[ad_1]

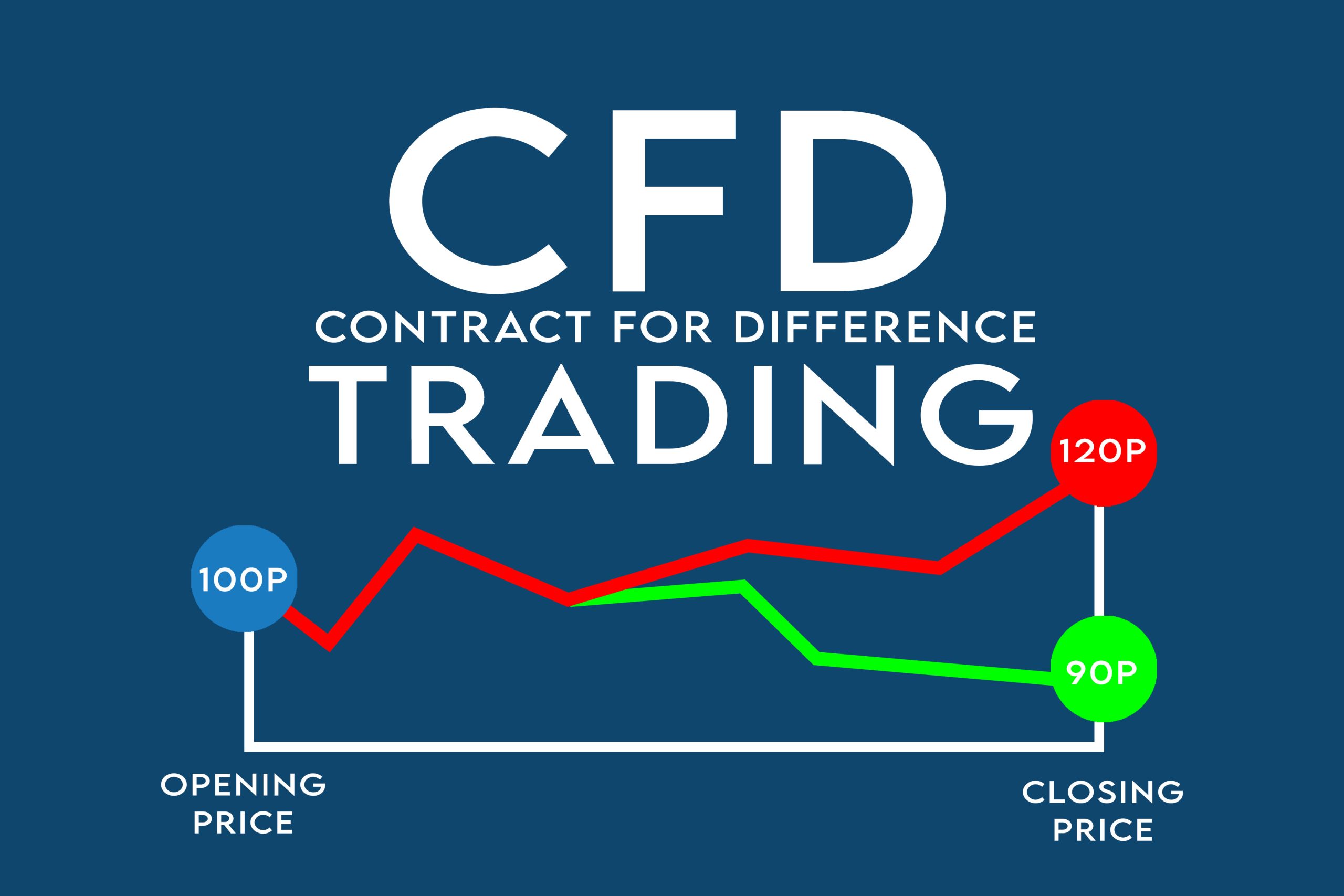

Contracts for Distinction, generally referred to as CFDs, characterize a good portion of the trendy buying and selling panorama. They’re intricate monetary devices that present merchants with a bunch of alternatives, however additionally they include their very own distinctive set of challenges and dangers. This text goals to make clear what CFDs are, how they function, and the implications they maintain for merchants.

A Deeper Dive into Contracts for Distinction

CFDs are a lovely instrument for a lot of merchants as a result of their flexibility. They permit merchants to invest on a big selection of worldwide markets with no need to spend money on the bodily asset. This will open up alternatives that may in any other case be inaccessible as a result of monetary or logistical constraints. For instance, worldwide shares, commodities, or currencies may be out of attain for some merchants, however CFDs on these property are available on most buying and selling platforms.

One other notable facet of CFDs is their software in hedging methods. If a dealer has a bodily portfolio and fears a short-term drop out there, they will ‘go brief’ with a CFD to doubtlessly offset any losses of their precise portfolio. It’s vital to notice, nonetheless, that whereas this technique can shield in opposition to losses, it may well additionally restrict income if the market rises as a substitute.

Furthermore, CFDs are traded on margin, which means merchants solely have to deposit a share of the total worth of their place. This leverage can enlarge income if the market strikes within the dealer’s favor. Nonetheless, it’s essential to keep in mind that leverage may also enlarge losses, doubtlessly even exceeding the preliminary deposit, making prudent danger administration an absolute necessity.

Lastly, not like conventional buying and selling, CFD buying and selling affords alternatives 24 hours a day, reflecting the worldwide nature of the monetary markets it encompasses. This will permit merchants to reap the benefits of value actions at any time, offering a degree of flexibility that conventional buying and selling strategies might not.

Buying and selling CFDs on a CFD Buying and selling Platform

Trendy buying and selling has been remodeled by the appearance of on-line buying and selling platforms, and CFD buying and selling isn’t any exception. A CFD buying and selling platform affords merchants the power to invest on value actions with out the necessity to personal the underlying property. These platforms present a spread of instruments to help merchants in making knowledgeable choices, comparable to superior charting capabilities, market information feeds, and analytical instruments.

Utilizing these platforms, merchants can rapidly react to market fluctuations and capitalize on short-term value actions. Moreover, many of those platforms provide options comparable to stop-loss orders, which will help mitigate potential losses by routinely closing a commerce if the market strikes in opposition to the dealer’s place by a certain amount.

Elements Influencing CFD Buying and selling

A variety of things can affect the costs of the underlying property in CFD buying and selling, and consequently, the potential income and losses for merchants. These components can vary from firm earnings experiences and main information occasions to modifications in financial indicators and shifts in market sentiment.

For instance, let’s take into account a current monetary replace: the Central Financial institution of Nigeria elevated the rate of interest by 0.25% to 18.75%. Such a change may have an effect on the worth of Nigerian shares and bonds, and thereby, the CFDs related to these property. Merchants speculating on these CFDs would want to take this rate of interest hike into consideration when making their buying and selling choices.

The Dangers and Rewards of CFD Buying and selling

CFD buying and selling isn’t with out its dangers. Using leverage signifies that each potential income and potential losses are magnified, and there’s a danger of shedding greater than your preliminary funding. Subsequently, danger administration is crucial in CFD buying and selling, and merchants ought to use instruments like stop-loss and take-profit orders to handle their danger publicity.

On the flip aspect, CFD buying and selling affords a excessive diploma of flexibility. Merchants can go lengthy or brief with ease, making it doable to revenue from each rising and falling markets. Moreover, CFDs allow merchants to realize publicity to a wide range of markets and property with no need to personal them outright, which generally is a main benefit when it comes to each value and comfort.

In conclusion, Contracts for Distinction characterize a fancy but doubtlessly rewarding facet of recent buying and selling. They require an in-depth understanding of the market and a strong technique, however for these prepared to speculate the effort and time, they provide a flexible and dynamic method to buying and selling.

[ad_2]

Source link