[ad_1]

Sakorn Sukkasemsakorn

U.S. firms broadly notched better-than-expected ends in the second quarter, whilst total earnings development for the S&P 500 noticed a decline.

Fairness investor Carrie King sees extra fascinating developments past the numbers and posits one space that could be getting drained as one other readies for a reawakening.

By the numbers

Earnings for S&P 500 firms largely got here in higher than anticipated for the second quarter, whilst analyst expectations had been rising all through the reporting season.

The variety of firms beating estimates on each gross sales and earnings was barely higher than the historic common, but inventory costs weren’t well-rewarded for his or her comparatively sturdy displaying. It could be that a lot of the excellent news is already baked into costs.

General, the S&P 500 is monitoring for a year-over-year earnings decline, dragged down primarily by power and supplies. Many analysts have steered that Q2 may symbolize the trough, with an earnings upturn kicking off in Q3.

Client discretionary led amongst S&P 500 sectors, with the motels, eating places and leisure section greater than doubling its prior 12 months’s earnings development. The common market response to beats within the sector: a disappointing -2.3% return the day after reporting.

Past the numbers

A lot of our evaluation as forward-looking basic traders facilities on what firms are saying and parsing that alongside the information.

The numbers recommend shoppers are nonetheless making up for misplaced enjoyable because the pandemic. And the rhetoric from journey and restaurant firm managements has been equally buoyant, with notes of “additional acceleration,” “bettering traits,” “good momentum” and even some “shocked by shoppers’ resilience.”

However the market response appeared skeptical and, to make sure, shoppers’ pockets are solely so deep. Retailers of hardlines have steered “see-through shouldn’t be good,” the “on-line market is extra aggressive” and “promos are ramping up.”

Customers, it appears, are having to make decisions. They’re prioritizing experiences over items, managing their pantries, exercising warning and worth looking even in packaged meals. Staples firms are seeing shoppers shopping for bulk for worth, going to smaller packages to handle their budgets, or not replenishing.

Customers rising drained

Regardless of a powerful earnings season, the truth that shoppers are making trade-offs to reprioritize their spending suggests some prudence could also be warranted going ahead.

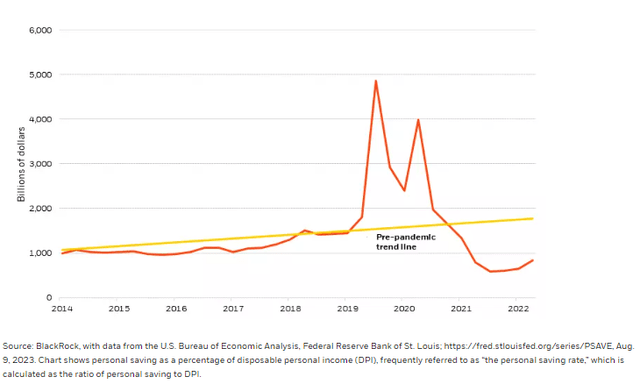

U.S. households nonetheless have roughly $500 billion in mixture extra financial savings accrued both via lowered spending or aid funds acquired in the course of the Covid pandemic.1 However as proven beneath, these financial savings are on a fast drawdown.

Customers are spending down financial savings

Private financial savings, 2014-2023

Supply: BlackRock, with information from the U.S. Bureau of Financial Evaluation, Federal Reserve Financial institution of St. Louis; Private Saving, Aug. 9, 2023. Chart exhibits private saving as a share of disposable private revenue (DPI), regularly known as “the non-public saving price,” which is calculated because the ratio of non-public saving to DPI.

Wages have been rising and unemployment is close to a 50-year low of three.5%.2 But inflation stays elevated, rates of interest on mortgages and client credit score are greater, and the federal government is ending its three-year pause on pupil mortgage funds this 12 months. Family debt rose to $17 trillion within the second quarter, based on the Federal Reserve Financial institution of New York, with bank card balances touching a brand new excessive.

All advised, we could also be nearing the tip of the patron growth ― and this clouds the image going ahead. We stay selective in client firms and customarily see larger potential in experiences over items, as spending on companies remains to be shy of pre-pandemic ranges.

Industrials due for an awakening

On the alternative aspect of the ledger is industrials, the place Q2 earnings got here in blended however we see the seeds of alternative being sown. One signpost is the world’s largest maker of development gear.

The corporate posted stellar outcomes amid wholesome demand, an consequence we consider may repeat throughout the sector as long-awaited spending and funding lastly begins to materialize.

What may immediate the spend? Catch-up from years of deferred infrastructure upgrades; a deglobalization pattern that might see firms relocating their operations nearer to house; world decarbonization efforts that can require the build-out of latest eco-friendly programs, together with authorities packages that earmark funding to advance these efforts; and elevated curiosity in automation as a shrinking working age inhabitants makes the case for industrial and technological automation of processes.

After a protracted interval of underinvestment, we consider these secular drivers may energy an acceleration in industrial spending and underpin future development. Whereas shoppers have been “pedal to the steel” for a while, we count on that momentum may wane simply because the constructing blocks of an industrial resurgence could possibly be in formation.

This put up initially appeared on the iShares Market Insights.

Editor’s Observe: The abstract bullets for this text have been chosen by In search of Alpha editors.

[ad_2]

Source link