[ad_1]

Jarmo Piironen

Easterly Authorities Properties (NYSE:DEA) improved their debt construction by way of the paydown of their revolving credit score facility. An anticipated thaw within the transactional markets additionally enabled constructive revisions to full-year steerage. And since a previous replace on the inventory, shares have traded right down to a extra engaging valuation.

Regardless of the constructive developments, I nonetheless keep a impartial view on the inventory resulting from a mix of unsure development prospects, weak earnings development, and the still-elevated menace of an eventual dividend lower.

DEA Key Inventory Metrics

On the finish of Q2, DEA owned 86 properties both wholly or by way of three way partnership (“JV”). At interval finish, the portfolio remained about 98% leased. And all however certainly one of these properties had been leased to america Authorities (“USG”) with a complete weighted common remaining lease time period (“WALT”) of 10.3 years.

DEA Q2 Outcomes

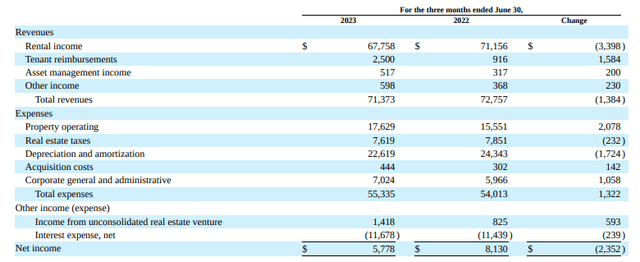

In Q2, whole rental revenues had been down +$3.4M or 4.8% YOY due primarily to a decrease whole property depend than in the identical interval final yr. The losses had been offset partially by the contributions of 1 new property holding, in addition to by the complete yr impact of two properties that had been acquired throughout Q2 of final yr. The decrease rental revenues weighed on general whole revenues, which was down +$1.4M in the course of the interval.

Whole bills had been up by the identical quantity, led larger by a mixed +$3.2M enhance in property degree bills and company G&A prices. It needs to be famous, nevertheless, that the rise in property degree bills had been pushed to a big extent by reimbursable initiatives. And the associated fee restoration on these initiatives would have been mirrored throughout the tenant reimbursements line merchandise.

DEA Q2FY23 Investor Complement – Quarterly Comparative Snapshot Of Revenues/Bills

Taken collectively, with changes, money internet working revenue (“NOI”) got here in at +$46.2M for the quarter. This compares to +$49.2M in the identical interval final yr. On a ahead foundation stacked in opposition to their whole enterprise worth of +$2.7M at interval finish, shares traded at an implied capitalization (“cap”) price of 6.7% on the finish of Q2.

On an general foundation, DEA reported core funds from operations (“FFO”) of $0.29/share, down from $0.33/share in the identical interval final yr resulting from each larger curiosity bills and weaker property degree efficiency.

How DEA Plans To Improve Whole Revenues

DEA is at present down a number of properties from latest inclinations. And till now, transactional markets have been muted because of the disparity in bid/ask spreads between consumers and sellers. Within the Q2 convention name, nevertheless, DEA Chairman, Darrell Crate, reported constructive developments referring to vendor expectations within the present price atmosphere.

Accordingly, DEA revised their full yr steerage to include as much as +$50M in wholly owned acquisitions. This contributed to a constructive revision of $0.01/share to the low finish of their full-year core FFO expectations. 2023 core FFO is now anticipated to be $1.14/share on the midpoint, up barely from $1.135/share beforehand.

For the acquisitions, it seems DEA will probably be concentrating on properties leased to state and native governments. This may function a wholesome complement to their federal holdings. It might additionally insulate them from funds/political-related volatility on the federal degree. The pivot can also be well timed, given the latest debt downgrade on the federal degree.

Does DEA Have The Monetary Capability To Meet Their Acquisition Goal?

Along with present yr acquisitions, DEA is anticipating the pipeline to develop additional into 2024. And by estimates supplied by CEO, William Trimble, they imagine +$200M to +$300M in acquisitions might drive FFO development of between 2% and three%. This may be a constructive, supplied DEA doesn’t overextend from a leverage standpoint.

DEA does have their ATM program, which is anticipated to offer internet proceeds of just below +$37M upon settlement. This could present a lot of the funds to cowl their near-term acquisition targets. DEA additionally totally repaid the excellent steadiness on their credit score facility subsequent to quarter finish. They now have entry to the complete +$450M accessible on the revolver.

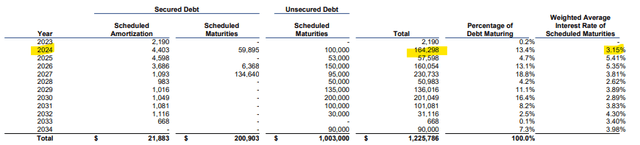

Their general debt load, nevertheless, does restrict their flexibility. Whereas leverage is on the midpoint of their goal zone, I nonetheless view it as excessive at 7.1x EBITDA. Taking over a further load, due to this fact, doesn’t appear sensible. In a single constructive, all debt excellent is at fastened charges, with a weighted common rate of interest of three.8%. However that is offset by their near-term maturity in 2024 on debt which carries a decrease price of curiosity. Refinancing/rate of interest danger, due to this fact, is considered as elevated.

DEA Q2FY23 Investor Complement – Debt Maturity Schedule

Is DEA’s Dividend Protected?

I view DEA’s dividend payout with skepticism. At present buying and selling ranges, the annualized payout yields simply shy of 8%. Yields on comparatively risk-free options, equivalent to high-yield financial savings accounts and Treasurys, are providing about 5%.

The three% unfold over the risk-frees doesn’t instill a lot pleasure in me, particularly given the heightened danger of a lower. On quarterly core FFO of $0.29/share, the payout ratio stands at over 90%. And that is earlier than contemplating FFO from an adjusted perspective. money accessible, DEA had simply $0.23/share in Q2 to cowl a $0.265/share quarterly dividend.

Further acquisitions might assist the topline. And if DEA can meet their development targets for core FFO, protection ranges might turn out to be extra in-line. However till these targets are realized, I might view the sustainability of the dividend with warning.

Is DEA Inventory A Purchase, Promote, Or Maintain?

DEA is buying and selling close to their 52-week lows and at a extra engaging valuation than on the time of my prior replace following Q1 outcomes. However this nonetheless doesn’t warrant a “purchase” ranking on the inventory.

Shares had been not too long ago downgraded by analysts at RBC Capital Markets. And general consensus Wall Road targets see lower than 10% upside potential within the inventory. This degree of bearish sentiment on the institutional degree will doubtless anchor the inventory at present buying and selling ranges till there are clearer indicators of a reversal.

Profitable execution of their acquisition technique and the ensuing enchancment of their development prospects is one catalyst that would produce a reversal in sentiment. The topline enhance from the extra properties might additionally enhance dividend protection, although I’m much less optimistic on this resulting from their larger expense burden.

Within the area of interest area of leasing to government-backed companies, buyers could discover Postal Realty Belief (PSTL) a greater purchase when it comes to the dividend prospects. And for share worth upside potential, I view Company Workplace Properties (OFC) because the title most price holding on this entrance. At 10.5x ahead FFO, OFC trades at a full flip decrease than DEA. OFC’s properties are additionally of higher high quality, in my opinion.

With these concerns in thoughts, I might discover it hard-pressed to allocate scarce funds to DEA at the moment. For buyers persevering with to look at DEA, observers ought to regulate how the corporate is progressing of their acquisition targets. Till there are indicators of additional progress right here, I might proceed to view shares finest left on maintain.

[ad_2]

Source link