[ad_1]

LeoPatrizi

Introduction

Ever since 1998, Greystone Housing Affect Buyers LP (NYSE:GHI) has targeted on the true property market the place it acquires and sells mortgage income bonds in an funding portfolio. What appears to have set the corporate other than others is the very excessive dividend yield sitting at practically 10%. This has been achieved by way of a really excessive payout ratio, one which appears fairly unsustainable at this level too.

As a lot of the attraction of GHI got here from the dividend the probability of lackluster progress to it because the housing market cools off makes me anxious concerning the true potential right here with an funding. The final report from the corporate showcased that they had $0.62 in CAD for shareholders. The place I’m anxious is the truth that some quarters produce fairly diversified CAD which makes it troublesome to foretell the precise potential of the dividend. A slowing actual property market makes it probably CAD will lower and that suppresses any purchase case within the firm for my part. I feel it is wiser to look elsewhere, however accumulating the dividend till higher occasions comes appears advisable and I will likely be score GHI a maintain because of this.

Firm Construction

As talked about earlier on, GHI operates as a holder and vendor of mortgage income bonds that are issued to offer building and/or everlasting financing for each multifamily and pupil housing. The corporate operates in america and has managed to construct up fairly the title for itself right here up to now. By way of the valuation, it is not essentially that prime regardless of the large run-up the residential market had in the previous couple of years. This resulted in GHI distributing an excellent dividend which appealed to many traders.

The true property market nonetheless appears to be fairly shaky and a few predict additional downward strain for total costs. This is able to harm demand for GHI and certain end in softer income and earnings reviews going ahead.

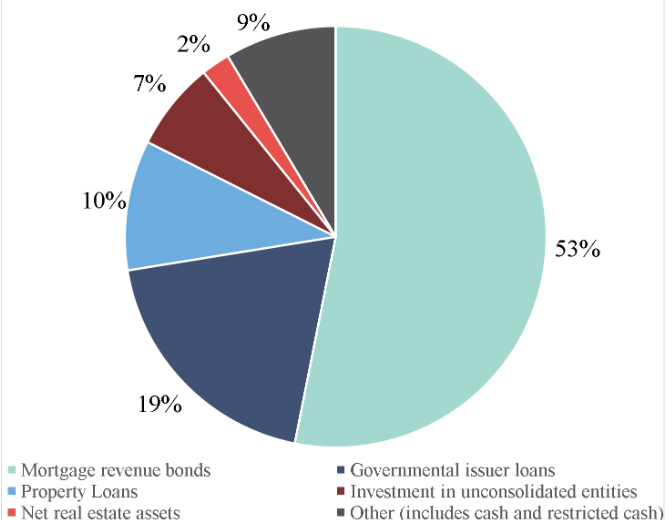

Portfolio (Investor Presentation)

The asset profile for GHI showcases nevertheless that they’re very reliant on the revenues from mortgage bonds because it makes up 53% of the asset base. Apart from that, a big portion sits in governmental issuer loans and property loans as an alternative. In Q2 FY2023 the full property amounted to $1.66 billion and it needs to be mentioned that GHI has completed an honest job leveraging this into returns because the ROA sits at 3.2% utilizing the TTM numbers.

Administration Outlook

Greystone traders can discover solace within the constructive improvement of the corporate’s base enterprise, which is exhibiting indicators of stabilization. Whereas Greystone initially skilled some delay in adapting to the rise in rates of interest, the next efforts to ascertain efficient hedges have borne fruit. This strategic response aimed toward mitigating rate of interest dangers has helped to navigate the evolving monetary panorama.

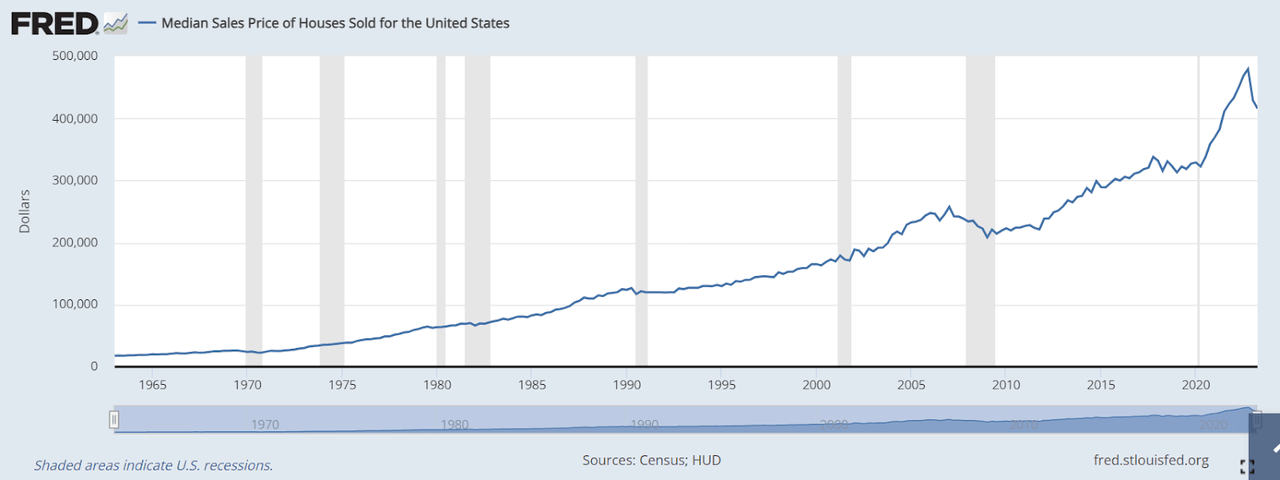

Home Costs (Fred)

Throughout the interval from Q2-2022 to Q2-2023, there was a slight uptick in curiosity bills, with an extra $2 million being incurred. Nonetheless, this enhance was met with a multi-faceted counterbalance that successfully neutralized its affect on the general monetary image.

One pivotal facet contributing to this stability is the concerted curiosity income generated throughout this era. Greystone’s targeted efforts to optimize curiosity income streams have performed a pivotal position in offsetting the rising curiosity bills. This calculated method not solely underscores the corporate’s dedication to efficient monetary administration but additionally displays its responsiveness to altering market dynamics.

Valuation & Comparability

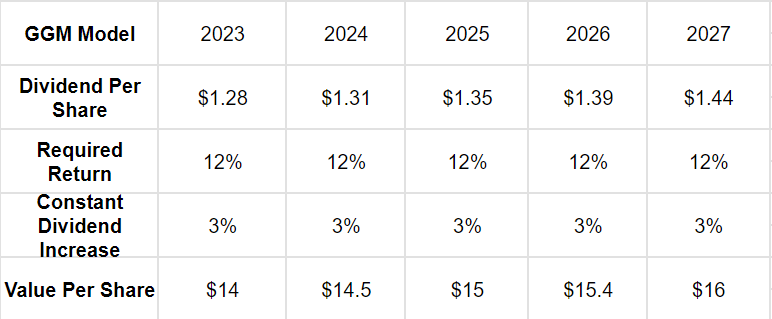

GGM Mannequin (Writer)

The mannequin above right here for GHI showcases among the dangers which can be related to an funding proper now. The corporate I do not suppose will be capable to sustain the identical quantity of dividend it has beforehand. I began with a $1.28 dividend after which utilized a fast low terminal enhance of three%, which make my targets extra threat protected. I additionally apply a reasonably excessive 12% required return to additional facilitate what I search from GHI proper now, but additionally as a result of the market circumstances appear shaky. This requires a better threat evaluation for my part. As we are able to additionally see, the goal value is not essentially the place right now’s value is. For me to be investing the share value would want to land underneath this for me to really feel snug with the danger and rewards you might be getting.

Threat Related

In This autumn-2022, a interval marked by the absence of any beneficial properties from asset gross sales, the corporate generated a modest $0.09 of money accessible for distribution. It is noteworthy that this quantity is significantly lower than 1 / 4 of the common quarterly distribution. This stark distinction raises pertinent questions concerning the sustainability of the present distribution ranges. This showcases that risky CAD is an actual chance and this can probably end in shifting dividend yields if GHI would not need to begin diluting shares extra steadily. Fortunately it would not look like debt has been the answer for the corporate right here to proceed the dividend a minimum of, which after all can be a horrible path to go down.

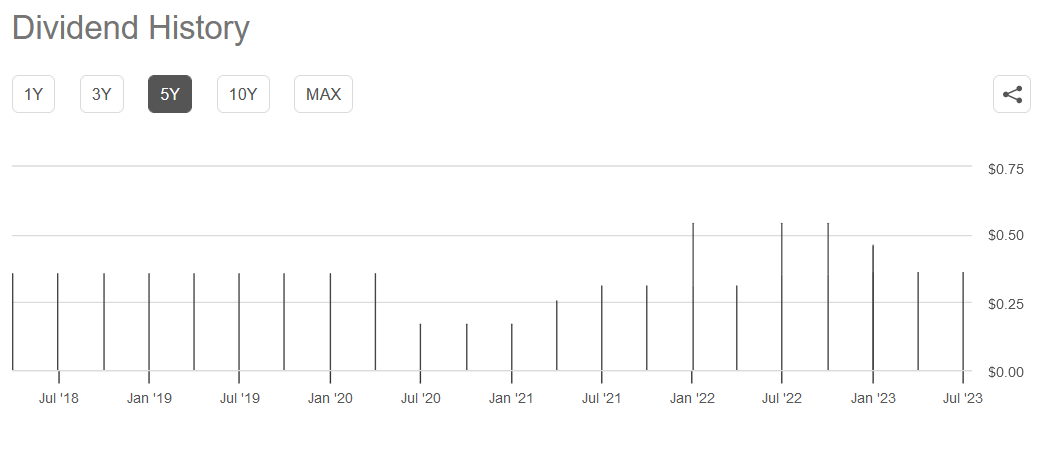

Dividend Historical past (Looking for Alpha)

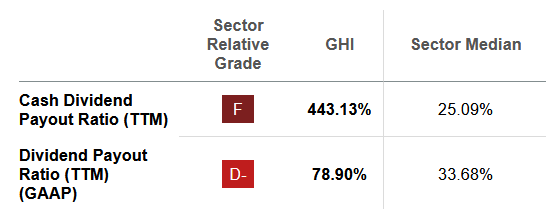

The continued concern revolves across the obvious misalignment between the money generated by the bottom enterprise operations and the substantial distributions being paid out. This dissonance turns into notably evident when assessing the comparatively modest money accessible for distribution towards the backdrop of a distribution fee that exceeds it by greater than fourfold.

Money Dividend (Looking for Alpha)

The scenario prompts a pertinent inquiry: Within the absence of a strong earnings generated by the core enterprise, is the rationale behind GHI’s determination to keep up such elevated distribution ranges warranted? With the backdrop of escalating borrowing charges, the corporate is confronted with a posh monetary panorama, which poses challenges by way of assembly the present distribution commitments whereas navigating potential shifts within the broader financial panorama.

Investor Takeaway

GHI has been very interesting to dividend earnings traders because the yield is sort of at 10% supported by what looks like an virtually constrained payout mannequin. I feel that the shakiness available in the market is making GHI extra affordable to commerce at a slight low cost. As my goal concluded the share value is above the place I’m snug paying and this ends in me score it a maintain for the second.

[ad_2]

Source link