[ad_1]

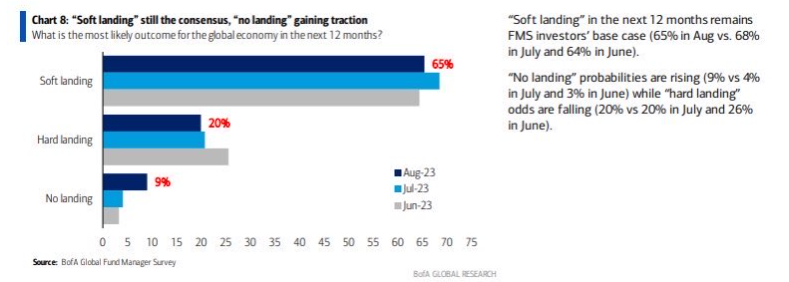

A tender touchdown is a extra doubtless state of affairs, based on a survey by Financial institution of America

There are three tech shares you possibly can take into account shopping for if that state of affairs performs out

The shares are at the moment present process a corrective section alongside the US indexes, nearing key help ranges

August hasn’t been very type to U.S. inventory indexes as far as they proceed to right. Trying forward, one of many main components more likely to steer the market within the coming months is the U.S. GDP trajectory.

In line with a survey carried out by Financial institution of America, round 65% of respondents predict a tender touchdown. Apparently, this aligns with the alerts coming from Treasury Secretary Janet Yellen and the Federal Reserve.

Supply: BofA

The primary argument to this viewpoint revolves across the constant inversion of yield curve, which traditionally has been a dependable predictor of a recession.

Nevertheless, if we assume the extra optimistic state of affairs, which is a tender touchdown, three tech business corporations deserve our consideration. They’re at the moment present process a corrective section, but they possess the potential to renew their upward trajectory if the tender touchdown state of affairs unfolds.

Let’s try to analyze them one after the other.

1. Belden

Belden (NYSE:), a community part producer, stands as one of many outstanding suppliers of high-speed community cables in the USA.

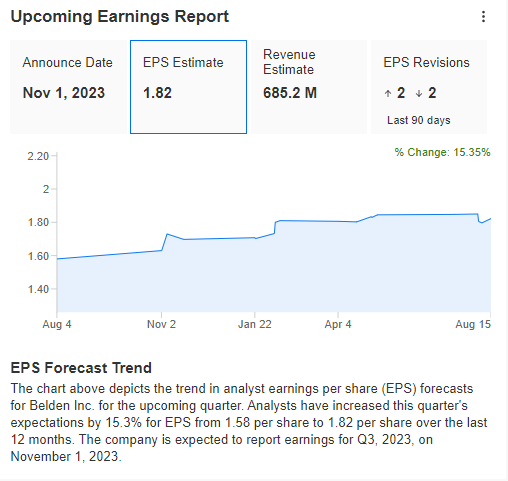

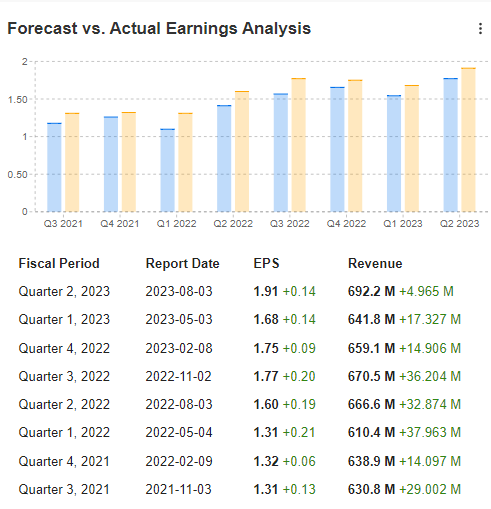

With a good model presence and strong monetary stability, the corporate adeptly meets its present monetary commitments. Notably, Belden has persistently surpassed market expectations in its quarterly outcomes and forecasts progress in earnings per share.

Belden Upcoming Earnings

Supply: InvestingPro

Forecast Vs. Precise Earnings

Supply: InvestingPro

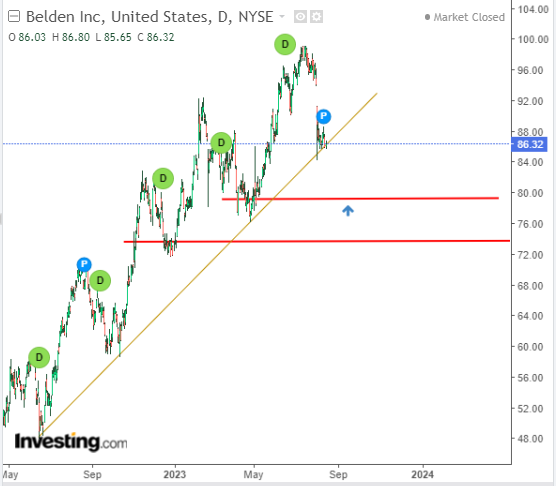

The inventory’s correction section would possibly persist till it reaches the $80 vary, which coincides with a major demand zone. If this stage is breached, it may set off a decline towards the $73 mark.

Belden Every day chart

Within the bullish state of affairs, a breakout towards new highs above $100 could be within the playing cards.

2. STMicroelectronics N.V

STMicroelectronics NV (NYSE:) stands as Europe’s largest chipmaker, poised to reap the advantages of elevated funding within the semiconductor and built-in circuit industries throughout the continent.

The European Fee’s survey anticipates a doubling of chip demand by 2030, with a strategic concentrate on decreasing dependency on non-EU suppliers.

To attain this, the newly introduced European chip act goals to mobilize over 40 billion euros to bolster the European market on this sector, positioning STMicroelectronics N.V. as a major beneficiary.

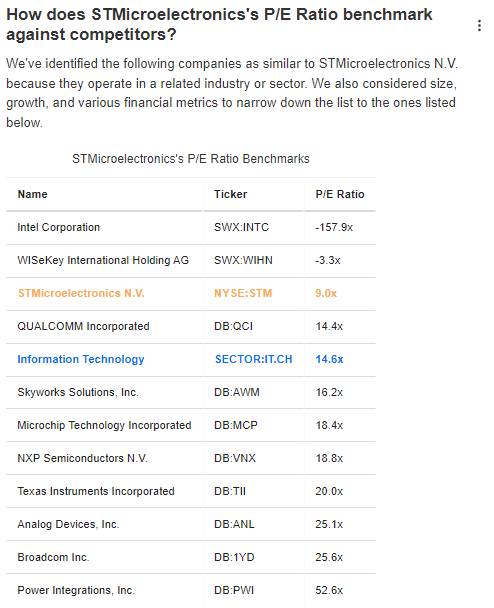

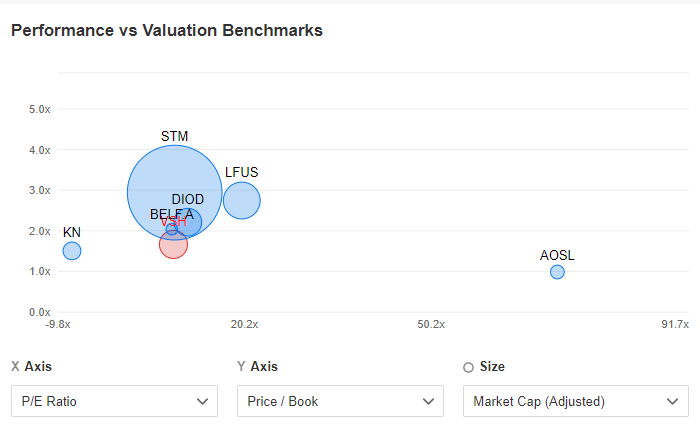

From a elementary standpoint, STMicroelectronics showcases a number of optimistic indicators, with its price-to-earnings ratio at the moment at a aggressive stage in comparison with its friends.

STMicroelectronics P/E Ratio

Supply: InvestingPro

Given the favorable financial components and powerful fundamentals, the continuation of the upward development will be thought-about a baseline state of affairs.

3. Vishay Intertechnology

Vishay Intertechnology (NYSE:) is a outstanding producer of digital elements and passive semiconductors, having fun with a major presence on this sector with a various buyer base throughout numerous areas.

Only recently, the corporate’s management unveiled plans to ascertain a cutting-edge resistor manufacturing facility, a transfer poised to considerably improve its manufacturing capability on this area. If executed based on plan, this long-term endeavor ought to bode properly for the US-based producer.

The inventory worth has remained in an uptrend for some time, earlier than present process some anticipated correction. The continuing corrective section is at the moment approaching a stable help stage close to $26.

Vishay Tech Worth Chart

Because the inventory continues its descent, it is prudent to regulate how the inventory reacts to approaching help round $24.

Moreover, it is noteworthy that the corporate’s elementary metrics, together with worth/earnings and worth/guide worth ratios, are fairly respectable compared to the broader sector. That is regardless of the inventory’s earlier rally.

Supply: InvestingPro

***

Discover All of the Data you Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it’s not meant to encourage the acquisition of belongings in any manner, nor does it represent a solicitation, provide, suggestion, recommendation, counseling, or suggestion to take a position. We remind you that each one belongings are thought-about from completely different views and are extraordinarily dangerous, so the funding choice and the related threat are the investor’s personal.

[ad_2]

Source link