[ad_1]

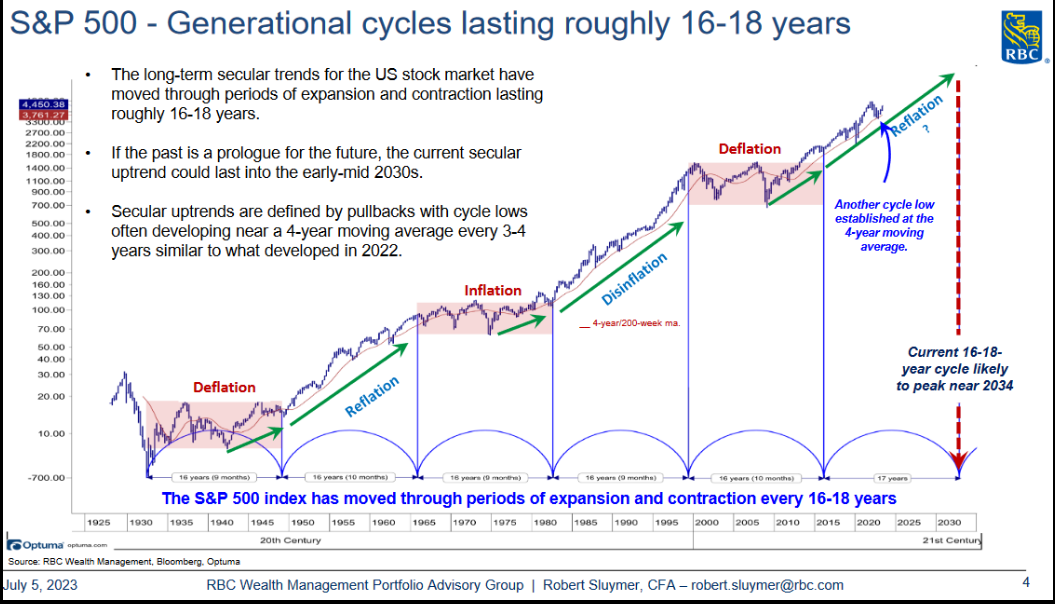

Now that we’ve had the 5% pullback we anticipated in latest weeks, many pundits are as soon as once more prognosticating the “starting of the top.” While you dig beneath the floor nonetheless, the clearer story seems to be like “the top of the start” and most shares are simply on the beginning gate of main cyclical recoveries.

Listed here are just a few now we have mentioned in earlier podcast|videocast(s):

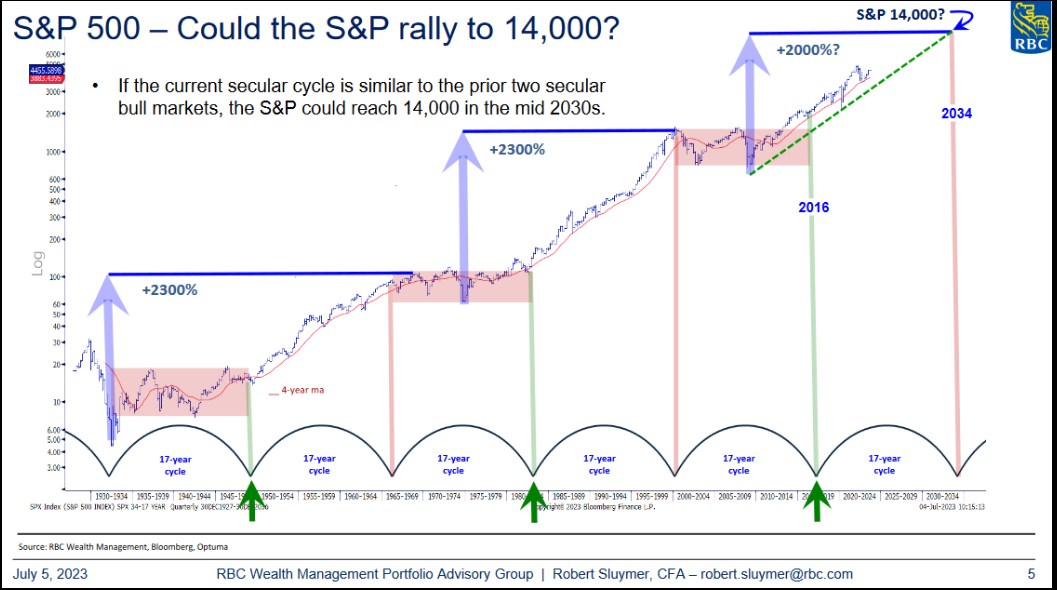

As I’ve acknowledged earlier than, the important thing to creating large cash on this enterprise is “zooming OUT.” While you get caught up within the brief time period noise, it takes you out of most of the finest corporations whose recoveries may be doubles, triples and extra in affordable time frames (over just a few years).

Do these shares (under) appear like they’re close to a prime or simply starting a multi-year restoration (in no explicit order)? If you happen to really feel such as you missed the rally, or if there’s nowhere to place new cash to work, you’ve obtained what we gently discuss with as “stinkin’ thinkin’!” You’ve been watching too many clickbait bears on TV, and it prices you some huge cash to hearken to them. A few of these corporations have taken off already, however most are simply popping out of the beginning gate and nowhere close to intrinsic worth/full restoration (opinion, not recommendation).

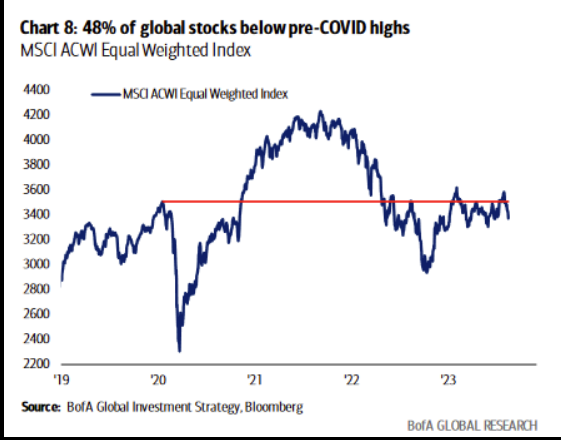

You want solely have a look at the chart of the All Nation World index under to see the p.c of shares BELOW their pre-pandemic highs.

48% of worldwide shares under pre-Covid highs

In case your hedge fund supervisor or cash supervisor can’t constantly discover high quality companies on sale (and have the fortitude/expertise/data to stay with them by means of the brief time period volatility – till worth reaches or exceeds intrinsic worth), rent somebody who can. Lots of you’ve got achieved simply that in latest days, weeks and months and we’re grateful for that! The neatest (most profitable) folks on the earth give attention to that they do finest (construct their companies/careers) and outsource the remainder.

They know that even in case you THINK you’ve got all the elements, until you understand how to combine them in the best proportions and know when to take each out of the oven (from years of expertise), you’re not going to provide world-class cookies (outcomes).

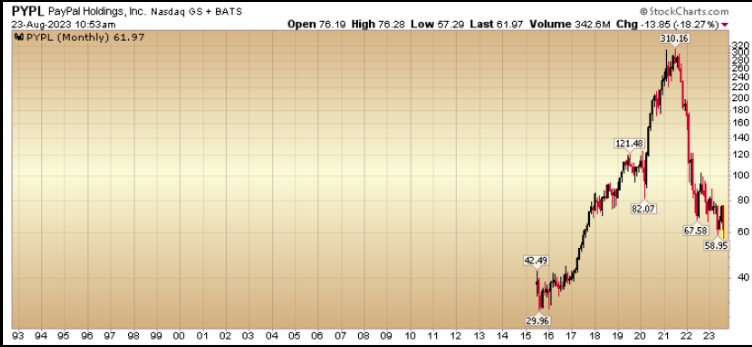

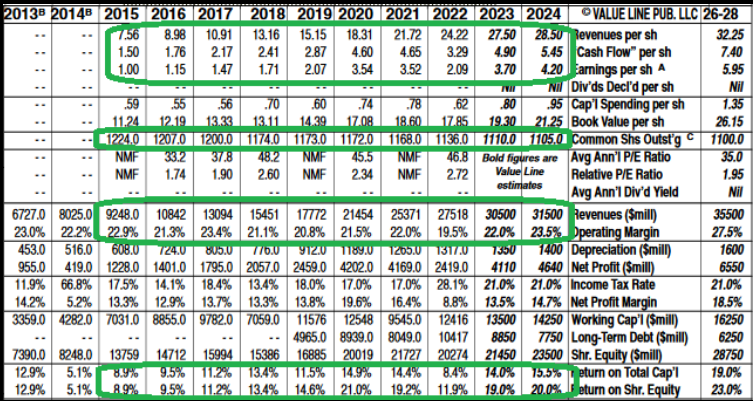

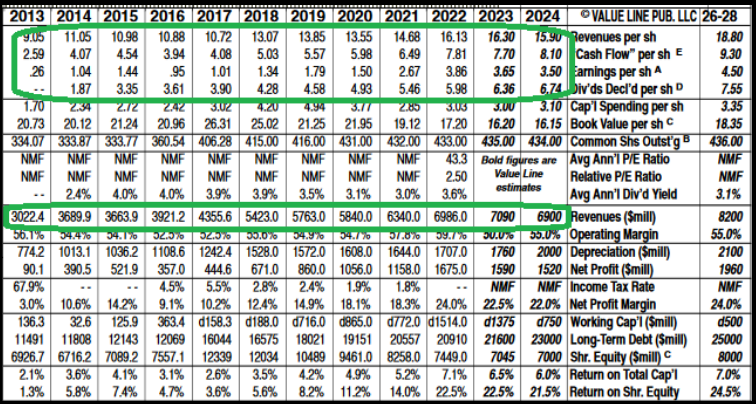

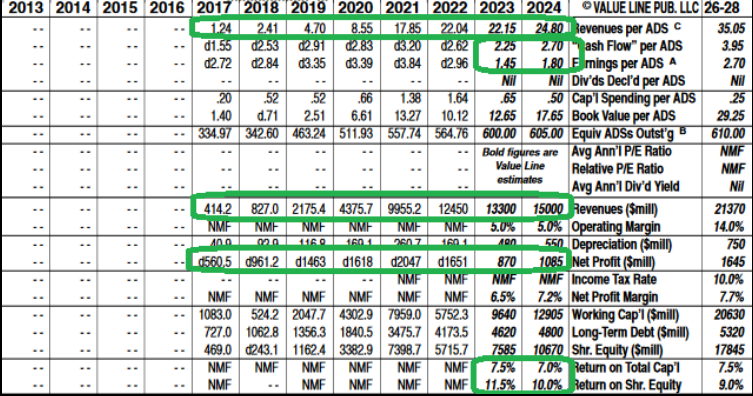

PYPL (PRICE fell ~81% from peak, not Earnings Energy or Income)

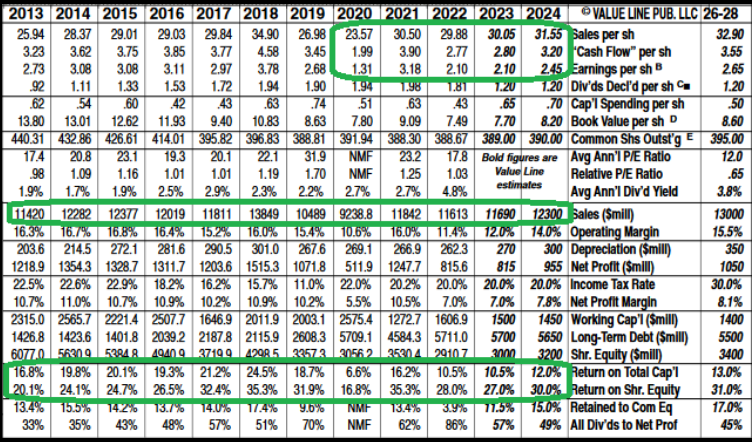

DIS (PRICE fell ~58% from peak, not Earnings Energy or Income)

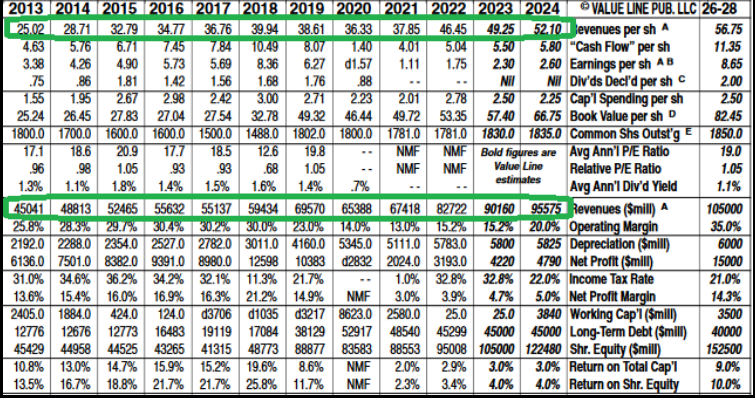

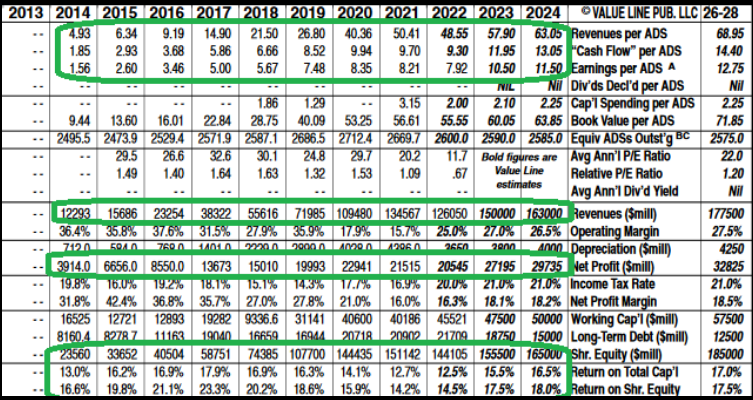

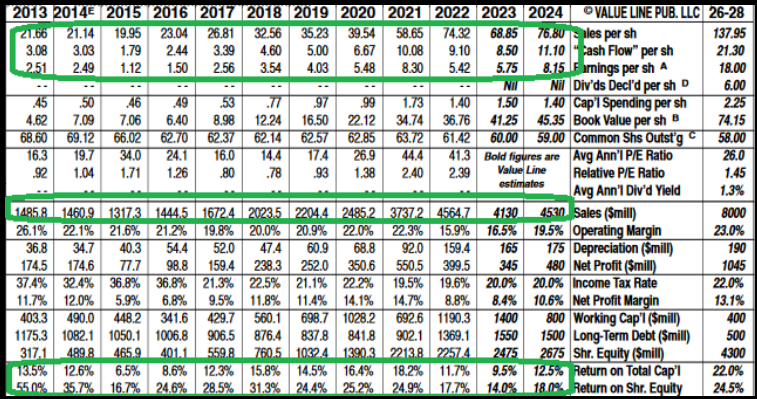

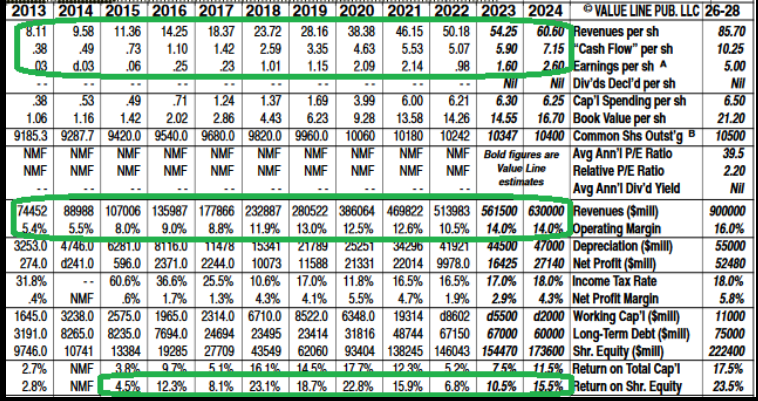

BABA (PRICE fell ~82% from peak, not Earnings Energy or Income)

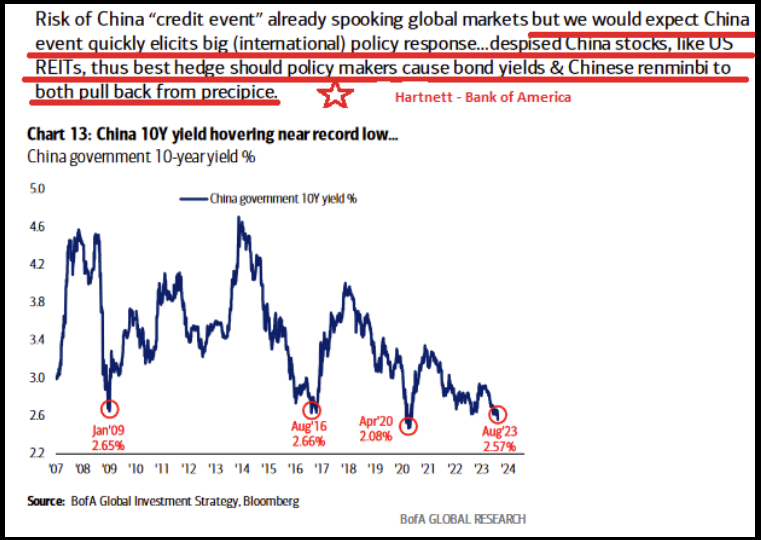

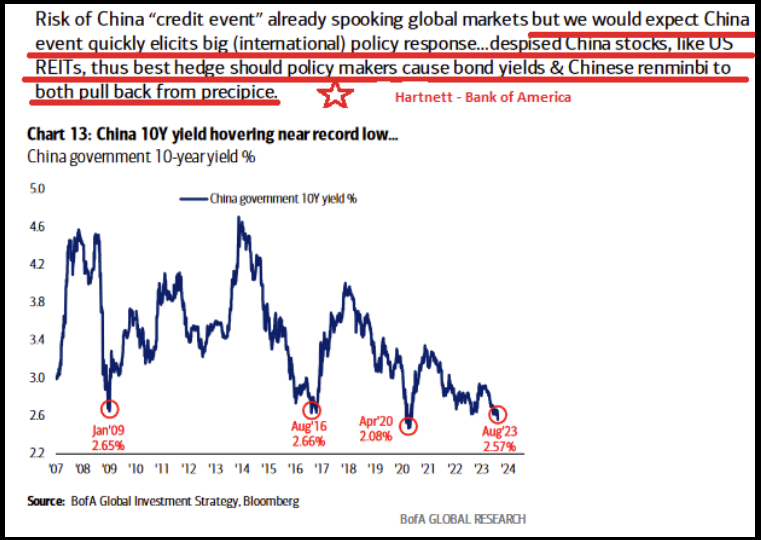

China 10Y yield hovering close to report low…

China 10Y yield hovering close to report low…

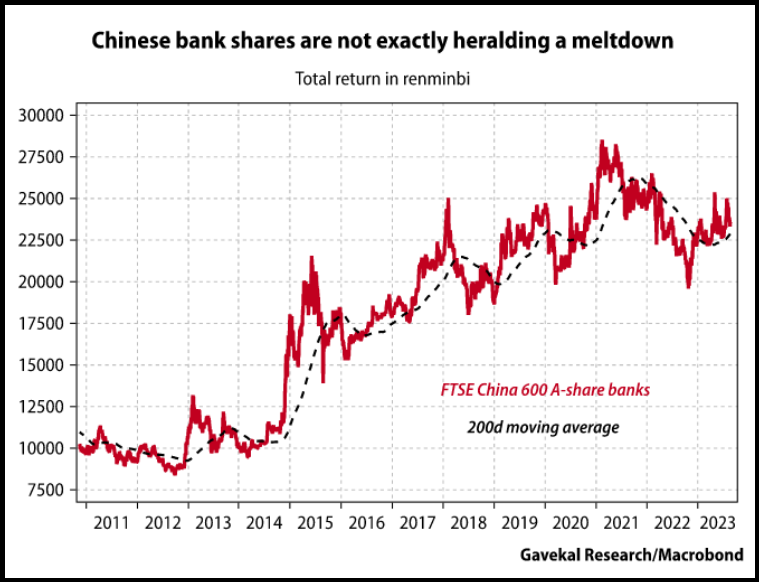

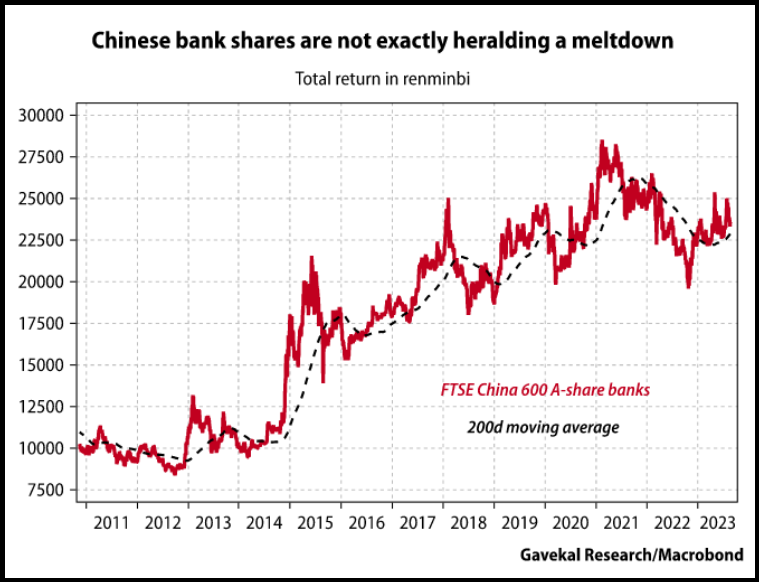

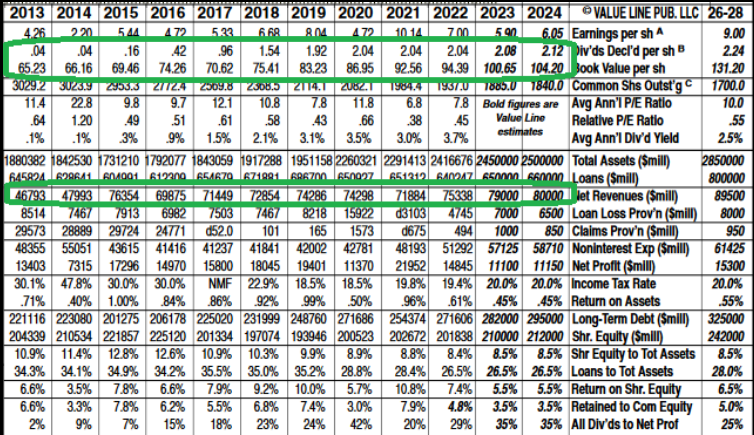

Chinese language financial institution shares should not precisely heralding a meltdown

Chinese language financial institution shares should not precisely heralding a meltdown

Alibaba delivered its strongest first quarter on report

Alibaba delivered its strongest first quarter on report

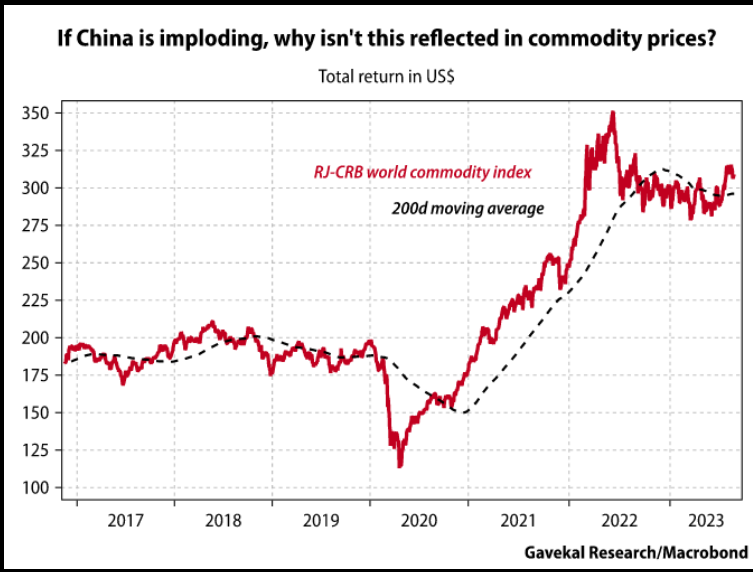

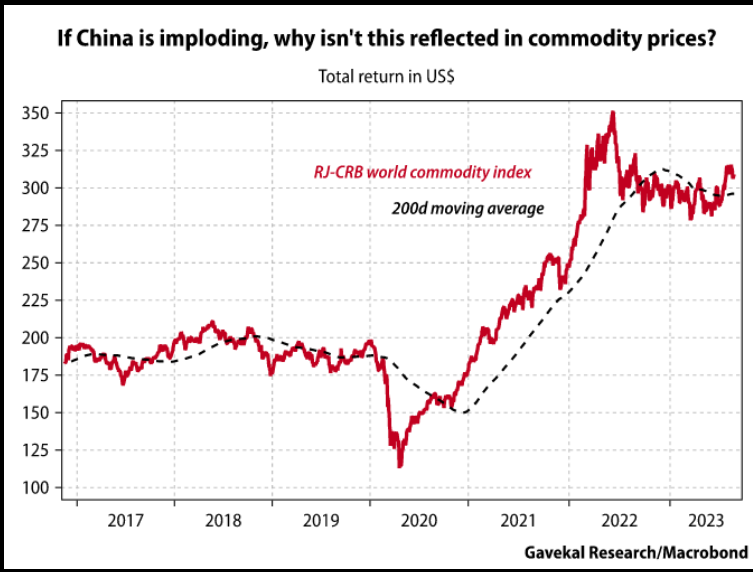

If China is imploding, why is not this mirrored in commodity costs

If China is imploding, why is not this mirrored in commodity costs

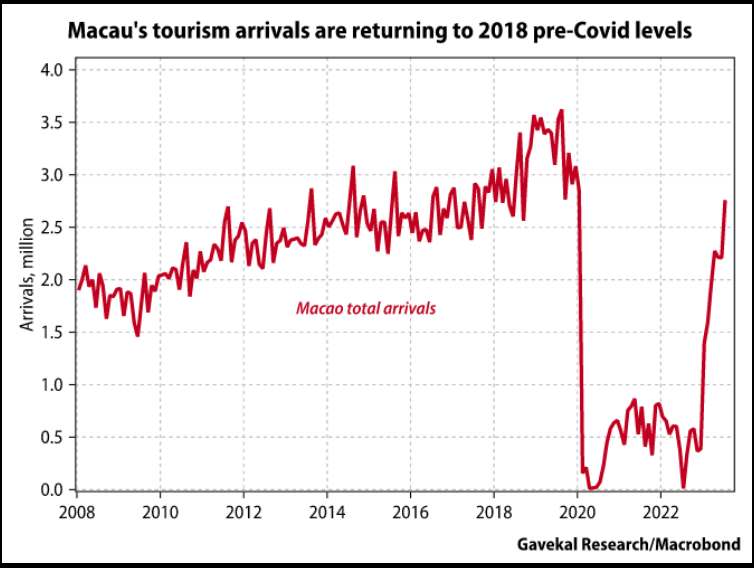

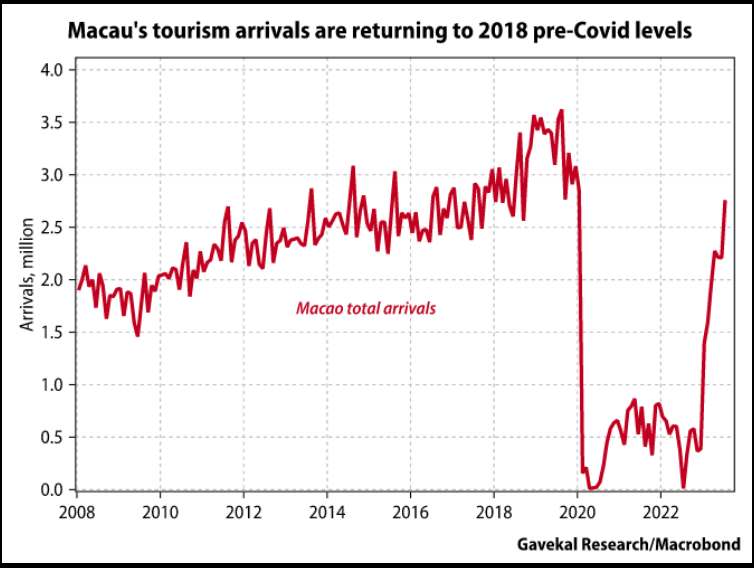

Macau’s tourism arrivals are returning to 2018 pre-Covid ranges

Macau’s tourism arrivals are returning to 2018 pre-Covid ranges

The renminbi has been weak, however has not damaged decrease towards the US

The renminbi has been weak, however has not damaged decrease towards the US

AAP (PRICE fell ~72% from peak, not Earnings Energy or Income)

CPS (PRICE fell ~97% from peak, not Income)

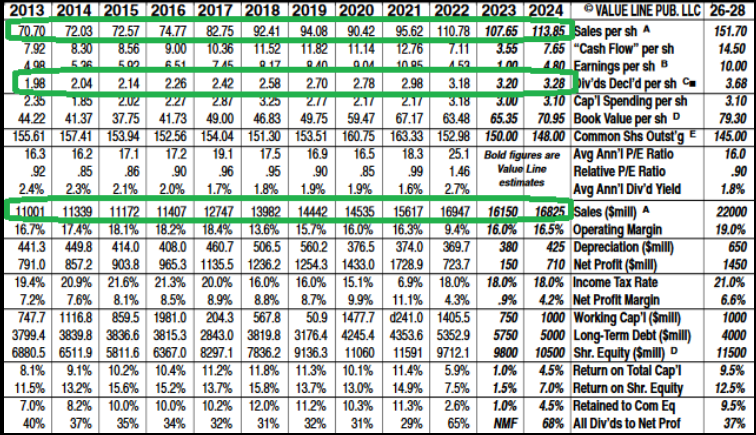

MMM (PRICE fell ~57% from peak, not Earnings Energy or Income)

BAX (PRICE fell ~59% from peak, not Earnings Energy or Income)

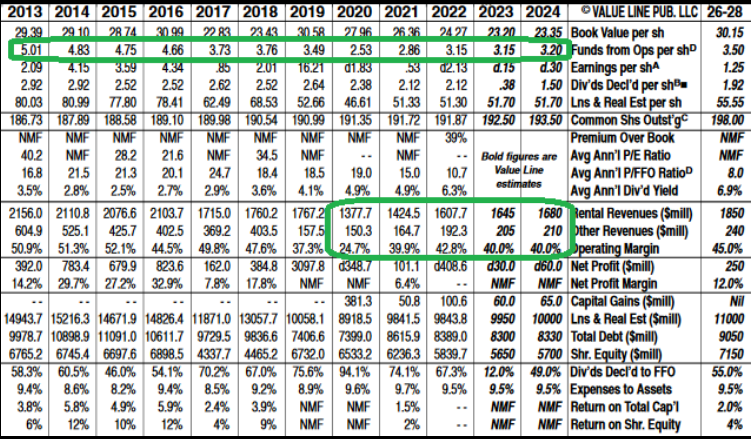

CCI (PRICE fell ~51% from peak, not Earnings Energy or Income)

VFC (PRICE fell ~81% from peak, not Earnings Energy or Income)

GNRC (PRICE fell ~83% from peak, not Earnings Energy or Income)

SWK (PRICE fell ~68% from peak, not Earnings Energy or Income)

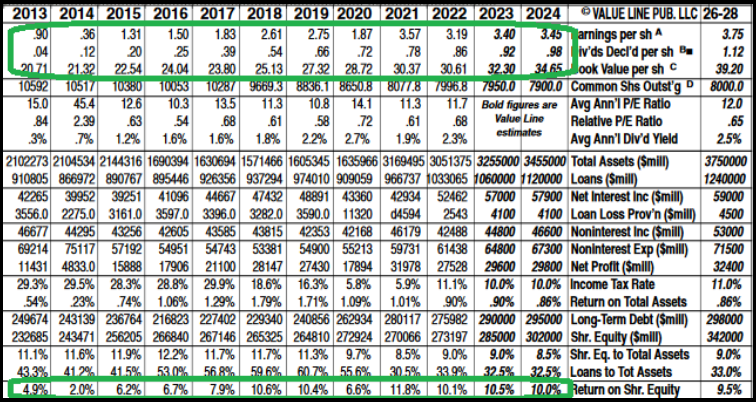

BAC (PRICE fell ~46% from peak, not Earnings Energy or Income)

AMZN (PRICE fell ~57% from peak, not Earnings Energy or Income)

C (PRICE fell ~48% from latest peak, not Earnings Energy or Income)

VNO (PRICE fell ~80% from peak, not Earnings Energy or Income)

GOOGL (PRICE fell ~45% from peak, not Earnings Energy or Income)

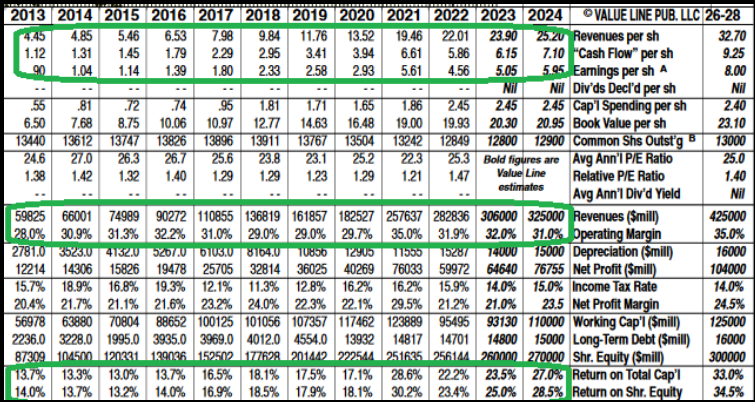

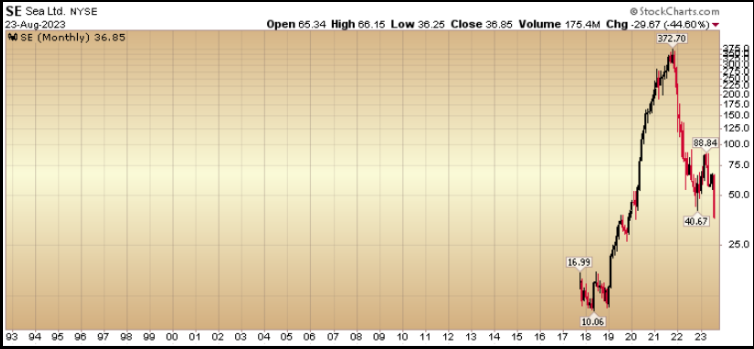

SE (PRICE fell ~90% from peak, not Earnings Energy or Income)

XBI (PRICE fell ~65% from peak)

INTC (PRICE fell ~62% from peak)

TLT (PRICE fell ~47% from peak)

The perma-bears on TV are just like the birds in a farmer’s area. The birds take a little bit of the crop on occasion (trigger short-term volatility), however in case you spend your entire days chasing (being attentive to) the “adverse” birds, it takes you out of the sector from planting your seeds (gaining an plentiful future harvest). Give attention to profiting from as soon as in a era alternatives and ignore the short-term noise.

The adverse ne’er–do–wells by no means wind up with a lot cash in the long run (even those that get fortunate on one or two trades in a profession). They sound the “smartest” on TV however earn the least over time. Fortunes are made constantly shopping for high-quality, cash-generative companies/property – when they’re out of favor (and holding them by means of volatility till they attain or exceed full intrinsic worth) – not predicting the subsequent apocalypse. These gamblers who hit on the roulette wheel as soon as in a profession (predicting a crash) generally tend to provide all of it again to the on line casino over time as a result of their course of was by no means sturdy or repeatable. To not point out, the “finish of the world” solely comes as soon as!

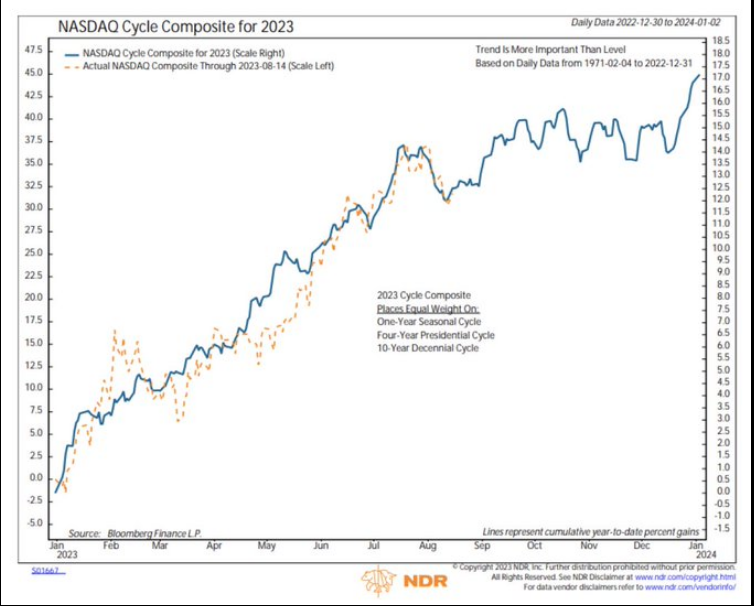

For these of you shopping for the adverse narrative, there are DOZENS of shares like those above we’re at present engaged on for brand spanking new cash and when a few of these hit our honest worth targets and are harvested. This situation is not going to final without end, however we’re constructive on markets so far as the attention can see:

Abstract: Count on bouts of volatility on the floor, search for alternatives beneath the floor. Rinse, repeat…

Now onto the shorter time period view for the Basic Market:

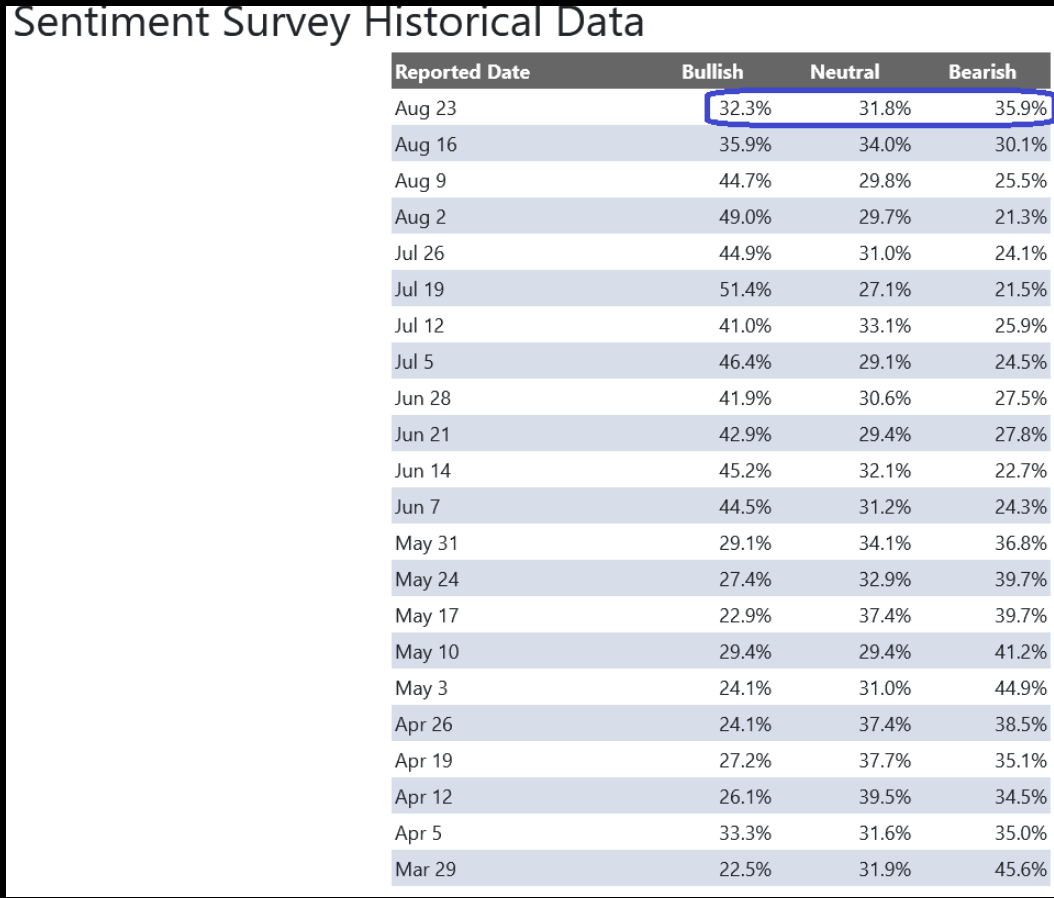

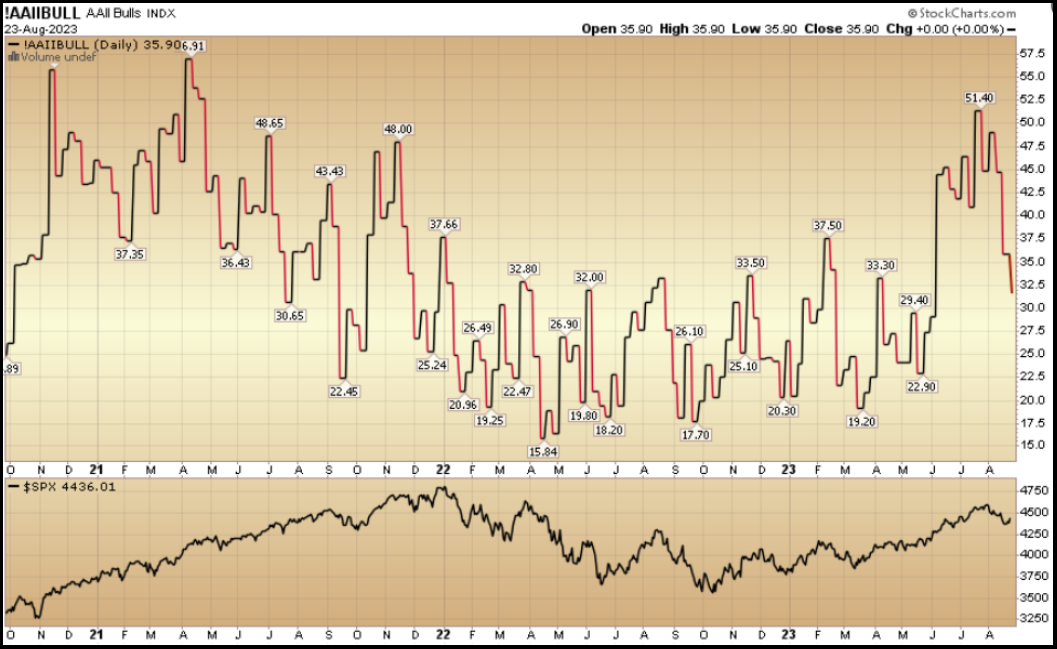

On this week’s AAII Sentiment Survey outcome, Bullish P.c (Video Clarification) dropped to 32.3% from 35.9% the earlier week. Bearish P.c rose to 35.9% from 30.1%. The retail investor is exhibiting some renewed trepidation.

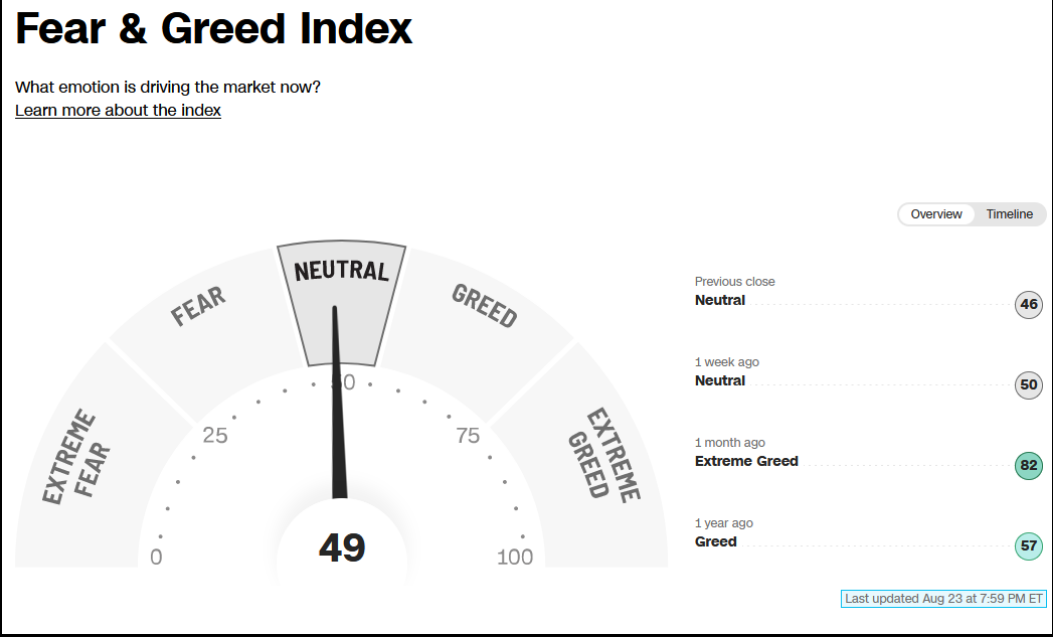

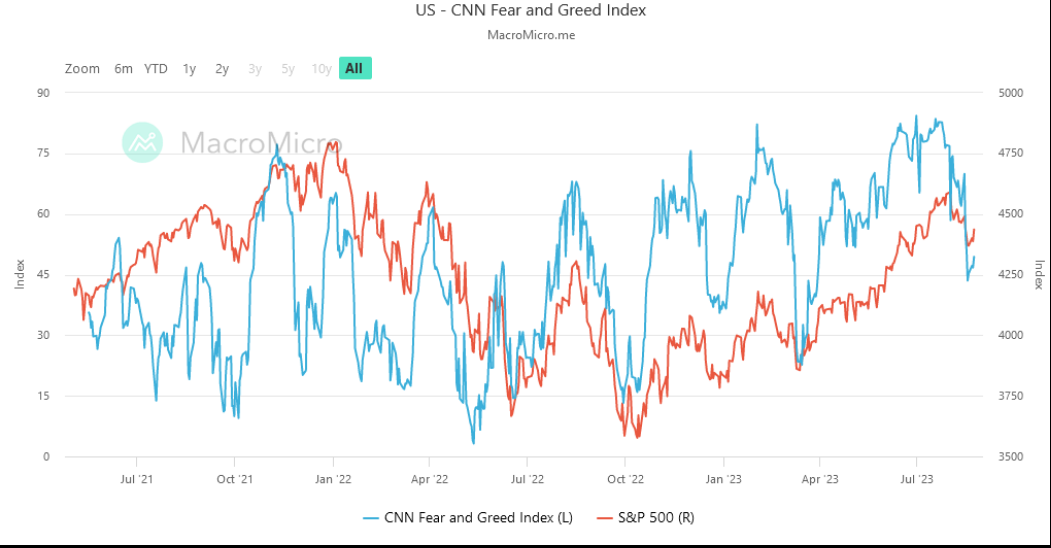

The CNN “Concern and Greed” dropped from 52 final week to 49 this week. You may find out how this indicator is calculated and the way it works right here: (Video Clarification)

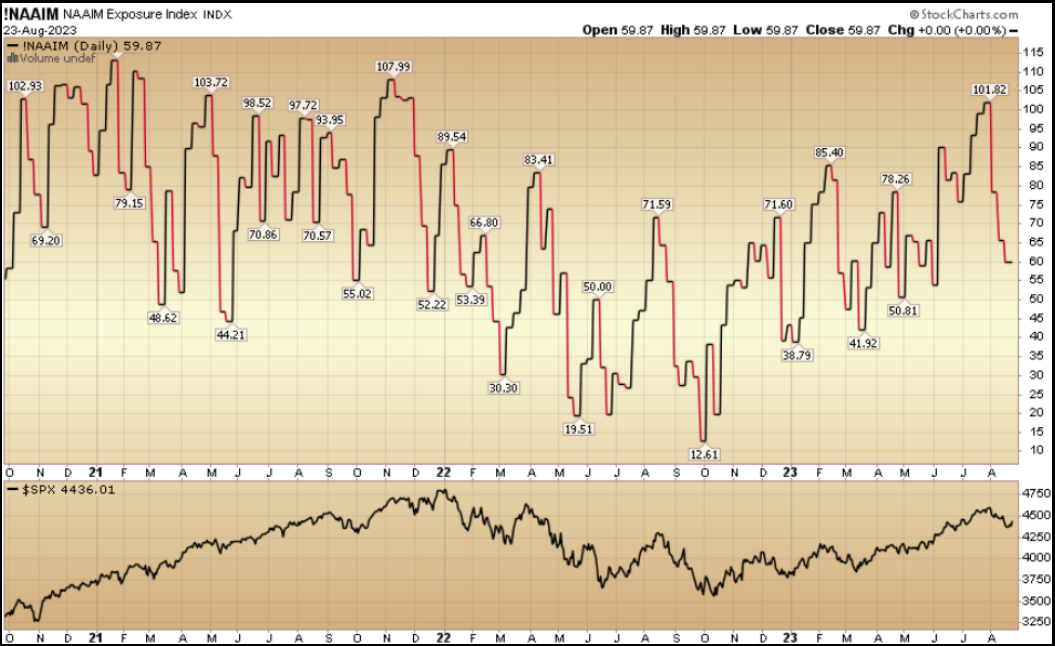

And at last, the NAAIM (Nationwide Affiliation of Lively Funding Managers Index) (Video Clarification) dropped to 59.87% this week from 65.49% fairness publicity final week.

This content material was initially printed on Hedgefundtips.com.

[ad_2]

Source link