[ad_1]

Wirestock/iStock Editorial through Getty Photos

Kering (OTCPK:PPRUF) (OTCPK:PPRUY) introduced its H1-23 outcomes, reporting an underwhelming 2% development Y/Y, an working margin lower, and near zero free money stream. The posh group continues to lag behind trade leaders in LVMH (OTCPK:LVMHF) and Hermès (OTCPK:HESAF), with no clear signal of change approaching, however the administration transformation might be a step in the appropriate course.

I reiterate a Maintain score, with a value goal of €526 per share, which equals $564 per share of the corporate’s ADR.

Background

A month in the past, I initiated protection on Kering claiming its ‘Ugly Duckling Story Continues’. I urge you to learn that article, by which I described my funding thesis intimately, in addition to the group’s working segments, and the primary causes for its underperformance in comparison with the trade leaders.

Briefly, I discover the firm’s administration inferior to its closest rival LVMH, because the latter continues to win the advertising battle massively and always enhance new manufacturers, whereas Kering’s operations exterior Gucci and YSL are deflated. Moreover, there are clear inefficiencies mirrored within the group’s money cycle, which require a turnaround.

Now, let’s deal with the corporate’s outcomes, see if it is nonetheless underperforming, and talk about the governance reorganization.

H1-23 Highlights

Kering reported consolidated revenues of €10.1 billion, a lackluster 2.0% improve from the prior 12 months. Primarily based on its historic seasonality, the French conglomerate is on tempo to ship 3.6% development for your complete 12 months. For comparability, LVMH grew by 15.0%, and Hermès grew by 22.0%.

Kering H1-2023 Presentation

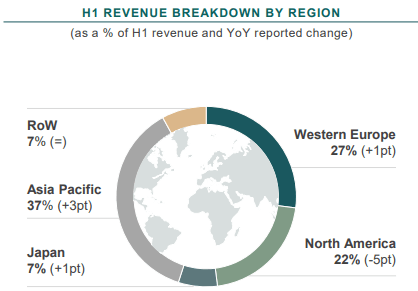

Geographically, Japan grew by 18%, Asia Pacific excluding Japan grew by 11%, Western Europe grew by 5%, RoW grew by 5%, and North America declined by 16%.

Kering H1-2023 Presentation

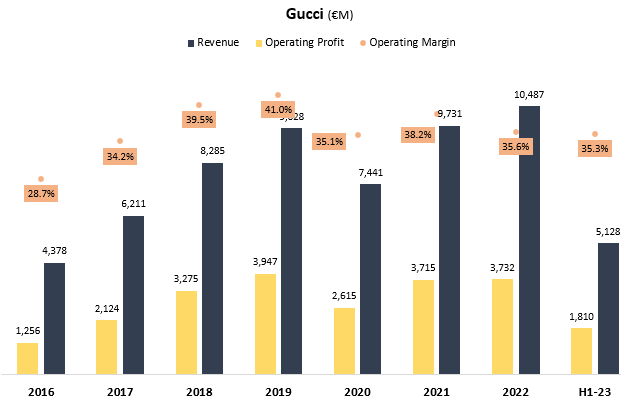

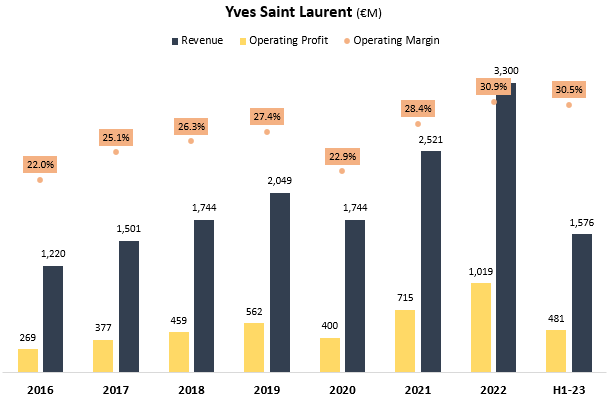

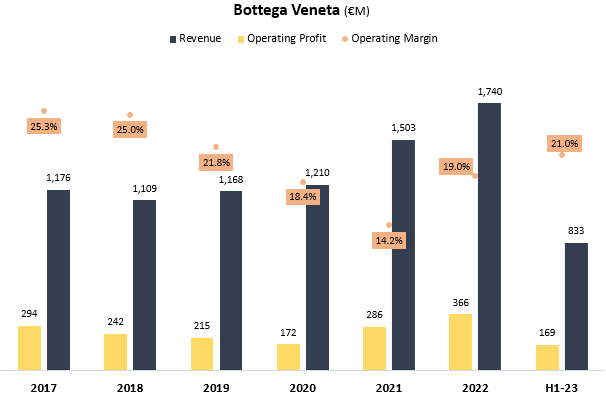

Gucci remained the biggest section when it comes to gross sales, accountable for over 50% of the group’s whole gross sales. Additionally it is probably the most worthwhile section, with 35.3% EBIT margins. Saint Laurent is second, with 15.6% attributed to the model, and 30.5% EBIT margins. Third is Bottega Veneta, with 8.2% of gross sales and a a lot decrease 20.3% margin.

Gucci

The Gucci section consists of the outcomes of Gucci branded merchandise that are distributed by means of 536 operated shops worldwide (8 openings within the interval), in addition to by means of wholesale channels.

Created and calculated by the creator utilizing knowledge from Kering monetary reviews.

Gucci is the crown jewel of the group, rising at a 14.6% CAGR between 2016-2022, sustaining 35% and above working margins. Between 2019 and 2022, Gucci went by means of a reorganization of the model’s distribution chain, which culminated within the firm surpassing the 90% threshold for gross sales generated in straight operated shops.

In H1-23, Gucci generated 91.0% of its gross sales from operated shops, reflecting €17.7 million in annual gross sales per operated location, a lower from the prior 12 months. Revenues decreased by 0.9%, and margins decreased by 20 bps.

Saint Laurent

The Saint Laurent section consists of the outcomes of YSL branded merchandise that are distributed by means of 288 operated shops worldwide (8 openings within the interval), in addition to by means of wholesale channels.

Created and calculated by the creator utilizing knowledge from Kering monetary reviews.

Saint Laurent is the fastest-growing model inside the group, with a 15.3% CAGR between 2016-2022. The section achieved all-time excessive working margins in 2022, at 30.9%.

In H1-23, Saint Laurent generated 80% of its gross sales from operated shops, reflecting €9.8 million in annual gross sales per operated location, an enchancment from the prior 12 months. Revenues elevated by 6.4%, and margins decreased by 40 bps.

Bottega Veneta

The Bottega section consists of the outcomes of Bottega Veneta branded merchandise that are distributed by means of 279 operated shops worldwide (8 openings within the interval), in addition to by means of wholesale channels.

Created and calculated by the creator utilizing knowledge from Kering monetary reviews.

Bottega is clearly the laggard among the many firm’s three largest manufacturers, rising at an unimpressive 6.8% CAGR between 2016-2022. Moreover, the model operates at a decrease margin, attaining 21.0% in 2022, nonetheless considerably under its 2016 highs.

In H1-2023, Bottega Veneta generated 80.0% of its gross sales from operated shops, reflecting €5.0 million in annual gross sales per operated location, according to the prior 12 months. Revenues remained flat, and margins improved by 200 bps.

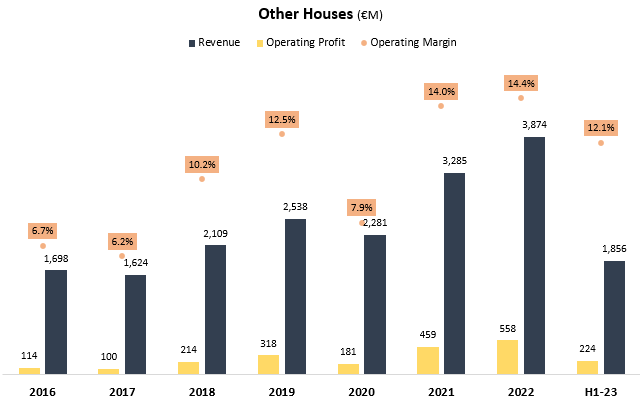

Different Homes

The Different Homes section aggregates the outcomes of the Alexander McQueen, Balenciaga, Brioni, Boucheron, Pomellato & Dodo, and Queelin manufacturers. Their merchandise are distributed by means of 591 operated shops worldwide (11 openings within the interval), in addition to by means of wholesale channels.

Created and calculated by the creator utilizing knowledge from Kering monetary reviews.

Different Homes are rising at a powerful tempo, with a 14.7% CAGR between 2016-2022, whereas considerably bettering margins alongside the way in which. It looks as if it is solely a matter of time earlier than among the manufacturers aggregated beneath the section might be awarded a section of their very own.

In H1-23, 68.0% of the section’s gross sales have been generated in operated shops, reflecting €4.2 million in annual gross sales per operated location, a lower from the prior 12 months. Revenues decreased by 5.1%, and margins declined by 230 bps.

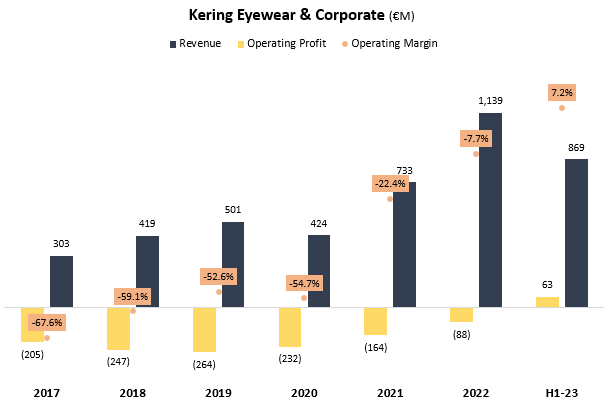

Kering Eyewear & Company

This section is sort of bizarre, because it aggregates the outcomes of the corporate’s eyewear and wonder companies with fragmented company bills.

The group lately introduced the acquisition of Creed, which is a high-end luxurious perfume home established in 1760. Creed’s outcomes needs to be aggregated into the Eyewear & Company section, which can most likely undergo some form of restructuring within the close to future.

Created and calculated by the creator utilizing knowledge from Kering monetary reviews.

We will not be taught an excessive amount of from the section’s outcomes, except for the truth that it turned to profitability within the first half and revenues grew by 50%. We’ll have to attend for restructuring till we get a greater understanding.

Backside Line

General, Kering’s underperformance remained obvious within the first half of 2023. As LVMH and Hermès continued to widen the hole with double-digit efficiency.

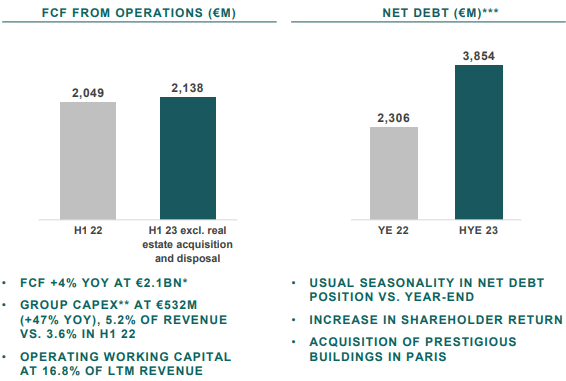

Kering H1-2023 Presentation

As I mentioned in my earlier article, the largest downside with Kering is its money cycle, an issue that continued within the first half. The corporate exhibits adjusted FCF in its presentation, however in actuality, FCF got here in at €287 million. Excluding its non-recurring investments in buildings, free money flows have been €1.6 billion which continues to be a cloth lower from the prior 12 months.

Vital Notes From The Name

An important replace, I believe, is that Kering is shuffling its administration construction.

Francesca Bellettini, President and CEO of Yves Saint Laurent since 2013, along with her present function, is appointed Kering Deputy CEO, in command of Model Improvement.

Marco Bizzarri, President and CEO of Gucci since 2015 and a member of Kering’s govt committee since 2012, will depart the corporate efficient September 23, 2023.

Jean-François Palus, presently Kering Group Managing Director, is appointed President and CEO of Gucci for a transitional interval. He’s tasked with strengthening Gucci’s groups and operations because the Home rebuilds affect and momentum, and readying its management and group for the long run.

Lastly, Jean-Marc Duplaix, Chief Monetary Officer since 2012, is appointed Kering Deputy CEO, in command of Operations and Finance. Jean-Marc Duplaix will head all Group company capabilities and be accountable for enhancing effectivity and accountability.

Based on François-Henri Pinault, Chairman and CEO of the group (and the bulk proprietor consultant), the rationale for the reorganization is as follows:

In a nutshell, the rationale of our group is the next: It’s to raise the operational experience on the group degree. It is about enhancing our stewardship of our Homes. And it’s to empower them to deal with their core knowhow. And I am sure that this reorganization is a decisive step, not solely in getting our efficiency again on observe within the short-term, however extra importantly, to seize the expansion of the luxurious world for the following decade.

Personally, I like this quote. To me, it is a signal that the group is acknowledging its failure over the previous decade, and that is a primary step in the direction of fixing that. Nonetheless, the brand new change appears fairly stretch, with two deputy CEOs working beneath a CEO and having different C-level obligations. It stays to be seen simply how efficient and transformative will this shakeup find yourself being.

Relating to Gucci, the group expects a transition interval in 2023, which mixed with general weak point within the trend luxurious trade, will most likely lead to a really low 12 months.

2023 is a transition 12 months with mushy income developments up to now for Gucci. H1 margin could also be, in a approach, a great proxy for the total 12 months. However I wish to be clear that we are going to assist all initiatives that the brand new administration and the brand new design crew at Gucci, we want to launch in H2 and going ahead to reignite the model for the long term. So I do not know if it is per se a reset, however we’ll assist all of the investments wanted. And as already acknowledged, the potential of the model when it comes to revenues and EBIT margin is immense and intact in comparison with what we had the event to current, however the trajectory to succeed in that goal may not be linear and comprise some part of investments.

— Jean-Marc Duplaix, CFO & Deputy CEO, H1-23 Earnings Name

One other vital replace is the acquisition of a 30% stake in Valentino from Mayhoola, an funding fund primarily based in Qatar. The settlement will allow Kering to progress in the direction of a 100% stake in Valentino in 2028. The deal values Valentino at €5.7 billion. In the present day, Valentino has 211 straight operated shops in additional than 25 nations and has recorded revenues of €1.4 billion and recurring EBITDA of €350 million in 2022.

Kering and Mayhoola additionally mentioned that as a part of the broader partnership, Kering and Mayhoola will discover potential joint alternatives according to their respective growth methods. We do not actually know what this implies and we do not have an excessive amount of details about Mayhoola, however François-Henri Pinault talked about Mayhoola confirmed inclination to purchase shares of Kering within the open market to strengthen the connection.

Valuation

I used a reduced money stream methodology to judge Kering’s honest worth. I forecast the group will develop revenues at a 5.4% CAGR between 2023-2030 on the tempo of the luxurious market.

I venture FCF margins will improve steadily as much as 17.6% in 2030, as the corporate realigns its operations and returns to a traditional money cycle.

Created and calculated by the creator primarily based on knowledge from Kering monetary reviews and the creator’s projections.

Taking a WACC of 8.9% and including its web debt place, I estimate Kering’s honest worth at €526 per share, which quantities to $564 per PPRUF ADR primarily based on the present USD/EUR ratio.

Conclusion

Kering has an extended strategy to go earlier than its ugly duckling story ends, nonetheless, the administration change is a optimistic step in the direction of restoration. The inventory has considerably underperformed its friends within the final decade, primarily as a result of stagnant free money flows and trailing the trade’s development.

Luxurious is all about model worth, and Kering clearly suffers from inferior advertising. We have obtained extra proof in H1, as the corporate’s gross sales grew by a depressing 2.0%, whereas LVMH has grown by 15.0%.

Regardless of activist headlines inflicting a short-term upswing, the Pinault household nonetheless holds vital management over the corporate and most activist makes an attempt will seemingly be blocked.

Whereas Kering owns a high-quality portfolio of manufacturers, I discover its operations essentially worse than its friends, and thus view its low cost justified. Subsequently, I fee the inventory a Maintain, however plan to watch its efficiency intently, and if we get an indication that the administration transformation is working, I’d most likely improve the inventory to a Purchase.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link