[ad_1]

FG Commerce Latin/E+ by way of Getty Photos

Introduction

Verona Pharma (NASDAQ:VRNA), a UK-based clinical-stage biopharmaceutical firm, focuses on creating progressive therapies for respiratory ailments. It is at the moment searching for FDA approval for ensifentrine for COPD therapy in 2024.

In my earlier evaluation, I recognized Verona Pharma as a compelling funding because of its stable monetary well being and promising investigational product, ensifentrine. Their market capitalization hinted at potential undervaluation, given the possible annual income from a modest COPD market share. I acknowledged the scientific trial dangers, however emphasised optimistic outcomes within the ENHANCE program. My ‘Purchase’ advice remained robust contemplating their 2023 progress and 2024 market entry potential, however I suggested warning because of regulatory and aggressive dangers.

The next article discusses Verona Pharma’s monetary well being following Q2 earnings, progress on ensifentrine for COPD, and its potential market impression in 2024.

Q2 2023 Earnings

Taking a look at Verona’s most up-to-date earnings report, their money place at June 30, 2023, stood at $270.7M, up from $227.8M on the finish of 2022. This, mixed with anticipated receipts from the UK tax credit score program and a $150M debt facility, is anticipated to fund Verona Pharma’s operations by 2025, together with the potential U.S. launch of ensifentrine. R&D bills confirmed a web reversal of $2.5M in Q2 2023, in distinction to a $15M price in Q2 2022, largely because of the wrap-up of the Part 3 ENHANCE program and a good decision of disputes saving $6.3M. SG&A bills climbed to $12.4M in Q2 2023, up from $5.5M the earlier yr, largely due to personnel prices and preparations for a 2024 product launch. The corporate reported a web lack of $8.8M for the quarter, which is a lower from the $17.8M loss in Q2 2022.

Liquidity And Money Runway

Turning to Verona Pharma’s stability sheet, the corporate’s money and money equivalents stand at $270.7M. There aren’t any listed marketable securities, however there’s an fairness curiosity valued at $15M. This sums as much as a complete of $285.7M in liquid property. Over the six months ended June 30, 2023, Verona Pharma utilized $27.1M in its working actions, averaging a month-to-month money burn of $4.5M. Given this common month-to-month burn fee, the corporate has an estimated money runway of roughly 63.5 months, or simply over 5 years. Nevertheless, these estimates are my very own and should differ from different analyses. Verona’s total liquidity seems robust, with substantial money reserves to cowl its operational expenditures for the foreseeable future. With liabilities of $30.8M and a time period mortgage of $19.9M, it is important to watch the agency’s debt place. Nevertheless, given its present liquidity, there appears to be no rapid want for added financing.

Valuation, Development, And Momentum

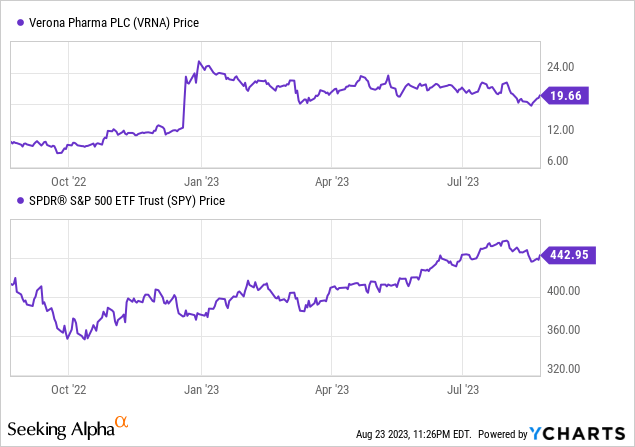

Based on Looking for Alpha information: Verona’s capital construction is characterised by a small debt relative to its market capitalization, coupled with a major amount of money. The enterprise worth stands at $1.27B. When it comes to valuation, conventional metrics reminiscent of P/E usually are not significant, as the corporate stays pre-revenue. The corporate tasks notable progress, with no income in 2023 however escalating to $36.29M in 2024 and surging to $152.50M by 2025. The earnings estimates present a transition from damaging to optimistic EPS by 2025. Lastly, Verona’s inventory momentum over the previous yr has considerably outperformed the S&P 500, with a 77.48% improve up to now yr, regardless of some short-term pullbacks within the final 3–6 months.

Verona Paves a Clearer Path for COPD Sufferers

On the newest earnings name, Verona’s administration offered updates on the developments concerning ensifentrine, their drug candidate for the therapy of COPD. In Might, additional analyses from the ENHANCE research had been showcased on the American Thoracic Society Worldwide Convention. These research additionally obtained acknowledgment in a peer-reviewed publication. In June, the corporate submitted a brand new drug software (NDA) to the FDA, supported by profitable outcomes from the Part 3 ENHANCE program and different scientific research. Parallel to their regulatory progress, the corporate is gearing up for potential U.S. market launch of ensifentrine within the latter half of 2024, upon FDA approval. They highlighted ensifentrine’s potential as the primary new methodology for COPD upkeep therapy in over a decade. Externally, their Better China improvement associate, Nuance Pharma, started a Part 3 trial for the drug. The success of ensifentrine within the Part 3 ENHANCE program trials and its distinctive mechanism are seen as promising for addressing the in depth international COPD affected person inhabitants. Upcoming plans embrace presenting new trial analyses at important respiratory occasions and internet hosting an analyst assembly in New York to elaborate on their launch methods.

My Evaluation And Suggestion

In conclusion, Verona Pharma has positioned itself prominently inside the respiratory therapeutics sector, with its frontrunner, ensifentrine, aiming to disrupt the COPD therapy paradigm. The drug’s distinctive positioning as the primary twin inhibitors of PDE3 and PDE4, coupled with a promising scientific profile, implies that the pharmaceutical panorama could be on the verge of witnessing a breakthrough in COPD administration. Whereas the last word placement of ensifentrine within the COPD therapy algorithm stays speculative, the info to date means that Verona is carving a possible area of interest for itself.

From an funding standpoint, Verona’s astute monetary administration has been noteworthy. Their prudent OpEx administration has given them a considerable money runway, which, within the risky world of clinical-stage biopharmaceuticals, is invaluable. The rise of their money place, coupled with the anticipated receipts from tax credit and the accessible debt facility, additional strengthens their monetary stability, at the very least by 2025. Traders ought to hold an in depth eye on the FDA’s resolution concerning ensifentrine, as this can have important implications for the corporate’s income stream and, finally, its inventory valuation. Moreover, the corporate’s evolving debt place and potential want for added financing, given its deliberate 2024 product launch, are very important metrics to watch.

Within the coming weeks and months, apart from the FDA’s verdict, traders must be attentive to the corporate’s displays at important respiratory occasions and their analyst assembly in New York. These may present deeper insights into Verona’s launch methods and potential market penetration. Primarily based on the present monetary well being, promising therapeutic profile of ensifentrine, and the numerous market want for progressive COPD therapies, my funding advice for Verona Pharma stays “Purchase”. The corporate seems poised for progress, however as with all biopharmaceutical inventory, traders ought to stay cautious and cognizant of the inherent scientific and regulatory dangers.

Dangers to Thesis

When the info change, I alter my thoughts.

In revisiting my funding advice for Verona Pharma, potential oversights or underestimations embrace:

Regulatory Hurdles: Whereas the Part 3 ENHANCE program was profitable, the FDA approval isn’t assured. Delays or rejection may derail market entry timelines.

Market Adoption: Even when ensifentrine receives FDA approval, its adoption by healthcare suppliers could be slower than anticipated. Competing merchandise and ingrained prescription habits can pose challenges.

International Market Dynamics: With Nuance Pharma’s involvement in Better China, geopolitical and regulatory challenges in worldwide markets may have an effect on prospects.

Lengthy-term Efficacy and Security: Submit-approval, long-term unwanted effects or diminished efficacy may emerge, affecting gross sales and fame.

Aggressive Panorama: Speedy developments within the biopharmaceutical sector imply potential rivals may emerge with progressive therapies.

Inventory Volatility: The previous yr’s inventory momentum is strong, however short-term pullbacks point out potential volatility, which might be unnerving for some traders.

Money Burn Fee: Whereas present liquidity seems robust, the burn fee may improve as they ramp up for product launch.

[ad_2]

Source link