios.

Profitability metrics (10-Okay and TIKR)

Peer Comps

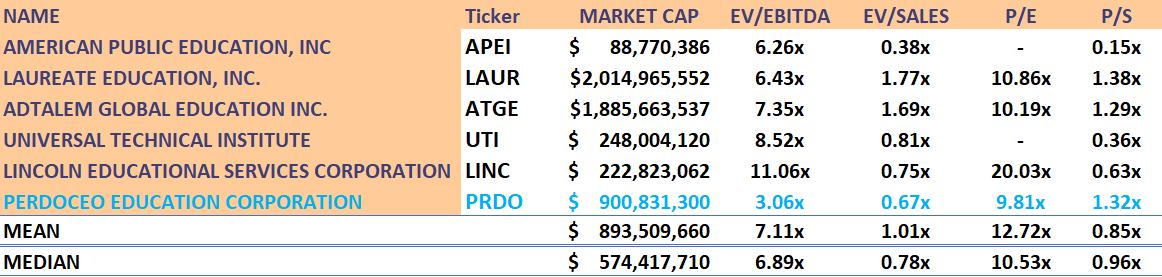

The following query I’ll speak about is valuation and peer comparability. In brief, how costly is the inventory in comparison with others? Nicely, right here is the icing on the cake. At the moment, the corporate trades at 2.70x instances NTM EV/EBITDA – whereas the vary over the past 5 years has been a excessive of 10.87x and a low of 1.46x and at 4.58x imply. By the ahead P/E ratio, PRDO additionally seems like a cut price, presently buying and selling at 7.41x instances in comparison with a sector median of 15.74, per Looking for Alpha.

The peer group for the valuation section has been chosen to supply the closest enterprise mannequin comparability potential. Some on-line platforms comparable to Coursera or Udemy have been omitted of the group as they primarily give attention to MOOCs and are extensively unprofitable. With that being mentioned, the desk under reveals how Perdoceo’s valuation compares to friends. All of the multiples are based mostly on a NTM foundation, for readability. It doesn’t take a lot time to understand that the shares appear cheap.

Peer group comparability (TIKR and Creator’s Personal Estimates)

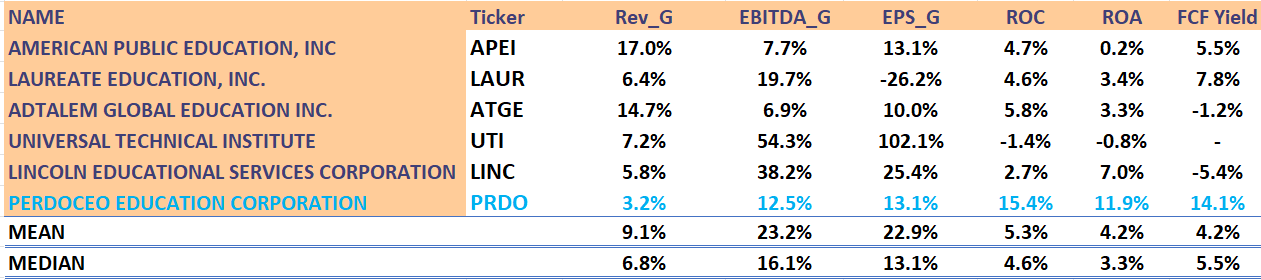

Some might intuitively attribute this low-cost valuation to too low development charges, nevertheless, I’m not arguing about development, moderately I’m making a worth pitch. It’s illustrative to see within the determine under how the corporate compares development and profitability metrics, particularly FCF yield. Decrease-than-median development charges are in distinction with above-average profitability. So the query then turns into, is it worthwhile sufficient? Or is the expansion not as strong as different firms to justify a a number of enlargement? Nicely, to reply these questions I’ll stroll you thru a DCF mannequin for extra readability.

Peer Group Comparability (Looking for Alpha and Creator’s Personal Estimates)

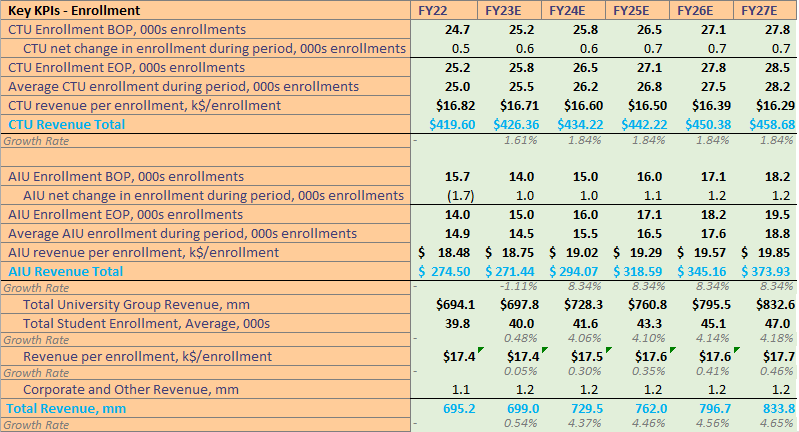

Coping with a worth story, I believed that arising with a DCF mannequin will likely be extra explicative. The comps group, whereas illustrative, might not inform the entire story. As I’ve been arguing in the course of the article, the corporate has been cautious at taking good care of working prices, and over the previous couple of years, the margin developments have coupled properly with the M&A. As a part of our assumptions for the DCF mannequin, I’ll take barely enhancing margins – particularly within the dangerous debt expense space and gentle pupil enrollment development as a result of new course choices and acquisition tailwinds. As well as, some key KPIs, comparable to pupil enrollment and income per enrollment are depicted under for the subsequent five-year interval.

Mannequin Forecasts (10-Okay and Creator’s Personal Estimates)

DCF Evaluation

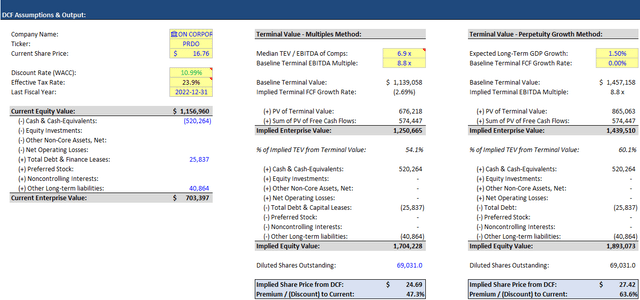

Lastly, let me stroll you thru the DCF. In a conservative situation, working margins as outlined by EBIT will likely be round 17% by 2027, down from 19% in 2023. Adjustments in NWC will likely be estimated to be the common of the previous 15 years, or about -6% of the change in revenues on a YoY foundation. Lastly, Capex will likely be round 1.5% of revenues.

All in all, I imagine that that is taking a conservative method to our valuation. This may be seen within the WACC as I attributed a better fairness threat premium of seven% and a risk-free fee of 5.5% as the present yield curve is inverted. Lastly, the median multiples are extracted from the peer group, and the shares are based mostly on a diluted foundation. Observe I’m not accounting for future share buybacks regardless that there may be nonetheless $27 million out there in this system.

Given the present money and money equivalents, long-term liabilities, and shares excellent I arrive at two totally different costs by the multiples and the perpetuity methodology. The previous arrives at $24.7 per share whereas the latter offers us a $27.4 goal worth. That’s a mean of $26 per share, or roughly 55% upside from present ranges. After all, quite a bit has to go properly to achieve these ranges, and I’m simply offering the outcomes of the DCF as explanatory – as I mentioned the corporate’s worth proposition might take time to materialize. Nevertheless, I imagine that directionally the inventory has quite a lot of potential from present ranges. For additional shade, see under the snapshot of the DCF mannequin and key figures.

DCF Valuation (Creator’s Personal Estimates)

Dangers

This all sounds good, nevertheless, the for-profit training {industry} has battled some ups and downs. Adjustments associated to Title IV, the federal funds program, might adversely have an effect on the corporate’s operations. As of final yr’s finish, about $511 million of the corporate’s income got here from Title IV’s money receipts. That might be critical if PRDO reaches the 90-10 (learn extra concerning the 90-10 rule) threshold degree, which for the time being is much from reaching (presently round 73%). Additional rulings concerning mortgage compensation and debt forgiveness have been additionally issues that the corporate is coping with. In numbers, authorized charges amounted to $14.5 million over the past fiscal yr, fueled by responses to the DOE and acquisition efforts.

There might be extra updates concerning the regulatory framework shortly. In any case, the corporate has confirmed to be heading in the right direction in the case of complying with these issues. Any topic adjustments might have an effect on the corporate’s operations and pupil retention particularly.

Conclusion

In conclusion, there are just a few key factors to spotlight for PRDO. First, the corporate has entered right into a second section of a enterprise mannequin transformation, that’s, disposing of the in-person campuses to give attention to on-line studying, whereas slowly addressing M&A alternatives. Notably, the margins have gotten higher every quarter, as a result of higher pupil funding administration and price efficiencies. The corporate’s profitability is best-in-class as in comparison with its friends, whereas the valuation stays low-cost. Importantly, there may be monetary soundness to help natural and inorganic development in the long run. The steadiness sheet is rock stable and the money movement statements verify a wholesome enterprise mannequin. All of that ends in an affordable inventory, a sound enterprise mannequin, and {industry} tailwinds that place the corporate to do properly if we now have a long-term horizon. Total, I like the worth proposition and imagine there’s a affordable upside from right here.

[ad_2]

Source link