[ad_1]

champc

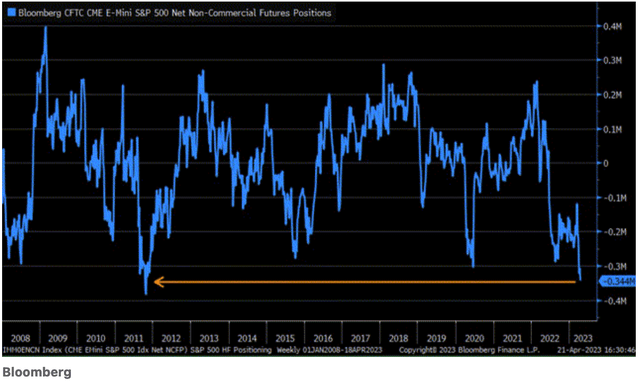

There have been many cross currents at play in 2023, which has made this 12 months a troublesome 12 months for traders. For instance, we’ve seen one of the vital inverted yield curves in trendy market historical past, decelerating home liquidity, the specter of a looming recession, all coupled with a string of enormous failing banks. This has led to a number of the most bearish bets within the markets since 2011, as most traders have piled into money, treasuries and shorts.

Bloomberg

Because the previous saying goes, “the market tends to maneuver within the route that hurts the most individuals.” In Q2 of 2023, that route was up. At the moment, primarily based on macro knowledge coupled with an outsized money place in equities, the route continues to be seemingly up from right here, in need of an unexpected occasion triggering a July high.

It’s our perception {that a} recession is unavoidable. The 2022 bear market didn’t worth on this recession, leaving the one query as to when this recession will hit? Primarily based on historic knowledge from when the yield curve inverts at numerous durations and the common lag time between these inversions, the almost definitely vary can be This fall of 2023, on the earliest – Q1 of 2024, on the newest.

Many traders at the moment are calling for a soft-landing primarily based on the brand new 2023 bull market. We imagine this can be a cyclical bull inside a secular bear market, and have outlined three potential situations this bull market may take primarily based on when a recession is prone to hit.

Robust Development = Robust Inflation

This was a theme we launched in our June report. We imagine this theme continues to be legitimate, and that the continued disinflation that equities have been celebrating will seemingly not final. Although we imagine inflation will seemingly hit equities within the subsequent 3 months, it’s vital to know that this isn’t taking place now.

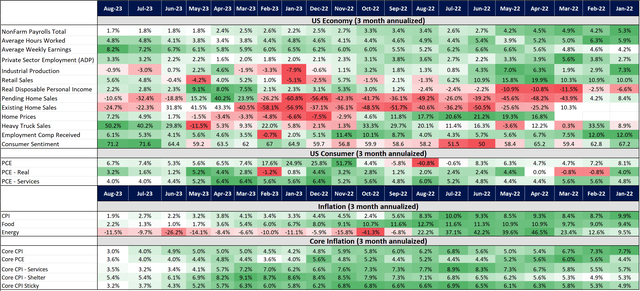

The chart under helps this, because the job market continues to speed up, together with heavy truck gross sales, house costs, retail gross sales, and a secure client. In response to the financial traits we’re seeing, there’s merely no proof of a recession brewing in Q3 of this 12 months, and that is vital for traders to understand this when searching for some kind of high.

Tech Insider Community

Nonetheless, what the market will not be pricing in, and will trigger a roadblock within the close to future, is the theme we proceed to repeat – with cussed development will come cussed inflation.

This is a crucial theme as a result of equities are rallying beneath the idea that the Fed has handled inflation, and may due to this fact pause and even decrease charges ahead of most assume. So, if inflation begins shocking to the upside once more, it will throw a wrench into this assumption, and drive equities to reprice a brand new Fed timeline.

The inflation knowledge in the identical chart above breaks down the disinflation the market is celebrating within the headline CPI numbers. The query is – will this development proceed, and additional assist the bull market? What turns into clear while you have a look at the sample is: 1) Core inflation stays sticky, and nonetheless notably above the Fed’s goal 2% goal; 2) the explanation for the CPI knowledge’s deceleration is due to power costs. We simply noticed crude oil undergo a +1.5 12 months bear market that seems to be stabilizing. I don’t imagine power commodities will have the ability to assist additional CPI readings into the longer term.

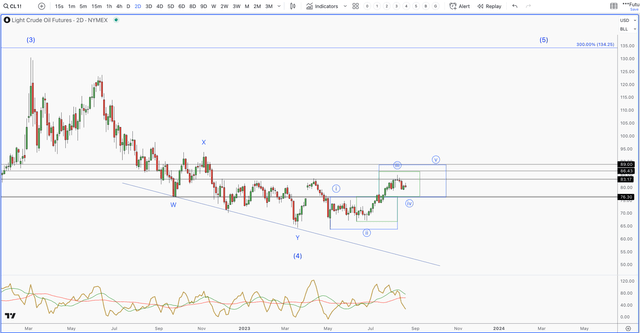

Crude Oil

Crude is just not solely engaged on its first increased excessive in over a 1.5 12 months time-frame, however it’s also engaged on a creating 5-wave sample off the low. If this bounce can maintain the $76.30 assist after which flip in the direction of $89, then the following few months may put stress on equities as oil continues increased.

Tech Insider Community

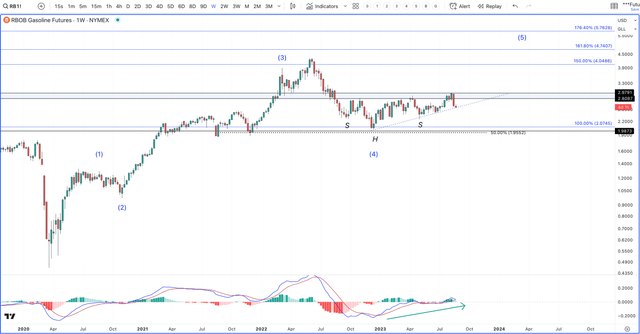

Gasoline

Fuel costs are one of the vital important parts inside an inflationary surroundings. The reason being as a result of it’s so carefully adopted by all shoppers. You’ll be able to’t drive various miles with out seeing gasoline costs marketed on the street. Due to this, they’ve a robust psychological impact on the patron’s habits.

The under chart is just not encouraging. We have now an incomplete 5-wave sample in play, which suggests yet one more push to new highs earlier than finishing. Moreover, be aware the inverse head and shoulders sample creating under the $2.8-$3 pivot. If worth breaks above the $3 pivot, we must always see a pointy rise that can solely put stress on future CPI readings, in addition to equities.

Tech Insider Community

So, with power not capable of do the lion’s share of the deceleration throughout the CPI knowledge, this leaves core inflation to choose up the slack. As proven, in prior stories, we’ve by no means seen an occasion going again to the Nineteen Forties the place core inflation acquired uncontrolled and went down with out the assistance of a recession. So, to ensure that this to be the case, it would actually be the primary occasion in trendy market historical past.

Moreover, with the patron sentiment hitting a 20 month excessive, actual disposable earnings staying constructive for over a 12 months, and employment compensation accelerating to a 9 month excessive, it’s unlikely that the patron will gradual spending on discretionary objects.

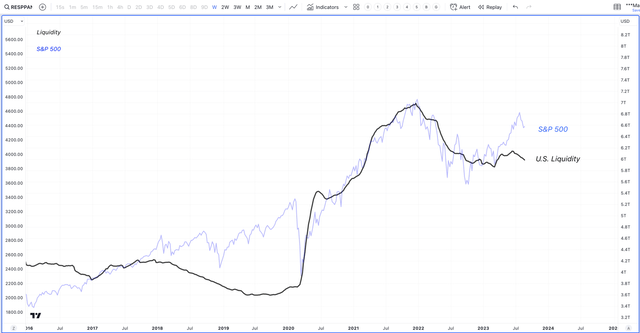

So, the issue, because it pertains to equities is core inflation, not headline numbers. So long as core inflation stays notably above the Fed’s goal, they will be unable to decrease charges, and begin a brand new spherical of QE. These instruments are the first mechanism for flooding the economic system and markets with liquidity. The rationale this matter is as a result of liquidity is what is required to verify a chronic bull market, and the Fed continues to empty it from the economic system with no sign of ending.

Tech Insider Community

Potential Paths the Broad Market Might Take

With the macro dynamics in place, the chances {that a} soft-landing, or a gentle recession that was priced in with the 2022 decline is kind of low. Inflation is probably going not fastened, and the Fed has no selection however to stay restrictive. Nonetheless, this doesn’t imply that the market can’t proceed to push increased primarily based on when the recession is probably going going to hit.

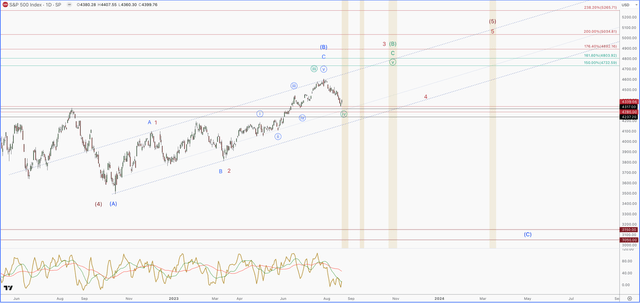

Because of this, I’ve outlined 3 potential situations the S&P 500 (SPX) may take primarily based on when a recession will seemingly hit.

Blue – This depend assumes that we already topped, and within the early levels of a big drop to new lows. We would wish to see SPX make two consecutive new lows in the direction of the $4275 area for affirmation.

Primarily based on the catalyst being seemingly recession, there’s merely no proof of a Q3 recession. So, with a view to be confirmed, it must be worth motion selecting up on some kind of unknown occasion/black swan. These black swan occasions have a better chance of taking place in an elevated price surroundings, however it’s merely not an investible technique. If that is enjoying out, it would present up in worth motion first, which we are going to focus on under.

Inexperienced – This depend assumes a This fall recession. It might mark this drop in equities as a correction inside a bigger uptrend. Nonetheless, as soon as we push to new highs, it needs to be the ultimate swing on this cyclical bull market. I might search for some kind of high in mid-October – early November. For affirmation, we have to see SPX break above 4425 quickly. Purple – This depend assumes a Q1 recession. We might seemingly commerce sideways after making yet one more excessive into October/November, adopted by a big swing to new highs into the February/March timeframe of 2024. The identical affirmation because the inexperienced depend would apply, and we might not know if that is in play or the inexperienced depend till we see new highs adopted by the following drop.

Tech Insider Community

What is going to decide if this can be a shopping for alternative (inexperienced or crimson) vs. a significant high (blue), would be the construction of this drop. The Blue depend means that we’re beginning the ultimate leg in a big diploma correction.

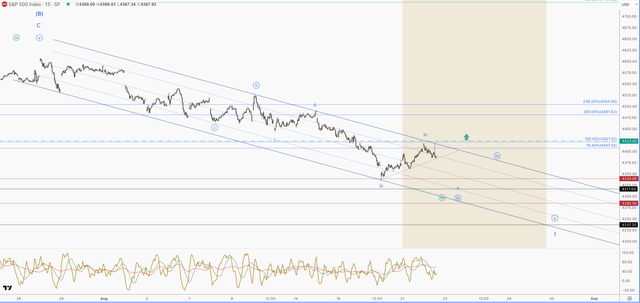

These closing legs (C waves) are at all times within the type of a 5-wave sample. Whereas the inexperienced and crimson counts counsel a correction in a bigger uptrend. Corrective patterns are at all times 3-wave patterns. So, the query is 5-waves down or 3-waves?

If we zoom into the S&P 500, up to now, we solely have 3-waves down (inexperienced). Now, this could morph right into a 5-wave sample. However, it could require two extra decrease lows and yet one more failed bounce. If this occurs, no bounce can break above 4425. If we get a break above 4425, then odds begin favoring the inexperienced or blue depend, and we are going to begin trying to purchase any following dips.

Tech Insider Community

In conclusion, the NASDAQ has offered the most effective 6 month efficiency in its historical past. The prior 12 months we noticed such epic returns was in 2019. Apparently, this was an identical 12 months the place many cross currents confounded traders. We noticed comparable quick overlaying as traders tried to entrance run a recession as a result of decelerating development. We don’t imagine a recession is priced into equities, and that it’s inevitable. Nonetheless, this doesn’t imply that we are able to’t see increased ranges from right here, earlier than a recession hits.

[ad_2]

Source link