[ad_1]

Pgiam/iStock through Getty Photos

Funding briefing

Following the June publication on IRadimed Company (NASDAQ:IRMD) the agency continues to unlock worth for its shareholders and provide beneficial long-term {industry} positioning. Central to the thesis, is the agency’s gross sales and earnings development, and larger share of the revenue pool in MRI-compatible units and screens. Right here I am going to run by means of the transferring elements of the IRMD funding debate, and hyperlink this again to the broader funding alternative.

Web-net, on asset components and earnings energy, IRMD continues to current with engaging economics and a purchase score is nicely supported in my opinion.

Earlier than continuing, I would encourage you to research the prior IRMD publications, in dated order (latest to oldest):

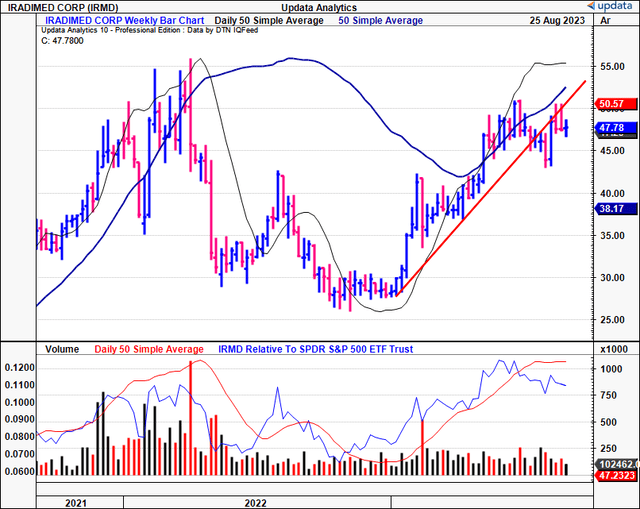

Determine 1.

Knowledge: Updata

Important components driving reiterated purchase thesis

Outlined under is the revised case underpinning the IRMD purchase thesis. The essential information of the funding debate are of basic, financial and valuation origin.

1. Insights from Q2 earnings

IRMD got here in with one other sturdy set of numbers in its Q2 FY’23 outcomes. It clipped gross sales income of $16.1mm, up 27% YoY, and pulled this to 75% gross and earnings of $0.33/share, a development of 27% from Q2 final 12 months. The majority of revenues have been earned in U.S. markets (80%) with the rest obtained on worldwide gross sales. Curiously, there was a 500bps shift towards ex-U.S. gross sales from final 12 months, with worldwide gross sales up 67% over the 12 months to $3.2mm.

The breakdown of the top-line is as follows:

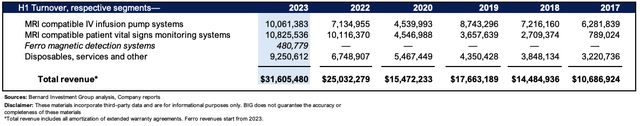

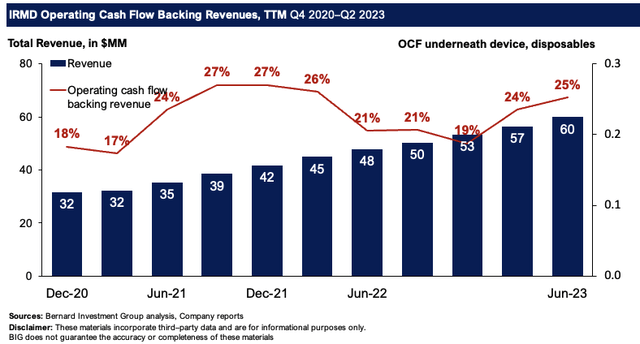

System revenues have been up 24% YoY to ~$11mm, with pumps and screens underlining this upside securing 17% and 25% development in gross sales, respectively. Disposables additionally grew by 40% YoY to ~$5mm and continued its upward bias. This was exemplified within the firm reserving $9.25mm in disposables income for the YTD. Actually, Determine 2 outlines the agency’s section revenues from H1 FY’17-H1 FY’23. Comparatively, IV pump techniques have been at $10.61mm for the half, up from $6.3mm, and monitoring techniques clipped $10.8mm, up from $0.78mm over this time.

Determine 2.

BIG Insights

By the identical token, IRMD is a professional development firm based mostly on the document proven in Determine 3. It additionally aggregates the H1 revenues throughout the 2017-’23 interval, albeit in consolidated style. Word, IRMD has compounded each working segments at 19-20% over the 6 years, with total gross sales rising on the identical geometric price.

One of many inflection factors value noting is that IRMD’s important competitor within the screens space-Phillips-looks to be “[deteriorating] in how strongly they’re remaining on this market”, per administration. This, mixed with evidenced demand in its IV infusion pumps, is a key development lever for the corporate going ahead for my part. Sustaining a 20% development price on the high line is actually no simple feat, particularly when hitting dimension. However contemplate that 1) administration initiatives 22% gross sales development this 12 months, and a pair of) consensus estimates on Wall Avenue help this view. My estimates have the corporate ending the 12 months with $78mm in capital invested, and at 0.85x capital turnover (mentioned later) I get to $66.3mm in FY’23 gross sales. Therefore, I am aligned with the notion of a 20% compounding price for IRMD going ahead.

Determine 3.

Sources: BIG Insights, Firm studies

2. Further insights to enterprise economics

Critically, observations from the agency’s financial development levers are promising to IRMD catching an additional bid.

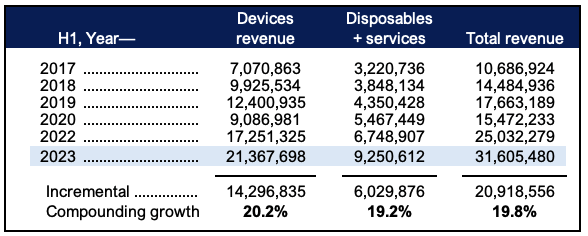

Determine 4 particulars the diploma of working money flows beneath every income print on a rolling TTM foundation. It captures the conversion from the receivables account versus revenues booked ahead. Word, it has ranged from 19-25% from FY’22-’23, while the income ramp has walked greater in a near-linear style. Having 25% of the gross sales clip as “money revenues” are engaging economics in my opinion and allows the agency to recycle money flows again into further inventories and capability to satisfy demand. It additionally reveals the agency is working by means of its backlog at an inexpensive tempo, therefore, no capability points to speak of.

Determine 4.

BIG Insights

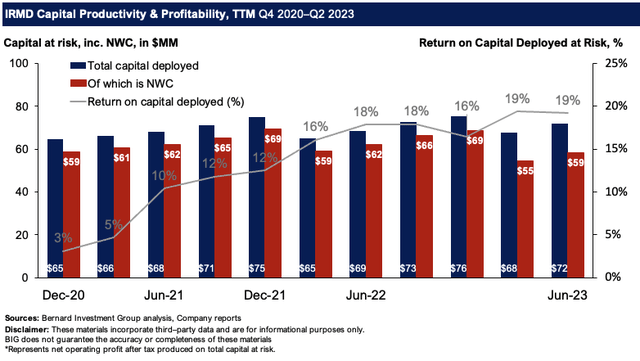

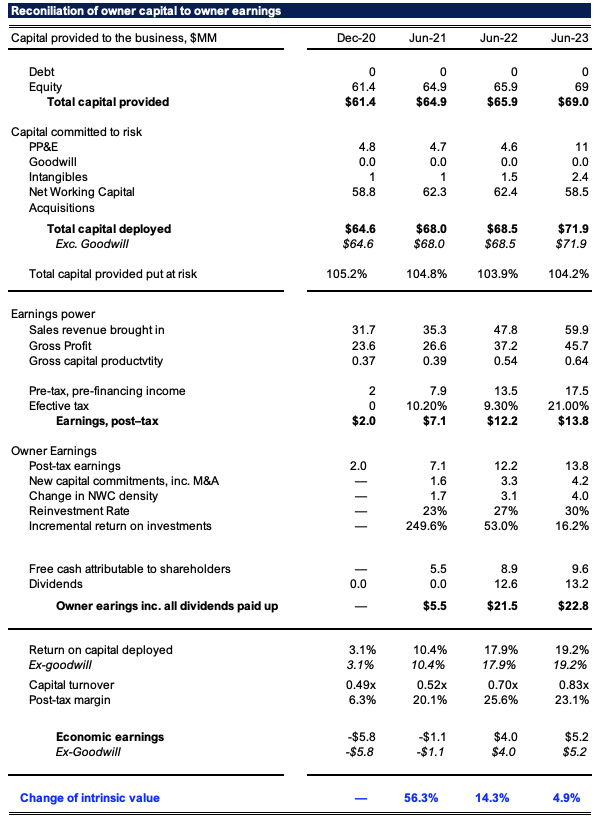

In the meantime, Determine 5 outlines the key financial development lever in IRMD’s arsenal in rolling TTM figures. It depicts the diploma of capital employed into the enterprise, and the income earned on this capital in danger. The total reconciliation is noticed in Determine 6. Critically:

A complete $6/share in capital employed ($72mm) produces $$1.15/share ($13.8mm) in post-tax earnings, a 19.2% return on funding. The bolus of capital necessities are tied as much as NWC, i.e., stock and receivables and the likes. This suits the enterprise mannequin and means that to develop, future funding in further fixtures (together with land) is mild. This return on capital has inflected greater from 13% in 2020 to 19% in Q3 on a trailing foundation.

As an fairness investor, when shopping for an organization/a place you are shopping for the mixture of asset components and earnings energy. That’s, what capital/belongings are within the enterprise, and how much gross sales + income do that produce.

You are what quantity of earnings are produced on what quantity of capital. The upper the earnings relative to the invested capital, the upper the profitability-a greater attractiveness, in my eyes.

You are additionally within the enterprise of capital allocation, very like the companies beneath the funding radar. Besides with each funding choice comes a chance price. On the corporate facet, it’s the subsequent highest NPV within the collection of development initiatives. For the investor, it’s the long-term market return on capital, usually the benchmark indices (equating to 12% on this evaluation). Therefore, a optimistic unfold in return on capital deployed vs the hurdle price is prime within the worth creation of corporations for his or her fairness holders.

That IRMD is outpacing the 12% hurdle suggests capital is extra precious in its arms than our personal, offering safety that it could compound its intrinsic valuation over the long-term. Market returns have a tendency to trace enterprise returns over the long-run, therefore, that is completely essential within the IRMD purchase thesis.

These are tremendously engaging financial traits in my opinion and help a purchase score.

Determine 5.

BIG Insights

Determine 6 additionally illustrates that benefits drawn from agency’s capital productiveness are pushed on the margin versus capital turnover. Submit-tax margins have crept up from 6.3% in 2020 to 23.1% final interval (TTM foundation).

By the identical token, capital turnover is up from 0.5 turns to 0.83x over the identical interval. This reveals it has shopper benefits and is using a price differentiation technique, pricing its choices at above-industry averages and accumulating greater margins on this. These are shopper benefits that exhibit the attractiveness of its product strains. As IRMD strikes extra inventories out the door, absolutely the margins collected on these are conducive to driving profitability greater, particularly because it begins to get pleasure from the advantages of economies of scale, thus setting within the flywheel.

Determine 6.

Sources: BIG Insights, Firm studies

3. Valuation components

The inventory sells at premium multiples to friends and is obtainable at 34x ahead earnings and ~39x ahead money flows. That is 73% and 115% to the sector, respectively. However what does this actually say? Is it an outsized a number of to scoff at, or, does it indicate the market’s excessive expectations for IRMD going ahead?

Take into account that the market additionally values its internet belongings at ~$9 in market worth for each $1 in NAV. I’ve outlined earlier why this might be so-the agency’s capital is efficacious, and returning ~19% from each $1 of capital deployed into the enterprise. IRMD is due to this fact valued at 8.4x invested capital on the present market cap, up from 4.4x in 2020. Buyers, due to this fact, acknowledge the earnings energy from what the agency’s belongings can produce and have priced IRMD accordingly.

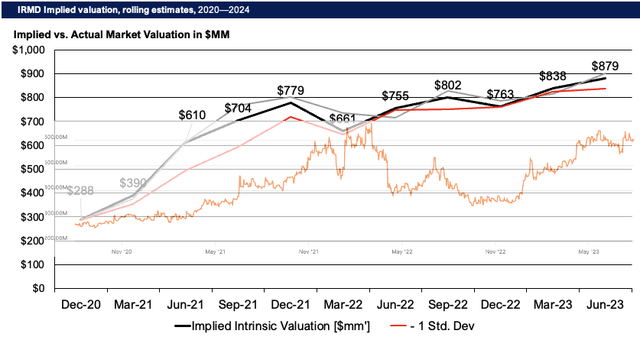

A company can compound its intrinsic worth on the perform of its ROIC and what quantities it reinvests at these charges of return. Making use of this calculus to IRMD’s fairness line, my estimates have the agency perpetually undervalued since 2020. Determine 7 illustrates this. The latest fairness beneficial properties are corroborated by the economics of the enterprise and indicate it’s value ~$880mm in market worth or $73/share, 53% worth hole as I write. This helps a bullish view. The pink and gray strains present 1 commonplace deviation above and under the implied worth, and align with the upside and draw back circumstances, respectively.

Determine 7.

Sources: BIG Insights, Looking for Alpha

Briefly

IRMD continues to current with engaging financial traits, with excessive potential to develop earnings and profitability in my opinion. The agency’s newest numbers help this narrative nicely, and underlying forces in its core markets add one other set of tailwinds to place towards. My estimates have the agency pretty valued at $73/share, a 53% worth hole on the time of writing. Every of the findings offered right here as we speak due to this fact help a purchase score. Web-net, reiterate purchase.

[ad_2]

Source link