[ad_1]

zhengzaishuru/iStock through Getty Photos

That was a traditional Mike Burry commerce,” says considered one of his buyers. “It goes up by 10 occasions, however first it goes down by half.” This is not the type of journey most buyers take pleasure in, but it surely was, Burry thought, the essence of worth investing. His job was to disagree loudly with standard sentiment. He could not do that if he was on the mercy of very short-term market strikes, and so he did not give his buyers the power to take away their cash on brief discover, as most hedge funds did.

– Michael Lewis, The Huge Quick.

Burry Bets Huge On Market Crash

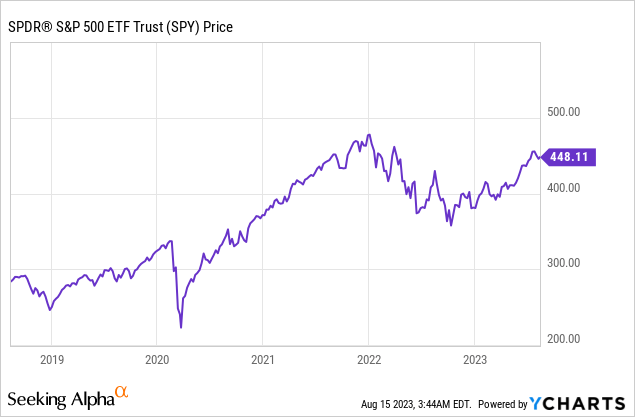

13-F filings for big asset managers got here out late yesterday, and Michael Burry’s are at all times among the many most attention-grabbing. Burry had disappeared from public view since April, sustaining radio silence since. Now, new filings present that Burry has raised the stakes on his brief bets, shopping for places on the S&P 500 (SPY) and NASDAQ 100 (QQQ) with over $1.6 billion in notional worth. With this, Michael Burry seems to be practically all-in on bets that can revenue from a pointy decline in shares, notably high-flying tech shares.

Is Burry’s commerce genius, or is it insane? Burry has a long-time penchant for being early on trades, together with his “promote” name early this yr previous his radio silence. Burry probably noticed the steadily worsening main financial indicators that {many professional} buyers are seeing and assumed that buyers would shortly agree. As a substitute, buyers purchased the dip en masse after a number of giant banks failed this yr, ignoring the slow-motion practice wreck growing in enterprise credit score and actual property credit score. His final notable tweet earlier than going darkish was that there was “no BTFD technology such as you”.

Now, it seems that Burry has positioned a contemporary guess on an enormous market decline. That is not precisely an endorsement for a comfortable touchdown pushed by dovish rates of interest and the mammoth deficits of the present administration, nor an affirmation of Ninety fifth-percentile P/E valuations for the S&P 500. It is a gutsy name, however I feel he’ll be proper in the long run. Analysis reveals that all these late-cycle rallies after the Fed pauses and credit score begins tightening are inclined to see about 13% rises for the S&P 500 on common, adopted by 35% falls to the ultimate lows. If historical past holds, Burry would stand to revenue someplace within the ballpark of $500 million from his brief bets, relying on his strike worth, premium paid, and expiration.

After all, I might be remiss if I did not be aware that there are limitations to 13-F filings as they’re delayed 45 days and do not embrace brief positions (for instance, if Burry purchased put spreads then I imagine solely the lengthy leg would present up). However we all know from previous filings that lots of his holdings stay the identical from quarter to quarter, so it is pretty probably that the 13-F displays his precise positioning. And opposite to standard perception, Burry shouldn’t be a one-trick pony from 2007-2008. He did very effectively as a price investor in the course of the dot-com bubble and after within the 2010s as effectively. Burry is sort of all-in for “desk stakes” right here utilizing choices that restrict his draw back. His brief guess is not essentially reckless, simply very aggressive. It is probably he laid out someplace between $10 million and $100 million on the guess, relying on the strike and expiration. Burry probably has tons of of hundreds of thousands in private wealth even when he loses this.

Burry’s Different Worth Investing Performs

Burry’s 13-F additionally comprises info on his most up-to-date worth investments. Whereas they are much smaller in measurement than his large brief guess, they’re nonetheless price discussing.

Burry’s different holdings:

Expedia (EXPE): Taking a fast look right here, Expedia’s price-to-earnings a number of is simply 12x, and their monetary statements look fairly stable as effectively, apart from dropping cash in 2020. Analysts expect some margin enlargement for the corporate, which might put the inventory at roughly 9.5x 2024 earnings. This looks as if a stable play from Burry. I do not suppose they’re going to hit these 2024 estimates with scholar loans kicking again in, however I might simply see EXPE having 50% or better upside over the following three years. With low cost shares like these, it is easy to get fortunate. Constitution Communications (CHTR): Once more, about 13x earnings, an enormous selloff from 2021, and perhaps some worth potential within the enterprise. It is low cost sufficient that they do not must develop earnings considerably for buyers to earn a optimistic return. I haven’t got a lot of an opinion on this one. Generac (GNRC): Generac makes turbines for houses and companies. GNRC is reasonably valued at 21x P/E, my guess is that Burry sees large progress potential right here as a result of pressure and issues with the American electrical grid. This jogs my memory of one other place the place Burry beforehand invested closely in non-public prisons and detention facilities (GEO) earlier than the migrant surges. He appears to have seen it coming earlier than anybody else did. Scary stuff… Cigna (CI): Cigna simply trades for lower than 12x earnings and is due for some slight earnings progress. I am ballparking the probably return for CI inventory at 15% yearly from briefly taking a look at their valuation and monetary statements. CVS Well being (CVS): That is one other worth inventory that has come out and in of trend. CVS is in deep worth territory at 8.7x earnings, and analysts aren’t projecting any progress in any respect. There may be loads of money stream although, so if issues do find yourself being higher than anticipated the market may erase a few of its large low cost to the large-cap universe. This looks as if one other affordable guess. MGM Resorts Worldwide (MGM): I do not actually get this one. It is not practically as low cost because the others at 18.9x earnings, and it is economically delicate. It is likely to be a China play, as they’ve a three way partnership in Macao. China’s economic system is dramatically weaker than anticipated and vacation spot playing shouldn’t be recession-proof. Burry’s is a Wall Avenue legend and I am a man who writes on In search of Alpha, however I do not see the worth on this one. Additionally notable is that Burry appears to have jettisoned the remainder of his Chinese language inventory holdings. It is a bit contradictory, and time will inform what Burry is likely to be pondering. For now, he isn’t saying a lot publicly. Stellantis (STLA): That is the father or mother firm behind CDJR (Chrysler, Dodge, Jeep Ram), and an entire host of European manufacturers reminiscent of Fiat, Citroen, and Maserati. This one makes sense- the corporate is filth low cost. STLA has a 3.4x PE ratio and an 8% dividend yield. There are fears over the UAW after the union president symbolically tossed the automakers’ supply within the trash, however we’ll see what shakes out. For 3.4x earnings, I can see this being a play with stable upside.

Backside Line

Michael Burry is probably the most attention-grabbing fund supervisor on the earth, and up to date filings present he is brief $1.6 billion in notional S&P 500 and NASDAQ. That is a large guess, and we’ll see if it really works out over the following 6-12 months. Burry can also be lengthy some choose worth shares with surprisingly good financials. So will he be vindicated for his large guess on a market crash? And can his worth performs work out? Share your ideas within the feedback beneath!

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.

[ad_2]

Source link