[ad_1]

Spencer Platt/Getty Photos Information

Tesla’s (NASDAQ:TSLA) inventory has been on a gentle decline because the firm reported its Q2 earnings outcomes a month in the past. Whereas we’re presently seeing a slight rebound in share value, the corporate faces a number of headwinds that might forestall additional appreciation within the upcoming weeks. Although Tesla has reported respectable outcomes and continues to ramp up its manufacturing to realize its long-term objectives, the continuing value warfare in China together with the worsening of the Sino-American relations might undermine the corporate’s development story within the foreseeable future. As buyers are deciding what to do with their shares within the firm, this text highlights the main challenges that Tesla already faces because it tries to diversify its provide chains to mitigate geopolitical dangers.

The Nice Diversification Begins

Let’s begin with the excellent news. The most recent earnings report for Q2 confirmed that Tesla continues to ramp up its manufacturing and in Q2 it set a brand new document by producing and delivering 479,700 autos and 466,140 autos, respectively. On the similar time, its revenues through the interval elevated by 47.3% Y/Y to $24.93 billion and had been above the estimates by $200 million. The corporate additionally had $23.1 billion in money reserves on the finish of June, which is a rise of twenty-two% Y/Y primarily because of the $1 billion in FCF that it generated in Q2.

One other piece of excellent information is that Tesla is about to increase its lead in autonomous growth within the following quarters because it not too long ago began producing its supercomputer which matches below the title of Dojo.

What’s extra, is that the corporate has began to actively mitigate geopolitical dangers by diversifying its provide chain. Simply final month, the information got here out that Tesla is planning to launch the manufacturing of its automobiles in India, whereas in early August it was reported that the corporate has already began leasing workplace house within the nation. On high of that, earlier this week Elon Musk himself admitted that he plans a visit to India subsequent yr, which indicators that Tesla is really considering increasing its footprint in essentially the most populous nation on this planet.

On the similar time, there’s additionally a sign that Tesla is aiming to construct its greatest Gigafactory to this point with an annual capability of 1 million autos in Mexico by 2025. At first of this month, varied standard retailers reported that Tesla had already employed its Chinese language suppliers to arrange EV element vegetation in Mexico.

All of these diversification efforts are definitely aimed not solely at assembly the rising demand for EVs throughout the globe but additionally at reducing Tesla’s publicity to China in case a Sino-American confrontation enters a brand new and extra harmful section. Nonetheless, these efforts nonetheless don’t absolutely resolve Tesla’s issues.

Main Headwinds To Think about

A number of main headwinds might undermine Tesla’s bullish case and stop its shares from rallying once more within the quick to near-term. The primary such headwind is the comparatively weak efficiency of the Chinese language economic system. Contemplating that China is the second greatest marketplace for Tesla, it’s doubtless that the corporate might be negatively affected by the truth that the nation is on the point of deflation as its shopper confidence wanes because of structural issues that the economic system faces.

The deflation together with the continuing Chinese language EV warfare have already altered Tesla’s margin story. In Q2, Tesla’s GAAP gross margin was 18.2% towards 25% a yr in the past and under the estimates of 18.7%. On the similar time, its working margin was 9.6%, down from 11.4% 1 / 4 in the past. Contemplating that Tesla not too long ago as soon as once more trimmed costs for a few of its fashions in China, there’s a threat that margins would contract much more within the following months.

What’s attention-grabbing although is that regardless of these cuts, the corporate’s deliveries fell to document lows in July. Whereas a few of that is attributed to the retooling of the Shanghai Gigafactory, there’s nonetheless an indication that the corporate is about to overlook its 2023 gross sales development goal.

On high of that, the corporate’s predominant competitor BYD (OTCPK:BYDDF) can be catching up and will pose a menace to Tesla’s dominance within the EV enterprise within the foreseeable future. Along with increasing its presence in China, BYD’s flagship SUV has not too long ago outsold Tesla in Sweden, whereas the corporate’s international market share within the EV trade has elevated to 16.2% towards Tesla’s 21.7%.

As for the geopolitical dangers, it turns into apparent that Sino-American relations are more likely to enter a brand new section of confrontation sooner or later, which might make it even tougher for Tesla to realize its objectives. Along with getting its automobiles banned in varied public locations throughout China, Tesla’s battery provide chain continues to drastically depend on Chinese language corporations. Contemplating that China not too long ago imposed export controls on varied supplies which might be wanted to create semiconductors, whereas the Biden administration restricted investments into the Chinese language tech sector, an extra confrontation might disrupt Tesla’s provide chains that depend on undisrupted globalization to develop the enterprise.

What’s Subsequent?

Contemplating all of this, there are questions on whether or not Tesla would be capable of proceed to commerce at a major premium if its enterprise is at a relentless threat of disruption by exterior forces. Its shares have already depreciated in latest weeks after they’ve entered the overbought territory however with a ahead P/E and ahead P/S of over 60x and ~7x, respectively, there’s a case to be made that there’s nonetheless extra room to fall in case extra detrimental information comes out.

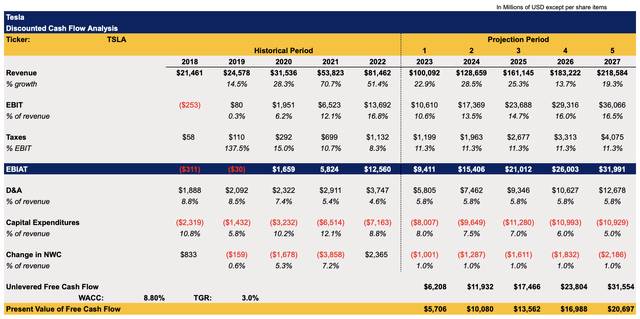

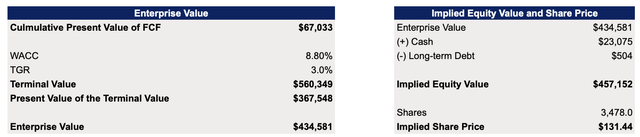

Given the quantity of challenges Tesla presently faces, the road has already made numerous downward revisions for the next quarter because of the powerful atmosphere wherein the corporate operates. As well as, though my up to date DCF mannequin under confirmed that the corporate would proceed to develop at a double-digit price with a WACC of 8.8% and a TGR of three%, whereas its earnings would slowly rebound, it seems that Tesla’s shares however commerce at a major premium primarily based solely on the basics.

Tesla’s DCF Mannequin (Historic Knowledge: Looking for Alpha, Assumptions: Writer)

The mannequin reveals that Tesla’s honest worth is $131.44 per share, under the present market value.

Tesla’s DCF Mannequin (Historic Knowledge: Looking for Alpha, Assumptions: Writer)

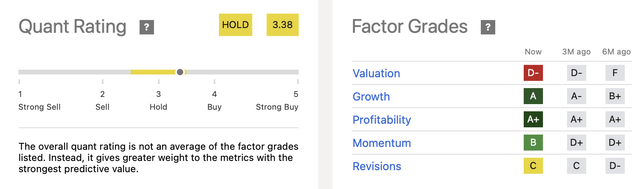

Looking for Alpha’s Quant system additionally reveals that Tesla is overvalued solely primarily based on the basics because it has given its inventory a score of D- for the valuation and an general score of Maintain.

Tesla’s Quant Score (Looking for Alpha)

Regardless of this, it doesn’t imply that Tesla would abruptly depreciate to these ranges on no detrimental information. We shouldn’t neglect that Tesla is a development inventory that has been buying and selling at extreme premiums for years because of the fixed enchancment of its top-line efficiency that was fueled by the aggressive improve in automobiles bought. The road and my mannequin itself present that the corporate’s revenues are anticipated to proceed to develop at a double-digit price within the following years. This would possibly point out that even when Tesla’s shares depreciate within the following months, they’d nonetheless be buying and selling at a good premium to the basics if the corporate manages to adapt to the fixed disruptions to its operations.

Nonetheless, if the geopolitical dangers considerably improve within the following months and Sino-American relations enter a brand new section of confrontation, then overvalued shares of companies that depend on undisrupted globalization akin to Tesla are more likely to expertise essentially the most quantity of ache in such a situation.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]

Source link