[ad_1]

pupunkkop

This text is a part of a sequence that gives an ongoing evaluation of the modifications made to Baupost Group’s 13F inventory portfolio on a quarterly foundation. It’s primarily based on Klarman’s regulatory 13F Kind filed on 8/11/2023. Please go to our Monitoring Seth Klarman’s Baupost Group Holdings article for an concept on how his holdings have progressed over time and our earlier replace for the fund’s strikes throughout Q1 2023.

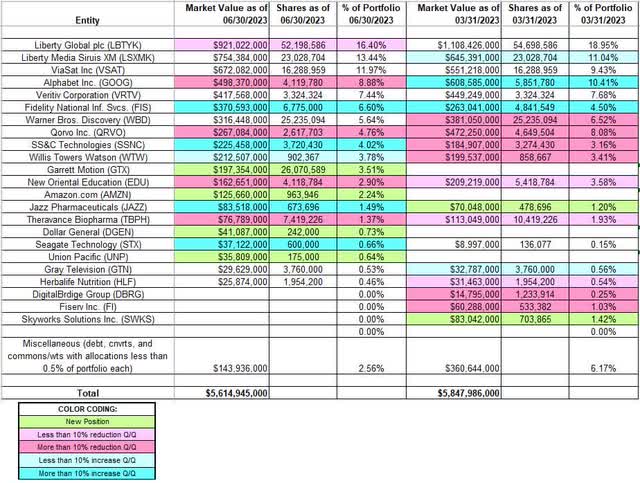

Baupost Group’s 13F portfolio worth decreased from $5.85B to $5.61B this quarter. The entire variety of 13F securities decreased from 31 to 29. The portfolio is closely concentrated with Liberty International, Liberty Media Sirius XM, ViaSat, Alphabet, and Veritiv collectively accounting for ~58% of the 13F holdings.

Since inception (1982), Baupost Group’s 13F portfolio has accounted for between 2.4% to fifteen% of the Property Beneath Administration [AUM]. The present allocation is on the high-end of that vary. The remainder of the AUM is diversified amongst money, debt, actual property, and hedges. On common, the fund has held ~25% money during the last decade. Seth Klarman’s distinct funding type is elaborated in his 1991 e-book “Margin of Security: Threat-averse worth investing methods for the considerate investor”. The e-book is out-of-print and copies promote for an enormous premium.

New Stakes:

Garrett Movement (GTX), Amazon.com (AMZN), Greenback Normal (DG), and Union Pacific (UNP): Baupost managed ~32% of Garrett Movement (GTX) as of final quarter. The majority of the possession was by way of a sequence A most popular share providing. They have been transformed to widespread inventory in the course of the quarter. The inventory is now at ~$8. AMZN is a 2.24% of the portfolio place bought at costs between ~$98 and ~$130 and the inventory is now above that vary at ~$138. DGEN and UNP are very small (lower than 0.75% of the portfolio every) stakes established in the course of the quarter.

Word: The GTX place was diminished to a 2.31% (5.99M shares) possession stake after the quarter ended at a mean worth of ~$7.75. That is in comparison with ~26M shares within the 13F Report.

Stake Disposals:

Skyworks Options (SWKS): SWKS was a small 1.42% of the portfolio stake established final quarter at costs between ~$91 and ~$123. The disposal this quarter was at costs between ~$96 and ~$118. The inventory presently trades at ~$106.

Fiserv Inc. (FI): FI was a ~1% of the portfolio place bought in This autumn 2021 at costs between ~$96 and ~$111. There was a ~30% stake improve in Q1 2022 at costs between ~$93 and ~$110 whereas within the subsequent quarter there was a ~11% trimming. This autumn 2022 noticed a ~45% discount at costs between ~$94 and ~$106. That was adopted with a ~75% promoting final quarter at costs between ~$99 and ~$118. The elimination this quarter was at costs between ~$112 and ~$126. The inventory is now at ~$123.

DigitalBridge (DBRG) beforehand Colony Capital: The very small 0.25% stake in DigitalBridge happened on account of the three-way merger of Colony Capital, Northstar Asset Administration Group, and Northstar Realty Finance that closed in January 2017. Baupost held stakes in all three of those shares and people received transformed into CLNY shares. Roughly half the place was offered in Q2 2020 at costs between ~$5.70 and $12.40. Q1 2022 noticed one other ~20% promoting at costs between ~$26.40 and ~$33. That was adopted with one other ~30% discount subsequent quarter at costs between ~$18 and ~$30. The final quarter noticed a ~60% promoting at costs between ~$10.50 and ~$15.40. The rest was offered this quarter. DBRG presently trades at ~$17.

Word: the costs quoted above are adjusted for the one-for-four reverse inventory break up final August. Their total cost-basis was ~$50 per share.

Stake Will increase:

Constancy Nationwide Data Companies (FIS): The 6.60% FIS place was bought throughout Q3 2022 at costs between ~$76 and ~$105 and it’s now at $55.88. There was a ~250% stake improve throughout This autumn 2022 at costs between ~$57 and ~$85. That was adopted with a ~125% improve final quarter at costs between ~$50 and ~$78. This quarter additionally noticed a ~40% improve at costs between ~$52 and ~$59.

SS&C Applied sciences (SSNC): SSNC is a ~4% place in-built Q3 2020 at costs between ~$56 and ~$65. The 2 quarters by way of Q1 2021 had seen a ~25% stake improve at costs between ~$63 and ~$71. There was a ~22% promoting in Q2 2022 at costs between ~$55 and ~$79. The subsequent quarter noticed an identical improve at costs between ~$48 and ~$63. There was a ~13% trimming final quarter whereas this quarter there was an identical improve. The inventory is now at ~$56.

Willis Towers Watson (WTW): WTW is a 3.78% of the portfolio stake established in Q1 2021 at costs between ~$200 and ~$235. The 2 quarters by way of Q3 2021 noticed a ~60% promoting at costs between ~$202 and ~$270 whereas the subsequent quarter there was a ~25% stake improve at costs between ~$226 and ~$249. There was an identical discount in Q2 2022 at costs between ~$191 and ~$243. Q3 2022 noticed a ~40% improve at costs between ~$192 and ~$221 whereas within the final quarter there was a one-third discount at costs between ~$220 and ~$257. The inventory presently trades at ~$197. There was a minor ~5% stake improve this quarter.

Jazz Prescription drugs (JAZZ): The 1.49% place in JAZZ stake was bought final quarter at costs between ~$134 and ~$161 and it’s now at ~$140. There was a ~40% stake improve this quarter at costs between ~$123 and ~$147.

Seagate Know-how (STX): The 0.66% STX stake was primarily constructed this quarter at costs between ~$55 and ~$67. The inventory presently trades at $65.50.

Stake Decreases:

Liberty International (LBTYK) (LBTYA): LBTYK is presently the most important place at ~16.40% of the portfolio. It was established in Q3 2018 at costs between $25 and $28.50 and elevated by ~120% subsequent quarter at costs between $19.50 and $27.50. There was one other ~27% stake improve in Q1 2019 at costs between $19.80 and $25.80. Since then, the exercise had been minor. There was a ~10% discount in Q2 2022 at costs between ~$22 and ~$26. This quarter additionally noticed a ~5% trimming. The inventory presently trades at $19.49.

Alphabet Inc. (GOOG) (GOOGL): The massive (high 5) 8.88% GOOG stake was bought in Q1 2020 at costs between ~$53 and ~$76. The final three quarters of 2020 had seen a ~75% promoting at costs between ~$55 and ~$92. There was a ~265% stake improve in Q1 2021 at costs between ~$86 and ~$105. This autumn 2021 noticed a ~22% trimming at costs between ~$133 and ~$151 whereas subsequent quarter there was a ~7% improve. The zig-zag buying and selling sample continued within the subsequent quarter: ~30% discount at costs between ~$106 and ~$144. That was adopted with one other ~60% promoting throughout Q3 2022 at costs between ~$96 and ~$123. The stake was rebuilt subsequent quarter at costs between ~$83.50 and ~$105. The final quarter noticed a ~47% stake improve at costs between ~$87 and ~$109 whereas this quarter noticed a ~30% promoting at costs between ~$104 and ~$128. The inventory is now at ~$130.

Qorvo Inc. (QRVO): QRVO is a 4.76% portfolio stake established in Q1 2017 at costs between $53 and $69 and elevated by ~25% the next quarter at costs between $63 and $79. There was one other ~22% stake improve in This autumn 2017 at costs between $65 and $81. 2019 had seen a ~75% promoting at costs between $60 and $118. This autumn 2020 noticed an about flip: ~50% stake improve at costs between ~$125 and ~$170. That was adopted with a ~18% additional improve subsequent quarter. The 2 quarters by way of Q1 2022 noticed one other ~31% stake improve at costs between ~$119 and ~$178. The final three quarters noticed a ~61% discount at costs between ~$78 and ~$114. The inventory is now at ~$100.

New Oriental Training (EDU): EDU is a 2.90% of the portfolio place bought in Q2 2022 at costs between ~$9.75 and ~$23.50. There was a ~25% promoting throughout This autumn 2022 at costs between ~$19 and ~$40. That was adopted with an identical discount this quarter at costs between ~$36 and ~$46. The inventory is now at ~$51.

Theravance Biopharma (TBPH): TBPH is a 1.37% of the portfolio place established in Q2 2014 on account of the spinoff of TBPH from Theravance (now Innoviva). The spinoff phrases referred to as for Theravance shareholders to obtain 1 share of TBPH for each 3.5 shares of Theravance held. The 2 quarters by way of Q3 2021 noticed a ~50% stake improve at costs between ~$7 and ~$22.50. The final three quarters noticed a ~45% promoting at costs between ~$9.70 and ~$12. The inventory is now at $10.14.

Word: they’ve a ~13% possession stake within the enterprise.

Saved Regular:

Liberty Media Sirius XM (LSXMK): The ~11% LSXMK stake was primarily in-built Q3 2020 at costs between $32 and $37. This autumn 2020 noticed a ~14% stake improve. The 4 quarters by way of Q2 2022 noticed the place doubled at costs between ~$35 and ~$56. The inventory presently trades under the low finish of their buy worth ranges at ~$24.

ViaSat (VSAT): VSAT is a big (high 5) place at 9.43% of the portfolio. Klarman first bought VSAT in 2008 at a lot decrease costs and his total cost-basis is within the high-teens. In July 2020, Baupost participated in ViaSat’s 4.47M share non-public placement by buying ~2.56M shares at ~$39 per share. The inventory presently trades at $31.23.

Word: Baupost’s possession stake within the enterprise went down from 21% to 13% following ViaSat’s acquisition of Inmarsat as a result of associated dilution.

Veritiv Company (VRTV): VRTV is a 7.44% of the 13F portfolio place established in Q3 2014 at costs between $32.50 and $50.50. This autumn 2017 noticed a ~20% stake improve at costs between $22.50 and $32.50. The inventory presently trades at ~$168.50.

Word: Klarman’s possession curiosity in VRTV is ~25%. Earlier this month, the inventory popped as they acquired a $170 per share money provide from an affiliate of Clayton, Dubilier & Rice, LLC.

Warner Bros. Discovery (WBD): The massive 5.64% of the portfolio stake in WBD was established in Q2 2022 at costs between ~$13 and ~$26. The subsequent quarter noticed a ~60% improve at costs between ~$11.30 and ~$17.50. The inventory is now at $13.42. There was a minor ~7% stake improve throughout This autumn 2022 whereas the final quarter noticed a ~19% trimming.

Grey Tv (GTN): The very small 0.53% GTN stake noticed a ~75% improve in Q2 2022 at costs between ~$17 and ~$22. That was adopted with a ~45% improve subsequent quarter at costs between ~$16.25 and ~$20.75. The inventory presently trades at $8.62.

Herbalife Diet (HLF): HLF is a small 0.46% of the portfolio stake established throughout This autumn 2022 at costs between ~$12.60 and ~$22.20 and the inventory presently trades at ~$16.

Word: They personal ~9% of Atara Biotherapeutics (ATRA).

The spreadsheet under highlights modifications to Klarman’s 13F inventory holdings in Q2 2023:

Seth Klarman – Baupost Group’s Q2 2023 13F Report Q/Q Comparability (John Vincent (creator))

Supply: John Vincent. Knowledge constructed from Baupost Group’s 13F filings for Q1 2023 and Q2 2023.

[ad_2]

Source link